Draghi Finally Says The Words EUR/USD Traders Have Been Waiting For

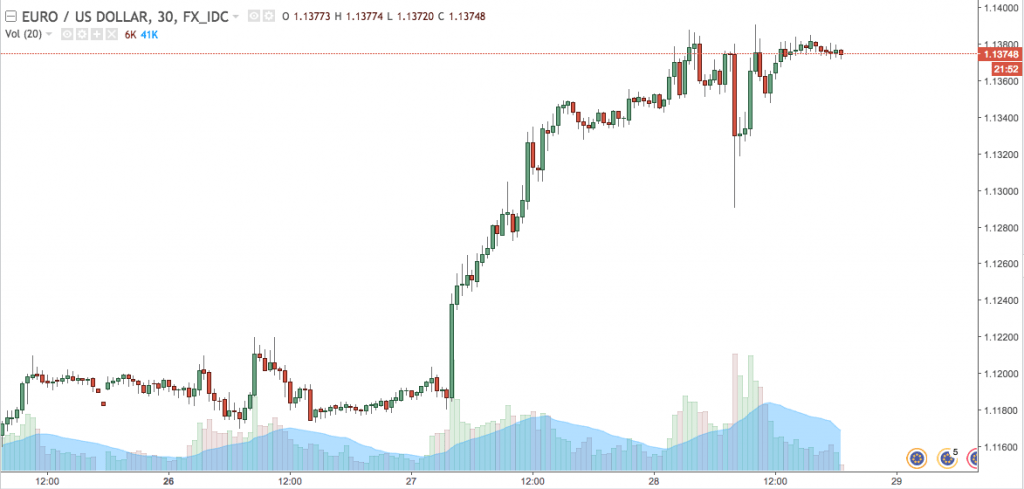

On Tuesday, ECB President Mario Draghi remarked that the ECB was ready to begin looking at phasing out its stimulus measures. The Euro responded accordingly, rallying around 200 pips as traders took this as the long confirmation they have been patiently waiting for.

It hasn’t been all smooth sailing though. On Wednesday morning the ECB attempted to recalibrate the message and suggested that traders over-interpreted Draghi’s comments. As you can see on the chart above, the EUR/USD fell sharply on the comments, however it appears that the cat is out of the bag…the Euro quickly rebounded. There’s nothing stronger than Central Bank policy, and that’s been the last piece of the puzzle for traders to capitulate on short Euro.

If you’ve been following this blog, you’d have seen that the comments from Draghi were stipulated as the “liftoff” point that the Euro has been waiting for. Patient traders have been rewarded. Data continues to impress in the Eurozone, equities remain firm, and the political risks have eased for the time being. The Euro, it seems, is poised for a rally. Couple this with the somewhat disappointing data coming out of the US recently, and you have the perfect recipe for a EUR/USD rally.

How much further can the Euro go?

You need to zoom out on your chart to find the EUR/USD up at these levels. There’s significant resistance at 1.14, with the 1.16 (3 May 2016) and 1.17 (24 August 2015) levels the real hurdles for a major move higher. There’s plenty of upside room for traders to capitalise on Euro strength, should they believe that the current trend will continue into the medium term.

This change in policy has been a long time coming, and should take the break off a repressed Euro. Keep an eye on both US data (look for weakness) and Eurozone data (look for strength), if the trend continues then the ECB will have little recourse than to follow through with tapering stimulus.