Tadawul

Tadawul brokers allow investors to speculate on Saudi Arabia’s sole stock exchange – the largest exchange in the Middle East and the 9th largest in the world. Tadawul is the main market in the Gulf Cooperation Council (GCC) and contains more than 260 listings with a focus on the energy, materials, finance and industrial sectors.

This guide will cover how to choose the best Tadawul brokerage for your trading strategy. We also review market trading hours, list the biggest companies on the exchange, and provide tips for trading the Tadawul.

Tadawul Brokers UK

-

Interactive Brokers (IBKR), a leading brokerage, offers access to 150 markets across 33 countries and provides extensive investment services. With more than 40 years of experience, this Nasdaq-listed company complies with strict regulations from the SEC, FCA, CIRO, and SFC. It is among the most reliable brokers worldwide for traders.

Instruments Regulator Platforms Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, Cryptocurrencies, CFDs FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower Min. Deposit Min. Trade Leverage $0 $100 1:50 -

Founded in 1974, IG is a part of IG Group Holdings Plc, a publicly listed brokerage (LSE: IGG). The company provides spread betting, CFD, and forex trading, offering access to over 17,000 markets. Its platforms and investing apps are notably user-friendly. Over the past 50 years, IG has consistently been an industry leader, excelling in all essential areas for traders.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM, JFSA Web, L2 Dealer, MT4, TradingView, AutoChartist, TradingCentral, ProRealTime Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:222 (Pro)

Safety Comparison

Compare how safe the Tadawul are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|---|---|---|---|---|

| Interactive Brokers | ✔ | ✔ | ✘ | ✔ | |

| IG | ✔ | ✔ | ✔ | ✔ |

Payments Comparison

Compare which popular payment methods the Tadawul support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|---|---|---|---|---|---|

| Interactive Brokers | ✔ | ✔ | ✘ | ✘ | ✘ | ✘ |

| IG | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ |

Mobile Trading Comparison

How good are the Tadawul at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| Interactive Brokers | iOS & Android | ✔ | ||

| IG | iOS & Android | ✔ |

Beginners Comparison

Are the Tadawul good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|---|---|---|---|---|

| Interactive Brokers | ✔ | $0 | $100 | ||

| IG | ✔ | $0 | 0.01 Lots |

Advanced Trading Comparison

Do the Tadawul offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Interactive Brokers | Capitalise.ai, TWS API | ✘ | 1:50 | ✘ | ✔ | ✔ | ✔ |

| IG | Expert Advisors (EAs) on MetaTrader, build your own on ProRealTime | ✔ | 1:30 (Retail), 1:222 (Pro) | ✔ | ✔ | ✔ | ✔ |

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the Tadawul.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|---|---|---|---|---|---|---|---|---|

| Interactive Brokers | |||||||||

| IG |

Our Take On Interactive Brokers

"Interactive Brokers ranks highly for seasoned traders due to its robust charting platforms, live data, and bespoke layouts via the new IBKR Desktop app. Its competitive pricing and sophisticated order choices appeal to traders, and its wide equity options are industry-leading."

Pros

- Interactive Brokers has been awarded Best US Broker for 2025 by DayTrading.com. This accolade highlights its dedication to traders in the US, offering exceptionally low margin rates and access to global markets at minimal expense.

- IBKR consistently offers unparalleled access to global equities, with thousands of shares available across over 100 market centres in 24 countries, including the recently added Saudi Stock Exchange.

- While initially targeting seasoned traders, IBKR has recently widened its appeal by eliminating its $10,000 minimum deposit requirement.

Cons

- Support can be sluggish and frustrating. Tests reveal that you may face challenges reaching customer service quickly, which could result in delays in issue resolution.

- IBKR offers a variety of research tools, but their inconsistent placement across trading platforms and the 'Account Management' webpage creates a confusing experience for users.

- The learning curve for TWS is quite steep, making it tough for novice traders to navigate and grasp all its features. In contrast, Plus500's web platform is far more accessible for those new to trading.

Our Take On IG

"IG offers a complete package: an easy-to-use web platform, top-tier beginner education, enhanced charting via TradingView, up-to-date data, and strong trade execution for seasoned traders."

Pros

- IG provides a wide range of professional and engaging educational materials, such as webinars, articles, and analyses, tailored for traders.

- IG secured a crypto asset license from the FCA, enabling its return to the UK market. It now offers buying, selling, and storage services for over 55 digital tokens with fees starting at 1.49%, all under FCA regulation.

- The IG app provides an excellent mobile trading experience with an intuitive design, earning it the Runner Up position in our 'Best Trading App' award.

Cons

- In the UK and EU, negative balance protection is available. However, US clients lack account protection and guaranteed stop losses.

- Based on tests, stock and CFD spreads remain less competitive than the lowest-cost brokers, such as CMC Markets.

- IG has ended its swap-free account, diminishing its attractiveness to Islamic traders.

Choosing Tadawul Brokers

Tadawul brokers are the intermediary between retail investors and the stock exchange. Key features to consider when doing a comparison of Tadawul brokers are:

Instruments

The Saudi government primarily allows foreign institutional investors to trade on its exchange. As a result, retail investors are usually restricted to ETFs, bonds, funds, and derivative products based on indices.

Look for funds and ETFs that have a focus on the Middle East or energy sectors. The main indices tracking the exchange are the Tadawul All Shares Index and the MSCI Tadawul 30 Index, and these are used as the basis for derivatives such as MSCI 30 futures contracts.

Regulation

The Capital Markets Authority of Saudi Arabia (CMA) has control and influence over activities on the Tadawul exchange. This regulatory body, created in 2004, works in a similar way to the UK’s Financial Conduct Authority (FCA), protecting investors from unfair trading practices.

Established regulators tend to offer more consumer protection to traders, though you may find more products and lenient terms on leverage at offshore brokers.

Trading Fees

Brokerage commissions and spreads are usually the main costs when trading Saudi stocks. You should also take non-trading charges into account, including inactivity fees, account maintenance fees and deposit and withdrawal charges.

UK traders should also consider currency conversion costs, particularly when intraday trading foreign stocks. IG Index, for example, allows clients to trade on international markets with a 0.5% conversion fee on foreign currency balances.

Platform

Tadawul brokers may offer bespoke proprietary trading platforms or robust third-party terminals such as MT4, MT5, or TradingView.

Choose a solution that is intuitive to use and has the tools you need to trade effectively, whether that’s indicators for technical analysis or reports for fundamental analysis. Leading Tadawul platforms will offer average daily trading volumes and insights into group investor relations.

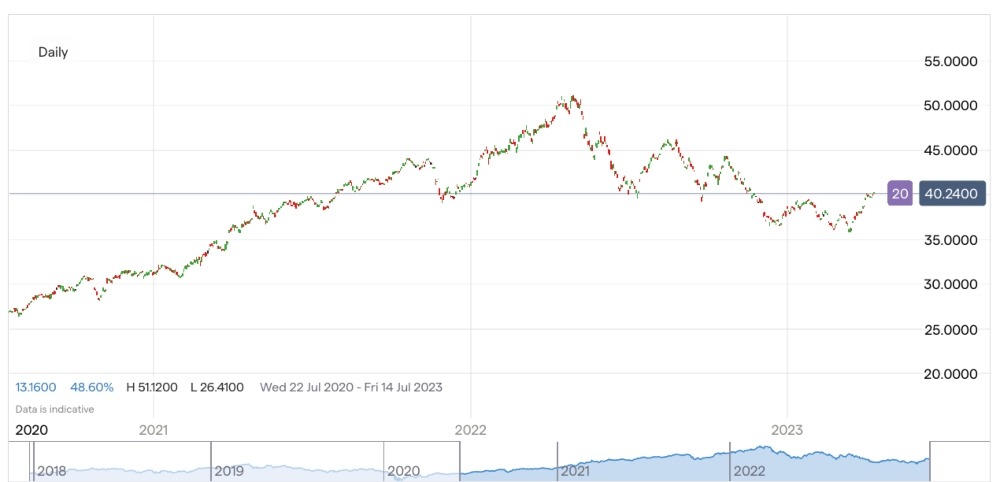

IG Index: iShares Trust – iShares MSCI Saudi Arabia Capped ETF

Tutorials, step-by-step user guides and virtual trading accounts are useful for getting to grips with a new trading platform. Spend time reviewing all the features and functions provided such as copy trading, signals, algorithm-based setups, and custom charts.

Mobile app compatibility is also useful for trading the Tadawul while on the go.

How To Sign Up With A Tadawul Broker

- Choose a Tadawul broker with the products and features you need and register for an account

- Complete the registration form with your personal details, including name, email address, and contact number

- Verify your email address and phone number (often via a one-time passcode or email link)

- Provide documents for proof of ID and address verification

- Fund your account (minimum deposits vary)

- Start trading Saudi stocks online

What Is The Tadawul Stock Exchange?

The Saudi Stock Exchange, Tadawul, is the securities market of Saudi Arabia, formed in 2007 as a joint stock company. The exchange was founded in 1954, but only became regulated in 1984.

Today, it is the largest and most liquid market in the MENA region. Though the Tadawul is difficult for UK traders to access directly, they can gain exposure to Saudi markets and securities through exchange-traded funds (ETFs), bonds, and mutual funds.

The Saudi Stock Exchange is a fully owned subsidiary of the Saudi Tadawul Trading Group which was founded relatively recently in 2021.

The exchange operates from a head office location in Riyadh, Saudi Arabia and the current CEO of the Saudi Exchange is Mohammed Al-Rumaih.

Markets & Indices

Main Market

The main market of the Saudi Exchange is home to around 200 listed companies. The Tadawul All Share Index (TASI) tracks the performance of all the stocks.

The index was launched in 1985 before being restructured in 2008. Some of the listed companies include the country’s state oil company Saudi Aramco as well as the Arab National Bank and construction firms including Saudi Industrial and Zamil Industrial.

The index is open for trading from Sunday to Thursday 10am to 3pm (GMT+3).

Nomu

The Nomu market is the ’parallel equity market’ with eased listing requirements for member firms. Operating alongside the main market, the Nomu is an alternative public listing method for organisations such as SMEs.

The Parallel Market Capped Index known as NOMUc is the associated index tracking this market. The largest companies listed on the index include Ladun Investment, National Environmental Recycling Co, and Alwasail Industrial.

MSCI Tadawul 30 Index (MT30)

The MSCI Tadawul 30 (MT30) index tracks the performance of the 30 biggest and most liquid large-, mid-and small-cap stocks listed on the Saudi Stock Exchange.

The free-float-adjusted market capitalisation index was introduced in 2019, primarily to act as a basis for derivatives and exchange-traded products.

To reduce the dominance of major securities, no firm is permitted to have more than a 15% weighting.

Major Stocks

The largest stocks on the Tadawul include:

- SABIC

- Almarai

- Maaden

- Riyad Bank

- Al Rajhi Bank

- Saudi Aramco

- Saudi Electricity

- Arab National Bank

- The Saudi National Bank

- Saudi Telecom Company

Trading Hours

The Saudi Arabia Stock Exchange operates slightly differently from many other major global exchanges as it trades from Sunday to Thursday rather than Monday to Friday.

Tadawul market hours are 10am to 3pm Arabian Standard Time (GMT+3). There is no lunchtime closure. Some Tadawul brokers may offer pre-market extended trading sessions, available between 9:30am and 10am.

Other useful tools offered by the best brokers include a trading calendar with upcoming holidays such as the Eid Al-Fitr and Eid Al-Adha holidays and changes to trading hours during Islamic festivals such as Ramadan.

Foreign Investor Ownership

Tadawul only allows established foreign investors the opportunity to trade stocks directly, and these investors must meet a list of stringent criteria to qualify to trade.

For UK retail traders, therefore, access to the Tadawul exchange must be via the services of registered brokers, and through alternative instruments such as ETFs.

Membership Rules & Listing Requirements

Companies must meet a list of criteria to qualify for listing on the main or nomu Tadawul markets:

Main Market

- Be a joint stock company

- Hold a minimum market cap of SAR300 million

- Be in a position to float at least 30% of issued shares

- Have at least three years of audited financial statements

- Have at least 200 public shareholders

- Have been actively engaging in the firm’s main activities for at least three years

- Have sufficient working capital for the 12 months following the listing

Nomu Market

- Be a joint stock company

- Hold a minimum market cap of SAR10 million

- Be in a position to float at least 20% of issued shares

- Have at least one year of audited financial statements

- Have at least 50 public shareholders at the time of listing

Post Trade Technology Program

The Tadawul Group has announced the launch of the Post Trade Transformation Program (PTTP) to enhance and develop the country’s capital market infrastructure. Buyers and sellers will now be permitted to agree on a settlement cycle between T+0 and T+5.

The trading system enhancements, to be completely rolled out by 2030, also include a new central securities depository (CSD) system, designed to improve the experience for custodians, settlement agents, and retail investors.

Tips For Trading The Tadawul

- Choose The Right Instrument – Tadawul brokers may offer investment vehicles for long-term growth in the form of ETFs or funds that track the performance of the major companies on the exchange. Alternatively, you could speculate on shorter-term price movements with other derivatives.

- Know The Market – The Tadawul’s biggest companies are in the energy, industry and finance sectors. Factors affecting these areas can have a large impact on the exchange’s overall performance and rankings.

- Follow The News – The Middle East is a politically volatile region, and there is always the chance that a major news event could impact the performance of Saudi companies. Likewise, energy markets have seen a huge amount of volatility in recent years, and this will impact the Tadawul thanks to the large weighting of energy firms like Saudi Aramco.

Bottom Line On The Tadawul Stock Exchange

Tadawul is a major player in the global stock market and online brokers provide trading opportunities through instruments such as index-based derivatives, ETFs and funds. Constituents listed on the exchange are primarily in energy, materials, finance and industry, including big names like The Saudi National Bank.

FAQ

Can Expats Invest In The Tadawul Exchange?

Foreign investors can trade on the Tadawul Exchange via registered brokers, though individuals that are not residents or nationals of Gulf Cooperation Council countries cannot invest in the exchange directly. Instead, retail investors primarily turn to ETFs and derivatives based on the exchange’s indices.

What Are The Trading Hours Of The Saudi Stock Exchange?

The Saudi Stock Exchange is open from Sunday to Thursday 10am to 3pm Arabian Standard Time (GMT+3).

How Can I Trade On The Tadawul Exchange?

There are several products available to UK investors looking to trade on the Tadawul exchange. This includes ETFs, bonds and mutual funds.

Is Tadawul Regulated?

Yes, the Saudi Arabia Stock Exchange (Tadawul) is regulated by the Capital Market Authority (CMA). The authority oversees the financial market in Saudi Arabia by stipulating rules and regulations for member firms to comply with, which in turn protects retail investors against business malpractice.

What Companies Are Available To Trade Via Tadawul Brokers?

Some of the largest listed companies on the Tadawul Exchange include Saudi Aramco, the Arab National Bank, Saudi Electricity, and the Saudi National Bank. Leading Tadawul brokers provide historical price data, forecasts, and trends to help track these companies’ performance.