Australian Securities Exchange

The Australian Securities Exchange (ASX) is the main stock exchange in Australia and one of the most established in the Asia-Pacific region. It plays an important role in the Australian economy and has over 2,200 listed companies across a range of industries, making ASX brokers popular with investors looking to trade stocks, options, and other financial instruments.

In this tutorial, we provide an overview of the Australian Stock Exchange, explain how to compare the top online brokers that offer access to the ASX, and list some of the biggest players. Our experts have also reviewed and ranked the best Australian Securities Exchange brokers for UK traders:

Best Australian Stock Exchange Brokers

-

Founded in Australia in 2010, Pepperstone is a highly regarded broker specialising in forex and CFDs. Serving more than 400,000 clients globally, it provides access to over 1,300 financial instruments through popular platforms like MT4, MT5, cTrader, and TradingView. Its fee structure is both low and transparent. With regulation by reputable bodies such as the FCA, ASIC, and CySEC, Pepperstone guarantees a safe trading environment for traders at every level.

Instruments Regulator Platforms CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade, Quantower Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:500 (Pro) -

Established in Poland in 2002, XTB caters to over a million clients worldwide. This forex and CFD broker offers a robust regulatory framework, a diverse range of assets, and prioritises trader satisfaction. It provides an intuitive proprietary platform equipped with excellent tools to support aspiring traders.

Instruments Regulator Platforms CFDs on shares, Indices, ETFs, Raw Materials, Forex currencies, cryptocurrencies, Real shares, Real ETFs FCA, CySEC, KNF, DFSA, FSC xStation Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 -

FXCC, a well-established brokerage since 2010, offers cost-effective online trading. Registered in Nevis and regulated by CySEC, it is distinguished by its ECN conditions and absence of a minimum deposit requirement. The account opening process is efficient, taking under five minutes.

Instruments Regulator Platforms CFDs, Forex, Indices, Commodities, Crypto CySEC MT4, MT5 Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:500 -

IC Markets is an internationally acclaimed forex and CFD broker, admired for its competitive pricing, diverse trading instruments, and superior technology. Established in 2007 and based in Australia, the firm is under the regulation of ASIC, CySEC, and FSA. It has successfully drawn over 180,000 clients from more than 200 nations.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto ASIC, CySEC, CMA, FSA MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade, Quantower Min. Deposit Min. Trade Leverage $200 0.01 Lots 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) -

IC Trading belongs to the reputable IC Markets group. Designed for dedicated traders, it offers highly competitive spreads, dependable order execution, and sophisticated trading tools. However, it operates from Mauritius, an offshore financial centre, allowing high leverage but within a less regulated environment.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, Bonds, Cryptos, Futures FSC MT4, MT5, cTrader, AutoChartist, TradingCentral Min. Deposit Min. Trade Leverage $200 0.01 Lots 1:500 -

Trade Nation is a leading FX and CFD broker regulated in the UK and Australia, among other places. The company provides competitively priced fixed and variable spreads on over 1,000 assets. Traders benefit from advanced platforms and comprehensive training materials. Additionally, the Signal Centre offers valuable trade ideas.

Instruments Regulator Platforms Forex, CFDs, Indices, Shares, Commodities, Futures, Bonds, Spread Betting, Cryptos (Bahamas Entity Only) FCA, ASIC, FSCA, SCB, FSA MT4 Min. Deposit Min. Trade Leverage $0 0.1 Lots 1:500 (entity dependent) -

Eightcap, an acclaimed broker regulated by the FCA, offers exceptionally low trading costs. Recognised as the top-rated brand by TradingView's vast user base of 100 million, traders can directly access the platform. UK traders can open a live account with a minimum deposit of just £100.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities ASIC, FCA, CySEC, SCB MT4, MT5, TradingView Min. Deposit Min. Trade Leverage £100 0.01 Lots 1:30

Safety Comparison

Compare how safe the Australian Securities Exchange are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✘ | ✔ | |

| XTB | ✔ | ✔ | ✔ | ✔ | |

| FXCC | ✘ | ✔ | ✘ | ✔ | |

| IC Markets | ✘ | ✔ | ✘ | ✔ | |

| IC Trading | ✘ | ✘ | ✘ | ✔ | |

| Trade Nation | ✔ | ✔ | ✘ | ✔ | |

| Eightcap | ✔ | ✔ | ✘ | ✔ |

Payments Comparison

Compare which popular payment methods the Australian Securities Exchange support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| XTB | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| FXCC | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| IC Markets | ✔ | ✘ | ✔ | ✔ | ✔ | ✘ |

| IC Trading | ✔ | ✔ | ✔ | ✔ | ✘ | ✘ |

| Trade Nation | ✔ | ✔ | ✔ | ✘ | ✔ | ✘ |

| Eightcap | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

Mobile Trading Comparison

How good are the Australian Securities Exchange at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| Pepperstone | iOS & Android | ✘ | ||

| XTB | iOS & Android | ✔ | ||

| FXCC | iOS & Android | ✘ | ||

| IC Markets | iOS & Android | ✘ | ||

| IC Trading | iOS & Android | ✘ | ||

| Trade Nation | iOS & Android | ✘ | ||

| Eightcap | iOS & Android | ✘ |

Beginners Comparison

Are the Australian Securities Exchange good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|---|---|---|---|---|

| Pepperstone | ✔ | $0 | 0.01 Lots | ||

| XTB | ✔ | $0 | 0.01 Lots | ||

| FXCC | ✔ | $0 | 0.01 Lots | ||

| IC Markets | ✔ | $200 | 0.01 Lots | ||

| IC Trading | ✔ | $200 | 0.01 Lots | ||

| Trade Nation | ✔ | $0 | 0.1 Lots | ||

| Eightcap | ✔ | £100 | 0.01 Lots |

Advanced Trading Comparison

Do the Australian Securities Exchange offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Pepperstone | Expert Advisors (EAs) on MetaTrader | ✔ | 1:30 (Retail), 1:500 (Pro) | ✔ | ✘ | ✔ | ✘ |

| XTB | - | ✔ | 1:30 | ✘ | ✘ | ✔ | ✘ |

| FXCC | Expert Advisors (EAs) on MetaTrader | ✘ | 1:500 | ✔ | ✘ | ✔ | ✘ |

| IC Markets | Expert Advisors (EAs) on MetaTrader, cBots on cTrader, Myfxbook AutoTrade | ✘ | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) | ✔ | ✘ | ✔ | ✘ |

| IC Trading | Expert Advisors (EAs) on MetaTrader, cBots on cTrader | ✘ | 1:500 | ✔ | ✘ | ✔ | ✘ |

| Trade Nation | Expert Advisors (EAs) on MetaTrader | ✘ | 1:500 (entity dependent) | ✘ | ✘ | ✘ | ✘ |

| Eightcap | TradingView Bots | ✘ | 1:30 | ✔ | ✘ | ✔ | ✘ |

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the Australian Securities Exchange.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|---|---|---|---|---|---|---|---|---|

| Pepperstone | |||||||||

| XTB | |||||||||

| FXCC | |||||||||

| IC Markets | |||||||||

| IC Trading | |||||||||

| Trade Nation | |||||||||

| Eightcap |

Our Take On Pepperstone

"Pepperstone is a premier trading platform, providing tight spreads, swift execution, and sophisticated charting tools for seasoned traders. Beginners benefit from no minimum deposit, comprehensive learning materials, and outstanding 24/7 support."

Pros

- Pepperstone offers rapid execution speeds of approximately 30ms, enabling swift order processing and execution, making it ideal for traders.

- Over the years, Pepperstone has consistently garnered recognition from DayTrading.com’s annual awards. Recently, it was honoured as the 'Best Overall Broker' in 2025 and was the 'Best Forex Broker' runner-up the same year.

- Support for top-tier charting platforms such as MT4, MT5, TradingView, and cTrader. These tools accommodate different short-term trading methods, including algorithmic trading.

Cons

- Although its market range has improved, its crypto offerings remain limited compared to brokers specialising in this sector, lacking real coin investment options.

- Pepperstone's demo accounts expire after 30 days, which may not provide sufficient time to explore various platforms and evaluate trading strategies.

- Pepperstone doesn't offer cTrader Copy, a favoured feature for copying trades found in the cTrader platform, which is available on other platforms such as IC Markets. However, Pepperstone has launched its own user-friendly copy trading app.

Our Take On XTB

"XTB excels for novice traders with its superb xStation platform, minimal trading costs, no required deposit, and outstanding educational resources, many of which are fully integrated into the platform."

Pros

- XTB offers a diverse array of instruments, including CFDs on shares, indices, ETFs, commodities, forex, crypto, real shares, real ETFs, and share dealing, along with newly introduced Investment Plans. This allows XTB to serve both short-term traders and long-term investors efficiently.

- XTB offers a superb array of educational resources, such as training videos and articles, embedded within the platform to assist traders of all experience levels.

- Setting up an XTB account is straightforward and fully online, requiring only a few minutes. This simplicity eases new traders into the world of trading.

Cons

- It is frustrating that XTB products do not allow traders to modify the default leverage level. Manually adjusting leverage can greatly reduce risk in forex and CFD trading.

- XTB has stopped supporting MT4, restricting traders to its own platform, xStation. This decision may discourage experienced traders accustomed to using the MetaTrader suite.

- The research tools at XTB are commendable but have the potential to excel further. Enhancing them with access to top-tier third-party services like Autochartist, Trading Central, and TipRanks would significantly elevate their offering.

Our Take On FXCC

"FXCC remains a top choice for forex traders, offering over 70 currency pairs, very tight spreads from 0.0 pips in tests, and high leverage up to 1:500 with the ECN XL account."

Pros

- There are no deposit fees other than standard cryptocurrency mining charges, which benefits active traders.

- The complimentary education section, featuring the 'Traders Corner' blog, provides a wide array of resources suitable for traders of all experience levels.

- FXCC offers competitive and transparent ECN spreads starting from 0.0 pips, with no commissions. This makes it one of the most cost-effective forex brokers available.

Cons

- Unaware traders might face steep withdrawal fees, such as a notable $45 for bank transfers.

- The range of research tools, such as Trading Central and Autochartist, is quite limited. Leading platforms in this category, like IG, offer more advanced features.

- FXCC's exclusive MetaTrader platform is a limitation, especially when compared to more versatile options like AvaTrade, which offers five different platforms to cater to various trader needs.

Our Take On IC Markets

"IC Markets provides excellent pricing, swift execution, and easy deposits. With cutting-edge charting tools like TradingView and the Raw Trader Plus account, it continues to be a preferred option for intermediate and advanced traders."

Pros

- IC Markets provides some of the industry's narrowest spreads, offering 0.0-pip spreads on major currency pairs. This makes it an extremely cost-effective choice for traders.

- IC Markets provides reliable 24/5 support, especially for account and funding queries, drawing from direct experience.

- As a well-regulated and reputable broker, IC Markets focuses on client safety and transparency to provide a dependable global trading experience.

Cons

- Although there are four top-tier third-party platforms available, the absence of in-house software or a trading app tailored for novice traders is notable.

- The tutorials, webinars, and educational resources require enhancement, lagging behind competitors such as CMC Markets, which diminishes their appeal to novice traders.

- IC Markets provides metals and cryptocurrencies for trading through CFDs, though the selection is narrower compared to brokers such as eToro. This limits opportunities for traders focused on these asset classes.

Our Take On IC Trading

"IC Trading offers an ideal environment, featuring top-tier execution speeds of around 40 milliseconds, extensive liquidity, and advanced charting tools, perfect for scalpers, traders, and algorithmic traders."

Pros

- The streamlined digital account setup allows traders to commence trading swiftly, eliminating lengthy paperwork. Testing shows the process takes mere minutes.

- Trading Central and Autochartist provide valuable technical analysis and actionable ideas. These tools are readily available within the account area or on the cTrader platform.

- IC Trading provides exceptional flexibility, allowing traders to open as many as 10 live accounts and 20 demo accounts. This enables the management of distinct profiles for various activities, including manual and algorithmic trading.

Cons

- The educational materials require significant enhancement unless accessed via the IC Markets website. This limitation is particularly disadvantageous for beginners seeking a thorough learning experience, especially when compared to industry leaders such as eToro.

- Although IC Trading operates under the reputable IC Markets group, it is licensed by the FSC in Mauritius, a regulator known for its limited financial transparency and lack of robust safeguards.

- Unlike IC Markets, IC Trading lacks support for social trading via the IC Social app or the ZuluTrade platform.

Our Take On Trade Nation

"Trade Nation is ideal for novice traders seeking diverse markets on an easy-to-use platform. It offers no minimum deposit, complimentary funding options, and robust educational resources."

Pros

- The trading firm provides narrow spreads and a clear pricing structure.

- Access a comprehensive selection of investments through leveraged CFDs, enabling both long and short strategies.

- Trade Nation, a highly regarded and well-regulated broker, was formerly known as Core Spreads.

Cons

- Reduced legal safeguards with an offshore entity.

Our Take On Eightcap

"Eightcap excels for traders, offering diverse charting platforms, educational Labs, and AI tools. With over 120 crypto CFDs, it stands out in crypto trading and has won our 'Best Crypto Broker' award twice consecutively."

Pros

- With spreads starting at 0 pips, minimal commission charges, and leverage up to 1:500 for select clients, Eightcap delivers affordable and flexible trading opportunities. These conditions suit various strategies, such as trading and scalping.

- Eightcap excels with a suite of advanced trading tools, such as MT4 and MT5, and has recently joined the 100-million-user social trading network, TradingView.

- In 2021, Eightcap enhanced its lineup, now providing an extensive range of cryptocurrency CFDs. It offers crypto/fiat and crypto/crypto pairs, along with crypto indices for comprehensive market exposure.

Cons

- The demo account is available for 30 days, after which it requires a request for extension. This is less convenient than XM's offering, which provides an unlimited demo mode.

- Eightcap must enhance its range of over 800 instruments to rival top competitors like Blackbull Markets, which offers 26,000+ assets, especially improving its limited commodities selection.

- Despite the growing range of tools available, Eightcap lacks popular industry resources such as Autochartist and Trading Central. These provide advanced charting analytics, live news, and essential market insights for traders focused on short-term strategies.

Choosing ASX Brokers

When comparing brokers that offer trading on the Australian Stock Exchange, there are several factors to consider:

- Products: A range of vehicles can be used to trade the ASX beyond just stocks, including options, futures, and ETFs. Other popular products offered by ASX brokers include CFDs (a derivative that allows the contract buyer to make a leveraged bet), spread betting (works in a similar way to CFDs and is popular with UK traders as profits are tax-exempt), plus binary options (a simple prediction on whether an asset’s price will rise or fall in a given timeframe with a pre-defined profit if your forecast is correct).

- Fees: Brokers have different fee structures for trading on the ASX. Some online brokers may advertise as commission-free but will earn money from clients’ trades in the spread or some other way, such as deposit and withdrawal fees and account charges.

- Platforms: Some Australian Securities Exchange brokers offer their own platforms, while others use third-party software such as MetaTrader 4. Ultimately, traders should look for a platform that is user-friendly, reliable, and has the features they need, such as live graphs and real-time data, multiple order types, and copy trading. Also check if the platform is available as a mobile investing app.

- Regulation: The ASX is regulated by the Australian Securities and Investments Commission (ASIC), which has different rules and requirements than other regulatory bodies. Traders using ASX brokers from outside Australia, i.e. those based in the UK, should look for oversight from the Financial Conduct Authority (FCA). This will give retail investors various protections, including access to compensation should the brokerage go bankrupt.

- Time zone: The ASX is based in Australia, so its trading hours are different from other major exchanges around the world, such as the LSE. The Australian Stock Exchange opens at 10am local time (11pm GMT) and closes at 4pm local time (5am GMT). Fortunately, UK brokers that provide access to ASX assets may set their own hours.

Why Trade On The Australian Stock Exchange?

Trading on the ASX offers a range of benefits for investors, including exposure to a diverse range of industries, such as mining, finance, and healthcare. The ASX is also known for its high level of transparency and corporate governance, with listed companies required to comply with the Australian Securities Exchange Corporate Governance Principles and Recommendations (2019).

The ASX offers a variety of tools and resources to support traders, including an entity search function to help investors find specific firms and information on the latest news and trends. The exchange also places a strong emphasis on investor education, providing access to a wide range of resources to help traders make informed investment decisions.

Moreover, the Australian Securities Exchange has a reputation for offering stability and high liquidity to traders. The Australian economy has consistently demonstrated steady growth and a relatively low unemployment rate, so many traders have confidence in stock prices rising again if they ever fall. High volatility also means there is often high trading volume and tight spreads for many of its listed securities.

Strategies For Trading At ASX Brokers

- Buy and Hold: The simplest long-term trading strategy involves buying a stock or an ETF and holding onto it for an extended period. Investors should look for an asset that presents good value and is likely to display long-term growth; they should also pay attention to dividend yields. As the investor takes a long-term view, they are not as concerned with short-term volatility and can ride out market dips. This can work well when trading on the Australian Stock Exchange as it is known for its stability.

- Technical Analysis: Short-term trading strategies usually involve analysing charts and using technical indicators to predict stock price movements over a short timeframe. Traders who use this approach rely on chart patterns, such as trend lines, moving averages, and support and resistance levels, to identify opportunities. They also use technical indicators like the Relative Strength Index (RSI) to confirm the strength of a trend.

- Contrarian Trading: When everyone else is selling, contrarian traders will buy and when everyone else is buying, contrarian traders will sell. The idea behind this strategy is that the market tends to overreact to news or events, causing the stock to move in one direction too quickly. Traders using this strategy believe that the market will eventually correct itself and the stock will move in the opposite direction, allowing them to profit.

What Is The Australian Stock Exchange?

The Australian Securities Exchange (ASX) is a securities exchange located in Sydney, Australia. The role of the ASX is to serve as a marketplace where investors can buy and sell shares of publicly traded companies. The ASX is one of the largest exchanges in the Asia-Pacific region, with a market capitalisation of over AUD 2 trillion.

The exchange ensures that all trades are executed fairly and in compliance with ASIC regulations. It also provides a range of services to market participants, including clearing and settlement services, asset data, and educational resources.

Like most exchanges, the ASX is also useful for gauging the health of its home country’s economy – in this case, Australia. This is because it is comprised of the top 2,200 publicly-traded firms, many of which are based in Australia, though the ASX also lists some large multinational companies like BHP Group and Rio Tinto, which are headquartered in other countries. Smaller overseas firms may even list on the ASX as a way of raising capital.

For UK traders, the ASX is an attractive exchange, as it offers a range of securities on many markets, including stocks, options, exchange-traded funds (ETFs), futures, and bonds. Investors can make a profit from accurately predicting the performance of the companies listed on the exchange or by speculating on the respective stock indices.

History

Early History

- 1861: The first stock exchange in Australia is established in Melbourne.

- 1871: The Sydney Stock Exchange is founded, becoming the second exchange in Australia.

- 1980s: The Australian government begins to push for the merging of regional stock exchanges into a single entity.

- 1987: The ASX officially comes into existence, following the merger of the six independent state-based stock exchanges.

- 1997: The ASX becomes a publicly listed company, with shares trading on its own exchange.

Recent History

- 2012: The ASX launch the ASX Centre Point dark pool, which provides an alternative trading venue for professional investors looking to trade large blocks of shares anonymously.

- 2016: The ASX announces plans to replace its existing clearing and settlement system (known as CHESS) with a blockchain-based system. The new system, called CHESS replacement, is expected to improve the speed and efficiency of the settlement process and was meant to go live in 2020.

- 2019: The ASX DataSphere is launched. It is designed to provide a range of real-time and historical data.

- 2020: A new sustainability index, the S&P/ASX All Technology Index, is launched. It lists firms that are focused on environmental, social, and governance (ESG) issues, as well as those involved in technology and innovation.

- 2021: The ASX announces plans to partner with Digital Asset, a blockchain technology company, to develop and test the CHESS replacement system.

- 2022: After an already delayed launch, the blockchain replacement of CHESS is scrapped after an Accenture review reveals numerous problems.

Key Dates

- 1987: The Black Monday stock crash affects the ASX, with the All Ordinaries index dropping by 25% in a single day.

- 1998: The introduction of the ASX Trade24 platform, which enables after-hours trading of ASX 24 derivatives products.

- 2010: Chi-X Australia, the first competitor to the ASX, is launched in the Australian equities market.

- 2012: The merger between the ASX and the Singapore Exchange (SGX) is blocked by the Australian Treasurer due to concerns over national sovereignty.

- 2020: The ASX experiences significant volatility and a sharp decline in March due to the COVID-19 pandemic, with the All Ordinaries index dropping by over 30% in a month.

Indices

The Australian Stock Exchange is also home to several well-known indices that track the performance of various segments of the Australian market. Investors can trade some of these indices at the best ASX brokers:

- S&P/ASX 200: This is the main benchmark index for the ASX, made up of the 200 largest and most actively traded companies on the exchange. The S&P/ASX 200 is widely used to measure the overall health of the Australian country.

- S&P/ASX 300: A broader index that includes the firms in the S&P/ASX 200 as well as an additional 100 smaller-cap companies.

- S&P/ASX 50: This tracks the performance of the 50 largest companies on the ASX by market capitalization.

- S&P/ASX Small Ordinaries: This index tracks the performance of around 300 small-cap firms that are not included in the S&P/ASX 200 index.

- S&P/ASX All Ordinaries: Made up of the 500 largest companies listed on the ASX, making it a more comprehensive benchmark than the S&P/ASX 200.

In addition to these main indexes, the ASX also has other indexes that track specific market segments such as resources, technology, and healthcare. These include:

- S&P/ASX 200 Materials Index

- S&P/ASX 200 Information Technology Index

- S&P/ASX 200 Health Care Index

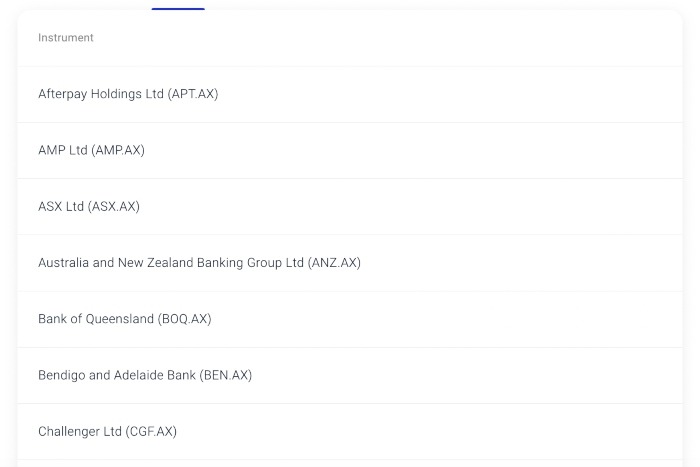

Biggest Players

ASX brokers are home to some of the largest and most valuable companies in Australia, spanning various industries. The largest share of the exchange by far is taken up by the financial sector, which alone accounted for more than 40% by market cap in 2022. Other big players include materials and industry, which combined made up more than 20% of the exchange that year.

Here are some of the biggest players on the exchange, based on their market capitalisation and share price in 2023:

- Commonwealth Bank of Australia (CBA): With a market cap of approximately AUD 200 billion and a share price of around AUD 100, CBA is the largest company on the ASX. The bank is one of the “big four” Australian banks and offers a range of financial services, including retail, business and institutional banking, insurance, and broking services.

- BHP Group Limited (BHP): BHP is one of the largest global resources firms and the largest mining company on the ASX, with a market cap of approximately AUD 150 billion. BHP is known to produce oil and gas, iron ore, coal, copper, and other minerals. In early 2023, a share cost almost AUD 50.

- CSL Limited (CSL): CSL is a global biotech company that develops and manufactures life-saving biotherapies and vaccines (market cap: approximately AUD 120 billion). The company operates in more than 30 countries and had a share price of AUD 350 in early 2023.

Other notable ASX-listed companies include Goodman Group, Qantas, Macquarie Group Limited, DLT, and GME. Note, the best ASX brokers will offer low-cost investing in these securities.

Australian Shares (Financial) at Pepperstone

How Does The Australian Stock Exchange Work?

The ASX provides a platform for companies to list their securities and for investors to buy and sell those securities. Retail traders can then speculate on these firms using brokers with access to the Australian Securities Exchange.

Here is how it works:

- Companies that wish to list on the ASX must meet certain requirements, such as having a minimum market capitalisation. In 2023, the minimum capitalisation requirement for the ASX main board was AUD 75 million. This differs for different boards, for example, the ASX Small Caps, which is designed for smaller firms. The minimum capitalisation requirement for this board was AUD 10 million in 2023.

- Once a company is listed, its shares can be traded on the Australian Stock Exchange. Buyers and sellers of shares place orders through ASX brokers, who then place the orders on the exchange’s trading platform.

- The ASX platform matches buyers and sellers of shares, and the trade is executed.

- The price of the shares is determined by the supply and demand for those shares. If there are more buyers than sellers, the price of the shares will go up, and vice versa. The top Australian Stock Exchange brokers offer insights into daily volume and volatility.

Tiers

Some stock exchanges have tiers for their listed companies, with higher tiers needing a higher market cap to appear on the listings. This is similar to the different boards ASX has.

The top tier is the ASX 200. These companies are typically well-established, blue-chip companies with a strong track record of profitability and liquidity.

The second tier is known as the ASX 300, which is made up of companies ranked between 201 and 500 by capitalisation. These companies are typically mid-sized, growth-oriented firms that have not yet achieved the size and scale of the largest companies on the ASX.

The ASX All Ordinaries is the third tier and is a broader index that includes all companies listed on the ASX, except for those listed on the ASX 200 and ASX 300. This includes many smaller firms that still have plenty of potential for growth.

The ASX also has other indices that track specific sectors or industries, such as the ASX Small Ordinaries, the ASX 50, and the ASX Emerging Companies Index. However, most retail ASX brokers do not provide access to these.

Weightings

ASX indexes are heavily influenced by the performance of the largest companies listed on the exchange due to each company’s weighting being determined by its market cap. Capitalisation refers to the total value of a company’s outstanding shares of stock, and is calculated by multiplying the company’s share price by the number of shares outstanding.

The S&P/ASX 200 is a market-capitalisation-weighted index, which means that the companies with the highest market capitalisation make up a larger percentage of the index than smaller firms.

Australian Stock Exchange Rules

How Do Companies Get Listed?

For a company to be listed on the ASX, it must meet certain requirements. This is to ensure that companies are of sufficient size and financial standing to be listed on the exchange and to provide investors with the information they need for trading. Some of the key requirements for listing on the ASX include:

- Profit test or asset test: The company must either prove it has a satisfactory earnings history or asset base.

- Company structure: There should be a suitable legal structure, with clear ownership and management arrangements.

- Financial requirements: There are certain financial thresholds to be met, including meeting a minimum market capitalisation (currently A$75 million) and having at least 300 shareholders.

- Corporate governance: The company needs to comply with certain corporate governance requirements, such as having a board of directors, an independent chairperson, and audit and remuneration committees.

- Compliance with listing maintenance rules: The company must agree to comply with the ASX Listing Rules and other regulatory requirements, including regular financial reporting and disclosure of material information.

Reviews

The ASX typically announces any changes in rankings to the boards well in advance, but here is a comprehensive list of when each index is reviewed:

- S&P/ASX 20; 50; 100; 200 and 300: Quarterly in March, June, September, and December

- S&P/ASX All Ordinaries: Semi-annually in March and September

- S&P/ASX All Technology Index: Quarterly in March, June, September, and December

- S&P/ASX Small Ordinaries: Semi-annually in March and September

- S&P/ASX MidCap 50: Quarterly in March, June, September, and December

- S&P/ASX 300 Metals and Mining Index: Quarterly in March, June, September, and December

- S&P/ASX 200 A-REIT Index: Semi-annually in March and September

- S&P/ASX All Australian 50: Quarterly in March, June, September, and December

- S&P/ASX All Australian 200: Quarterly in March, June, September, and December

- S&P/ASX 200 Index: Quarterly in March, June, September, and December

Australian Securities Exchange Trading Hours

The ASX is open for live trading Monday through Friday, except for public holidays. Trading hours at ASX brokers vary depending on the type of securities being traded.

For equities, the ASX trading hours are from 10am to 4pm Australian Eastern Standard Time (AEST). This is equivalent to 11pm to 5am Greenwich Mean Time (GMT) during daylight saving time and 12am to 6am GMT during non-daylight saving time.

The ASX also has different trading hours for fixed-income and commodities, which can be found on the ASX website.

It’s important to note that the ASX may have special trading hours during certain periods, such as Christmas and other public holidays. Additionally, in the event of an extreme market movement (such as unexpected economic news), the ASX may implement a securities halt to protect investors.

Traders can check the ASX calendar for information on scheduled trading hours and public holidays. Alternatively, the best Australian Stock Exchange brokers publish details of closures on their websites and platforms.

Bottom Line On Australian Stock Exchange Brokers

The ASX presents a strong option for those looking to diversify their portfolios and get exposure to the Australian market. With a wide range of securities and indices available for trading, along with easy access to asset data and analysis, traders have many tools at their disposal to trade at ASX brokers. While there are risks involved in trading on any exchange, the ASX offers a stable and regulated environment for traders to operate in. With its long history and strong reputation, the Australian Securities Exchange is a trusted and reliable option for UK investors.

To get started, sign up with one of the best ASX brokers.

FAQs

Why Has My Broker Halted Trading On The Australian Stock Exchange?

Several factors can potentially halt or disrupt trading on the ASX. Examples include elections in major countries like the US, natural disasters, global pandemics, market crashes, and regulatory changes. Unexpected events, such as a system shutdown, can completely halt the market. The top Australian Securities Exchange brokers will communicate any changes to standard operating hours to their customers.

What Are The Best Brokers With Access To The Australian Stock Exchange?

This will depend on your financial goals and investing requirements. Look for oversight from the FCA or ASIC, low spreads and commissions, user-friendly platforms and apps like MT4, plus access to market information and expert insights on the equities listed on the Australian Stock Exchange. Use our ranking of the top ASX brokers to find a suitable firm.

Who Is The Regulator Of ASX Brokers?

The ASX is regulated by the Australian Securities and Investments Commission (ASIC), which is the regulatory body for financial services in Australia. However, traders in the UK should look for ASX brokers that are regulated by the Financial Conduct Authority for added protection when investing on the Australian Stock Exchange.

What Does The Australian Securities Exchange Do?

The ASX is Australia’s primary stock exchange and is also used as an indicator to measure the health of the Australian economy. It is a marketplace for investors to buy and sell financial products such as stocks and ETFs. The best ASX brokers also offer leveraged derivatives like CFDs which are suitable for short-term trading.

Are There Goldmining Companies Listed At Australian Securities Exchange Brokers?

Yes, there are several gold mining companies listed on the Australian Securities Exchange, including Newcrest Mining, Northern Star Resources, Evolution Mining, and Saracen Mineral Holdings. The top ASX brokers will offer direct trading in the stocks of these firms or exposure through indices, ETFs and CFDs.

How Can I Find The Australian Stock Exchange On My Broker’s Platform?

The Market Identifier Code (MIC) for the Australian Securities Exchange is XASX. Most AXB brokers use this or a slight variation. Simply search for the code in the firm’s desktop platform or mobile app.