Automated Forex Trading

Automated forex trading strategies are nothing new – adopted by institutional traders for decades. But their growth in the retail investing scene has seen them become more accessible on PC and mobile platforms. Automated forex trading systems and strategies allow individuals to process data and execute trades at unmatched speeds. In this review, we cover how automated forex trading works, some of the best software in the UK and how to get started for beginners.

Brokers with Auto Trading

Safety Comparison

Compare how safe the Automated Forex Trading are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|

Payments Comparison

Compare which popular payment methods the Automated Forex Trading support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|

Mobile Trading Comparison

How good are the Automated Forex Trading at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|

Beginners Comparison

Are the Automated Forex Trading good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|

Advanced Trading Comparison

Do the Automated Forex Trading offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the Automated Forex Trading.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|

What Is Automated Forex Trading?

The definition of automated forex trading is the reliance on algorithm-based software to create signals or execute trades on your behalf. FX software is programmed using coding languages such as Python and MQL4. The code defines the conditions in which it expects a trade to be profitable. It looks for these conditions in the data and executes a trade or creates a signal.

Fully automated systems are also known as trading robots. Other tools will notify a trader of a signal in the data which the trader can use to inform a buy/sell position. These are known as expert advisors (EA).

Automated Forex Trading Strategies

There are a number of strategies you can employ. These techniques are known as ‘logic’ when programmed into software.

High Frequency Trading (Scalping)

Scalping is when software is programmed to execute thousands of forex trades per second – beyond anything a human could make manually. Only a small profit needs to be made from each trade because of the frequency made in a short period.

Arbitrage

Arbitrage is another trading strategy that can only be operated using automated software. It involves identifying inefficiencies in the market and exploiting them. Again, these inefficiencies are likely to yield minute profits, but if they can be executed frequently enough, or with sufficient capital, it can translate into healthy sums.

It is also a relatively less risky forex strategy, as it involves trading on current prices rather than predicting future trends. However, these price inefficiencies don’t hand around for long as competitive software will likely also identify the opportunity.

Trend-based Algorithms

The most common automated forex trading algorithms look at past patterns in prices to identify trends. When a trend occurs, the software generates a signal or executes a trade on the assumption that the trend will continue.

Average/Mean Reversion

This strategy works on the logic that most assets return to their average value eventually. If a price moves far away from this average, the software will execute a buy/sell order and then once it returns to the average price as predicted, it will execute again and take the profit.

And The Rest…

There are hundreds of different strategies out there but these are some of the most common. Others include algorithms that react to news events, or more maths-based algorithms such as Delta Neutral strategy. Further still, some look to minimise transaction costs such as the Implementation Shortfall strategy.

Best Automated Forex Trading Software In The UK

The top automated forex trading software lets you create your own robots as well as purchase existing programs from others. You’ll need a system with fast processing speeds and the ability to backtest your software.

Let’s explore the best automated trading services on the market:

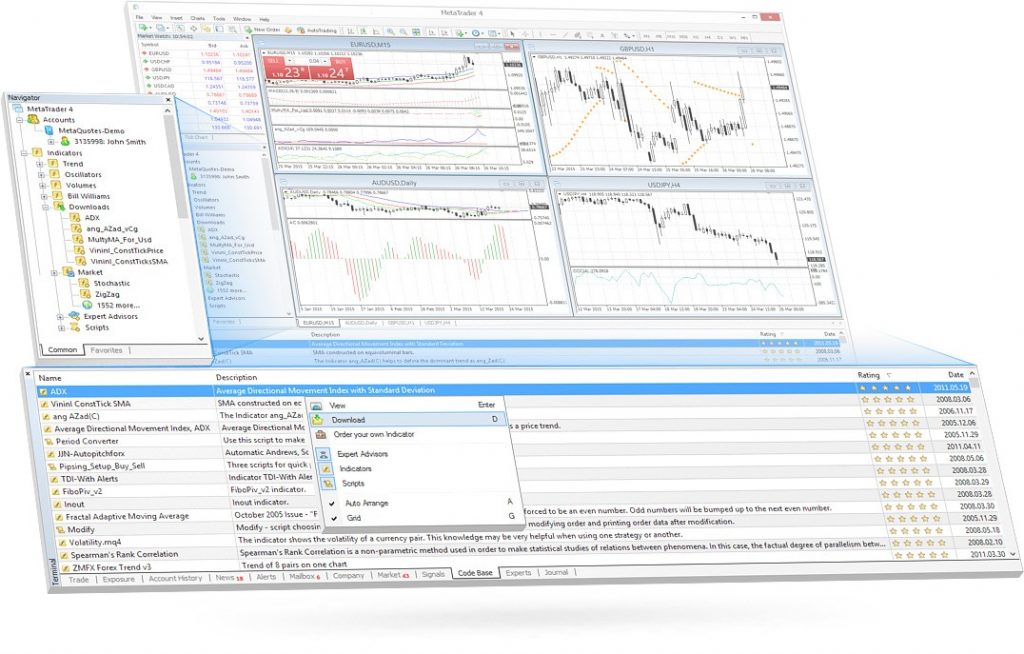

- MetaTrader 4 – Known for being one of the best forex trading platforms, MT4 includes a feature where users can create their own expert advisors (EAs) or automated trading robots. Code is written in MQL4 (the MT4 coding language). Algorithms can be sold on the MT4 marketplace or loaded to the CodeBase for users to download for free.

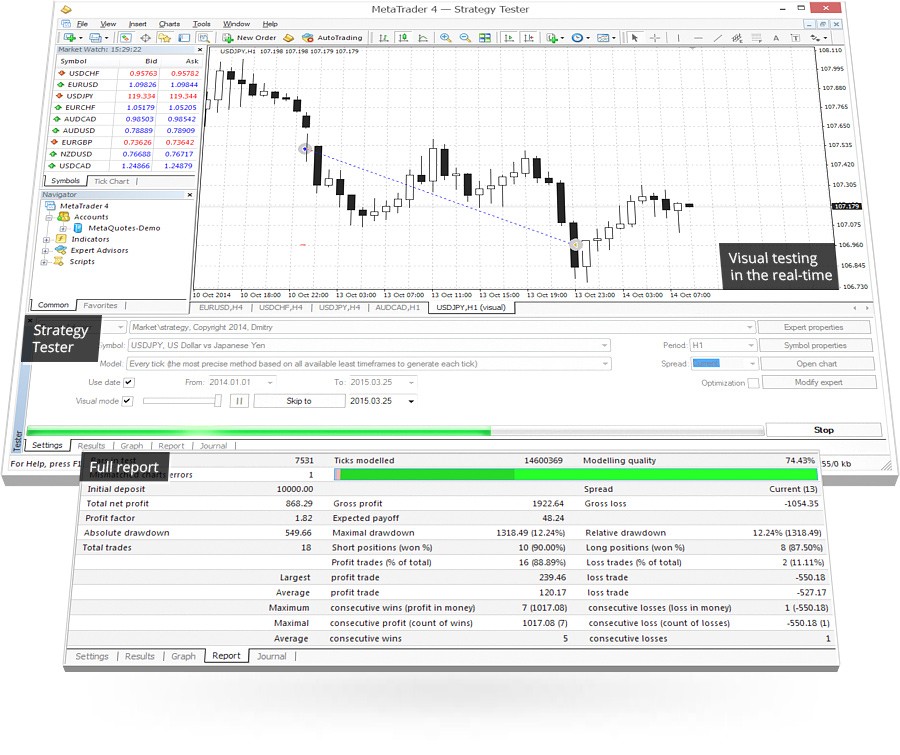

- MetaTrader 5 – More forex assets than MT4 and a simpler coding language (MQL5) makes this another strong platform for automated trading. It also offers CFD trading and arguably has better backtesting capabilities.

- CTrader Automate – This popular platform offers hundreds of free and paid for cBots (automated forex trading robots) for users to choose from. cBots can function with synchronous execution (meaning that multiple orders are filled at once) reducing the likelihood of slippage.

- ProRealTime – The ProRealTime Backtesting and Automatic Trading System Creation allows you to build your own robots without having to write a single line of code. Assisted creation lets you pick your long/short position based on the criteria you set. Backtest your new bot so you know it works, then start trading FX. The lack of coding knowledge required makes it a great option for beginners who are interested in creating their own automated forex trading software.

Advantages Of Automated Forex Trading

Speed Of Execution

Perhaps the number one reason for utilising automated forex trading is the speed you can execute trades at. Automated software can assess market conditions and execute a trade in milliseconds with a high degree of accuracy.

Emotional Influences

Automated forex software will only execute a trade that matches its predefined criteria. Therefore, it removes any impulsiveness, gut-feeling, or nervousness around investing.

Time Savings

Since no human intervention is required to analyse the data or execute a trade, there are undisputed time savings to be made from automated trading vs manual forex trading.

Disadvantages Of Automated Forex Trading

Past Performance Is Not Indicative of Future Gain

Automated forex trading is based on algorithms that are programmed by looking at patterns in past data. This is a good way to predict how the market might react in the future, but it is by no means fool proof. Investors should understand that automated bots are still at risk of losing if the market doesn’t follow the predicted trend.

Only As Good As The Person Who Built It

Automated forex trading software is built by humans, so if the underlying logic is flawed, you could be executing trades that might not be profitable.

For this reason, we’d advise caution when buying off-the-shelf bots. Do you know who wrote them and fully understand the logic behind them? How much backtesting has the owner done? And can you find proof of this? It’s vital you can trust the software.

Expertise Required

Coding using Python, Java or C languages is not for beginners. It can take software developers years to become proficient. Therefore, beginners may choose to purchase existing bots and rely on the logic of other forex traders.

With that said, there are services out there which enable software production without writing code, such as the ProRealTime Automated Trading Creation system.

How To Get Started Automated Forex Trading

To create your own automated forex trading software, you’ll need to first select a broker. The best brokers offer trading platform access for free when you sign up for an account. For example, Forex.com provides you with access to TradingView, another highly regarded platform with automated FX trading capabilities.

Deposit the minimum amount and download your chosen system via the app store (on both iPhone or Android) or your broker’s website.

Log in to the platform using the credentials provided by your broker and you’re ready to get trading. Select a bot from the marketplace or create your own programme.

FAQ

Do Top Automated Forex Trading Systems Work?

Yes, automated forex trading systems do work and can be effective if the software is programmed correctly and regularly tested. However, whether it works for your bottom line depends entirely on the quality of the bot selected. Ensure software is back tested, has a fast processing speed and that the logic is sound before you invest.

What Is An Automated Forex Trading Expert Advisor?

An expert advisor (EA) is a software system used to notify traders of trading signals based on their programmed algorithm. Unlike automated forex trading robots, EAs will not always automatically execute positions.

Is Automated Forex Trading Profitable?

Yes, automated forex trading is profitable for many traders. But, it also depends entirely on the software used. You should look for evidence that the bot is profitable. Reading online reviews can help, but you should also test it out on a demo account beforehand to check you’re happy with the results.

What Is Automated Forex Trading Backtesting?

Backtesting involves running the software on past FX market data to see how it performs. Algorithms should be backtested regularly to ensure they are effective at producing results.

Can Automated Forex Trading Make Money?

The best automated forex trading software and systems can help bolster profits. They can reduce the manual time spent trading and improve efficiencies. However, there are no guarantees in the forex market. Automated trading strategies still need careful development, fine tuning and monitoring. Moreover, effective risk management systems will need to be put in place.