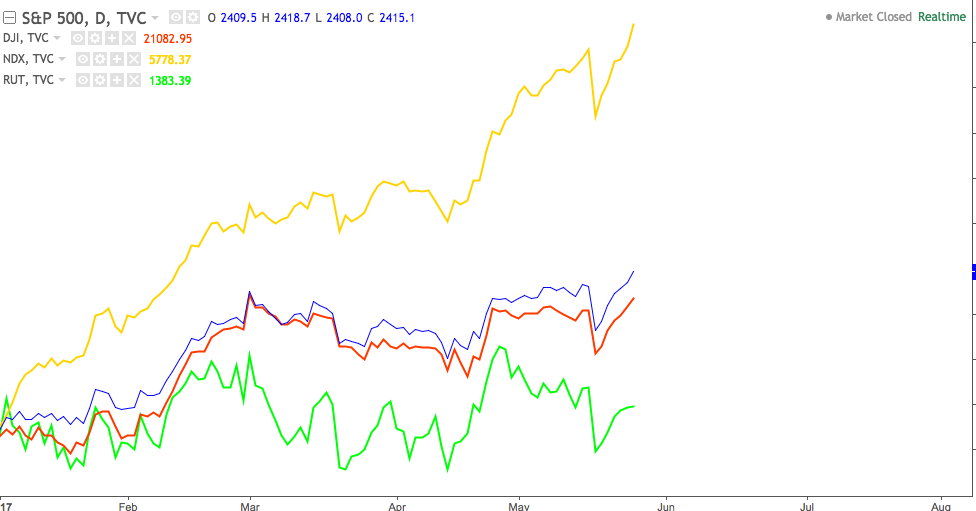

S&P500 Hits All-Time Highs, Divergence With Russell 2000 Widens

The US market has shrugged off last weeks risk-off event with the S&P500 making all-time high’s today. Interestingly, some divergence has appeared between other markets, suggesting that the bulls haven’t totally taken control just yet.

Using divergence in your investing

Divergence is often applied in technical analysis on a per-stock or per-market basis. A simple divergence strategy may look something like this:

- Stock ABC is making higher highs

- MACD (or another indicator of your choice) is not making higher highs

- Traders may view this as suggesting weakness in the stock

That strategy oversimplifies things, however divergence can form part of your market analysis. Let’s take a look at the four US indices in 2017:

- S&P500 (purple)

- NASDAQ (yellow)

- Dow Jones Industrial (red)

- Russell 2000 (green)

Lead by the FANG (Facebook, Amazon, Netflix, Google) stocks, the NASDAQ has been this years best performer by far. The Dow Jones is close to making record highs, and has also been strong. This tells us that large-cap companies are doing well in 2017.

The Russell 2000 has been the worst performer by far. For those that don’t know, the Russell 2000 tracks small cap stocks. What’s interesting is that small caps are underperforming this year, while America’s largest companies are doing amazingly well.

This raises some interesting questions for an investor, and presents some possible trade ideas:

- Is this an opportunity to invest in small caps, looking for them to perform well in H2 2017?

- Is this actually a sign of economic weakness? If the US economy was really that strong, wouldn’t small companies be doing well too?

Take divergence further

Do your own research into other markets, and look for divergence. European stocks have been doing very well this year, however they’re still considered undervalued as compared with historical highs. Ask yourself, how is the DAX performing compared to other equity markets, or the bund market? What about the FTSE, and it’s relationship to the Pound?

There are endless opportunities to apply divergence to your market analysis. Do the hard work and you may unearth some useful insights and information.