Retirement Investing and Pension Plans

In retirement, a well-funded pension is often key to a stress-free life. Whether you aim to retire early or enhance your quality of life after retirement, everyone in the UK can boost their state pension with additional forms of income. This guide contains practical information on UK pensions and retirement investing, covering the different plans available, comparing the tax advantages of various accounts, and sharing tips for managing your pension once retired.

Individual Savings Accounts (ISAs) are a popular tool used by investors saving for the long-term. ISAs can be used instead of, or alongside, traditional retirement plans. The top ISA providers in 2026 are:

Brokers With ISAs

Note, this article is for information purposes only. It is not intended as investment advice. Consult a local pension professional / financial advisor for guidance relating to your circumstances and retirement goals.

What Is Retirement Investing?

Retirement investing is the practice of saving and investing money to enable individuals to live without active forms of income, such as an employee salary or self-employment income.

After retirement, an individual typically receives a lump sum or annuity from their retirement pension, meaning they carry on receiving passive income despite no longer actively working.

These funds are often stored in retirement pension plans and accounts, which have incentives such as tax benefits and employer match schemes to encourage individuals to invest their money for the future.

In the UK, examples of retirement plans include workplace pensions, personal pensions, self-directed investment accounts and state pensions.

Although many believe that the transition to retirement pension takes place over 60, this is not necessarily true. Depending on how early investing begins, how much an individual is able to put away, and how much capital a retired individual requires per year, retirement is possible earlier. More on this later.

Why Is Retirement Investing Important?

Independent retirement investing is more important than ever. Here is why:

The Current ‘State Pension’

As of the April 2023 tax year, a full state pension pays £203.85 per week. Earning this amount requires individuals to have made qualifying national insurance contributions in 35 or more years before retirement. Those with fewer qualifying years may receive substantially less income under the new UK pension rules.

This works out as £10,600.20 per year for the full state pension, though can be far less for a basic retirement pension. Due to rapidly increasing inflation, especially in areas such as food and energy, this average retirement pension won’t be enough for many on its own.

Furthermore, the current retirement pension age is 66 – rising to 67 in 2026. The pension forecast suggests that this age will continue to rise to help save the government money in the face of an ageing population, to the extent that UK citizens currently under 30 could be forced to wait until their 70s to receive a state pension.

Retirement Pension Benefits

As well as giving retirees a higher quality of life than with just state pension income alone, retirement pension benefits can include reduced tax paid on earnings and an earlier retirement date than the fast-rising pension age.

For higher-rate taxpayers, the tax benefits of a workplace or personal pension can be even greater, with salary sacrifice schemes allowing UK citizens to put money in before tax is applied.

In addition, having given much of their life to work, some will not want to spend their 50s and 60s in employment. A solid retirement plan can help bring forward the transition to a retirement pension, whether by allowing workers to reduce hours or give up their jobs altogether.

Planning For Retirement

Despite the importance of having a fit-for-purpose retirement pension, many are entirely in the dark about the status of their investments.

As we have discussed, the state pension alone will not be enough for most to enjoy a comfortable retirement. However, this may also be the case when employees make minimum contributions to a workplace retirement pension.

In addition, recent FCA figures show that the average pension pot in the UK is £61,897 – far less than most retirees will require for a long and stress-free retirement.

Like most aspects of finance and investing, the key to success in retirement is early planning. There are three key questions to consider before beginning to work with a retirement pension estimator or calculator. These are:

- When am I aiming to retire?

- How much do I need per year to live a comfortable life?

- How much autonomy would I like over my investments?

When Should I Retire?

Some will not want to make the transition to retirement pension aged over 60 but rather be finished with work before. However, individuals must corroborate their dreams of an early retirement with the finances behind such a decision.

The benefit of delaying retirement by a few years can be significant financially due to the power of compound interest. This means that some of the biggest gains can be made in the latter years of a retirement pension investment. Furthermore, defined benefit or military pensions can reward additional years of service with large bonuses.

While the draw of additional gains can be appealing, it is important to note that leaving your retirement too late has its own disadvantages. These include less time to enjoy your money, as well as potentially a less able physical condition when the funds are released.

While the exact year of retirement should not and often can not be predetermined decades in advance, it is good practice to have a 3-year or 5-year range in mind when aiming for a retirement age.

How Much Pension Do I Need To Retire?

The amount you need to retire depends on your desired retirement age, your average annual investment return and how much you expect to need to live a comfortable quality of life.

Though morbid, this calculator can also depend on your expected lifespan, though choosing certain post-retirement pension plans can remove this consideration by guaranteeing an annuity until your death.

However, due to factors such as taxes and inflation, pensions often do not go as far as people would believe.

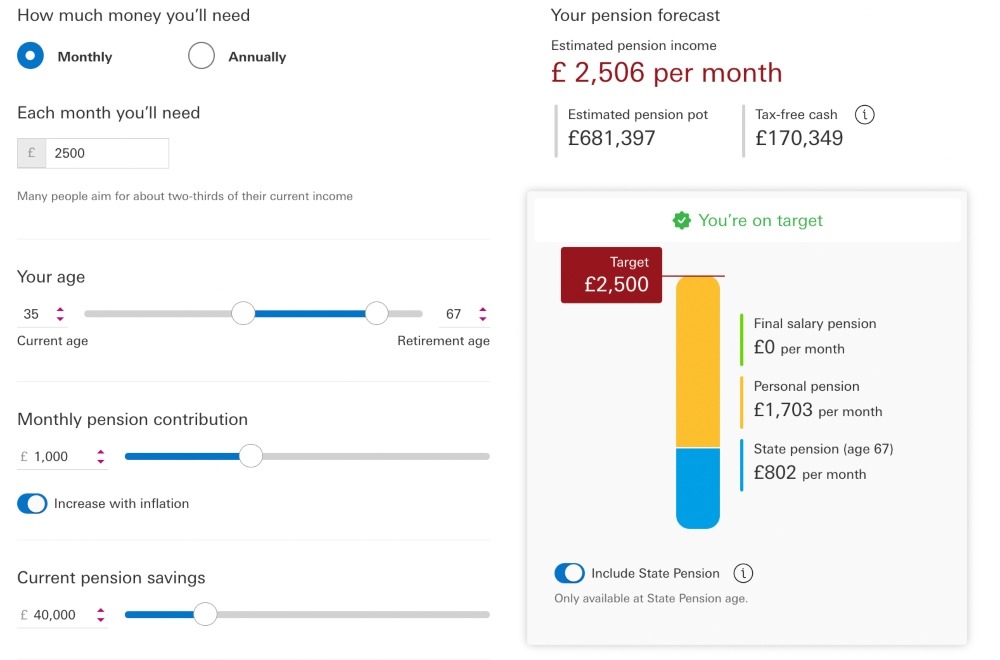

To put these concepts into practice, we have put example figures into a leading UK pension provider’s retirement pension estimator to reveal how much you need to store away to meet common goals.

How Much Pension Do I Need To Retire At 55?

To provide an annuity paid for the rest of your life of £28,220, or £2,351.66 per month, an investor retiring at 55 would need a pension pot of £750,000.

We also calculated the pension pot required to fund a pension plan paid over 25 years, or until the recipient is 80. To receive £28,440 per year, or £2370 per month, the pension pot must be £600,000.

Note that these figures are all pre-tax and do not increase with inflation.

How Much Pension Do I Need To Retire At 65?

To provide an annuity paid for the rest of your life of £28,400, or £2,366.66 per month, an investor retiring at 65 would need a smaller pension pot of £660,000.

We also calculated the pension pot required to fund a pension plan paid over 25 years, or until the recipient is 90. To receive £28,440 per year, or £2,370 per month, the pension pot must be £600,000 – as with the previous example.

However, to receive a similar amount of £29,785 per year, or £2,482.08 per month, you would only need a pension pot of £450,000. This would pay every year until you turned 80.

When Should I Begin Investing?

Often, the earlier you can start building a pension pot through the investing the better. However, due to personal circumstances and the lack of public knowledge about the importance of retirement investing, focused retirement saving can often happen later rather than sooner.

Due to the impact of compound interest, there are significant advantages to investing earlier rather than later. Einstein once hailed compound interest as “the most powerful force in the universe”. This power refers to the ability for your interest to earn interest, which over an extended period, such as when investing for retirement, can yield high returns.

Putting It All Together

Once you have an idea of a goal retirement age, the amount you need to save to live comfortably in retirement, and the age at which you can start to put money away, you can begin planning your retirement and investing strategy.

Putting these figures into a retirement pension calculator will show you how much you need to set aside per year and per month to achieve these goals.

Some calculators will let you adjust for increasing contributions to follow inflation and change the predicted annual growth rate – for these additional features, a compound interest calculator can be helpful. Other estimators will let you add other information such as employer pension contributions and multiple income and investing sources.

Vanguard Pensions Calculator

These figures can provide a framework for your investments, but personal circumstances, inflation, fund return rates and employment are all likely to change before retirement. Due to this, use these figures as a guide rather than a definitive plan, and ensure you regularly check up on the status of different pension plans.

Types Of Retirement Fund

In the UK, there are many retirement pension options. These fall into three main types of pensions, which are state pensions, workplace pensions and personal retirement investments and pension plans.

The best retirement pension plan will depend on your individual circumstances and needs, such as your tax rate, preference for autonomy or passivity in investing and when you want to retire.

Different retirement pension accounts will have different benefits and drawbacks, so keep reading to discover the relevant details for different retirement investing plans in the UK.

State Pension

The full state pension currently pays £203.85 per week, which equals a yearly amount of £10,600.20. This amount is based on non-deferred payments to individuals with a national insurance payment record of 35 years or more.

However, for men born before 6 April 1951 and women born before 6 April 1953, you will receive the basic state pension instead, which only entitles retirees to £156.20 per week or £8,122.40 per year.

Eligibility

Old age pension status is currently earned at age 66 following a 2022 review, though there are plans for the retirement pension age to rise again sooner than expected.

The state pension was changed in 2016, with those who reached pension age prior to 6 April 2016 receiving a lower basic state pension rate.

To qualify for each state pension, retirees must make a specific amount of national insurance (NI) contributions during their working life. These are:

Basic State Pension

To qualify for the full basic state pension amount, men need:

- 30 qualifying years of national insurance records if they were born between 1945 and 1951

- 44 qualifying years of national insurance records if they were born before 1945

Women require:

- 30 qualifying years of national insurance records if they were born between 1950 and 1953

- 39 qualifying years of national insurance records if they were born before 1950

To be eligible to receive any basic state pension, men must have eleven or more years of NI payments, while women must have ten years of NI records. There are benefits available to top up these amounts.

New State Pension

Old age pension eligibility is more straightforward with the new state retirement pension. The qualifying years for both men and women are 10 years to receive a basic retirement pension.

A 35+ year record of contributions or national insurance credits entitles retirees to the full amount.

Adding Qualifying Years

For those not yet retired, it is possible to add missing years of national insurance payments by making voluntary contributions. This can increase how much pension you stand to receive at retirement.

State Pension Deferral

Deferring your pension payments is a way to increase the amount of pension you are paid. This works by waiting until after you have reached the qualifying years for the state retirement pension to claim it.

For those eligible for the new state pension, the amount increases by 1% for every 9 weeks it is deferred.

With the basic pension, the amount increases by 1% for every 5 weeks it is deferred. However, the extra amount is also available as a lump sum for the basic state pension.

What Is The State Pension “Triple Lock”?

The UK State Pension Triple Lock is a government policy that guarantees that the basic pension will increase each year by the highest of three measures: the rate of inflation, the average earnings growth, or a minimum of 2.5%.

The state pension triple lock was suspended for 2022-2023, meaning pensioners were not protected against inflation by this measure.

However, from the start of the 2023 tax year, the state pension triple lock is being reintroduced. This will see the largest-ever state pension rise of 10.1%, in line with inflation figures for September 2023.

Is The State Retirement Pension Taxable?

Many future retirees will want to know if their retirement pension is taxable. The answer is yes – state pension payments count towards your personal tax-free allowance.

If your total income exceeds this figure, currently at £12,570 per year, you will be required to pay tax.

Advantages

- Paid until death

- Fixed amount

- No saving required

Disadvantages

- Counts towards personal allowance

- May be insufficient as a sole income

- High (and growing) age requirements

Defined Benefit Pensions

In a defined benefit pension scheme, retirees build up pension pots by accumulating years of service with a company and giving up a fraction of their yearly earnings. Employees are guaranteed a set amount of pension income from retirement, paid until death.

The value of pension earned in each year is calculated using a fraction – such as 1/60th or 1/80th – of your pensionable pay. This is known as the accrual rate.

The pensionable pay element of the accrual rate will either be based on a career salary average or on the final year’s salary, depending on the specific scheme.

Eligibility

Defined benefit pension schemes are becoming less common, as most employers have switched to defined contribution programs. However, these schemes are still offered by some large UK employers or in public sector professions.

These form the basis for the retirement pension schemes offered in the army and other military roles, the police, healthcare and fire services and civil service and other government jobs.

Getting The Pension

The minimum retirement pension age for a defined benefit policy varies from plan to plan, but can be unlocked as early as 55 with some providers. However, this figure is set to increase to 57 in April 2028. It is possible to take your pension without retiring, though this may have tax implications in some circumstances.

In terms of pension payment, defined benefit annuity payments funds offer an annuity that is paid until the end of your life. In some cases, a pension is transferable to a spouse, civil partner or dependents in the case of an early death.

Some investing schemes may offer a tax-free lump sum worth up to 25% of your total pot, as long as it is below the lifetime allowance limit (more on this later). This amount will be capped at £268,275 from April 2024. The size of the cash lump sum taken will affect the size of annuity payments.

Tax Benefits

In some cases, employees will contribute to a scheme with a fixed amount of their monthly paycheck. These contributions will be deducted before tax is taken from a gross salary.

However, defined benefit pensions are usually funded by the employer, meaning that employees looking for salary sacrifice or tax-advantaged retirement savings should pursue an alternative or additional pension plan.

Other than the tax-free lump sum of 25% available with all defined contribution and benefit pension plans, pension annuity income is treated as normal income and subjected to standard pay-as-you-earn (PAYE) tax.

Advantages

- Often employer funded

- Can pay lucratively

- Guaranteed payments

- Early retirement possible

Disadvantages

- Difficult to get into

- Lack of funding control

- Lack of investing control

- Limited special tax benefits

Defined Contribution Pensions

The most common type of retirement fund in the UK is the defined contribution pension. Used in both personal pensions and workplace pensions, this scheme involves making elective contributions to a specific fund, where your contributions are directly invested to earn interest.

Types of personal pension include plans using pension providers as well as self-invested pension plans (SIPPs), which allow for greater or even full control over investments. SIPPs may have high account fees and further fees for purchasing investment products such as stocks or ETFs.

When investing in a workplace-defined contribution plan, individuals can make salary sacrifice contributions to the plan, storing away pay before tax is taken from it. Employers will commonly match these contributions up to a certain percentage, increasing as an employee pays a larger percentage into their pension fund.

Eligibility

When UK residents reach 22, employers are legally required to enrol them automatically in a workplace pension scheme if they earn over £10,000 per year. However, employees may request to opt-out of the scheme and receive a full refund.

For a defined contribution personal pension plan, UK residents over 18 are able to open an account with no restrictions. To remain in a providers’ scheme, investors must meet the minimum contribution requirements. For SIPP accounts, investors are free to make contributions at any time.

Investing Autonomy

Defined contribution pensions cover the full spectrum of investing autonomy. Many workplace pensions offer employees little or no control over where their money is invested.

Personal pensions opened with a provider can offer several levels of risk to choose from, along with greater or lower potential rewards.

The highest levels of control are offered by a SIPP, where several UK brokers offer individuals full autonomy over their investments. Best suited to those familiar with the financial markets, investors can put their capital into mutual funds, ETFs, stocks or even gold bullion.

Getting The Pension

Currently, it is possible to claim a defined contribution pension from age 55. However, this is set to rise to 57 on 6 April 2028.

Pension funds are available as a tax-free lump sum of up to 25% of the pension, with the remainder of the funds paid in an annuity or in more taxable lump sums.

Early Release

While it is possible to withdraw pension funds before this age, withdrawals may be accompanied by a significant tax bill of up to 55%. There are also potentially hefty fees to pay that can reach up to 30%, as a transfer to another scheme is usually required to release funds early.

To make matters worse, most pension plans that allow early withdrawals are not licensed by the UK Pensions Regulator or the Financial Conduct Authority (FCA). This makes finding a reputable firm difficult and strips away some of the protections offered when investing with a regulated provider.

Tax Benefits

Investing in a defined contribution pension can have tax benefits – especially for higher-rate taxpayers.

Investors can receive tax relief on pension contributions at varying rates depending on their income status. For those who pay income tax at a rate of 20% or below, tax relief is applied automatically – this also applies to the first 20% of earnings for higher-rate taxpayers.

For those whose income falls into higher brackets, additional tax relief is available (on top of the base 20% rate).

Eligible savers can receive:

- An extra 20% relief on contributions up to the amount of any income in the 40% tax bracket

- An extra 25% relief on contributions up to the amount of any income in the 45% tax bracket

This may be applied automatically for some workplace pensions or SIPPs, but in some circumstances, investors will need to call or write to HMRC to apply for this additional relief.

Advantages

- Range of investing autonomy options

- Best scheme for tax relief for higher earners

- Potential for generous employer contributions

Disadvantages

- Fees can be considerable

- Income is taxable (other than 25% lump sum)

Lifetime ISA

One of the overlooked retirement pension options is the Lifetime Individual Savings Account, or LISA.

As with a regular ISA, the LISA offers a tax wrapper protecting the funds or investments inside from capital gains tax. This allows the funds within to grow without interference from HMRC, and means that funds can be released as a lump sum without any tax payable.

While a regular ISA is a solid option for savings, especially when investing in stocks and shares, the lifetime ISA offers additional benefits (as well as rules) that make it suitable for retirement investing.

Saving With The LISA

There is a £4,000 per tax year limit on deposits into a lifetime ISA. Any contributions put into a LISA also count towards the £20,000 per tax year limit on contributions to ISAs.

The Lifetime ISA offers investors a 25% cash boost on any money put into the account, up to £1,000. Assuming a full £4,000 per year investment, this means that savers will receive a total of £5,000 cash into their LISA.

While this does not reduce your tax bill at source as with some other pensions, this can be advantageous for lower-rate taxpayers, as the 25% paid can exceed the 20% or 0% tax paid by these individuals.

Eligibility

UK investors must be over 18 but below 40 to open a LISA. Contributions can be made until an individual turns 50.

Investment Autonomy

Funds put into the Lifetime ISA can be stored as cash or invested into products such as stocks, ETFs and mutual funds. Some providers offer preset portfolios with various levels of risk, while others allow investors full autonomy over their investments.

Getting The Pension

The Lifetime ISA is designed to support savers in some of the most financially significant events of their “lifetime”. These are purchasing a first home and retirement.

The contents of a LISA can be withdrawn tax-free in these two events – for this purpose, we will focus on the latter.

Investors can continue making contributions to a LISA until they reach 50. After that, the funds are locked away until the individual turns 60, after which they can be withdrawn. More on the retirement pension tax later.

Early Release

The funds from a LISA are free to withdraw at any age if an investor is terminally ill with 12 months or less to live.

Otherwise, there is a 25% charge to withdraw funds from a LISA before the account holder reaches 60. While this may sound like an investor simply loses their bonus, this is not the case.

To illustrate this, let us say that an investor puts £2,000 into their Lifetime ISA. They then receive a £400 government bonus.

The investor then wishes to withdraw their £2,400. However, 25% of £2,400 is £600, leaving the investor with £1,800 post-withdrawal – £200 less than they put in.

Tax Benefits

In addition to the tax wrapper on the LISA, additional tax benefits are available upon withdrawal.

With a defined benefit or defined contribution pension, a 25% lump sum is available tax-free – the rest of the funds are subject to PAYE tax.

The LISA offers a better withdrawal deal, as all funds are available for withdrawal tax-free at the end of the term.

Investors can withdraw their funds fully, shift their funds into income-generating products and draw a pension-like income from their LISA, or mix and match a combination of these – at any time.

Advantages

- Tax-free withdrawals after 60

- Can also be used to purchase a first home

- Options available for full investment autonomy

- Deposits can be made at any time

Disadvantages

- Funds only unlock at 60

- £4,000 yearly contributions limit

- No additional benefits for higher-rate taxpayers

- No employer contributions

Investing Tips & Strategies

Investing in a pension pot, whether through a workplace or private fund, can be difficult to get your head around. While a full understanding of your investments is not required in many cases, some principles will help you make the best use of a retirement pension plan.

Here are our top tips and strategies:

Maximising Tax Advantages

Depending on the tax bracket your income falls under, different retirement pension plans will offer better tax benefits.

Higher-rate taxpayers can receive up to 45% tax relief on contributions made into a defined contribution pension such as a workplace pension plan or SIPP. As a result, this class of treatment fund is often more tax-efficient than a defined benefit pension or LISA.

However, for lower-rate taxpayers, the best tax benefits can often be found in the LISA. For those that pay no tax or 20% tax on their income, the 25% government bonus added to LISA deposits will be greater than the 20% tax relief on a defined contribution pension.

For self-funded retirement plans such as a personal pension, SIPP or LISA, it is important to keep track of your contributions in regard to the tax year. This can enable investors to make the most of a deposit allowance or boost their deposits at the end of the tax year for further benefits.

Employer Matches

One of the most powerful methods of maximising a pension fund is to take advantage of employer contribution matches. This is commonly applicable for those with defined contribution workplace pensions.

Getting the maximum employer contribution percentage possible at a current workplace is a positive step anybody can take.

For those serious about retirement, the employer pension match percentage should be a key consideration when changing jobs, as these can vary from as low as 3% up to well over 10% or 15% with the best schemes.

Regular Contributions

When investing in a partially or fully self controlled pension such as a SIPP or LISA, choosing your own investments can be difficult and potentially overwhelming.

However, many providers allow you to set up regular contributions, which can help reduce the work required to top up a fund. With some schemes, investors can even schedule regular purchases of specific stocks, ETFs and mutual funds, completely automating your investments.

When investing over the long term, such as with a pension scheme, it is more manageable to invest regularly and take advantage of pound cost averaging rather than to time the market.

Pound Cost Averaging

Pound cost averaging involves allocating a regular amount of funds to an investment each month or in regular intervals, automatically allowing investors to maximise their contributions.

When prices are low, fewer products will be purchased, minimising costs. When prices are high, the fixed investment amount will buy fewer units/shares, taking advantage of a reduced cost.

Leverage Compound Interest

When it comes to long-term investing, compound interest is one of the most powerful forces an investor can employ. Here are two ways to maximise the impact of compound interest on a fund:

Start Early

The first is to begin investing early. Because of compound interest, in most cases, the earlier an investor begins saving into a fund, the less they will have to invest to gain a certain savings pot. Even a small initial investment can begin to get the ball rolling in a fund.

Re-Invest Dividends

When investing using self-controlled funds such as a SIPP or LISA, try to find accumulation funds rather than dividend funds while saving for retirement, and think about setting your account to reinvest stock and ETF dividends where possible.

This ensures that your money is working for you, rather than just stacking up and only earning through often low interest rates. This becomes more important as your fund builds, but is good practice to set up while your account is still in its early days.

Keeping Track

Whether you are investing in a workplace pension or personal account, it is easy to “set it and forget it”, allowing automatic contributions to handle your contributions.

However, it is good practice to review your contributions annually, and, where possible, to increase your payments in line with inflation or any pay rises or additional income you have received.

This is partially relevant if you have been promoted or found new work and are subject to a new tax bracket.

Furthermore, keeping track of your pensions is also sensible, especially if you have several schemes from different workplaces. It is sometimes possible to combine pensions, though there are fees and dangers associated with this.

There are different methods for how to check your retirement pension, as well as tracking down lost pensions, with a government service as well as third party providers that can help you do so.

How To Apply For A Retirement Pension

While applying for a pension can seem daunting, most providers make it stress-free and straightforward to set up an investing plan.

State Pension

Future retirees may assume that their state pension payments begin automatically after reaching a qualifying age. However, would-be retirees have to apply for their state retirement pension by phone, post or online through the department of work and pensions (DWP).

To notify those approaching a qualifying age, a letter should be sent to inform them of their eligibility. If this is not received, individuals will need to request an invitation code to make an old age pension online application.

Workplace Pensions

As previously mentioned, UK residents of 22 and over making over £10,000 per year should be enrolled into a workplace pension scheme automatically by their employer. To change your contribution levels or to to learn more about how your particular scheme operates, contact your employer.

As you approach the qualifying UK pension age, which is currently 55, pension companies should get in touch with you to lay out your options in terms of lump sum and annuities. However, investors may also have to track down old pension programs from previous employers to redeem multiple pension pots.

Personal Pension Schemes

Personal retirement pensions that are managed by a third party rather than an investor must be applied for online. There are often different qualification criteria for these pensions, with elements such as expected returns, fees and payment plans differing from plan to plan.

Ensure your chosen provider is registered and protected by the UK Pensions Regulator and/or the FCA.

Self Directed Retirement Accounts

Investors can open a self-directed retirement account such as a SIPP or LISA with several UK providers. Due to the UK specific nature of the retirement accounts, these providers should be FCA-regulated.

As savers can make contributions to these accounts more freely, there are little to no requirements to register for one of these schemes, other than age restrictions and UK residency.

Post-Retirement

Managing your money post-retirement often requires careful planning. Even those with the best retirement pension plans can come unstuck at this stage, so it is important to keep on top of your finances.

Here are our top tips for managing your money after your retirement pension has paid out.

Budgeting & Planning

While many pensions offer a tax-free lump sum, most of the pension payments that retirees will rely on are the annuity payments. These can provide a standalone income before state pension age or these retirement pensions can serve to supplement the paltry government pension payments.

Whatever the case, having a fairly strict monthly budget and plan is important when living off an annuity. With a plan such as this, you should not be desperately awaiting retirement pension payment dates for more money.

Lump Sum Or Annuity?

It can be difficult to turn down the prospect of a large tax-free lump sum when cashing out a retirement pension. However, investors should consider the impact different sizes of lump sum will have on any annuity payments.

For most investors, taking some amount of lump sum makes financial sense – as does spending it on luxuries or holidays to reward yourself for your years of diligent saving. Just ensure that the remaining annuity payments will last long enough or be large enough to sustain you comfortably for the rest of your life.

Consider keeping a good amount of any lump sum payments you may take as an emergency fund rather than splurging it all immediately – this money can be used in case of big unexpected bills such as car or house maintenance and issues.

Paying Off Debts

Many retirees view their pension as a way to quickly pay off debts or mortgages, either through the tax-free lump sum or by allocating a lot of their first few payments to it.

However, while the feeling of being debt-free is often freeing, in some situations, pensioners may be better off maintaining their current payments rather than rushing to pay off loans.

In some cases, for those with manageable interest payments, paying off debts using a lump sum may be worse than continuing to pay interest payments with annuity payments.

Furthermore, if investors have secured a low interest rate loan or mortgage, they may earn more money by investing their funds in a reliable fixed-income product or leaving them in a retirement account to grow further.

This is a very individual decision and should not just be based on finances – the stress relief of being debt-free may have a significant impact on health and happiness in retirement. Investors can use a retirement pension plan calculator or contact a financial advisor to determine the best move.

Wealth Management Services

While investing can seem exciting to a younger person, many retirees want to prioritise relaxation and free time rather than worrying about their investments. When making the transition to retirement pension income from self-directed funds such as a SIPP or LISA, it is worth considering if you would like to continue managing your own funds.

After retirement, investors will normally have to pivot their portfolios to alternative forms of investments, including real estate, bonds, dividend stocks and fixed-income financial products like bonds to generate reliable income.

Instead, some investors may benefit from taxing their funds and entrusting them with a reputable and regulated wealth management firm. Here, investors can access pension-like annuities.

It is worth noting that for SIPP users, this transfer will be penalised with fees or taxes if the funds withdrawn exceed the tax-free lump sum. In addition, LISA users will lose their tax wrappers and these retirement pension-like annuities will be classed as taxable income.

Additional Investing Considerations

Maximum Retirement Pension

In the UK, there is a limit on how much you can build up in pension benefits over your lifetime while still enjoying the full tax benefits. This is called the lifetime allowance and applies to defined contribution and defined benefit retirement pensions, but not the state pension or ISA savings.

The lifetime allowance is currently £1,073,100, but is set to be abolished from April 2024.

If you exceed this cap, there can be significant tax penalties applied to the excess funds. To take the excess as a lump sum, there is a 55% tax charge. When taking excess money through an annuity or drawdown, there is a 25% additional tax charge on top of any income tax paid on the income.

Death

Many pensioners want to know what happens to your retirement pension when you die. Unfortunately, this can be a complex question and depends significantly on the type of pension plan you have.

In many cases it is possible to add a beneficiary to your pension plan, who will receive some or all of a remaining pot if a pensioner dies before claiming their full retirement pension. This is often a spouse or child, but can sometimes be another family member as well.

Furthermore, in case of a terminal illness, some retirement funds such as the LISA will unlock and allow tax-free withdrawals, allowing investors freedom to use their funds into their final 12 months.

Bottom Line On Retirement Investing And Pension Plans

Faced with a state pension struggling to keep pace with rampant inflation and an old age pension eligibility age that continues to rise, it is increasingly important for investors to make additional contributions to secure their future. These can be made through a range of British retirement pension plans, which have various tax and release advantages and disadvantages.

Use our guide to retirement investing and choosing pension plans to find a suitable strategy for your financial goals. For individuals interested in investing in ISAs for retirement, see our rankings of the best ISA providers.

Note, this article is for information purposes only. It is not intended as investing advice. Consult a local pension professional / financial advisor for guidance relating to your circumstances and retirement goals.

FAQ

What Is The UK Retirement Pension Age?

The state pension is available to UK residents over 66. This eligibility age will rise to 67 from April 2026.

Individuals can begin to take money out of a retirement pension from 55 with some providers, though this age is set to increase to 57 in April 2028.

Do You Pay Taxes on Retirement Pension?

For most types of retirement pension, individuals can withdraw a tax-free lump sum of 25% of their pot up to the lifetime allowance. Further lump sum withdrawals and annuity payments are subject to retirement pension tax.

ISAs such as the LISA are a good option for those that want to receive tax-free retirement investments.

How Much Is A Retirement Pension?

The amount received by an individual varies drastically based on the specific pension plan, size of contribution, years of contribution and further factors.

From 2023 to 2024, the full new state pension pays £203.85 and is available to those with 35+ years of national insurance contributions. Those with fewer state pension qualifying years will receive a lower amount.

Is There A State Pension Christmas Bonus?

There is an Xmas bonus paid to pensioners and other benefits claimants of £10 per year. This has been paid since 1972 and is tax-free.

How Do I Calculate My Retirement Pension?

In addition to retirement pension plan calculators, investors can consult with financial advisors to help them figure out how much a retirement pension pays as a lump sum or annuity. There is a free government tool available to help individuals track down lost pensions from old workplaces.

Article Sources

UK government state pension conditions

UK government pension tracker tool