Interactive Brokers Review 2025

Interactive Brokers, often abbreviated to IBKR, is one of the most popular international online trading providers. Through an award-winning proprietary platform, the firm offers UK investors access to a diverse set of asset classes, spanning forex, CFD, options, futures and stock trading. This 2025 broker review will guide you through the need-to-know aspects of Interactive Brokers’ service, covering margin fees, pricing, leverage capabilities, trading apps, minimum deposit requirements and demo account support. Read on to discover whether you should open an account with IBKR.

About Interactive Brokers

While many online brokers can boast a company history of a decade or more, clients of Interactive Brokers can trace the company’s origins back to 1978. At that time, the firm was named TP & Co. after the then and current CEO, Thomas Peterffy.

Over the next few decades, the operation expanded significantly, making inroads into major exchanges in Europe and Asia. In 2000, Interactive Brokers Group formed a UK-based operation regulated by the FCA. In 2007, the company was listed publicly on the Nasdaq 100 exchange in the US.

Today, the company provides more than 1.8 million clients with high-execution-speed trading services from its 14 global office locations. A genuinely international broker, IBKR holds regulatory licences with bodies including the SEC, FINRA, NYSE and FCA.

Asset Classes

The sheer breadth of markets offered by Interactive Brokers far exceeds many of its competitors, boasting CFDs, futures, bonds, options and equity investing all under one roof.

Whether you are day trading on short-term market movements using leverage, investing for retirement through a SIPP or hedging against inflation using bonds, IBKR can offer an investing solution for you.

Markets

Interactive Brokers offers over a million trading products, with markets including forex, stocks, indices, metals, mutual funds and soft commodities.

Forex

The firm offers more than 100 currency pairs encompassing major, minor and exotic forex instruments. Interactive Brokers routes trades to more than 15 prominent global dealers, providing real-time quotes to clients from its extensive liquidity pool.

Forex spreads are tight and start from 0.1 pips, while commission ranges from 0.08 to 0.2 basis points (0.00008% to 0.002%) of the total trade size on top of this spread.

Indices & Mutual Funds

Indices are a great way to speculate on the financial futures of specific economies or market sectors. Alternatively, mutual funds are governed by investment managers and designed to outperform the wider market or sector.

The firm provides clients with a comprehensive selection of over 1,000 spot and futures indices from global exchanges, including the FTSE 100 index, CAC 40, AUS 200 from Australia and new Dax 40 from Germany. However, the broker sets itself apart from many competitors by providing more specialised and niche indices that track specific sectors in a country’s economy.

Additionally, the broad range of mutual funds available to investors allows the delegation of stock-picking to experienced investment managers or algorithms.

Commodities

Interactive Brokers offers spot and futures commodities from three subcategories – metals, energies and soft commodities.

Spot metals are unfortunately limited to gold and silver and are traded on an unallocated basis as standard, meaning that no physical bullion is delivered upon purchase. For this service, the broker levies a carrying fee of 10 basis points per purchase. However, IBKR can provide spot metal bullion to clients upon request, subject to shipping charges.

Metals futures products include gold, platinum and palladium futures instruments, as well as more exotic metals such as uranium. Energies futures products include natural gas, coal and several oil instruments from the US, UK and Europe.

Soft commodities instruments and futures are also available, allowing investors to speculate on the price of assets such as cotton, coffee, wheat and corn.

Stocks & ETFs

Investors can access single stocks and ETFs from over 90 market centres through Interactive Brokers. Clients can purchase IBKR stocks and ETFs as long-term investments, trade shares as CFDs and use leverage to go long or short on specific tickers with margin.

Unfortunately, while several large market cap equities such as Apple and Tesla are available to US clients as single stock futures, UK traders are restricted from this market due to CFTC regulations.

Interactive Brokers provides a dedicated shortlist to customers detailing the stocks available to short and the associated fees for doing so. On the other side of this trade, clients can earn interest on fully paid stock investments by lending their shares to short sellers in exchange for a daily borrowing fee.

Interest Rates & Bonds

A substantial bonds market of over 1 million instruments is available through Interactive Brokers, with clients able to pick from a plethora of treasury bills, corporate bonds and municipal bonds from around the world.

Clients can also speculate on interest rates such as the SONIA, EURIBOR and SARON through futures contracts of various lengths.

Options

Interactive Brokers options traders can review offerings from over 30 international exchanges. Clients can trade options on stocks, interest rates, indices and several other markets.

IBKR options commissions are between £0.13 and £0.55 per US options contract, though UK and global exchanges can charge up to £1.70 per contract.

Cryptocurrency

Unfortunately, Interactive Brokers does not offer cryptocurrency investing or speculation to UK retail clients, partially due to FCA regulations surrounding cryptocurrency derivatives. Those interested in digital investments must look elsewhere to trade products such as spot Ethereum (ETH) and Bitcoin (BTC) futures.

Leverage

Interactive Brokers clients can utilise leverage while trading CFDs and spot products when using a compatible margin account.

As an FCA-regulated broker, IBKR is restricted in the leverage it can offer to CFD traders. The maximum buying power on CFD products is as follows:

- Up to 1:30 on major forex instruments

- Up to 1:20 on other currency pairs, major indices and gold

- Up to 1:10 on non-major indices and all other commodities

- Up to 1:5 on global stock CFDs

Clients must adhere to several margin requirements when opening, maintaining or holding a position overnight. This means that day trading a particular stock or futures contract will entitle clients to a higher margin than long-term investments in the same asset.

Using equities as an example, when taking a long or short stock position through Interactive Brokers, the initial margin required to open the position is set by the individual exchange that hosts the shares listing. A maintenance margin of 25% or higher must be kept intraday and, for clients who wish to hold the position overnight, margin rates rise to 50%.

It is worth noting that customers using a cash, SIPP or ISA account have no access to margin and must purchase products using 100% of their value.

Margin Rates

Margin rates are the fees that traders must pay to loan capital from the brokerage. IBKR charges a variable rate depending on the amount of capital borrowed from the firm. The website features a handy blended rate calculator to quickly work out interest rates. The margin rates are as follows:

- Tier 1 – Balances up to £80,000 are charged a 2.778% interest rate

- Tier 2 – Loans funds between £80,000 and £800,000 are subject to a 2.278% fee

- Tier 3 – Borrowed amounts from £800,000 to £38,000,000 come with a 2.028% charge

- Tier 4 – £38,000,000 to £150,000,000 loans are charged a margin rate of 1.778%

- Tier 5 – Funding amounts above £150,000,000 are also charged a 1.778% fee

An additional surcharge of 1% is added to loans in tier 3 and above that are not pre-arranged with the broker.

Account Types

UK investors can open three account types with Interactive Brokers, depending on their trading goals. The firm offers a Universal account that caters to all investment and speculation needs, a tax-free ISA account and a retirement-focussed SIPP account variant.

Universal Account

The Universal account is designed to offer all of the broker’s markets and features in one place. As a result, clients can take advantage of this versatility and trade forex, CFDs, options, futures and bonds from one place.

Perks like fractional share dealing and the share lending program allow investors to make the most of equity and ETF trades. In addition, clients can access advanced portfolio management tools such as the IBKR robo-advisor service, the Mutual Fund/ETF Replicator and PortfolioAnalyst software.

However, the Universal account minimum deposit to open an account is an eye-watering £8,400. While this requirement is lowered to £2,500 for investors 26 or younger, this is still a sizeable amount of upfront capital compared to many other firms.

Interactive Brokers offers this account type to all UK residents 18 and over. Those over 21 with a maintained balance of £1,700 or more can upgrade to a margin account to trade using leverage.

Stocks & Shares ISA

UK residents can take advantage of tax-advantaged equities trading through the Interactive Brokers Stocks and Shares ISA. Clients can deposit £20,000 per tax year across ISA accounts, including Cash ISAs, LISAs and IF ISAs, and any profits withdrawn are tax-free.

The Stocks & Shares ISA is suited to most investors regardless of initial capital, as IBKR does not impose a minimum deposit requirement on this account type. Furthermore, account holders can engage in fractional share dealing for selected high market cap equities from the UK, US and Europe.

Stock commissions follow the broker’s overall trading fee template (more on this later).

SIPP Account

A SIPP, or Self-Investment Personal Pension, is available to UK residents who wish to create a personal pension pot and manage their investments independently. Funds added to a SIPP enjoy certain tax advantages, often highly beneficial to higher rate taxpayers.

Interactive Brokers allows SIPP account holders to access its full range of instruments and utilise its fractional shares dealing and share lending program.

However, investors cannot open a SIPP account directly with the broker and must contact one of three supported UK-based intermediaries to access this service. These administrators will have their own fees and minimum deposit requirements separate from the IBKR platform, which should be carefully compared to competitors.

Demo Account

Whether you wish to demo the TWS trading platform or experience Interactive Brokers’ execution speed and trading conditions first-hand before committing to a full account, prospective clients can take advantage of the firm’s free trial account.

This practice account entitles traders to the broker’s full range of platforms, research and advanced tools, though live market data is not supported for most markets on simulated trading.

Platforms

While many brokers rely on the MetaTrader 4 and 5 trading platforms, Interactive Brokers has developed several proprietary solutions to ensure its full range of products and services is supported. Clients can choose from a browser-based WebTrader, the Trader Workstation (TWS) desktop software, several API solutions and a selection of mobile apps to download.

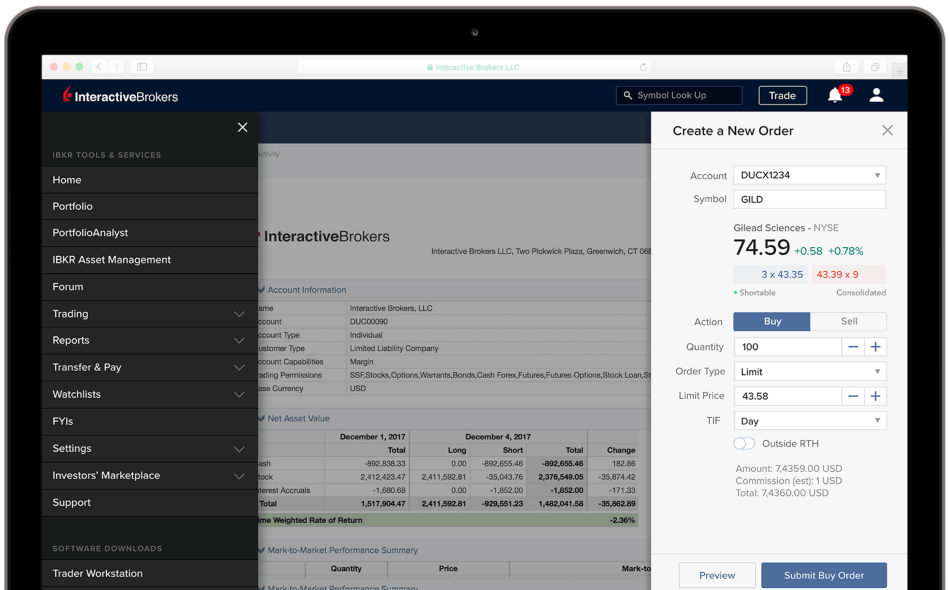

Client Portal

Interactive Brokers recognises that, while some traders may require advanced features such as complex order types, historical data backtesting and automated trading, many value a straightforward and intuitive platform from which they can manage their portfolio. For these investors, the platform built into the IBKR client portal will likely meet all of their needs.

IBKR Client Portal

The client portal platform provides access to the full range of markets traded through Interactive Brokers. It offers simple yet detailed metrics to view portfolio performance, capital allocation and monthly return at a glance. Advanced charting indicators such as SMA, Bollinger bands and volume indicators enable users to technical analysis, while recent news and social sentiment data feeds help provide guidance on the underlying asset.

The client portal also boasts ultimate accessibility as it can be accessed from the browser of any desktop device without the need for a download.

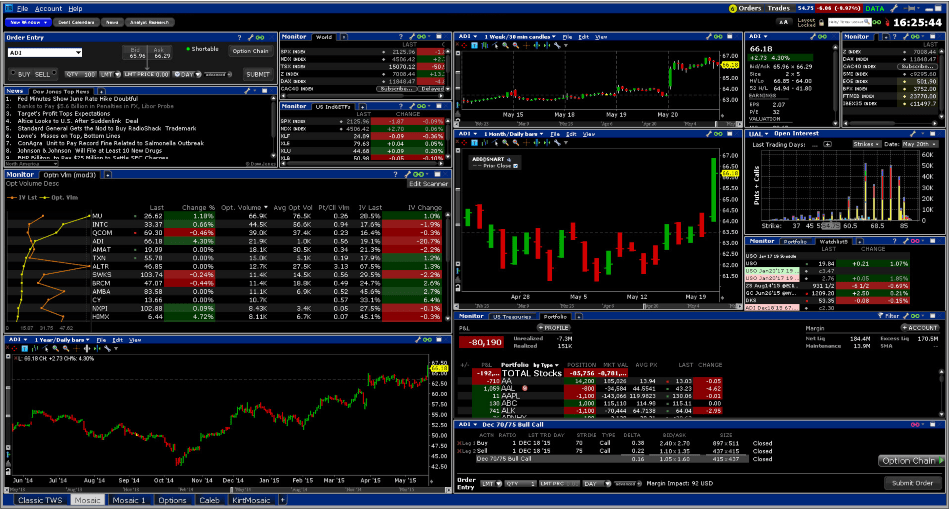

Trader Workstation

The Interactive Brokers Trader WorkStation (TWS) software caters to experienced investors, offering over 100 order types, such as the stop loss, trailing stop limit and volatility trigger orders, a fully customisable workspace and watchlists with real-time data monitoring and custom alerts. In addition, automated trading support enhances execution speed and ensures users never miss an opportunity.

IBKR Trader WorkStation

The Trader WorkStation takes analysis to the next level, with over 120 trading indicators available alongside comprehensive drawing and charting tools. Clients can also monitor their margin requirements on leveraged positions and input hypothetical portfolio asset values to ensure they are prepared for potential margin calls and liquidations.

The TWS platform is free to download on Windows, Mac and Linux devices.

API Solutions

Those who require complete control over their trading environment can build custom applications and connect to Interactive Brokers through a diverse range of API solutions.

Traders can connect to the Client Portal API key to access account information, live market data and order execution.

Alternatively, the TWS API supports additional features such as historical tick data and news feed integration. Additionally, custom programs written in languages including Java, C++ and Python can use the TWS API.

The third option for Interactive Brokers API access is the FIX API, an industry-standard connection protocol that provides simpler connection but relatively limited features compared to the other two integration methods.

Clients without the know-how to create their own custom programs can access the IBKR Investors’ Marketplace to connect with over 450 technology services that can provide bespoke API and FIX solutions.

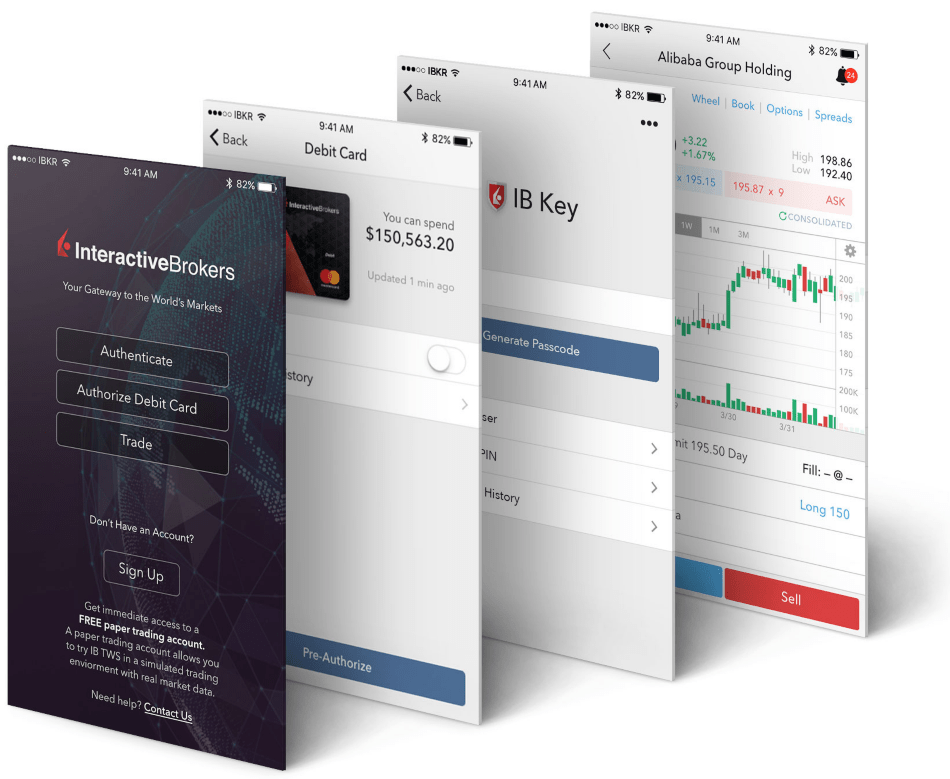

Mobile Trading Apps

A functional and intuitive mobile app can be a crucial weapon in the arsenal of a modern trader. Interactive Brokers recognises the value of on-the-go trading support and has developed three mobile platforms for its clients, as outlined in this review. These are the IBKR Mobile platform, the GlobalTrader app and the IMPACT service.

The IBKR Mobile app delivers powerful trading tools and 50 data columns to clients even away from their desktops, supporting the firm’s full range of markets and instruments. In addition, innovative features such as the options spread grid and order wheel are optimised for the mobile platform, providing app traders with efficient order placing capabilities.

IBKR Mobile App

The simplified GlobalTrader app provides access to over 90 stock exchanges, with clients able to select investments from the stocks, ETFs and mutual fund markets.

The IBKR IMPACT platform offers an ESG-centric experience to clients, utilising existing Interactive Brokers accounts to suggest stocks, ETFs and mutual funds that align with an investor’s values.

IBKR IMPACT

All three mobile platforms are available as Android or iPhone apps, with traders able to download the offerings from the respective app stores.

KEY Verification App

In addition to its mobile trading platforms, Interactive Brokers has created a bespoke login verification app for two-factor authentication (2FA) security. The IBKR Key app is available to download on iOS and Android devices and generates login codes for all supported trading platforms.

Payment Methods

A healthy selection of supported payment methods allows a broker to cater to the needs of a diverse set of clients, with some traders prioritising low or zero fees and others favouring instant transactions.

However, Interactive Brokers only supports one GBP funding method – bank wire transfer. This is particularly surprising for such a large company, as many smaller competitors allow clients to transfer British funds via Visa and MasterCard credit and debit cards, e-wallets like Skrill, Neteller and PayPal or even cryptocurrency tokens like Bitcoin and Ethereum.

While the firm does not impose any minimum deposit requirements or maximum withdrawal limits, bank wire transfers can take from 1-4 business days to clear. IBKR also enforces a three-day holding period between funds being deposited and then being available for withdrawals.

Investors should be aware that withdrawals from a SIPP may incur tax penalties if made before the specified retirement age.

Deposit & Withdrawal Fees

Excessive deposit and withdrawal fees can make a significant dent in traders’ hard-earned profits, especially when making regular transactions.

To this end, IBKR does not charge a deposit fee, though a trader’s specific bank account may levy a wire transfer fee. To make matters worse, clients are only eligible for one free withdrawal per month, with subsequent transactions subject to a fee of £7 per transfer.

Trading Fees

As previously detailed, margin interest rates range from 1.778% to 2.778%, depending on the total loan amount. Overnight fees on CFDs on margin positions vary based on the product traded and can be viewed through any trading platform that supports CFDs.

Trading Commissions

Due to the diverse range of markets provided by IBKR, its commission structure is fairly complex. Commission pricing is as follows:

Stocks & ETFs Commissions

For Western European stocks, such as German, French and UK shares, commissions stand at £3 per trade. However, for purchases over £6,000, a commission of 0.05% of the trade value is applied.

US equities commissions start from £0.004 per share, while the broker offers a separate range of zero-transaction-fee ETFs.

CFD Commissions

CFD charges are calculated differently depending on the trading market, with additional commissions levied on top of the broker’s displayed spreads.

Forex CFDs are subject to a tiered commission system that is based on monthly trading volume. Most will pay a 0.002% per side commission, though clients that exceed £835 million in monthly volume gain access to tiers that reduce this fee to as low as 0.0008% per side.

A standard minimum commission value of £1.70 applies to forex CFDs, falling to £0.85 at the highest tier.

Metals CFDs commissions pricing is between 0.007% and 0.03% per side, depending on order amount and product choice. Index CFDs feature a commission of between 0.005% and 0.01%, with a minimum value of £1.00.

The final CFD market available through IBKR is share CFDs, with commissions on US equities sitting between £0.0042 and £0.0025 per share, subject to a minimum fee value of £0.85 per order. Commissions on stock CFDs from other global markets can reach up to 0.17%, depending on the specific exchange. An additional 0.015% fee is levied on algorithmic (algo) orders made through IBKR or API software.

Options Fees

Options commissions vary significantly based on the underlying exchange, with fees of between £0.13 and £0.55 charged per contract. However, there are no fees for exercising or assigning a contract at expiry.

Other Commissions

Interactive Brokers’ futures commissions range from £0.20 up to £0.80 per contract, depending on the product, while bond fees are 0.1% of the total trade value.

Mutual fund commissions stand at 3% of the total trade value up to a maximum fee of £12.50 per transaction. IBKR also offers several no-transaction-fee funds.

Account Fees

Some brokers encourage traders not to leave accounts dormant by imposing an inactivity fee on clients with no transactions over a specified period. While the SIPP and Universal accounts do not penalise traders with an inactivity fee, a minimum monthly charge of £3 applies to IBKR ISAs.

However, this cost can be offset by generating monthly trading commissions for the broker. This means that clients must make up the difference between the £3 charge and their total monthly trading commission in fees. The fee is waived entirely for those whose commissions match or exceed this figure.

Security & Regulation

For traders and investors alike, the security of personal information and account funds is paramount. Choosing a well-regulated and established firm gives brokerage clients the best chance of staying safe in the online financial space.

While many companies are only overseen by one body, the global presence of Interactive Brokers means it can boast several full licences from prominent regulators worldwide. These regulators include the SEC and CFTC in the US, as well as the FCA in the UK.

In addition to holding client funds separately from company capital, IBKR clients are covered by the SIPC up to £420,000, of which a maximum of £210,000 covers cash holdings. The broker also holds additional insurance with high-value underwriters at Lloyd’s of London, protecting clients for up to £25 million, of which £750,000 covers cash.

In terms of protecting client accounts, Interactive Brokers employs two-factor authentication (2FA) login protection through its proprietary Key app. This enables traders to add an extra layer of security to their login details and can be easily set up while making an application to open an account.

Customer Support

An effective and responsive customer service team can be the difference between major earnings and devastating losses when trading in the fast-paced global financial markets. Whether your login details are not working, you have a query regarding overnight margin, want to close your account, forgot your password or are faced with error codes when trying to open or review a position, Interactive Brokers provides several avenues for support.

UK clients can contact the help team via a live chat feature, support telephone number, the account message centre or an email form on the broker’s website. IBKR provides a help chat service 24/5, while the UK-based phone number is available between 07:00 and 16:00 GMT, Monday through Friday. Due to spam concerns, the firm does not provide a direct email address.

- UK Contact Phone Number: 020 7710 5695

Interactive Brokers additionally operates a comprehensive FAQ section and a community forum in which clients can quickly find answers to commonly asked questions. Members can also request or vote on new features from the support hub and report software issues to the technical team.

Educational Content

A vast selection of quality educational content is produced by Interactive Brokers, including webinars, podcasts, trading courses and user guides.

The IBKR Trader’s Academy hosts content that includes beginner videos on fundamental market concepts, tutorials for making the most of the advanced features of the TWS platform and a comprehensive glossary covering key trading terms.

Research across the complete range of supported markets from a diverse selection of over 70 industry professionals is provided via the Traders’ Insight platform, which also incorporates a free daily newsletter to subscribers.

Those that want to take their trading to the next level can sign up to IBKR Quant, which provides guidance and content on coding API and blockchain solutions. The Student Trading Lab offers free access to realistic examples and education around trading strategies.

Advantages Of Interactive Brokers

- Top-tier educational content

- Class-leading additional features

- More than a million trading instruments

- Bespoke two-factor authentication support

- UK investor-centric ISA and SIPP accounts

- Strong selection of asset classes and markets

- Agile trading platform options and API solutions

- No minimum deposit requirements on existing accounts

Disadvantages Of Interactive Brokers

- Limited leverage rates

- No cryptocurrency trading

- Only one free withdrawal per month

- Only one supported GBP funding method

- High trading account initial minimum deposit

Promotions

Many brokers offer a welcome bonus for opening a new account or fee rebates for high-volume traders. However, Interactive Brokers only offers only one such scheme to UK investors through its ESG-focussed IMPACT platform.

Clients earn $1 (~£0.82) of Class A IBG common stock for every £82 in net cash deposits made via the IMPACT platform during the first six months following your first deposit, up to a total of £25 in free shares. The broker will also plant 25 trees for every £820 in net deposits maintained within an account.

Additional Features

Additional features, such as free VPS access, a trading scanner, earnings and currency conversion calculators and economic calendars with news and upcoming market events can help clients maximise their profitability when trading.

Interactive Brokers provides several such features to investors, including its Probability Lab software, where clients can break down the values implied by an options contract using a simple, interactive tool.

In addition, the broker provides third-party software integration for automatically managing an investment portfolio and its proprietary solution, PortfolioAnalyst. While VPS solutions can be integrated into the supported trading platforms and APIs, there is no free server offered by the broker regardless of trading volume or account minimums.

Trading Hours

Due to the highly varied asset types supported by Interactive Brokers, the platform runs 24/7. However, many of the products will follow the local trading hours of their underlying exchanges. Some instruments can be traded during extended hours, with after-hours execution supported by the TWS platform.

Clients can log in to their IBKR account at any time to view their trade history, portfolio allocation, profit and loss and the status of pending withdrawals.

Interactive Brokers Verdict

Due to the extensive selection of markets and asset types, Interactive Brokers is a one-stop global trading solution for everyone from retirement savers to CFD day trading clients. The Universal account provides all of these instruments in one place, while the inclusion of two UK-specific account types in the ISA and SIPP helps domestic investors build a tax-advantaged savings pot. FCA regulation and considerable fund protection from the SIPC only add to the case for IBKR. One disadvantage this review has highlighted is the lack of fee-free funding methods vs main competitors. Cryptocurrency traders will also need to look elsewhere as Bitcoin, Ethereum and other tokens are not supported by the UK platform.

FAQs

Can I Open A Second Account With Interactive Brokers?

Clients can access all of the firm’s instruments and trading platforms from a single Universal account. However, opening multiple accounts is possible for those that require different account types, such as the UK SIPP and ISA.

Does Interactive Brokers Support Penny Stocks?

Yes, Interactive Brokers clients can trade penny stocks if they meet the minimum financial and age criteria required to trade equity options on the platform.

Are There Any New Account Promotions Offered By IBKR?

Currently, Interactive Brokers offers a singular new account promotion, with clients able to earn up to £25 in IBG stock when funding via the IMPACT ESG-focussed platform.

Is There A Minimum Deposit Requirement For Interactive Brokers?

To open a Universal account, investors must deposit a substantial sum of £8,400 or greater, which is reduced to £2,500 for clients 26 or younger. There are no minimum deposit requirements on ISA or SIPP accounts nor subsequent deposits to any IBKR account type.

Does Interactive Brokers Support Two-Factor Authentication?

The broker’s proprietary IBKR Key app enables two-factor authentication (2FA) login security for all of the firm’s trading platforms.

Top 3 Interactive Brokers Alternatives

These brokers are the most similar to Interactive Brokers:

- IG - Founded in 1974, IG is a part of IG Group Holdings Plc, a publicly listed brokerage (LSE: IGG). The company provides spread betting, CFD, and forex trading, offering access to over 17,000 markets. Its platforms and investing apps are notably user-friendly. Over the past 50 years, IG has consistently been an industry leader, excelling in all essential areas for traders.

- Swissquote - Founded in 1996, Swissquote is a prominent Swiss bank and broker, providing online trading opportunities for an impressive portfolio of three million products, including forex, CFDs, futures, options, and bonds. Renowned for its reliability, Swissquote has earned a solid reputation through pioneering trading solutions. It was the first bank to introduce cryptocurrency trading in 2017, and has since expanded its offerings to include fractional shares and the Invest Easy service.

- Pepperstone - Founded in Australia in 2010, Pepperstone is a highly regarded broker specialising in forex and CFDs. Serving more than 400,000 clients globally, it provides access to over 1,300 financial instruments through popular platforms like MT4, MT5, cTrader, and TradingView. Its fee structure is both low and transparent. With regulation by reputable bodies such as the FCA, ASIC, and CySEC, Pepperstone guarantees a safe trading environment for traders at every level.

Interactive Brokers Feature Comparison

| Interactive Brokers | IG | Swissquote | Pepperstone | |

|---|---|---|---|---|

| Rating | 4.3 | 4.5 | 4 | 4.8 |

| Markets | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting |

| Minimum Deposit | $0 | $0 | $1,000 | $0 |

| Minimum Trade | $100 | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM, JFSA | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB |

| Bonus | - | Up To £200 In Free Shares For New Clients | - | - |

| Education | Yes | Yes | Yes | Yes |

| Platforms | - | MT4 | MT4, MT5 | MT4, MT5, cTrader |

| Leverage | 1:50 | 1:30 (Retail), 1:222 (Pro) | 1:30 | 1:30 (Retail), 1:500 (Pro) |

| Visit | 67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. |

72% of retail investor accounts lose money when trading CFDs |

||

| Review | Interactive Brokers Review |

IG Review |

Swissquote Review |

Pepperstone Review |

Trading Instruments Comparison

| Interactive Brokers | IG | Swissquote | Pepperstone | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | No | No | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | Yes | Yes |

| Silver | No | Yes | Yes | Yes |

| Corn | No | No | No | Yes |

| Futures | Yes | Yes | Yes | No |

| Options | Yes | Yes | Yes | No |

| ETFs | Yes | Yes | Yes | Yes |

| Bonds | Yes | Yes | Yes | No |

| Warrants | Yes | Yes | Yes | No |

| Spreadbetting | No | Yes | No | Yes |

| Volatility Index | No | Yes | Yes | Yes |

Interactive Brokers vs Other Brokers

Compare Interactive Brokers with any other broker by selecting the other broker below.

Popular Interactive Brokers comparisons:

|

|

Interactive Brokers is #5 in our rankings of CFD brokers. |

| Top 3 alternatives to Interactive Brokers |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies |

| Demo Account | Yes |

| Minimum Deposit | $0 |

| Minimum Trade | $100 |

| Regulated By | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| Leverage | 1:50 |

| Mobile Apps | iOS & Android |

| iOS App Rating | |

| Android App Rating | |

| Payment Methods | ACH Transfer, Cheque, Debit Card, Wire Transfer |

| Copy Trading | No |

| Auto Trading | Capitalise.ai, TWS API |

| Islamic Account | No |

| Commodities | Aluminium, Gold, Lead, Lean Hogs, Natural Gas, Precious Metals, Soybeans, Zinc |

| CFD FTSE Spread | 0.005% (£1 Min) |

| CFD GBPUSD Spread | 0.08-0.20 bps x trade value |

| CFD Oil Spread | 0.25-0.85 |

| CFD Stocks Spread | 0.003 |

| GBPUSD Spread | 0.08-0.20 bps x trade value |

| EURUSD Spread | 0.08-0.20 bps x trade value |

| GBPEUR Spread | 0.08-0.20 bps x trade value |

| Assets | 100+ |

| Crypto Coins | BTC, ETH, LTC, XRP |

| Crypto Spreads | 0.12%-0.18% |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |