Dow Jones

Dow Jones brokers provide investors with a simple way to get a ‘big-picture’ view of US economic performance and speculate on one of the world’s most respected equity indexes – the Dow Jones Industrial Average. This guide will introduce the Dow Jones, the second-oldest equity index and explain how it is composed. It will also list the key information you need to compare Dow Jones brokers and start investing, including information on trading times, strategy tips, charts, graphs, and price history.

UK Dow Jones Brokers

-

Founded in Australia in 2010, Pepperstone is a highly regarded broker specialising in forex and CFDs. Serving more than 400,000 clients globally, it provides access to over 1,300 financial instruments through popular platforms like MT4, MT5, cTrader, and TradingView. Its fee structure is both low and transparent. With regulation by reputable bodies such as the FCA, ASIC, and CySEC, Pepperstone guarantees a safe trading environment for traders at every level.

Instruments Regulator Platforms CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB Pepperstone Trading Platform, MT4, MT5, cTrader, TradingView, AutoChartist Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:500 (Pro) -

Established in Poland in 2002, XTB caters to over a million clients worldwide. This forex and CFD broker offers a robust regulatory framework, a diverse range of assets, and prioritises trader satisfaction. It provides an intuitive proprietary platform equipped with excellent tools to support aspiring traders.

Instruments Regulator Platforms CFDs on shares, Indices, ETFs, Raw Materials, Forex currencies, cryptocurrencies, Real shares, Real ETFs FCA, CySEC, KNF, DFSA, FSC xStation Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 -

Founded in 1974, IG is a part of IG Group Holdings Plc, a publicly listed brokerage (LSE: IGG). The company provides spread betting, CFD, and forex trading, offering access to over 17,000 markets. Its platforms and investing apps are notably user-friendly. Over the past 50 years, IG has consistently been an industry leader, excelling in all essential areas for traders.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM, JFSA Web, L2 Dealer, MT4, TradingView, AutoChartist, TradingCentral, ProRealTime Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:222 (Pro) -

Trade Nation is a leading FX and CFD broker regulated in the UK and Australia, among other places. The company provides competitively priced fixed and variable spreads on over 1,000 assets. Traders benefit from advanced platforms and comprehensive training materials. Additionally, the Signal Centre offers valuable trade ideas.

Instruments Regulator Platforms Forex, CFDs, Indices, Shares, Commodities, Futures, Bonds, Spread Betting, Cryptos (Bahamas Entity Only) FCA, ASIC, FSCA, SCB, FSA TN Trader, MT4 Min. Deposit Min. Trade Leverage $0 0.1 Lots 1:500 (entity dependent) -

Eightcap, an acclaimed broker regulated by the FCA, offers exceptionally low trading costs. Recognised as the top-rated brand by TradingView's vast user base of 100 million, traders can directly access the platform. UK traders can open a live account with a minimum deposit of just £100.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities ASIC, FCA, CySEC, SCB MT4, MT5, TradingView Min. Deposit Min. Trade Leverage £100 0.01 Lots 1:30 -

Established in 1999, FOREX.com is now integrated into StoneX, a prominent financial services entity catering to more than one million clients globally. The broker is regulated in numerous jurisdictions, including the US, UK, EU, and Australia. It offers a vast array of markets beyond forex, delivering competitive pricing on state-of-the-art trading platforms.

Instruments Regulator Platforms Forex, CFDs, Stock CFDs, Indices, Commodities, Futures, Options, Crypto NFA, CFTC, CIRO, FCA, CYSEC, ASIC, SFC, FSA, MAS, CIMA WebTrader, Mobile, MT4, MT5, TradingView Min. Deposit Min. Trade Leverage $100 0.01 Lots 1:30 -

eToro is a leading multi-asset platform providing trading services across numerous CFDs, stocks, and cryptocurrencies. Since its 2007 inception, it has attracted millions of traders worldwide. It operates with authorisation from top regulators such as the FCA and CySEC. Its social trading feature is especially well-regarded. Crypto investments are high-risk and possibly unsuitable for retail investors. There's a potential to lose all invested capital. Familiarise yourself with the risks. 61% of retail CFD accounts incur losses.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, ETFs, Smart Portfolios, Commodities, Futures, Crypto, NFTs FCA, ASIC, CySEC, FSA, FSRA, MFSA, CNMV, AMF eToro Web, CopyTrader, TradingCentral Min. Deposit Min. Trade Leverage $50 $10 1:30

Safety Comparison

Compare how safe the Dow Jones are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✘ | ✔ | |

| XTB | ✔ | ✔ | ✔ | ✔ | |

| IG | ✔ | ✔ | ✔ | ✔ | |

| Trade Nation | ✔ | ✔ | ✘ | ✔ | |

| Eightcap | ✔ | ✔ | ✘ | ✔ | |

| Forex.com | ✔ | ✔ | ✘ | ✔ | |

| eToro | ✔ | ✔ | ✘ | ✔ |

Payments Comparison

Compare which popular payment methods the Dow Jones support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| XTB | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| IG | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ |

| Trade Nation | ✔ | ✔ | ✔ | ✘ | ✔ | ✘ |

| Eightcap | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| Forex.com | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| eToro | ✔ | ✔ | ✘ | ✔ | ✔ | ✘ |

Mobile Trading Comparison

How good are the Dow Jones at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| Pepperstone | iOS & Android | ✘ | ||

| XTB | iOS & Android | ✔ | ||

| IG | iOS & Android | ✔ | ||

| Trade Nation | iOS & Android | ✘ | ||

| Eightcap | iOS & Android | ✘ | ||

| Forex.com | iOS & Android | ✘ | ||

| eToro | iOS & Android | ✘ |

Beginners Comparison

Are the Dow Jones good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|---|---|---|---|---|

| Pepperstone | ✔ | $0 | 0.01 Lots | ||

| XTB | ✔ | $0 | 0.01 Lots | ||

| IG | ✔ | $0 | 0.01 Lots | ||

| Trade Nation | ✔ | $0 | 0.1 Lots | ||

| Eightcap | ✔ | £100 | 0.01 Lots | ||

| Forex.com | ✔ | $100 | 0.01 Lots | ||

| eToro | ✔ | $50 | $10 |

Advanced Trading Comparison

Do the Dow Jones offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Pepperstone | Expert Advisors (EAs) on MetaTrader | ✔ | 1:30 (Retail), 1:500 (Pro) | ✔ | ✘ | ✔ | ✘ |

| XTB | - | ✔ | 1:30 | ✘ | ✘ | ✔ | ✘ |

| IG | Expert Advisors (EAs) on MetaTrader, build your own on ProRealTime | ✔ | 1:30 (Retail), 1:222 (Pro) | ✔ | ✔ | ✔ | ✔ |

| Trade Nation | Expert Advisors (EAs) on MetaTrader | ✘ | 1:500 (entity dependent) | ✘ | ✘ | ✘ | ✘ |

| Eightcap | TradingView Bots | ✘ | 1:30 | ✔ | ✘ | ✔ | ✘ |

| Forex.com | Expert Advisors (EAs) on MetaTrader | ✘ | 1:30 | ✔ | ✔ | ✔ | ✘ |

| eToro | Automate your trades via CopyTrader - follow profitable traders. Open and close trades automatically when they do. | ✘ | 1:30 | ✘ | ✔ | ✘ | ✔ |

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the Dow Jones.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|---|---|---|---|---|---|---|---|---|

| Pepperstone | |||||||||

| XTB | |||||||||

| IG | |||||||||

| Trade Nation | |||||||||

| Eightcap | |||||||||

| Forex.com | |||||||||

| eToro |

Our Take On Pepperstone

"Pepperstone is a premier trading platform, providing tight spreads, swift execution, and sophisticated charting tools for seasoned traders. Beginners benefit from no minimum deposit, comprehensive learning materials, and outstanding 24/7 support."

Pros

- Pepperstone now offers spread betting via TradingView, delivering a streamlined and tax-efficient trading experience with sophisticated analytical tools.

- Pepperstone offers rapid execution speeds of approximately 30ms, enabling swift order processing and execution, making it ideal for traders.

- Over the years, Pepperstone has consistently garnered recognition from DayTrading.com’s annual awards. Recently, it was honoured as the 'Best Overall Broker' in 2025 and was the 'Best Forex Broker' runner-up the same year.

Cons

- Pepperstone doesn't offer cTrader Copy, a favoured feature for copying trades found in the cTrader platform, which is available on other platforms such as IC Markets. However, Pepperstone has launched its own user-friendly copy trading app.

- Pepperstone's demo accounts remain active for 60 days. This duration might be insufficient to fully explore the platforms and trial various trading strategies.

- Although its market range has improved, its crypto offerings remain limited compared to brokers specialising in this sector, lacking real coin investment options.

Our Take On XTB

"XTB excels for novice traders with its superb xStation platform, minimal trading costs, no required deposit, and outstanding educational resources, many of which are fully integrated into the platform."

Pros

- XTB processes withdrawals swiftly, paying within 3 business days, subject to the method and amount.

- XTB offers a superb array of educational resources, such as training videos and articles, embedded within the platform to assist traders of all experience levels.

- Top-notch customer support, available 24/5, includes a welcoming live chat with response times under two minutes during tests.

Cons

- The demo account lasts only four weeks, posing a challenge for traders wanting to fully explore the xStation platform and refine short-term strategies before investing actual money.

- XTB has stopped supporting MT4, restricting traders to its own platform, xStation. This decision may discourage experienced traders accustomed to using the MetaTrader suite.

- The research tools at XTB are commendable but have the potential to excel further. Enhancing them with access to top-tier third-party services like Autochartist, Trading Central, and TipRanks would significantly elevate their offering.

Our Take On IG

"IG offers a complete package: an easy-to-use web platform, top-tier beginner education, enhanced charting via TradingView, up-to-date data, and strong trade execution for seasoned traders."

Pros

- The IG app provides an excellent mobile trading experience with an intuitive design, earning it the Runner Up position in our 'Best Trading App' award.

- IG secured a crypto asset license from the FCA, enabling its return to the UK market. It now offers buying, selling, and storage services for over 55 digital tokens with fees starting at 1.49%, all under FCA regulation.

- IG provides a wide range of professional and engaging educational materials, such as webinars, articles, and analyses, tailored for traders.

Cons

- Based on tests, stock and CFD spreads remain less competitive than the lowest-cost brokers, such as CMC Markets.

- IG imposes a monthly inactivity fee of $12 after two years, discouraging occasional traders.

- Beginners may find IG's fees complicated, as they vary depending on the trades or services. This could cause confusion and unexpected costs.

Our Take On Trade Nation

"Trade Nation is ideal for novice traders seeking diverse markets on an easy-to-use platform. It offers no minimum deposit, complimentary funding options, and robust educational resources."

Pros

- A variety of trading platforms and apps, such as MT4, make the brand suitable for experienced traders.

- Beginners benefit from a modest initial deposit.

- Global traders can use accounts in various currencies.

Cons

- Reduced legal safeguards with an offshore entity.

Our Take On Eightcap

"Eightcap excels for traders, offering diverse charting platforms, educational Labs, and AI tools. With over 120 crypto CFDs, it stands out in crypto trading and has won our 'Best Crypto Broker' award twice consecutively."

Pros

- With spreads starting at 0 pips, minimal commission charges, and leverage up to 1:500 for select clients, Eightcap delivers affordable and flexible trading opportunities. These conditions suit various strategies, such as trading and scalping.

- Eightcap excels with a suite of advanced trading tools, such as MT4 and MT5, and has recently joined the 100-million-user social trading network, TradingView.

- Eightcap has excelled in all essential trading areas, surpassing all rivals to clinch our 'Best Overall Broker' award for 2024. It also earned the titles of 'Best Crypto Broker' and 'Best TradingView Broker' for 2025.

Cons

- The demo account is available for 30 days, after which it requires a request for extension. This is less convenient than XM's offering, which provides an unlimited demo mode.

- Despite a helpful array of educational guides and e-books in Labs, Eightcap lags behind IG's extensive resources for aspiring traders. IG boasts a dedicated Academy app and features 18 diverse course categories.

- Despite the growing range of tools available, Eightcap lacks popular industry resources such as Autochartist and Trading Central. These provide advanced charting analytics, live news, and essential market insights for traders focused on short-term strategies.

Our Take On Forex.com

"FOREX.com excels in serving traders of all levels, offering more than 80 currency pairs, spreads starting at 0.0 pips, and competitive commissions. Its robust charting platforms provide over 100 technical indicators and comprehensive research tools."

Pros

- The in-house Web Trader remains a top-tier platform for budding traders, featuring an elegant design and more than 80 technical indicators for market analysis.

- An abundance of educational resources is available, such as tutorials, webinars, and an extensive YouTube channel, designed to enhance your understanding of financial markets.

- With more than two decades of expertise, strong regulatory governance, and numerous accolades, including a second-place finish in our 'Best Forex Broker' awards, FOREX.com is globally renowned as a reliable trading platform.

Cons

- Demo accounts are typically limited to 90 days, hindering effective strategy testing.

- FOREX.com's MT4 platform provides around 600 instruments, a notable reduction compared to the more than 5,500 options on its other platforms.

- US clients are not protected against negative balances, which means you could end up owing more than your initial deposit.

Our Take On eToro

"eToro's social trading platform excels with its outstanding user experience and lively community chat, aiding beginners in spotting opportunities. It offers competitive fees on numerous CFDs and real stocks, alongside exceptional rewards for seasoned strategists."

Pros

- Utilising TradingView, the charts provide robust tools for technical analysis, featuring nine chart types and more than 100 indicators.

- There is an extensive online training academy offering a range of accessible resources, from concise articles to detailed courses.

- eToro is a globally recognised brand, operating under top-tier international regulations. It boasts a community of over 25 million users.

Cons

- The absence of extra charting platforms such as MT4 may deter experienced traders who rely on external software.

- The only significant contact option, besides the in-platform live chat, is limited.

- The minimum withdrawal is set at $30, accompanied by a $5 fee. This may impact traders with limited funds, particularly those just starting out.

How To Compare Dow Jones Brokers

Traders need a reliable and secure broker with fair pricing to execute a winning Dow Jones strategy. Every investor will have their own criteria, however there are several key areas to compare Dow Jones brokers in:

Trading Vehicles

There are multiple ways to trade the Dow Jones Index, so you should choose a broker that provides the most appropriate product for your trading style. Common ways to gain exposure to the Dow Jones include CFDs, ETFs and spread betting, though more exotic alternatives like binary options are also available from some brokers.

- IG is a great choice for traders as it offers Dow Jones spread betting, CFDs and ETFs and supports a range of platforms including MT4

- eToro is a good Dow Jones broker for beginner traders thanks to its user-friendly, browser-based trading platform

- Pocket Option is a popular binary options broker with Dow Jones trading and useful features including a demo account

Check the fees and tools such as available leverage when deciding on your preferred method of trading.

Platforms & Apps

Serious traders will want access to a powerful trading platform with a full range of tools and indicators to help them read Dow Jones charts. Some Dow Jones brokers offer their own proprietary platforms, but many will also support third-party platforms such as MetaTrader 4 (MT4) or MetaTrader 5 (MT5).

While a beginner investor may prefer a broker like eToro with an easy-to-use browser-based platform, those who want a deeper trading experience may prefer a Dow Jones broker such as Pepperstone which supports MT4 or another dedicated trading platform.

Also check that the broker’s platform is available as an Android, iOS or Windows-compatible app if you plan to make trades and manage positions on the go.

Fees

Fees are usually toward the top of a trader’s list when it comes to choosing Dow Jones brokers as they have a direct impact on the profit they can make from trades. The most important fees will usually be commissions charged per trade and the spread.

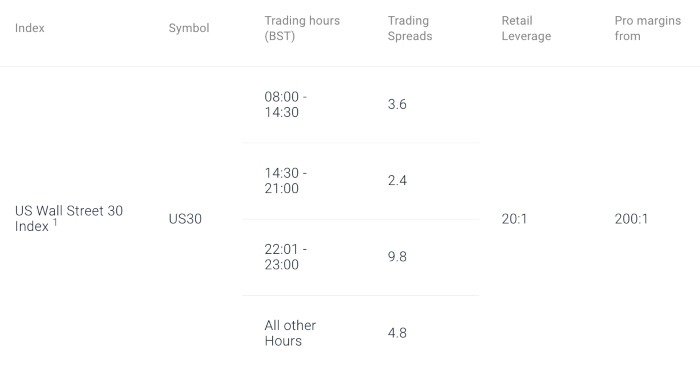

Note that UK traders can speculate on the Dow Jones using various instruments, including CFDs, ETFs, and spread betting, and the fees can vary according to how you trade. For example, eToro offers both a Dow Jones tracker ETF and CFDs on the index, with a 0% commission on standard ETF trades, a 0.15% commission on ETF CFDs, and a 6-point spread on Dow Jones CFDs. Alternatively, Pepperstone offers even tighter spreads during most of the trading day:

Additional Features

Some of the best Dow Jones brokers offer extra features to help traders improve their skills and get the best out of their trading platforms.

Copy trading and automated trading are among the most useful features for Dow Jones traders as they keep you updated with the latest information about the index’s price movements with signals and allow you to immediately place trades.

A full range of tools and indicators is another important feature to look out for as these help you to analyse the Dow Jones index’s price history and choose the ideal time to execute and close trades. Look out for Dow Jones brokers whose platforms support indicators and tools such as moving averages, Bollinger bands, and daily trading volume charts.

Beginner traders also benefit from educational resources. Some of the best Dow Jones brokers in the UK offer learning resources in the form of blog posts, YouTube videos and even courses. Combined with demo accounts, these can teach you how to formulate a strategy for trading the Dow Jones and allow you to practice and fine-tune it without risking any real cash.

Regulation

The Dow Jones Index tracks US companies, but regulation will depend on the individual broker you use. The regulatory body that oversees a brokerage may affect the type of products on offer and the amount of leverage available to retail clients – for example, the UK’s Financial Conduct Authority (FCA) limits leverage for retail clients (1:20 for indices), ensures negative balance protection is provided, and has various rules around trading bonuses and promotions.

Other major regulators include the US’s FINRA, CFTC and SEC, Australia’s ASIC and Cyprus’s CySEC.

Customer Support

A high-quality, responsive customer support service is the hallmark of a good broker and it can be key if you have any issues with your account. Look for Dow Jones brokers that have live chat and support hotlines as well as detailed FAQ areas on their site. You should also check that the support team is available in your timezone and look for a hotline that serves traders from the United Kingdom.

Pepperstone is an example of an established and reputable Dow Jones broker with comprehensive support, open 24 hours in the week and 18 hours on the weekend.

Security

Traders need to know their funds and personal information are in safe hands, so they should research the protocols and security measures used by each Dow Jones broker on their list.

Look for brokerages that securely store user data with cutting-edge encryption and offer reliable login security systems, such as two-step authentication. In addition, look for DJ30 brokers that use segregated accounts to separate traders’ funds from company capital.

What Is The Dow Jones?

The Dow Jones Industrial Average (DJIA), sometimes known as the US30 or simply the Dow, is a stock market index of 30 leading companies listed on US stock exchanges. Founded in 1885 by Wall Street Journal editor Charles Dow and his business partner, statistician Edward Jones, the index is the second oldest in the United States and is still one of the most widely followed in the world to this day.

As a price-weighted index, the stocks with higher values per share will impact the Dow’s price more than their lower-valued peers.

Today, the Dow Jones is one of several indexes maintained by S&P Dow Jones Indices, a company that is owned by S&P Global and is also known for maintaining the S&P 500 index.

The 30 companies comprising the Dow Jones are chosen by a committee, and over the years the addition of new companies has brought the Dow Jones a little diversity to make a change from its original, wholly industrial flavour.

Dow Jones Criteria Explained

For a company to be considered as a Dow Jones stock, it must be incorporated and headquartered in the US with a plurality of its income coming from that country, be representative of the US economy with an excellent reputation, attract a large amount of investment and demonstrate sustained growth.

The 10 Dow companies with the highest revenues yield are known as “the Dogs of the Dow”.

Dow Jones Companies List

- 3M Company

- American Express

- Apple Inc.

- Boeing Company

- Caterpillar Inc.

- Chevron Corporation

- Cisco Systems, Inc.

- The Coca-Cola Company

- Dow Inc.

- Exxon Mobil

- Goldman Sachs Group

- Home Depot, Inc.

- IBM

- Intel Corporation

- Johnson & Johnson

- JPMorgan Chase & Co.

- McDonald’s Corporation

- Merck & Co., Inc.

- Microsoft Corporation

- Nike, Inc.

- Pfizer

- The Procter & Gamble Company

- Travelers Companies, Inc.

- UnitedHealth Group Inc.

- Verizon Communications Inc.

- Visa Inc.

- Verizon Communications

- Walgreens Boots Alliance

- Walmart Inc.

- The Walt Disney Company

The Dogs Of The Dow

The Dogs of the Dow as of 2023 are:

- Verizon (VZ)

- Walgreens Boots Alliance (WBA)

- 3M (MMM)

- Intel (INTC)

- International Business Machines (IBM)

- Dow (DOW)

- Pfizer (PFE)

- Chevron (CVX)

- Cisco Systems (CSCO)

- Exxon Mobil (XOM)

Dow Jones Futures

Dow Jones futures contracts are the basic way to speculate on the price movements of the index, and just about anyone can do so through a Dow Jones broker that offers this instrument.

There are currently two Dow futures contracts available: the E-mini or mini-Dow, and the Micro E-mini. The E-Mini’s value corresponds to $5 per tick on the Dow, while the Micro E-mini represents $0.50 per tick.

Trading on Dow Jones futures is available from a wide range of online brokers, including some of the biggest names like Interactive Brokers.

However, many Dow Jones brokers also offer their own instruments that trade off the index’s price but are not directly linked to Dow Jones futures. These are sometimes represented by a different symbol, such as US30.

Trading Hours

Most of the companies on the Dow Jones trade during the opening hours of the New York and NASDAQ exchanges, on weekdays from 9:30 am to 4:00 pm Eastern time (EST)

Dow Jones futures are available Sunday through Friday and can be traded almost around the clock. After-hours and pre-market trading information on the Dow Jones is available on CNN Business.

Retail traders should also check their Dow Jones broker, as many platforms set their own hours for trading specific instruments.

Live Price Chart

Getting Started

Following a few simple steps to get started trading the Dow Jones index:

Create And Fund Your Account

Traders looking to sign up with Dow Jones brokers should compare their options, keeping in mind the criteria listed above. Registering with a trading broker for the first time usually involves providing documents for identity verification and know-your-customer checks, and it may also involve proof of address.

When the time comes to fund your Dow Jones brokerage account, pay attention to the minimum and maximum deposit limits as well as the supported payment methods. New traders will probably want to stick to smaller trades while they gain experience with the Dow Jones index, so a low minimum deposit is often desirable. The payment method can also make a big difference – you should use the method that has the lowest fees and the fastest transaction times, such as PayPal.

Do Your Research

The Dow Jones is made up of 30 of the leading companies in the world’s biggest economy. This will have a deep impact on how you analyse, plan and execute your trades for several reasons.

Firstly, as one of the world’s most widely followed and influential indexes, there will be no shortage of material online to help you research the Dow Jones. A little reading goes a long way, and you can quickly learn about the factors that have led to price movements on the Dow Jones’s historical price chart.

Moreover, the makeup of the Dow Jones in itself will help you to understand something of the price’s movement. These are all blue-chip stocks with global reach, and you can count on the Dow Jones to do well during market rallies. Look out for US numbers reports, including things like inflation, interest rate hikes, unemployment announcements etc to help inform your predictions about the Dow’s direction.

Also, note that this is a far smaller index than the S&P 500 and similar. This means that while the S&P 500 will give a broader view of the US economy as a whole, the Dow Jones reflects only the performance of 30 companies – significant as these may be – the majority of which are involved in industry or the manufacture of consumer goods.

Choose A Trading Instrument

Your choice of trading vehicle will have a big impact on your Dow Jones trading experience, affecting your profit potential, the length of contracts available, and more. Longer-term investors may wish to put their money in a Dow Jones EFT, while day traders often prefer derivatives with margin trading such as CFDs. Binary options can be a good option for newer traders or for those who wish to make a lot of short-term trades in one day.

Some Dow Jones brokers such as IG offer traders a variety of ways to trade the index, including EFTs, CFDs and spread betting. However, some of the top Dow Jones binary options brokers such as Pocket Option limit their offerings to only this product.

Choose A Strategy

Your strategy when trading the Dow Jones will depend a lot on the timeframe of your trade and the way the market is performing.

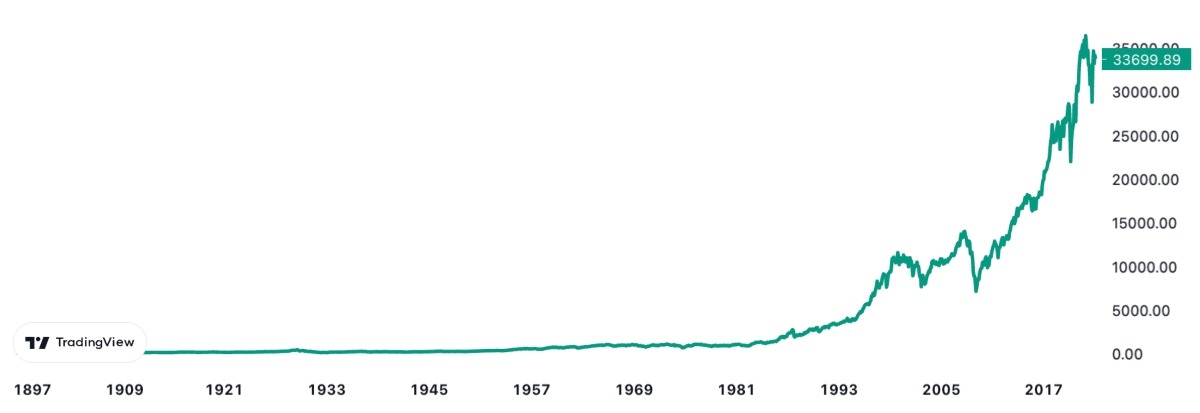

Since the Dow Jones tracks some of the US economy’s biggest companies, in the long-run, the value is often bound to go up – this means it can be a relatively low-risk addition to a trading portfolio for investors who are playing the long game. However, bear in mind that the index’s value will often go down with a big market crash and may take years to recover.

Dow Jones Historical Price Chart

For shorter-term trades, look out for factors that affect the US economy as a whole and particularly the companies that make up the Dow. Remember that the companies on the index with the highest share price will also have the greatest influence on the Dow’s price – this means that it should be your priority to keep an eye on those companies.

Execute A Trade

Once you have signed up to a good Dow Jones broker and researched the market, it’s time to place a trade. Chart analysis of the Dow’s recent performance on TradingView or a powerful trading platform will give you a good idea about price movements and help you identify levels of support and resistance. Also check graphs showing the trading volume and level of volatility for the Dow Jones before opening your position.

When you are satisfied with the market conditions and want to place your trade, navigate to the relevant section on your broker’s app or trading platform to set it up. You will need to input the size of your position, whether you are going long or short, and the amount of leverage you wish to use.

If possible, you may wish to open the trade by placing an order at a specific price. It is also a good idea to set stop loss and take profit levels, as this will curtail the risk of a bad trade leading to big losses and ensure you lock in profits from a good trade.

Bottom Line On Dow Jones Brokers

The Dow is a trading institution and one of the most trusted ways to understand the economic performance in the US. It can also be an exciting and profitable index to trade in the short-term using derivatives, and many investors also put their money in Dow Jones ETFs to reap longer-term profits.

Remember that finding a good and reliable Dow Jones broker will be a key part of your success and keep up to date with all the relevant news on the US economy and Dow Jones companies to stay ahead of the game.

To start trading, see our list of the best Dow Jones brokers and platforms for UK investors.

FAQs

Can You Trade The Dow Jones Through Online Brokers?

The Dow is a popular index and you should be able to take your pick from a large selection of trusted Dow Jones brokers. It’s best to have an idea of the type of trading you wish to do before choosing a Dow Jones broker, as each will have its own list of trading vehicles and features.

What Is The Dow Jones Industrial Average’s Symbol On My Broker’s Platform?

You will normally find information on the Dow Jones’s latest price movements under the ticker symbol DJI or DJIA. Simply search for this symbol in your broker’s trading platform or mobile app.

What Time Does The Dow Jones Index Start Trading?

The companies on the Dow Jones tend to start trading with the rest of the NYSE at 9:30 am EST, and stop trading at 4:00 pm – so, trading hours from 9:30 am–4:00 pm EST (GMT -5).

However, Dow Jones futures are available six days a week and almost round the clock, and your Dow Jones broker may set their own hours for this instrument.

When Is The Best Time To Trade Dow Jones?

You will need to execute trades during NYSE hours, though you may also be able to set up your trade during pre-market or after-hours. As for the best time to trade, this will depend on your strategy and the market conditions. Many prefer early trading on the Dow, as this is usually a busy period and the price can be subject to more extreme movements and breakouts.

Check out graphs to find the periods with the highest trading volume and volatility, and note any upcoming news events that could impact the index.

What Are The Best Dow Jones Stocks Available At Online Brokers?

The Dow consists of 30 of the leading companies that are based in the US and trade on US stock markets. Popular examples of Dow Jones stocks are Apple (AAPL), 3M (MMM), IBM and Microsoft (MSFT).

Is The Dow Jones Better Than The S&P 500?

The Dow Jones and S&P 500 are two of the most widely followed indexes in the trading world. Each has its place, with the S&P 500 providing a broader view of the economic performance across the US, and the Dow Jones focusing on a smaller group of influential companies, most of which are involved in industry and manufacturing in some way. Both are excellent tools for traders and can be used as a way to make trades through a Dow Jones broker.

One advantage of the Dow Jones is that, due to the smaller number of Dow Jones companies, a tracker ETF will usually have exposure to a fuller list of Dow stocks compared to the S&P 500.