Trading EUR/JPY

The Euro and Japanese Yen (EUR/JPY) is one of the most popular and volatile crosses traded in the world today. But before you start investing on the EUR/JPY exchange rate, use this guide to understand how to forecast future prices using live online charts, the latest news and technical analysis. We’ll also look at the history of both currencies, plus other top trading tips.

EUR/JPY Trading Brokers

-

Pepperstone provides forex spreads on the EUR/USD averaging just 0.12 pips with their Razor account. This is highly competitive. Their extensive portfolio includes over 100 currency pairs, which exceeds what most rivals offer. Furthermore, Pepperstone stands out by offering three unique currency indices: USDX, EURX, and JPYX, which are rare on other platforms. They have been recognised with our 'Best Forex Broker' award twice.

GBPUSD Spread EURUSD Spread GBPEUR Spread 0.4 0.1 0.4 Total Assets FCA Regulated Platforms 100+ Yes Pepperstone Trading Platform, MT4, MT5, cTrader, TradingView, AutoChartist -

XTB offers over 60 currency pairs with competitive spreads, averaging 1 pip on major pairs. The xStation platform is user-friendly, featuring over 30 indicators in its charting package and a variety of order types, supporting diverse trading strategies and risk management.

GBPUSD Spread EURUSD Spread GBPEUR Spread 1.4 1.0 1.4 Total Assets FCA Regulated Platforms 70+ Yes xStation -

IG provides an extensive selection of over 80 currency pairs through its own web platform, mobile app, or MetaTrader 4. For advanced charting and forex analysis, the ProRealTime software is available. Testing shows forex spreads are competitive, beginning at 0.1 pips on major pairs such as EUR/USD.

GBPUSD Spread EURUSD Spread GBPEUR Spread 0.9 0.8 0.9 Total Assets FCA Regulated Platforms 80+ Yes Web, L2 Dealer, MT4, TradingView, AutoChartist, TradingCentral, ProRealTime -

IBKR offers a vast range of over 100 forex pairs, including major, minor, and exotic currencies, outstripping most competitors except CMC Markets. Trading is available across multiple platforms with institutional-grade spreads beginning at 0.1 pips. There are also 20 sophisticated order types, such as brackets, scale, and one-cancels-all (OCA) orders, enhancing trading strategies.

GBPUSD Spread EURUSD Spread GBPEUR Spread 0.08-0.20 bps x trade value 0.08-0.20 bps x trade value 0.08-0.20 bps x trade value Total Assets FCA Regulated Platforms 100+ Yes Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower -

Vantage provides over 55 currency pairs, exceeding the industry norm, giving traders ample opportunities. With a robust liquidity pool, forex spreads start at 0.0 pips on the ECN account, often beating other options. Additionally, there are no commissions, deposit fees, or hidden charges.

GBPUSD Spread EURUSD Spread GBPEUR Spread 0.5 0.0 0.5 Total Assets FCA Regulated Platforms 55+ Yes ProTrader, MT4, MT5, TradingView, DupliTrade -

FOREX.com remains a leading FX broker, providing 80 currency pairs with highly competitive fees. EUR/USD spreads can reach as low as 0.0, with a $7 commission per $100k, making it a standout choice.

GBPUSD Spread EURUSD Spread GBPEUR Spread 1.3 1.2 1.4 Total Assets FCA Regulated Platforms 84 Yes WebTrader, Mobile, MT4, MT5, TradingView -

Eightcap provides over 50 currency pairs, matching the industry norm but falling short of leaders like CMC Markets, which offers more than 300. Nonetheless, Eightcap distinguishes itself with institutional-quality spreads starting from 0.0 pips on major pairs such as EUR/USD. The broker's competitively low commissions at $3.50 per side further enhance its appeal. Eightcap also equips traders with comprehensive forex data, including essential fundamentals, bullish and bearish signals, and a calendar monitoring significant foreign exchange market events.

GBPUSD Spread EURUSD Spread GBPEUR Spread 0.1 0.0 0.1 Total Assets FCA Regulated Platforms 50+ Yes MT4, MT5, TradingView

Safety Comparison

Compare how safe the Trading EUR/JPY are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✘ | ✔ | |

| XTB | ✔ | ✔ | ✔ | ✔ | |

| IG | ✔ | ✔ | ✔ | ✔ | |

| Interactive Brokers | ✔ | ✔ | ✘ | ✔ | |

| Vantage FX | ✔ | ✔ | ✘ | ✔ | |

| Forex.com | ✔ | ✔ | ✘ | ✔ | |

| Eightcap | ✔ | ✔ | ✘ | ✔ |

Payments Comparison

Compare which popular payment methods the Trading EUR/JPY support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| XTB | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| IG | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ |

| Interactive Brokers | ✔ | ✔ | ✘ | ✘ | ✘ | ✘ |

| Vantage FX | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| Forex.com | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| Eightcap | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

Mobile Trading Comparison

How good are the Trading EUR/JPY at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| Pepperstone | iOS & Android | ✘ | ||

| XTB | iOS & Android | ✔ | ||

| IG | iOS & Android | ✔ | ||

| Interactive Brokers | iOS & Android | ✔ | ||

| Vantage FX | iOS & Android | ✘ | ||

| Forex.com | iOS & Android | ✘ | ||

| Eightcap | iOS & Android | ✘ |

Beginners Comparison

Are the Trading EUR/JPY good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|---|---|---|---|---|

| Pepperstone | ✔ | $0 | 0.01 Lots | ||

| XTB | ✔ | $0 | 0.01 Lots | ||

| IG | ✔ | $0 | 0.01 Lots | ||

| Interactive Brokers | ✔ | $0 | $100 | ||

| Vantage FX | ✔ | $50 | 0.01 Lots | ||

| Forex.com | ✔ | $100 | 0.01 Lots | ||

| Eightcap | ✔ | £100 | 0.01 Lots |

Advanced Trading Comparison

Do the Trading EUR/JPY offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Pepperstone | Expert Advisors (EAs) on MetaTrader | ✔ | 1:30 (Retail), 1:500 (Pro) | ✔ | ✘ | ✔ | ✘ |

| XTB | - | ✔ | 1:30 | ✘ | ✘ | ✔ | ✘ |

| IG | Expert Advisors (EAs) on MetaTrader, build your own on ProRealTime | ✔ | 1:30 (Retail), 1:222 (Pro) | ✔ | ✔ | ✔ | ✔ |

| Interactive Brokers | Capitalise.ai, TWS API | ✘ | 1:50 | ✘ | ✔ | ✔ | ✔ |

| Vantage FX | Myfxbook AutoTrade, Expert Advisors (EAs) on MetaTrader | ✘ | 1:30 | ✔ | ✘ | ✘ | ✘ |

| Forex.com | Expert Advisors (EAs) on MetaTrader | ✘ | 1:30 | ✔ | ✔ | ✔ | ✘ |

| Eightcap | TradingView Bots | ✘ | 1:30 | ✔ | ✘ | ✔ | ✘ |

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the Trading EUR/JPY.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|---|---|---|---|---|---|---|---|---|

| Pepperstone | |||||||||

| XTB | |||||||||

| IG | |||||||||

| Interactive Brokers | |||||||||

| Vantage FX | |||||||||

| Forex.com | |||||||||

| Eightcap |

Our Take On Pepperstone

"Pepperstone is a premier trading platform, providing tight spreads, swift execution, and sophisticated charting tools for seasoned traders. Beginners benefit from no minimum deposit, comprehensive learning materials, and outstanding 24/7 support."

Pros

- Pepperstone presents itself as an economical choice for traders, offering spreads as low as 0.0 in its Razor account. The Active Trader programme provides rebates up to 30% on indices and commodities, plus $3 per lot on forex.

- Over the years, Pepperstone has consistently garnered recognition from DayTrading.com’s annual awards. Recently, it was honoured as the 'Best Overall Broker' in 2025 and was the 'Best Forex Broker' runner-up the same year.

- Pepperstone now offers spread betting via TradingView, delivering a streamlined and tax-efficient trading experience with sophisticated analytical tools.

Cons

- Pepperstone doesn't offer cTrader Copy, a favoured feature for copying trades found in the cTrader platform, which is available on other platforms such as IC Markets. However, Pepperstone has launched its own user-friendly copy trading app.

- Pepperstone's demo accounts remain active for 60 days. This duration might be insufficient to fully explore the platforms and trial various trading strategies.

- Although its market range has improved, its crypto offerings remain limited compared to brokers specialising in this sector, lacking real coin investment options.

Our Take On XTB

"XTB excels for novice traders with its superb xStation platform, minimal trading costs, no required deposit, and outstanding educational resources, many of which are fully integrated into the platform."

Pros

- The xStation platform stands out with its user-friendly design and intuitive tools, such as adaptable news feeds, sentiment heatmaps, and a trader calculator. These features streamline the learning process for new traders.

- Setting up an XTB account is straightforward and fully online, requiring only a few minutes. This simplicity eases new traders into the world of trading.

- Top-notch customer support, available 24/5, includes a welcoming live chat with response times under two minutes during tests.

Cons

- It is frustrating that XTB products do not allow traders to modify the default leverage level. Manually adjusting leverage can greatly reduce risk in forex and CFD trading.

- XTB has stopped supporting MT4, restricting traders to its own platform, xStation. This decision may discourage experienced traders accustomed to using the MetaTrader suite.

- The demo account lasts only four weeks, posing a challenge for traders wanting to fully explore the xStation platform and refine short-term strategies before investing actual money.

Our Take On IG

"IG offers a complete package: an easy-to-use web platform, top-tier beginner education, enhanced charting via TradingView, up-to-date data, and strong trade execution for seasoned traders."

Pros

- The ProRealTime advanced charting platform remains free, provided traders meet modest monthly activity requirements.

- IG excels with its diverse instruments, offering stocks, forex, indices, commodities, and cryptocurrencies. Additionally, it provides US-listed futures, options, and an AI Index, ensuring varied diversification opportunities.

- The IG app provides an excellent mobile trading experience with an intuitive design, earning it the Runner Up position in our 'Best Trading App' award.

Cons

- Based on tests, stock and CFD spreads remain less competitive than the lowest-cost brokers, such as CMC Markets.

- Beginners may find IG's fees complicated, as they vary depending on the trades or services. This could cause confusion and unexpected costs.

- IG has ended its swap-free account, diminishing its attractiveness to Islamic traders.

Our Take On Interactive Brokers

"Interactive Brokers ranks highly for seasoned traders due to its robust charting platforms, live data, and bespoke layouts via the new IBKR Desktop app. Its competitive pricing and sophisticated order choices appeal to traders, and its wide equity options are industry-leading."

Pros

- Interactive Brokers has introduced ForecastTrader, an innovative product offering zero-commission trading with yes/no Forecast Contracts on political, economic, and climate events. It features fixed $1 contract payouts, 24/6 market access, and a 3.83% APY on positions held.

- IBKR consistently offers unparalleled access to global equities, with thousands of shares available across over 100 market centres in 24 countries, including the recently added Saudi Stock Exchange.

- Interactive Brokers has been awarded Best US Broker for 2025 by DayTrading.com. This accolade highlights its dedication to traders in the US, offering exceptionally low margin rates and access to global markets at minimal expense.

Cons

- The learning curve for TWS is quite steep, making it tough for novice traders to navigate and grasp all its features. In contrast, Plus500's web platform is far more accessible for those new to trading.

- You are limited to a single active session per account, meaning you cannot use both your desktop programme and mobile app at the same time. This restriction can occasionally lead to a frustrating experience for traders.

- IBKR offers a variety of research tools, but their inconsistent placement across trading platforms and the 'Account Management' webpage creates a confusing experience for users.

Our Take On Vantage FX

"Vantage is an ideal choice for CFD traders looking for a well-regulated broker with access to the dependable MetaTrader platforms. With a swift sign-up process and a minimum deposit of $50, starting trading is simple and fast."

Pros

- Vantage addresses the needs of passive investors through user-friendly social trading on ZuluTrade and Myfxbook.

- ECN accounts offer competitive terms, featuring spreads starting at 0.0 pips and a commission of $1.50 per trade side.

- With a minimal deposit requirement of just $50 and no funding fees, this broker stands out as an excellent option for novice traders.

Cons

- Based on tests, average execution speeds of 100ms to 250ms are slower compared to other options.

- It's unfortunate that some clients must register with the offshore firm, which provides reduced regulatory safeguards.

- Regrettably, cryptocurrencies are accessible solely to clients in Australia.

Our Take On Forex.com

"FOREX.com excels in serving traders of all levels, offering more than 80 currency pairs, spreads starting at 0.0 pips, and competitive commissions. Its robust charting platforms provide over 100 technical indicators and comprehensive research tools."

Pros

- With more than two decades of expertise, strong regulatory governance, and numerous accolades, including a second-place finish in our 'Best Forex Broker' awards, FOREX.com is globally renowned as a reliable trading platform.

- An abundance of educational resources is available, such as tutorials, webinars, and an extensive YouTube channel, designed to enhance your understanding of financial markets.

- FOREX.com provides top-tier forex rates beginning at 0.0 pips, along with attractive cashback rebates up to 15% for dedicated traders.

Cons

- Demo accounts are typically limited to 90 days, hindering effective strategy testing.

- FOREX.com's MT4 platform provides around 600 instruments, a notable reduction compared to the more than 5,500 options on its other platforms.

- US clients are not protected against negative balances, which means you could end up owing more than your initial deposit.

Our Take On Eightcap

"Eightcap excels for traders, offering diverse charting platforms, educational Labs, and AI tools. With over 120 crypto CFDs, it stands out in crypto trading and has won our 'Best Crypto Broker' award twice consecutively."

Pros

- Eightcap has excelled in all essential trading areas, surpassing all rivals to clinch our 'Best Overall Broker' award for 2024. It also earned the titles of 'Best Crypto Broker' and 'Best TradingView Broker' for 2025.

- Eightcap excels with a suite of advanced trading tools, such as MT4 and MT5, and has recently joined the 100-million-user social trading network, TradingView.

- In 2026, Eightcap integrated TradeLocker, distinguishing itself as the premier regulated broker for TradeLocker. It continues to offer ultra-fast execution and competitive fees for active traders on the charting platform.

Cons

- Eightcap must enhance its range of over 800 instruments to rival top competitors like Blackbull Markets, which offers 26,000+ assets, especially improving its limited commodities selection.

- The demo account is available for 30 days, after which it requires a request for extension. This is less convenient than XM's offering, which provides an unlimited demo mode.

- Despite the growing range of tools available, Eightcap lacks popular industry resources such as Autochartist and Trading Central. These provide advanced charting analytics, live news, and essential market insights for traders focused on short-term strategies.

The EUR/JPY Explained

EUR/JPY is the forex pair quote representing the currency exchange rate between the Euro and the Japanese Yen. The base currency, EUR, is quoted against the counter currency, JPY, which means you need a certain amount of JPY to buy one EUR.

Due to high levels of volatility, the EUR/JPY pairing represents around 3% of all daily transactions and is the seventh most-traded currency pair on the market.

To fully understand the price movements of the pair, below we analyse the origins of the two currencies and what historical factors have affected the EUR/JPY price.

The Euro

Compared to the Japanese Yen and many other currencies, the Euro is relatively new. Originally released as an invisible currency in 1999, it was not until 2002 when coins and banknotes were launched to the public. This became the biggest cash changeover in history, taking place in 12 EU countries.

Despite its infancy, the Euro has seen high volatility due to political and economic events at the start of the century, including the 2008 financial crisis. From 2013 to 2015, the Euro fell heavily again as debt problems emerged in Portugal, Spain, Greece and Italy.

The Japanese Yen

The Japanese Yen is the third most-traded currency in the world and is the fourth reserve currency behind the US Dollar, the Euro and the Pound Sterling.

The Yen was officially created in 1871 by the Meiji government and was steadily boosted in value due to Japan’s strong industrial economy. After losing much of its value after World War II, the Yen was then fixed at 360 JPY per 1 USD in order to stabilise the Japanese economy.

When this system was abandoned in 1971, the Yen became undervalued and was allowed to float. Throughout the 1970s and 1980s, the Yen fluctuated in value due to government intervention in the ‘dirty float’ scheme and the Plaza Accord. Since that time, the price of the Yen has gradually decreased.

Pros Of Trading EUR/JPY

- Volatility – High volume and volatility products like EUR/JPY can result in good trading opportunities from upward price movements.

- Stronger trends – As EUR/JPY is a cross pair, it generally develops stronger trends compared to major currency pairs. You can easily see this in action on a realtime or 1-hour price chart.

- Diversity – Intraday traders also enjoy a range of EUR/JPY trading options, such as ETF products, futures and forward instruments, and more.

- Technical analysis – Today, any trading system can offer an abundance of technical and fundamental analysis tools. This includes daily forex candlestick chart analysis and tools which allow you to access real-time economic news.

- Spreads – As one of the most popular traded pairs, you should be able to find a low bid-ask spread for EUR/JPY at most forex brokers.

Cons Of Trading EUR/JPY

- Volatility risk – Whilst high volatility can be profitable, it can also result in heavy losses if you do not have appropriate risk management tools in place.

- Leverage – Leveraged trading is often misunderstood, especially by new traders. Remember that you can lose more than you initially put down, so make sure you understand this concept before committing to a trade.

- Commitment – Due to its volatility, the current price action of EUR vs JPY is dynamic and constantly moving. This means UK traders will need to monitor market conditions and stay on top of historical data downloads in order to successfully execute a trend forecast.

What Factors Affect EUR/JPY?

European Factors

For today’s UK traders, there are a number of factors that influence the movement of the Euro, namely economic, political and financial. A notable example is monthly reports released by the European Central Bank (ECB), which can give traders an indication of where the Euro is heading.

Current employment rates and job creation is often another factor that can see the Euro go up or down. This data is also readily available to the public and is worth keeping an eye on to monitor the strength of an economy.

Other factors include monetary policy, inflation and the Consumer Price Index, confidence and sentiment, plus GDP. Experts suggest that now that Brexit has occurred, France and Germany now account for nearly 50% of the Eurozone’s GDP. These are therefore the best places to start if you’re looking for economic reports.

Japanese Factors

The same kinds of economic, political and financial factors also affect the spot Euro and Yen exchange rate, in addition to the high rate of import and export trading in Japan.

Another major factor is the current rate of natural disasters in the region. Because Japan is a small country, natural events can cause the currency’s value to fluctuate hugely.

Interest rates and government intervention initiatives also play a huge role in affecting the direction of JPY. The Bank of Japan, for example, has maintained a consistent zero interest rate policy for decades.

How To Trade EUR/JPY

If you’re considering day trading on EUR/JPY, you can check out the best platforms to use in some of our online broker reviews. Before you start, it’s worth getting to know the various strategies and considerations associated with the pair.

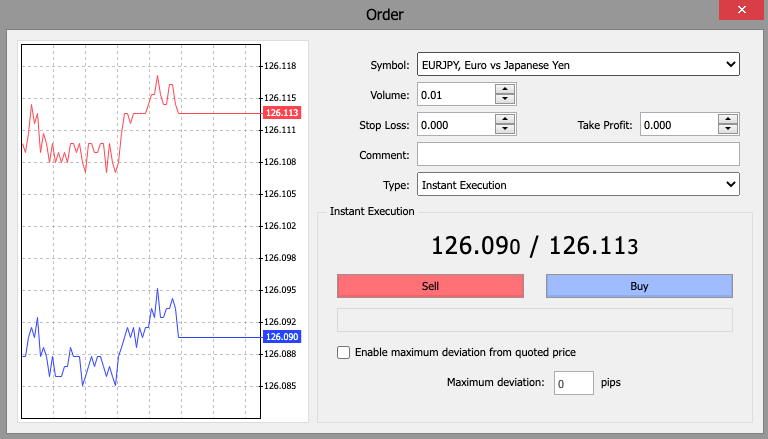

EUR/JPY Forex Trading MT4

Technical Analysis

For many traders, technical analysis is an essential base for any trading strategy. Technical analysis is the study of historical data on realtime price chart movements, which allow you to make a prediction on future forex trends.

Support and resistance levels, for example, can be used to indicate the high and low price points on a graph, at which the price will stop and reverse. These can also be used to analyse the average daily range pip movement of EUR/JPY, or to complement a breakout strategy. You could also use an indicator to map out bullish and bearish trends on an hourly chart, such as Elliott Wave analysis or daily Pivot Points.

Live streaming price charts are not only used for short-term forex analysis, as some can also facilitate a long-term chart forecast with timeframes spanning years. Moving averages, for example, work well on yearly charts, as they can show you the overall direction of price over time. You could also use a simple moving average on a 5 or 15 minute chart if you want to build your scalping strategy.

Fundamental Analysis

Whilst you can get a reasonable daily outlook from technical studies and indicators, these should also be combined with fundamental analysis. This involves monitoring any news reports and global events that might affect the EUR to JPY daily or weekly forecast.

Some of the most popular resources include Bloomberg, Forex Factory, Reuters, Yahoo Finance, Google Finance and CNBC. It’s also worth looking out for any economic news calendars, market sentiment tools or blogs within your trading platform.

Automated Trading

Some platforms also offer automated and algorithmic trading functionality, including Expert Advisors (EAs), which can be used for short-term or long-term strategies. For example, you could use a scalping strategy with an EA to make quick profits on EUR/JPY.

You can also use automated signals, where you can subscribe to another trader’s account and get their deals automatically copied into yours. This is a good option if you’re short on time or unable to monitor trades regularly.

You can easily apply a daily forex signal on EUR/JPY in the MetaTrader platform, for example, by exploring the vast range of providers in the Signals tab. Clicking on an individual provider will take you through to their success rates and monthly profit charts.

Note that automated trading isn’t for everyone and it will take practice to find the solution that suits you. If you encounter any issues, the community forum is an excellent place to get an initial prognosis, advice and recommendations.

Correlation

A simple EUR/JPY forex trading strategy that you can use to forecast the future price, is the positive currency correlation with both EUR/USD and USD/JPY. A positive currency correlation is when the values of the currency pairs move in tandem.

With this in mind, traders will avoid buying or selling EUR/JPY when EUR/USD is going up and USD/JPY is going down. Similarly, they will avoid trading the cross when EUR/USD is going down and USD/JPY is going up.

Therefore, the optimum conditions at which to buy EUR/JPY would be when both EUR/USD and USD/JPY are hitting the support level and rallying. Conversely, if you want to sell EUR/JPY, make sure the other two pairs are hitting resistance and coming down.

Note that the EUR/JPY and CHF/JPY also have a positive correlation. This is due to the close relationship between the Swiss Franc and the Euro.

Risk Management

Remember that the strategy above should be protected with stop loss and take profit barriers. These will ensure that your account automatically closes trades when prices hit a set level.

To determine your stop-loss price, you can employ technical analysis tools such as support and resistance, pivot points and trendlines. If you’re buying EUR/JPY, your stop-loss closing price should always be placed below the currency market price and if you’re selling, it should be placed above.

You can use an online calculator to determine how much you can risk per trade and make sure to check out any tips and advice online.

Session Times

Although FX markets operate around the clock, there are optimum session times for EUR/JPY where UK day traders can generate more profits from greater volatility.

Some sources suggest that the best time to trade EUR/JPY is when the London and New York trading sessions overlap, between 12:00 and 16:00 GMT. Swing traders may also want to keep an eye on EUR/JPY on Thursdays, when average daily volatility is highest.

Final Word On EUR/JPY

EUR/JPY is a volatile and exciting pair to trade, with plenty of analysis options available for day traders. Whether you’re scalping on a daily live chart, or long-term investing on 1 or 5 year charts, make sure to stay updated with the latest analysis and economic developments in Japan and Europe.

The technical and fundamental analysis tools mentioned above should also provide the basis of your research into trading EUR/JPY. Nonetheless, it’s ultimately up to you to decide on the best strategy to help you achieve your target.

Find out more about forex trading.

FAQ

What Does EUR/JPY Mean?

EUR/JPY is the currency pair that represents the Euro (EUR) to Japanese Yen (JPY) exchange rate. The pair determines how many units of JPY, the quoted currency, is needed to buy 1 Euro, the base currency. EUR/JPY is the seventh most-traded currency pair on the forex market.

How Do I Trade EUR/JPY?

To start trading, you will need access to a EUR vs JPY live chart which will indicate the historical rate of price action over multiple timeframes. You can then use chart indicators to analyse trends and forecast future movements. You can also implement other tools such as Expert Advisors or trading signals to boost your strategy.

What Is The Best Time To Trade EUR/JPY?

The best time to trade EUR/JPY is when the London and New York trading sessions overlap, between 12:00 and 16:00 GMT. Note that the trading hours available in the trading platform may depend on the timezone of your broker.

Where Can I Get News On EUR/JPY?

You should keep on top of economic, political and financial developments in both regions by following governmental reports and other news outlets such as Reuters and Bloomberg. Note that the Japanese Yen is also affected by natural disasters in the region.

Should I Trade EUR/JPY?

The EUR/JPY pair is a popular product due to its volatility and potential to generate profits. If you’re beginner, you may want to start with the easiest and most stable currency pair, EUR/USD, before moving on to minors like EUR/JPY.