CAC 40

CAC 40 brokers allow traders to gain exposure to the 40 largest companies on France’s leading exchange. The index tracks the economic performance of one of the most influential European countries, making it an exciting asset to trade. Airbus, L’oreal and Total Energies are just some of the major CAC 40 players. The index has a total market cap of just over £2 billion, rivalling other major European indices like the FTSE 100 and DAX 40.

In this guide, we will explore how to compare CAC 40 brokers, how the index works and how you can profit from its volatility and growth. We have also compiled a list of our top recommended brokers with access to the CAC 40 below.

Best UK CAC 40 Brokers

-

Founded in Australia in 2010, Pepperstone is a highly regarded broker specialising in forex and CFDs. Serving more than 400,000 clients globally, it provides access to over 1,300 financial instruments through popular platforms like MT4, MT5, cTrader, and TradingView. Its fee structure is both low and transparent. With regulation by reputable bodies such as the FCA, ASIC, and CySEC, Pepperstone guarantees a safe trading environment for traders at every level.

Instruments Regulator Platforms CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB Pepperstone Trading Platform, MT4, MT5, cTrader, TradingView, AutoChartist Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:500 (Pro) -

Established in Poland in 2002, XTB caters to over a million clients worldwide. This forex and CFD broker offers a robust regulatory framework, a diverse range of assets, and prioritises trader satisfaction. It provides an intuitive proprietary platform equipped with excellent tools to support aspiring traders.

Instruments Regulator Platforms CFDs on shares, Indices, ETFs, Raw Materials, Forex currencies, cryptocurrencies, Real shares, Real ETFs FCA, CySEC, KNF, DFSA, FSC xStation Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 -

Interactive Brokers (IBKR), a leading brokerage, offers access to 150 markets across 33 countries and provides extensive investment services. With more than 40 years of experience, this Nasdaq-listed company complies with strict regulations from the SEC, FCA, CIRO, and SFC. It is among the most reliable brokers worldwide for traders.

Instruments Regulator Platforms Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, Cryptocurrencies, CFDs FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower Min. Deposit Min. Trade Leverage $0 $100 1:50 -

Trade Nation is a leading FX and CFD broker regulated in the UK and Australia, among other places. The company provides competitively priced fixed and variable spreads on over 1,000 assets. Traders benefit from advanced platforms and comprehensive training materials. Additionally, the Signal Centre offers valuable trade ideas.

Instruments Regulator Platforms Forex, CFDs, Indices, Shares, Commodities, Futures, Bonds, Spread Betting, Cryptos (Bahamas Entity Only) FCA, ASIC, FSCA, SCB, FSA TN Trader, MT4 Min. Deposit Min. Trade Leverage $0 0.1 Lots 1:500 (entity dependent) -

Eightcap, an acclaimed broker regulated by the FCA, offers exceptionally low trading costs. Recognised as the top-rated brand by TradingView's vast user base of 100 million, traders can directly access the platform. UK traders can open a live account with a minimum deposit of just £100.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities ASIC, FCA, CySEC, SCB MT4, MT5, TradingView Min. Deposit Min. Trade Leverage £100 0.01 Lots 1:30 -

Established in 1999, FOREX.com is now integrated into StoneX, a prominent financial services entity catering to more than one million clients globally. The broker is regulated in numerous jurisdictions, including the US, UK, EU, and Australia. It offers a vast array of markets beyond forex, delivering competitive pricing on state-of-the-art trading platforms.

Instruments Regulator Platforms Forex, CFDs, Stock CFDs, Indices, Commodities, Futures, Options, Crypto NFA, CFTC, CIRO, FCA, CYSEC, ASIC, SFC, FSA, MAS, CIMA WebTrader, Mobile, MT4, MT5, TradingView Min. Deposit Min. Trade Leverage $100 0.01 Lots 1:30 -

eToro is a leading multi-asset platform providing trading services across numerous CFDs, stocks, and cryptocurrencies. Since its 2007 inception, it has attracted millions of traders worldwide. It operates with authorisation from top regulators such as the FCA and CySEC. Its social trading feature is especially well-regarded. Crypto investments are high-risk and possibly unsuitable for retail investors. There's a potential to lose all invested capital. Familiarise yourself with the risks. 61% of retail CFD accounts incur losses.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, ETFs, Smart Portfolios, Commodities, Futures, Crypto, NFTs FCA, ASIC, CySEC, FSA, FSRA, MFSA, CNMV, AMF eToro Web, CopyTrader, TradingCentral Min. Deposit Min. Trade Leverage $50 $10 1:30

Safety Comparison

Compare how safe the CAC 40 are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✘ | ✔ | |

| XTB | ✔ | ✔ | ✔ | ✔ | |

| Interactive Brokers | ✔ | ✔ | ✘ | ✔ | |

| Trade Nation | ✔ | ✔ | ✘ | ✔ | |

| Eightcap | ✔ | ✔ | ✘ | ✔ | |

| Forex.com | ✔ | ✔ | ✘ | ✔ | |

| eToro | ✔ | ✔ | ✘ | ✔ |

Payments Comparison

Compare which popular payment methods the CAC 40 support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| XTB | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| Interactive Brokers | ✔ | ✔ | ✘ | ✘ | ✘ | ✘ |

| Trade Nation | ✔ | ✔ | ✔ | ✘ | ✔ | ✘ |

| Eightcap | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| Forex.com | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| eToro | ✔ | ✔ | ✘ | ✔ | ✔ | ✘ |

Mobile Trading Comparison

How good are the CAC 40 at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| Pepperstone | iOS & Android | ✘ | ||

| XTB | iOS & Android | ✔ | ||

| Interactive Brokers | iOS & Android | ✔ | ||

| Trade Nation | iOS & Android | ✘ | ||

| Eightcap | iOS & Android | ✘ | ||

| Forex.com | iOS & Android | ✘ | ||

| eToro | iOS & Android | ✘ |

Beginners Comparison

Are the CAC 40 good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|---|---|---|---|---|

| Pepperstone | ✔ | $0 | 0.01 Lots | ||

| XTB | ✔ | $0 | 0.01 Lots | ||

| Interactive Brokers | ✔ | $0 | $100 | ||

| Trade Nation | ✔ | $0 | 0.1 Lots | ||

| Eightcap | ✔ | £100 | 0.01 Lots | ||

| Forex.com | ✔ | $100 | 0.01 Lots | ||

| eToro | ✔ | $50 | $10 |

Advanced Trading Comparison

Do the CAC 40 offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Pepperstone | Expert Advisors (EAs) on MetaTrader | ✔ | 1:30 (Retail), 1:500 (Pro) | ✔ | ✘ | ✔ | ✘ |

| XTB | - | ✔ | 1:30 | ✘ | ✘ | ✔ | ✘ |

| Interactive Brokers | Capitalise.ai, TWS API | ✘ | 1:50 | ✘ | ✔ | ✔ | ✔ |

| Trade Nation | Expert Advisors (EAs) on MetaTrader | ✘ | 1:500 (entity dependent) | ✘ | ✘ | ✘ | ✘ |

| Eightcap | TradingView Bots | ✘ | 1:30 | ✔ | ✘ | ✔ | ✘ |

| Forex.com | Expert Advisors (EAs) on MetaTrader | ✘ | 1:30 | ✔ | ✔ | ✔ | ✘ |

| eToro | Automate your trades via CopyTrader - follow profitable traders. Open and close trades automatically when they do. | ✘ | 1:30 | ✘ | ✔ | ✘ | ✔ |

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the CAC 40.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|---|---|---|---|---|---|---|---|---|

| Pepperstone | |||||||||

| XTB | |||||||||

| Interactive Brokers | |||||||||

| Trade Nation | |||||||||

| Eightcap | |||||||||

| Forex.com | |||||||||

| eToro |

Our Take On Pepperstone

"Pepperstone is a premier trading platform, providing tight spreads, swift execution, and sophisticated charting tools for seasoned traders. Beginners benefit from no minimum deposit, comprehensive learning materials, and outstanding 24/7 support."

Pros

- Pepperstone now offers spread betting via TradingView, delivering a streamlined and tax-efficient trading experience with sophisticated analytical tools.

- Pepperstone presents itself as an economical choice for traders, offering spreads as low as 0.0 in its Razor account. The Active Trader programme provides rebates up to 30% on indices and commodities, plus $3 per lot on forex.

- Over the years, Pepperstone has consistently garnered recognition from DayTrading.com’s annual awards. Recently, it was honoured as the 'Best Overall Broker' in 2025 and was the 'Best Forex Broker' runner-up the same year.

Cons

- Pepperstone’s demo accounts are active for only 60 days, which may not be not long enough to familiarize yourself with the different platforms and test trading strategies.

- Although its market range has improved, its crypto offerings remain limited compared to brokers specialising in this sector, lacking real coin investment options.

- Pepperstone doesn't offer cTrader Copy, a favoured feature for copying trades found in the cTrader platform, which is available on other platforms such as IC Markets. However, Pepperstone has launched its own user-friendly copy trading app.

Our Take On XTB

"XTB excels for novice traders with its superb xStation platform, minimal trading costs, no required deposit, and outstanding educational resources, many of which are fully integrated into the platform."

Pros

- Top-notch customer support, available 24/5, includes a welcoming live chat with response times under two minutes during tests.

- XTB processes withdrawals swiftly, paying within 3 business days, subject to the method and amount.

- XTB offers a diverse array of instruments, including CFDs on shares, indices, ETFs, commodities, forex, crypto, real shares, real ETFs, and share dealing, along with newly introduced Investment Plans. This allows XTB to serve both short-term traders and long-term investors efficiently.

Cons

- XTB has stopped supporting MT4, restricting traders to its own platform, xStation. This decision may discourage experienced traders accustomed to using the MetaTrader suite.

- The research tools at XTB are commendable but have the potential to excel further. Enhancing them with access to top-tier third-party services like Autochartist, Trading Central, and TipRanks would significantly elevate their offering.

- XTB lacks a raw spread account, a feature increasingly offered by competitors such as Pepperstone. This omission might not satisfy traders seeking the most competitive spreads.

Our Take On Interactive Brokers

"Interactive Brokers ranks highly for seasoned traders due to its robust charting platforms, live data, and bespoke layouts via the new IBKR Desktop app. Its competitive pricing and sophisticated order choices appeal to traders, and its wide equity options are industry-leading."

Pros

- While initially targeting seasoned traders, IBKR has recently widened its appeal by eliminating its $10,000 minimum deposit requirement.

- The TWS platform is tailored for intermediate and advanced traders, featuring over 100 order types and a dependable real-time market data feed with exceptional uptime.

- Interactive Brokers has introduced ForecastTrader, an innovative product offering zero-commission trading with yes/no Forecast Contracts on political, economic, and climate events. It features fixed $1 contract payouts, 24/6 market access, and a 3.83% APY on positions held.

Cons

- Support can be sluggish and frustrating. Tests reveal that you may face challenges reaching customer service quickly, which could result in delays in issue resolution.

- IBKR offers a variety of research tools, but their inconsistent placement across trading platforms and the 'Account Management' webpage creates a confusing experience for users.

- The learning curve for TWS is quite steep, making it tough for novice traders to navigate and grasp all its features. In contrast, Plus500's web platform is far more accessible for those new to trading.

Our Take On Trade Nation

"Trade Nation is ideal for novice traders seeking diverse markets on an easy-to-use platform. It offers no minimum deposit, complimentary funding options, and robust educational resources."

Pros

- A variety of trading platforms and apps, such as MT4, make the brand suitable for experienced traders.

- The trading firm provides narrow spreads and a clear pricing structure.

- Access a comprehensive selection of investments through leveraged CFDs, enabling both long and short strategies.

Cons

- Reduced legal safeguards with an offshore entity.

Our Take On Eightcap

"Eightcap excels for traders, offering diverse charting platforms, educational Labs, and AI tools. With over 120 crypto CFDs, it stands out in crypto trading and has won our 'Best Crypto Broker' award twice consecutively."

Pros

- Eightcap has excelled in all essential trading areas, surpassing all rivals to clinch our 'Best Overall Broker' award for 2024. It also earned the titles of 'Best Crypto Broker' and 'Best TradingView Broker' for 2025.

- Eightcap excels with a suite of advanced trading tools, such as MT4 and MT5, and has recently joined the 100-million-user social trading network, TradingView.

- In 2021, Eightcap enhanced its lineup, now providing an extensive range of cryptocurrency CFDs. It offers crypto/fiat and crypto/crypto pairs, along with crypto indices for comprehensive market exposure.

Cons

- Despite the growing range of tools available, Eightcap lacks popular industry resources such as Autochartist and Trading Central. These provide advanced charting analytics, live news, and essential market insights for traders focused on short-term strategies.

- The demo account is available for 30 days, after which it requires a request for extension. This is less convenient than XM's offering, which provides an unlimited demo mode.

- Eightcap must enhance its range of over 800 instruments to rival top competitors like Blackbull Markets, which offers 26,000+ assets, especially improving its limited commodities selection.

Our Take On Forex.com

"FOREX.com excels in serving traders of all levels, offering more than 80 currency pairs, spreads starting at 0.0 pips, and competitive commissions. Its robust charting platforms provide over 100 technical indicators and comprehensive research tools."

Pros

- With more than two decades of expertise, strong regulatory governance, and numerous accolades, including a second-place finish in our 'Best Forex Broker' awards, FOREX.com is globally renowned as a reliable trading platform.

- FOREX.com provides top-tier forex rates beginning at 0.0 pips, along with attractive cashback rebates up to 15% for dedicated traders.

- The in-house Web Trader remains a top-tier platform for budding traders, featuring an elegant design and more than 80 technical indicators for market analysis.

Cons

- FOREX.com's MT4 platform provides around 600 instruments, a notable reduction compared to the more than 5,500 options on its other platforms.

- Demo accounts are typically limited to 90 days, hindering effective strategy testing.

- US clients are not protected against negative balances, which means you could end up owing more than your initial deposit.

Our Take On eToro

"eToro's social trading platform excels with its outstanding user experience and lively community chat, aiding beginners in spotting opportunities. It offers competitive fees on numerous CFDs and real stocks, alongside exceptional rewards for seasoned strategists."

Pros

- The web platform and mobile app receive higher user reviews and app rankings compared to leading competitors like AvaTrade.

- eToro is a globally recognised brand, operating under top-tier international regulations. It boasts a community of over 25 million users.

- Utilising TradingView, the charts provide robust tools for technical analysis, featuring nine chart types and more than 100 indicators.

Cons

- The only significant contact option, besides the in-platform live chat, is limited.

- The minimum withdrawal is set at $30, accompanied by a $5 fee. This may impact traders with limited funds, particularly those just starting out.

- The absence of extra charting platforms such as MT4 may deter experienced traders who rely on external software.

How To Compare CAC 40 Brokers

Instruments

The CAC 40 is a popular index to trade amongst UK investors because of its high international exposure and exciting movement. As such, many brokers offer tradable CAC 40 assets. These include futures, options, ETFs, structured products and funds. Along with this, you can also invest in the stocks and shares that make up the CAC 40 (such as Renault or AXA).

For example, Interactive Brokers UK allows for the trading of CAC 40 options or futures contracts, while IG supports CAC 40 futures, CFD trading and spread betting.

Trading Platforms

The trading platform is what you use to open and close positions with your CAC 40 brokerage. Therefore, this is an incredibly important factor when choosing a firm. There is a multitude of different platforms available, including popular tools like MetaTrader 4, MetaTrader 5 and TradingView, as well as many bespoke software packages built by the brokers themselves.

Finding a platform that offers all the tools and features you require will be essential for successfully implementing your strategies and earning profits. Among these will likely be technical indicators, copy-trading functionality, AI automated trading, social investing, time frame ranges, one-click trading, order types, mobile trading compatibility and interface customisation. Indicators like the moving average and stochastic oscillators can be very useful when trying to predict future CAC 40 values.

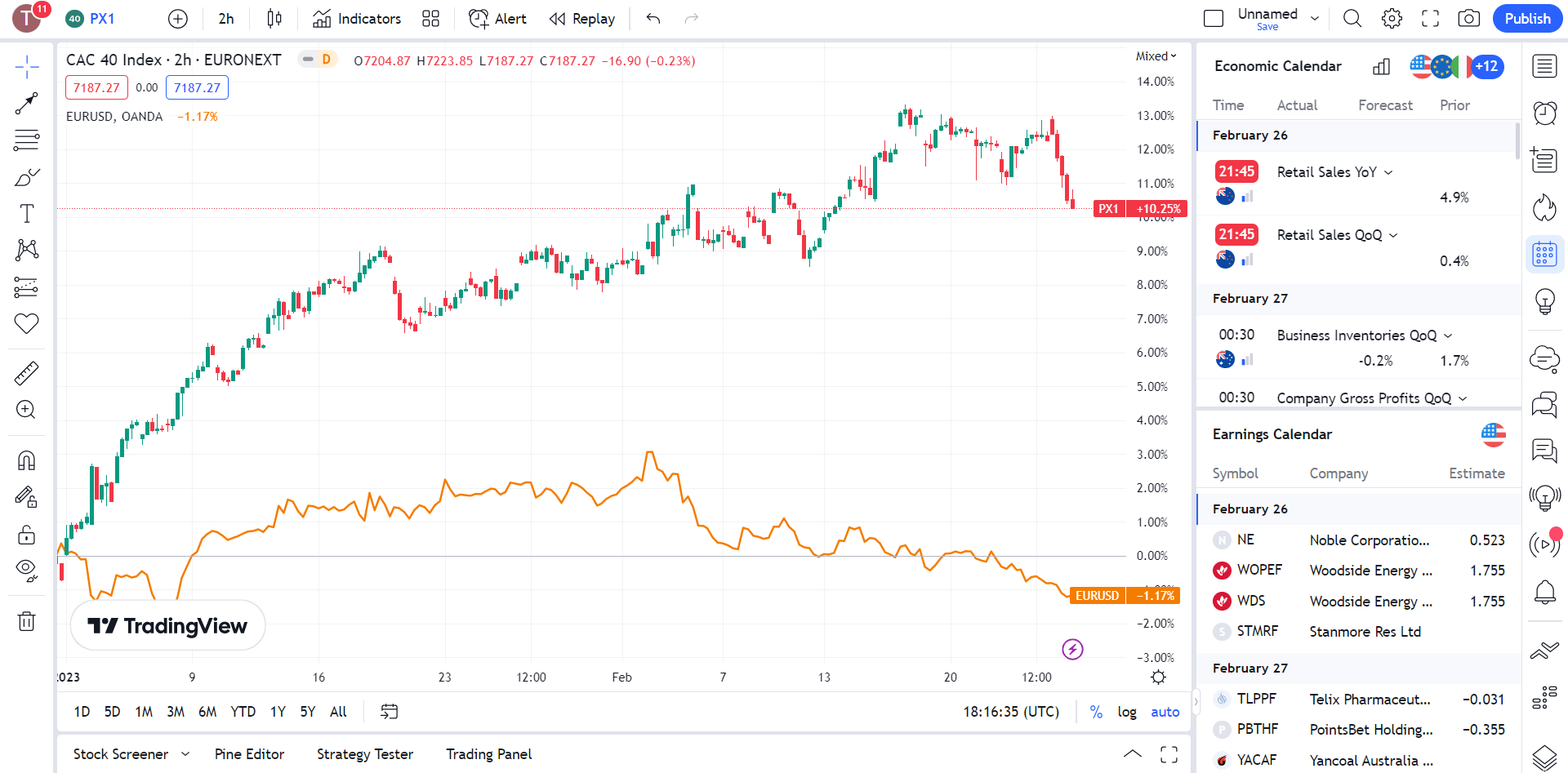

TradingView CAC 40 & EUR/USD Comparison

Our experts recommend you test a platform by opening a demo account. These allow you to invest with virtual money using the broker’s platform, letting you get accustomed to it and its features.

Research And Education

The FR 40 consists of forty of France’s largest companies. As such, lots of research will be required to stay on top of the major players’ actions and predict the movement of the index. Top CAC 40 brokers will provide clients with the research tools to accomplish this. Such tools include relevant news articles, professional analyst recommendations, economic calendars and price analyses.

Less experienced traders may also require educational resources to learn how to invest successfully. The best CAC 40 brokers will provide resources such as platform guides, key term glossaries, forums, explanatory videos, asset trading basics, etc.

Trading Fees

Different CAC 40 brokers have different fee structures. Some may charge subscription fees to access advanced features, while others may have zero commissions on trades. Deposit and withdrawal fees and spreads may also differ and can have a significant impact on your take-home. Finding a broker that offers the features you want with a fee structure that minimises costs is important to maximise profits.

For example, IG has spread ranges of 1.0 to 4.0 points on its CAC 40 futures contract with no account charge.

What Is The CAC 40?

The CAC 40 is a French benchmark stock market index, built to represent the 40 most significant stocks among the largest 100 market caps on the Euronext Paris exchange. The asset is a price return index, meaning it represents the capital appreciation of the constituent stocks.

The asset’s name comes from the Paris Bourse’s early automation system, Cotation Assistée en Continu. The base value of 1,000 was set on 31st December 1987, which was equivalent to 370,437,433,957.70 French Francs (roughly £50 billion).

What Is The CAC 40 Used For?

The CAC 40 gives a general idea of the level and direction of the Euronext Paris stock exchange. It gives a snapshot of the French stock market performance and indicates its overall economic health. However, because of the international nature of many of the companies listed (e.g. Renault, AXA, Michelin, etc.), it is debatable whether this is a true indication of France’s economic health. 45% of the CAC 40’s listed shares are owned by foreign investors.

Generally, the index reacts predictably to major economic events affecting France and the Eurozone. This is shown by the big 42.68% fall in 2008 because of the global financial crisis and the 7.68% drop because of the effects of Covid-19 in 2020.

Those looking to speculate on the FR 40 can do so by investing in several different exchange-traded funds (ETFs). Some of the more popular ETFs include Lyxor ETF CAC 40 (CAC), EasyETF CAC 40 (E40) and DBXT CAC 40 (X40) and can be traded via most of the top CAC 40 brokers. Other viable assets include funds, futures, options and structured products.

How The CAC 40 Works

Weighting

The CAC 40 is a capitalisation-weighted index. This means that it is impacted more by companies with greater market capitalisation than those with less. In particular, the companies chosen are the 40 with the most significant values out of the 100 with the largest market capitalisations in the Euronext Paris exchange. The market caps are decided in terms of liquidity on the exchange.

The index weightings of companies are capped at 15% at each quarterly review. However, the weightings range freely with underlying share prices.

CAC 40 Changes

Selection for the CAC 40 index composition is reviewed every quarter by an independent Index Steering Committee. At the review dates, companies on the Euronext Paris are ranked according to free float market capitalisation and share turnover over the last year. The forty chosen companies must create an index such that it is a relevant benchmark for portfolio management and is a suitable underlying asset for derivatives products.

Buffer Zone

Out of the 40 companies making up the CAC 40, the 35 highest-ranking companies are selected and a buffer zone is created between the 36th and 45th highest-ranking companies. Incumbent constituents of the CAC 40 take priority over those not in the index but the buffer zone does allow for movement in and out of the list, depending on performance.

Points To Remember

Below are some important CAC 40 facts and stats. Keep these in mind when investing with CAC 40 brokers:

- Company weightings are capped at 15%

- The index began in 1987, with a base value of 1,000.00

- There was a closing high of 7,376.37 on 5th January 2022

- The largest single-year rise was in 1988 with a 57.39% rise

- The was an intraday high of 7,384.86 on 5th January 2022

- The largest single-year fall was in 2008 with a 42.68% drop

- Most leading CAC 40 brokers are regulated and highly trusted

- There has been an average return of 7.74% between 1991 and 2023

- The underlying index is open from 08:00 to 16:30 GMT, Monday through Friday

- Operation shifted from total market capitalisation to free float-adjusted market capitalisation in 2003

- The exchange only trades in euros (CAC 40 brokers will usually provide accounts with the base currency of euros)

Why Trade With CAC 40 Brokers?

The CAC 40 is composed of France’s largest companies and stocks, with the index accounting for more than 80% of the total market cap of the CAC All-Tradable. France’s economy makes up around one-fifth of the European economy, showing its significance as a global economic power. As such, the FR 40 is an exciting index to invest in and trade.

Choosing A CAC 40 Asset

CAC 40 brokers allow you to invest in the index via several different asset types. While you can trade the individual assets making up the index, you can also trade structured products, options, futures, funds and exchange-traded funds (ETFs) that track it.

Trading the compositional assets of the CAC 40 will require specific industry and company knowledge, such as CEO changes, to speculate effectively. On the other hand, investing in the index through other means may require greater overall economic knowledge. Understanding and predicting the economic health of France and the European Union will be of utmost importance to maximise your profits.

The asset type you choose to use should depend on the type of investing you would like to perform and your risk appetite. Would you like to directly expose yourself to the index through futures or predict price action with options? Would you rather take a diversified approach through ETF or fund trading? Before choosing which asset class you want to take advantage of, these are the questions you need to ask yourself.

Different brokers will give traders access to different instruments, so make sure the firm you choose offers your desired instruments.

Biggest Players

So who are the most impactful players in the CAC 40 index? Below is a list with the weightings of the top 10 most influential companies included.

- LVMH – 11.73%

- TOTALENERGIES – 9.17%

- SANOFI – 6.83%

- L’OREAL – 6.09%

- SCHNEIDER ELECTRIC – 5.10%

- AIR LIQUIDE – 4.70%

- AIRBUS – 4.01%

- BNP PARIBUS ACT.A – 3.70%

- VINCI – 3.42%

- ESSILORLUXOTTICA – 3.36%

The full, up-to-date CAC 40 stock list can be found on the Euronext website.

Key Indicators

As with stocks, there are a vast number of factors that affect the performance of the CAC 40. Of course, the political and economic situation in France is very influential but, outside of that, the European Union and other nearby economies (like the UK) can have a strong impact. Major trading partners and world powers (e.g. USA and China) will also have a noticeable influence on the index’s value.

You will want to pay attention to these countries’ overall performances through their GDP and inflation stats, employment and unemployment levels, interest rates, political activity (including elections) and other key metrics.

For example, the recent Covid-19 pandemic beginning in 2020 had a major impact on the CAC 40 index, causing a fall of 7.68% in 2020 alone. However, the strong recovery efforts put in place by France and the EU have led to huge growth in the index, with a 28.85% increase in 2021.

Strategies

There is a vast array of investment strategies available to those looking to extract profits from the price movements of the FR 40. There is no perfect winning strategy that works for every available asset and person, though there are many formulae that can be found through exploration and practice. Here, we will cover a couple of the more popular strategies that have the potential to earn profits when applied effectively.

Moving Average Strategy

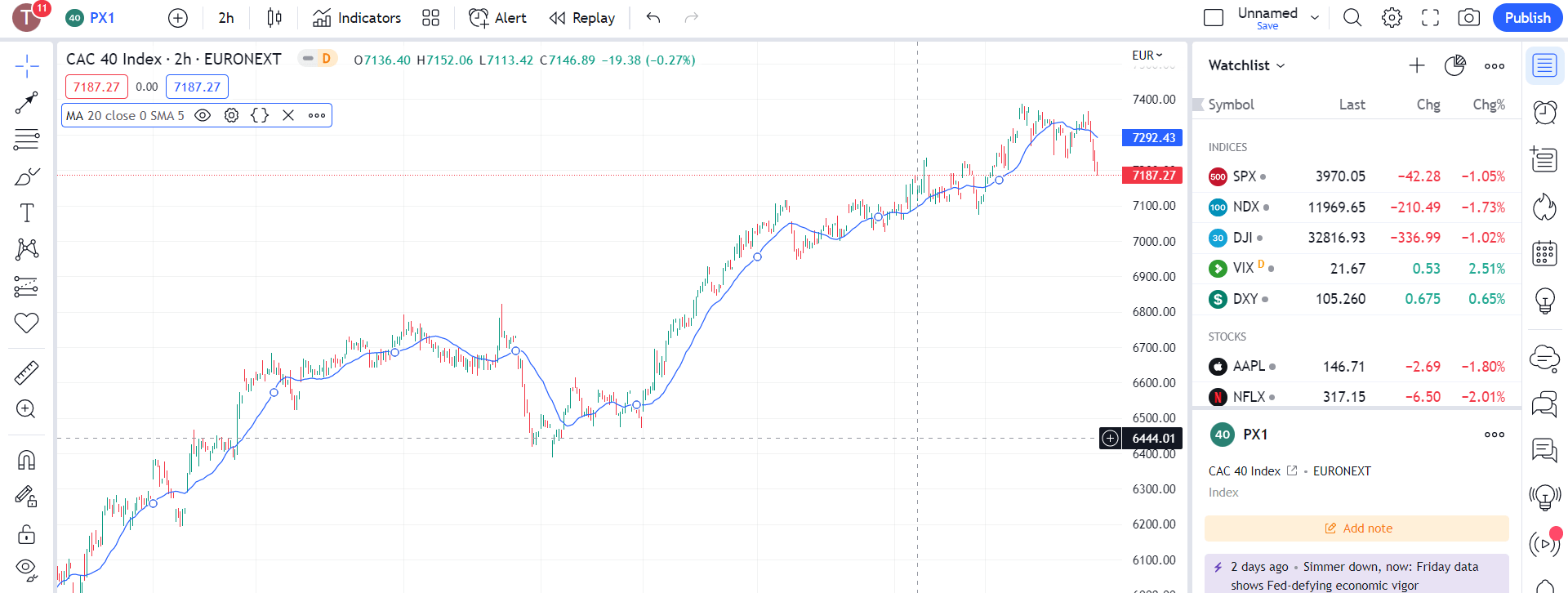

The moving average strategy is a popular technical indicator trading system that looks to smooth out index value data by calculating the average values over set periods. Doing so filters out noise from short-term fluctuations, highlighting the trend direction. The considered periods can be adjusted to whatever you like, allowing this strategy to be used by traders of all time frames.

Simple and exponential moving averages can be used to find trend reversal signals, allowing the prediction of a change in trend direction and facilitating effective position management.

CAC 40 Simple Moving Average Demo

Fundamental Trading

Investing via fundamentals requires strong levels of research and economic analysis to predict future movements by reading reports and articles. Information is key when trading, especially an index made up of many different stocks. To effectively use fundamental analysis, you will need to have a quick, reliable information stream providing you with news updates and reports on each of the constituent assets of the CAC 40 and any external factors. Using the information you obtain, you will need to apply economic analysis to predict how the news updates will affect the index’s value.

Bottom Line On CAC 40 Brokers

CAC 40 brokers provide access to a popular, exciting index with a strong correlation with the European and global economies. Switched-on investors can take advantage of both the domestic French and international economic and political situations to earn a profit. Given the significance of the index, many brokers in the UK support regulated, secure investment in the Euronext Paris asset, whether via CFD, ETF or options contract. Check out our list of the best UK CAC 40 brokers.

FAQ

What Currency Can I Trade The CAC 40 With?

The CAC 40 only trades in euros. However, the euro is one of the major world currencies, so most CAC 40 brokers will allow you to open euro trading accounts. Alternatively, many derivatives are priced in GBP, making the asset accessible to UK investors.

What Is The Best CAC 40 Broker?

The best broker is different for every person. Some will be looking for advanced functions available on the broker’s platform, such as AI automation capabilities, while others may be looking for more intuitive, simplified platforms that make investing easier. Brokers also all have different fee structures and ranges of CAC 40 instruments. To find the right broker for you, we recommend you open a demo account to try each company before investing any real capital.

Can UK Traders Invest In The CAC 40?

Yes, UK clients can trade the CAC 40 via a range of instruments. There are many brokers available to UK residents, such as IG and Interactive Brokers UK. Most firms offer CFDs and futures contracts, while others focus on options and spread betting.

What Time Do CAC 40 Brokers Trade?

While the official opening and closing times for the Euronext exchange are 08:00 to 16:30 GMT, Monday through Friday, many brokers offer extended or after-hours trading. For example, IG quotes the CAC 40 futures contracts 24 hours a day.

What Is The Best Strategy When Trading With CAC 40 Brokers?

No best strategy will always work. Strategies are honed through constant iteration and improvement. No strategy will work for every asset type or goal, so finding one that works for you may take time. Doing so requires implementing a strategy and improving it until you can profitably trade the CAC 40. We recommend iterating and improving your strategy on a broker’s demo trading account so that you do not risk losses before finding a winning formula.