FMOC Preview, Here’s What Barclays & Goldman Have To Say.

December 12, 2017

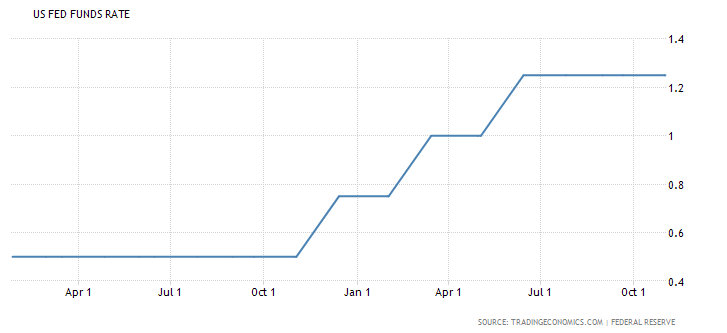

Another year, and another December FOMC meeting where the Fed is set to raise rates. Well, that’s the word on the street, where a 0.25% rate rise is all but priced in for Wednesday. This meeting is important as it sets up 2018, a change in forecast or language could set the USD off into the new year.

Both Barclays and Goldman have sent previews to their clients, let’s have a look at what they have to say.

Here’s what Barclays have to say:

- The FOMC is widely expected to increase the federal funds target range 25bp … a move that has been clearly telegraphed by FOMC members and should provide no surprises

- The committee appears confident it is nearing its full employment mandate, but is somewhat more cautious on inflation.

- We expect the Fed to stay the course on policy tightening next year, and it could even accelerate the pace somewhat from our baseline scenario of two hikes.

- Labor markets are improving faster than anticipated, and FOMC members are playing catch-up with their projections of the unemployment rate (UR). In September, they projected that the UR would decline to 4.1% by Q4 18, a threshold reached already by October 2017.

- In addition, the FOMC will likely be concerned that a prolonged period of extraordinarily accommodative monetary policy will lead to imbalances in financial markets and is somewhat concerned about financial stability risks.

- Finally, with looming tax cuts that are likely to boost demand but not enhance potential growth, FOMC will likely also be concerned about overshooting inflation in the medium term.

Summary of economic projections (SEP)

- We expect a lower path for the UR, marking it closer to the actual data; think the growth projections for 2018 should be revised slightly higher in light of strong momentum in activity at the end of this year; and believe inflation projections will be broadly unchanged.

- There is likely to be a discussion of the upside risks to the growth and inflation outlooks from the recently passed tax bill, but its effect on the macro economy will likely be included in the official SEP tables only once a final version of the bill has been approved and signed by the president.

Goldman doesn’t really differ from the narrative:

- FOMC almost certain to deliver the third rate hike of 2017

- Attention is likely to focus on the outlook for 2018 and beyond

- In particular on how the Federal Reserve will react to a tax reform that now appears likely to become law

- The economic data have improved slightly on net since the FOMC last met in early November

- Growth momentum has remained strong

- Unemployment rate has fallen further

- The latest inflation data were encouraging

- Financial conditions have eased once again, as they have in the aftermath of each Fed tightening action so far in this hiking cycle

And the summary projections:

In light of both the stronger growth momentum and the prospect of tax cuts:

- We expect the Summary of Economic Projections to upgrade GDP growth in 2018 and 2019

- And to mark down the unemployment path by two-tenths to 3.9%, offset only partly by a one-tenth reduction in the longer-run unemployment rate to 3.5%

- We expect the 2018 inflation projections to remain at 1.9%

- We continue to expect four rate hikes next year

Let’s hope that Wednesday’s meeting provides more volatility and action than NFP.