Exchange-Linked Warrants

Exchange-linked warrants (ELWs) are used by traders to speculate on the future price movements of underlying assets and to hedge against other positions. This tutorial explains how exchange-linked warrants work, from their structure and history to risks and limitations. Our team have also reviewed and ranked the best brokers with ELWs:

Exchange-Linked Warrant Brokers UK

-

Interactive Brokers (IBKR), a leading brokerage, offers access to 150 markets across 33 countries and provides extensive investment services. With more than 40 years of experience, this Nasdaq-listed company complies with strict regulations from the SEC, FCA, CIRO, and SFC. It is among the most reliable brokers worldwide for traders.

Instruments Regulator Platforms Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower Min. Deposit Min. Trade Leverage $0 $100 1:50 -

Founded in 1974, IG is a part of IG Group Holdings Plc, a publicly listed brokerage (LSE: IGG). The company provides spread betting, CFD, and forex trading, offering access to over 17,000 markets. Its platforms and investing apps are notably user-friendly. Over the past 50 years, IG has consistently been an industry leader, excelling in all essential areas for traders.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM, JFSA Web, L2 Dealer, MT4, TradingView, AutoChartist, TradingCentral, ProRealTime Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:222 (Pro) -

Founded in 1996, Swissquote is a prominent Swiss bank and broker, providing online trading opportunities for an impressive portfolio of three million products, including forex, CFDs, futures, options, and bonds. Renowned for its reliability, Swissquote has earned a solid reputation through pioneering trading solutions. It was the first bank to introduce cryptocurrency trading in 2017, and has since expanded its offerings to include fractional shares and the Invest Easy service.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA CFXD, MT4, MT5, AutoChartist, TradingCentral Min. Deposit Min. Trade Leverage $1,000 0.01 Lots 1:30 -

Saxo Markets is a renowned trading brokerage, investment firm, and regulated bank. Featuring over 72,000 trading instruments, alongside investment products and managed portfolios, it provides abundant opportunities for clients. This reputable brand ensures transparent pricing and is protected by top-tier regulations from more than ten agencies, including FINMA, FCA, and ASIC.

Instruments Regulator Platforms Forex, CFDs, indices, shares, commodities, cryptocurrencies, futures, options, warrants, bonds, ETFs DFSA, MAS, FCA, SFC, FINMA, AMF, CONSOB TradingView, ProRealTime Min. Deposit Min. Trade Leverage £500 Vary by asset 1:30

Safety Comparison

Compare how safe the Exchange-Linked Warrants are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|---|---|---|---|---|

| Interactive Brokers | ✔ | ✔ | ✘ | ✔ | |

| IG | ✔ | ✔ | ✔ | ✔ | |

| Swissquote | ✔ | ✔ | ✘ | ✔ | |

| Saxo | ✔ | ✘ | ✘ | ✔ |

Payments Comparison

Compare which popular payment methods the Exchange-Linked Warrants support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|---|---|---|---|---|---|

| Interactive Brokers | ✔ | ✔ | ✘ | ✘ | ✘ | ✘ |

| IG | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ |

| Swissquote | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ |

| Saxo | ✔ | ✘ | ✔ | ✘ | ✘ | ✘ |

Mobile Trading Comparison

How good are the Exchange-Linked Warrants at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| Interactive Brokers | iOS & Android | ✔ | ||

| IG | iOS & Android | ✔ | ||

| Swissquote | iOS & Android | ✘ | ||

| Saxo | SaxoTraderGo (iOS, Android, Windows) | ✘ |

Beginners Comparison

Are the Exchange-Linked Warrants good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|---|---|---|---|---|

| Interactive Brokers | ✔ | $0 | $100 | ||

| IG | ✔ | $0 | 0.01 Lots | ||

| Swissquote | ✔ | $1,000 | 0.01 Lots | ||

| Saxo | ✔ | £500 | Vary by asset |

Advanced Trading Comparison

Do the Exchange-Linked Warrants offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Interactive Brokers | Capitalise.ai, TWS API | ✘ | 1:50 | ✘ | ✔ | ✔ | ✔ |

| IG | Expert Advisors (EAs) on MetaTrader, build your own on ProRealTime | ✔ | 1:30 (Retail), 1:222 (Pro) | ✔ | ✔ | ✔ | ✔ |

| Swissquote | Expert Advisors (EAs) on MetaTrader and FIX API solutions | ✘ | 1:30 | ✘ | ✔ | ✔ | ✘ |

| Saxo | - | ✘ | 1:30 | ✘ | ✘ | ✘ | ✔ |

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the Exchange-Linked Warrants.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|---|---|---|---|---|---|---|---|---|

| Interactive Brokers | |||||||||

| IG | |||||||||

| Swissquote | |||||||||

| Saxo |

Our Take On Interactive Brokers

"Interactive Brokers ranks highly for seasoned traders due to its robust charting platforms, live data, and bespoke layouts via the new IBKR Desktop app. Its competitive pricing and sophisticated order choices appeal to traders, and its wide equity options are industry-leading."

Pros

- Interactive Brokers has introduced ForecastTrader, an innovative product offering zero-commission trading with yes/no Forecast Contracts on political, economic, and climate events. It features fixed $1 contract payouts, 24/6 market access, and a 3.83% APY on positions held.

- The new IBKR Desktop platform combines the top features of TWS with customised tools such as Option Lattice and MultiSort Screeners, providing an impressive trading experience for traders of all skill levels.

- IBKR offers an economical environment for traders, featuring low commissions, narrow spreads, and a clear fee structure.

Cons

- IBKR offers a variety of research tools, but their inconsistent placement across trading platforms and the 'Account Management' webpage creates a confusing experience for users.

- You are limited to a single active session per account, meaning you cannot use both your desktop programme and mobile app at the same time. This restriction can occasionally lead to a frustrating experience for traders.

- The learning curve for TWS is quite steep, making it tough for novice traders to navigate and grasp all its features. In contrast, Plus500's web platform is far more accessible for those new to trading.

Our Take On IG

"IG offers a complete package: an easy-to-use web platform, top-tier beginner education, enhanced charting via TradingView, up-to-date data, and strong trade execution for seasoned traders."

Pros

- The web-based platform supports traders at every level, offering advanced charting tools and real-time market data vital for trading. Additionally, IG now includes TradingView integration.

- The ProRealTime advanced charting platform remains free, provided traders meet modest monthly activity requirements.

- IG excels with its diverse instruments, offering stocks, forex, indices, commodities, and cryptocurrencies. Additionally, it provides US-listed futures, options, and an AI Index, ensuring varied diversification opportunities.

Cons

- Beginners may find IG's fees complicated, as they vary depending on the trades or services. This could cause confusion and unexpected costs.

- In the UK and EU, negative balance protection is available. However, US clients lack account protection and guaranteed stop losses.

- IG imposes a monthly inactivity fee of $12 after two years, discouraging occasional traders.

Our Take On Swissquote

"Swissquote is ideal for traders seeking a tailor-made platform, like its CXFD, which incorporates Autochartist for automated chart analysis to support trading decisions. Yet, its moderate fees and high $1,000 minimum deposit could deter novice traders."

Pros

- Swissquote offers robust platforms for traders, including MetaTrader 4/5 and its proprietary CFXD (formerly Advanced Trader). During testing, these platforms stood out with their adaptable layouts, advanced charting tools, and comprehensive technical indicators.

- Swissquote is highly reputable due to its status as a bank, its presence on the Swiss stock exchange, and its authorisations from credible regulators such as FINMA in Switzerland, FCA in the UK, and CSSF in Luxembourg.

- Swissquote offers sophisticated research tools such as Autochartist for technical analysis and real-time news from Dow Jones. The firm's exclusive Market Talk videos and Morning News provide daily expert insights, catering to active traders.

Cons

- Unlike brokers like eToro that offer social trading capabilities, Swissquote does not provide tools for community interaction or replicating successful traders. This absence can reduce its attractiveness to those who prioritise peer-to-peer learning.

- Analysis indicates that Swissquote's charges are relatively high. Forex spreads on Standard accounts begin at 1.3 pips, whereas brokers such as Pepperstone or IC Markets offer starting spreads of 0.0 pips. Additionally, transaction fees for non-Swiss stocks and ETFs could accumulate significantly for active traders.

- Swissquote focuses on serving professional and high-net-worth clients, requiring substantial initial deposits, such as $1,000 for Standard accounts. This approach is less favourable for smaller traders who prefer brokers offering higher leverage and no deposit requirements.

Our Take On Saxo

"Saxo suits active traders and high-volume investors, providing unmatched instrument variety, premium research, and fee rebates. With 190 currency pairs offering tight spreads, it excels for forex traders."

Pros

- Elite research centre offering specialised market analysis and exclusive forecasts, including 'Outrageous Predictions'.

- Outstanding educational materials are available, such as podcasts, webinars, and expert-led videos.

- Advanced proprietary trading platforms featuring extensive charting options and sophisticated analysis tools.

Cons

- Clients from certain regions, such as the US and Belgium, are not accepted.

- Trading accounts require substantial financial investment.

- A subscription is necessary to access Level 2 pricing.

Warrant Basics

A warrant gives the holder the right but not the obligation to purchase or sell the underlying security (usually a stock, index, commodity or currency) at a specified price (strike price) on a specified date (expiry date).

American warrants allow holders to exercise the warrant before the expiry date, whereas European warrants can only be exercised on this date. A call warrant is the right to buy the security and a put warrant is the right to sell it.

Stock exchange-linked warrants are often used as a way for companies to raise capital. Companies issue the warrants and, in return, they receive the cost of the warrant (the premium) from investors. Should the warrant then be exercised, the company receives the value of the share purchase.

Although the traditional way of issuing shares raises capital for companies, warrants can be more attractive to investors – their cost is usually lower than the cost of the underlying share and they are also leveraged, meaning that their value can move faster than the value of the underlying security. Although this could lead to higher losses, it also means traders can profit more from a given amount of capital.

Exchange-Linked Warrants

Exchange-linked warrants are a type of warrant that trade on an exchange and are linked to securities that trade there. ELWs can be found on major global exchanges like the New York Stock Exchange (NYSE) and the London Stock Exchange (LSE). Included under the umbrella of ELWs are equity warrants, index warrants, commodity warrants and FX-linked warrants.

Traders should also be aware of the difference between cash-settled and stock-settled warrants. With cash-settled warrants, the profit is received directly on the expiry of the contract. Share-settled warrants result in the exchange of shares when the contract expires. This is often on a 1:1 ratio (one warrant to one share) but different ratios may be stated.

Cash-settled warrants are often a suitable option for traders wanting to simply speculate and profit on price movement rather than take ownership of shares.

Warrants Vs Options

Although there are similarities between the two products, there are also some fundamental differences. Stock warrants are usually issued by the business. If the warrant is exercised, then the shares are also issued by that company – it is essentially an agreement between the trader and the business.

Options, on the other hand, are an agreement between two traders where the shares are exchanged between the traders and the company usually has no involvement.

Another difference is that options are usually active for a shorter period. Whereas options may have a few months until expiry, exchange-linked warrants can have several years – sometimes even as long as 15 years.

History

Warrants originated in the 1920s with stock warrants being issued by large companies such as Ford Motors and General Motors. They have since expanded to markets across the world as more companies attempt to access global liquidity.

Today, warrants are relatively popular in countries like the UK, Canada, and Germany.

How Exchange-Linked Warrants Work

The strike price of an exchange-linked warrant is important – it determines whether the holder makes a profit or not. The strike price is usually above the underlying asset’s current value when the exchange-linked call warrant is issued. If the market price of the underlying asset is above the strike price at the point when a call warrant is exercised and the gap exceeds the premium then the investor will make a profit.

If the market price drops below the strike price when the warrant expires, then the trader would not exercise the warrant and, instead, simply lose the premium they paid. Essentially, if traders think the price of the underlying asset will rise in value, they should purchase a call warrant – if they think it will fall, they should purchase a put warrant.

It is important to note that when a trader buys a warrant, the most they can lose is the premium. The fact that there is certainty over potential losses is one of the main benefits of purchasing exchange-linked warrants.

Remember that warrants can drop sharply in value and become almost worthless, depending on the value of the underlying asset relative to the strike price and time to expiry. The more likely it is that the strike price will be met within the set period, the higher the value of the warrant.

Exchange-linked warrants can be bought and sold on the secondary market before they expire.

Example

Suppose Company X offers warrants for £3 each. The current share price of Company X is £10 and the strike price of the warrants is £15. A trader has seen that the long-term growth prospects of Company X look positive and thinks that its share price will rise. They purchase 100 call warrants at a total cost of £300. The ratio of warrants to shares is 1:1.

Scenario 1

The share price does increase as the trader expected to £25. The trader can purchase shares worth £2,500 for only £1,500. The difference is, therefore, £1,000.

After the premium and any other brokerage costs, the profit will be around £700.

Scenario 2

Unfortunately for the trader, the share price of Company X stays at £10. As this is below the strike price of £15, the trader does not profit and instead loses the £300 that they paid for the exchange-linked warrants.

Characteristics

As mentioned previously, exchange-linked warrants can have different underlying assets.

Equity Warrants

Equity warrants are also known as stock-linked warrants. They are pegged to the price of a particular stock and companies use them as a way to make it more desirable for investors to purchase their shares.

These types of warrants may also be listed as part of a corporate bond sale. In these cases, a premium is not always paid for the warrant, instead, the investor has to accept a lower interest rate on the bond.

Index Warrants

Index-linked warrants track the price of a particular index, such as the FTSE 100 or S&P 500. They are generally cash-settled (as it is not possible to buy actual shares in an index).

In addition to them being used to speculate on the future value of the index, index-linked warrants may be used to hedge against an existing position. For example, an investor may also have an ETF that tracks the S&P 500. If the future of this index is uncertain, for example due to global economic headwinds, the trader may wish to purchase exchange-linked put warrants that track the same index, helping to reduce losses if its value decreases.

Currency Warrants

Currency-linked warrants give the holder the right to enter a position at a predetermined exchange rate (the strike price) at a specified point. The mechanism operates similarly to stock warrants but with the underlying asset being forex rather than a stock.

Although similar to currency options, currency warrants are usually longer-term contracts. Some companies may purchase currency warrants to hedge against forex fluctuations if their business is exposed to international currency markets.

Commodity Warrants

Warrants that are linked to commodities will fix a quantity of a particular commodity at a certain price on a predetermined date. For example, the warrant may specify a price of $76 per barrel of oil and set the expiry date in 18 months’ time.

This enables investors to hedge or speculate on the market’s volatility.

Benefits Of Exchange-Linked Warrants

- Losses are limited to the premium

- Wide range of underlying markets to choose from

- More long-term than options so less need for renewals

- The premium is usually lower than the cost of buying a share

- Leverage can create large profits if the price moves in the right direction

Risks Of Exchange-Linked Warrants

- Less widely available than options and CFDs

- No ownership rights or dividends before the warrant has been exercised

- The risk may be higher as exchange-linked warrants can rapidly decrease in value

- Some companies may use warrants as a way to offer lower interest rates on bonds

How To Trade Exchange-Linked Warrants

Find A Broker

We recommend traders consider the following factors when choosing an exchange-linked warrants broker:

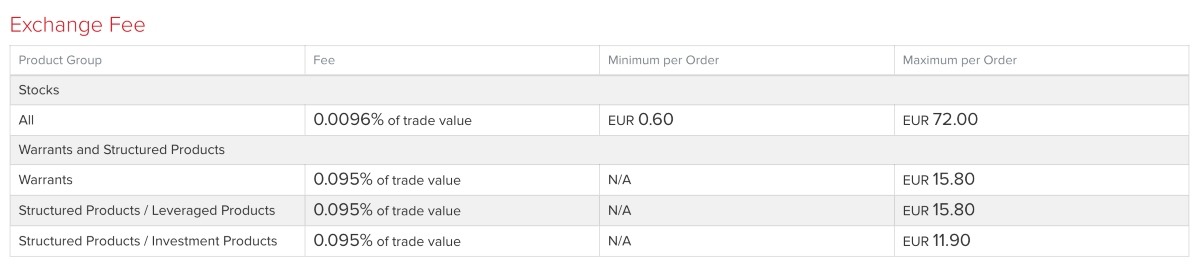

- Fees – It is not just the cost of the warrant that traders need to account for but also the cost of brokerage fees. This includes commissions, clearing fees, regulatory fees and any deposit and withdrawal fees. Interactive Brokers (FWB Cost Plus) has exchange fees for warrants of 0.095% (EUR 15.80 maximum), as well as clearing and regulatory fees per trade.

- Trading Platform – Brokers may use external platforms or a proprietary trading package. Saxo Bank has an in-house platform with over 50 technical indicators, as well as a demo account that gives traders EUR 100,000 of virtual money. What traders need from the software will depend on their chosen strategy. However, the platform should allow comprehensive analysis of the asset that the warrant tracks.

- Markets – Exchange-linked warrants track particular markets. It is important to ensure that the broker offers a market you have a good understanding of, whether the asset in question is a stock, index, commodity or currency. Saxo Bank has an extensive collection of warrants – more than 3000.

- Regulation – This is important as the regulator that the broker holds a license with (if any) helps determine the level of scrutiny over the firm’s operations and can also determine the amount of financial support available to the trader should the broker become insolvent. Regulators like the FCA in the UK are the best option for British traders.

- Customer Support – The trading hours of exchange-linked warrants can vary depending on the exchange they trade on. We recommend choosing a broker with 24/5 support. The best exchange-linked warrants brokers will offer live chat, email and phone contact options.

Interactive Brokers – Warrants Fees

Identify A Market

The value of exchange-linked warrants is heavily dependent on the price of the underlying security. This is why traders need to have a strong grasp of the underlying market. For example, the FTSE 100 can be impacted by decisions made by the Bank of England, the fiscal policy of the UK Government, inflation data and much more.

Having a good understanding of the market will enable traders to make informed decisions – this is important in the exchange-linked warrants market, where significant risk is often attached.

Some brokers may specialise in particular types of warrants like stock warrants and not offer other products.

Buy A Warrant

Traders can purchase newly-issued warrants or buy them on the secondary market from other traders. The important thing is to do your research before buying the exchange-linked warrant and also to carefully review the nature of the product – this includes looking at its strike price and expiry date.

These checks will help you to determine whether the premium represents value for money.

Monitor The Position

The markets can change fast. Traders must keep on top of developments that may affect the price of the underlying asset and, therefore, the warrant. If investing in stock warrants, keep an eye on earnings reports. If your outlook on the underlying asset has changed, consider whether to hold on or sell it.

Exercise The Warrant (Or Sell It)

Traders may be able to sell exchange-linked warrants to other traders on the secondary market – or they may wish to wait until the warrant expires.

Remember, if it is an American warrant, you do not have to wait until the expiry date – it can be exercised before this point.

Bottom Line On Exchange-Linked Warrants

Exchange-linked warrants offer a way for traders to purchase a particular asset at an attractive price if they think its value will move in the right direction. However, they carry a level of risk that traders must be aware of – if the asset fails to reach the strike price, then the value of the warrant may significantly decline as the expiry date approaches. Exchange-linked warrants can be bought as call or put contracts and are linked to a wide range of assets, including stocks, indices and commodities.

FAQs

Should I Buy Call Or Put Exchange-Linked Warrants?

This depends on which way you think the underlying market will move. Those that think the underlying market will increase in value should purchase a call warrant, whereas those that think it will move in the opposite direction should choose a put warrant.

Why Do Companies Offer Exchange-Linked Warrants?

Companies offer exchange-linked warrants to make it more attractive for investors to inject capital into the company. Buying warrants is often cheaper than buying shares and warrants are sometimes given to investors for free as part of a corporate bond deal with a lower interest rate.

What Influences The Price Of Exchange-Linked Warrants?

Several factors influence the price of exchange-linked warrants. These include changes in the value of the underlying market, time until expiry and the current difference in value between the underlying market and the strike price.

Can I Exercise Exchange-Linked Warrants Before Their Expiry Date?

Only American warrants can be exercised before their expiry dates. European warrants must be exercised on the expiry date and not any earlier.

What Is The Most I Can Lose When Investing In Exchange-Linked Warrants?

The most that can be lost when trading exchange-linked warrants is the cost of buying the warrant, called the premium. This means potential losses are known in advance, which can provide more certainty than trading other derivatives.