Day Trading Demo

Day trading demo accounts act as a practice simulator for live trading. Full demo accounts are available without a deposit, meaning day traders can explore platform features and test intraday strategies without handing over any money. The top demo day trading software also comes with extra perks, from free trading competitions to app compatibility and no time limit.

This review ranks the best demo accounts for online day trading in 2026. Our expert team also explain how demo brokerage accounts work, including any limitations and tips on getting the most out of day trading simulator software.

Best Day Trading Demo Accounts UK

-

In our assessments, XTB’s demo accurately replicated its live xStation 5 platform, featuring over 5,000 assets like forex, indices, commodities, stocks, and crypto. Execution was rapid through CEC liquidity, with EUR/USD spreads starting at approximately 0.6 pips and minimal slippage. Setup required only an email, provided a $100,000 virtual balance, and the demo had no expiration.

Instruments Regulator Platforms CFDs on shares, Indices, ETFs, Raw Materials, Forex currencies, cryptocurrencies, Real shares, Real ETFs FCA, CySEC, KNF, DFSA, FSC xStation Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 -

In FXCC's demo mode, trading mirrored live ECN conditions with rapid order execution, minimal slippage, and accurate MT4 data. Standard spreads began at 1.2 pips for EUR/USD, with no hidden fees. Setup needed just an email and came with $50,000 virtual funds, and the demo was unlimited—perfect for thorough strategy testing.

Instruments Regulator Platforms CFDs, Forex, Indices, Commodities, Crypto CySEC MT4, MT5 Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:500 -

In our tests, Vantage's demo provided real-market ECN conditions through MT4/MT5/cTrader. EUR/USD spreads were between 0.0 and 0.2 pips, with a $3 round-trip commission. Execution was fast with minimal slippage. Setup required just an email, offered up to $500K in virtual funds, and never expired—ideal for realistic strategy development.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Spread betting FCA, ASIC, FSCA, VFSC ProTrader, MT4, MT5, TradingView, DupliTrade Min. Deposit Min. Trade Leverage $50 0.01 Lots 1:30 -

In our thorough analysis, IC Markets' demo replicated live Raw and Standard account conditions with extremely narrow spreads—EUR/USD from 0.0–0.1 pips and a $3.50 fee per lot on Razor. Execution was exceptionally swift with minimal slippage. Through MT4/MT5/cTrader, more than 1,300 instruments were accessible. Setup needed just an email; $50K virtual balance, no expiration.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto ASIC, CySEC, CMA, FSA MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade, Quantower Min. Deposit Min. Trade Leverage $200 0.01 Lots 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) -

In our recent tests, Pepperstone’s demo reflected live spreads—EUR/USD averaged 0.1–0.3 pips with Razor accounts. Execution proved swift, with little slippage and over 1,000 assets available. The interface precisely mimicked the real trading environment. No personal information was needed, offering a 30-day trial with up to $50,000 virtual funds.

Instruments Regulator Platforms CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade, Quantower Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:500 (Pro) -

Using Interactive Brokers' demo mirrored the live TWS platform, featuring global market access and advanced order types. Execution speed felt genuine, although fast-moving assets experienced slight slippage. Basic details were needed for setup. With a virtual balance of $1M, paper trading started post-account approval.

Instruments Regulator Platforms Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower Min. Deposit Min. Trade Leverage $0 $100 1:50 -

In testing, IC Markets' demo replicated live ECN conditions, featuring rapid execution (0.02 ms) and narrow spreads - EUR/USD from 0.0–0.1 pips with a $3.50 commission per lot. Over 1,000 instruments were available through MT4/MT5/cTrader. Registration required just an email, offering a $50K virtual balance with no expiry. Perfect for new traders, scalpers, and algorithmic strategists.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, Bonds, Cryptos, Futures FSC MT4, MT5, cTrader, AutoChartist, TradingCentral Min. Deposit Min. Trade Leverage $200 0.01 Lots 1:500

Safety Comparison

Compare how safe the Day Trading Demo are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|---|---|---|---|---|

| XTB | ✔ | ✔ | ✔ | ✔ | |

| FXCC | ✘ | ✔ | ✘ | ✔ | |

| Vantage FX | ✔ | ✔ | ✘ | ✔ | |

| IC Markets | ✘ | ✔ | ✘ | ✔ | |

| Pepperstone | ✔ | ✔ | ✘ | ✔ | |

| Interactive Brokers | ✔ | ✔ | ✘ | ✔ | |

| IC Trading | ✘ | ✘ | ✘ | ✔ |

Payments Comparison

Compare which popular payment methods the Day Trading Demo support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|---|---|---|---|---|---|

| XTB | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| FXCC | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| Vantage FX | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| IC Markets | ✔ | ✘ | ✔ | ✔ | ✔ | ✘ |

| Pepperstone | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| Interactive Brokers | ✔ | ✔ | ✘ | ✘ | ✘ | ✘ |

| IC Trading | ✔ | ✔ | ✔ | ✔ | ✘ | ✘ |

Mobile Trading Comparison

How good are the Day Trading Demo at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| XTB | iOS & Android | ✔ | ||

| FXCC | iOS & Android | ✘ | ||

| Vantage FX | iOS & Android | ✘ | ||

| IC Markets | iOS & Android | ✘ | ||

| Pepperstone | iOS & Android | ✘ | ||

| Interactive Brokers | iOS & Android | ✔ | ||

| IC Trading | iOS & Android | ✘ |

Beginners Comparison

Are the Day Trading Demo good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|---|---|---|---|---|

| XTB | ✔ | $0 | 0.01 Lots | ||

| FXCC | ✔ | $0 | 0.01 Lots | ||

| Vantage FX | ✔ | $50 | 0.01 Lots | ||

| IC Markets | ✔ | $200 | 0.01 Lots | ||

| Pepperstone | ✔ | $0 | 0.01 Lots | ||

| Interactive Brokers | ✔ | $0 | $100 | ||

| IC Trading | ✔ | $200 | 0.01 Lots |

Advanced Trading Comparison

Do the Day Trading Demo offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| XTB | - | ✔ | 1:30 | ✘ | ✘ | ✔ | ✘ |

| FXCC | Expert Advisors (EAs) on MetaTrader | ✘ | 1:500 | ✔ | ✘ | ✔ | ✘ |

| Vantage FX | Myfxbook AutoTrade, Expert Advisors (EAs) on MetaTrader | ✘ | 1:30 | ✔ | ✘ | ✘ | ✘ |

| IC Markets | Expert Advisors (EAs) on MetaTrader, cBots on cTrader, Myfxbook AutoTrade | ✘ | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) | ✔ | ✘ | ✔ | ✘ |

| Pepperstone | Expert Advisors (EAs) on MetaTrader | ✔ | 1:30 (Retail), 1:500 (Pro) | ✔ | ✘ | ✔ | ✘ |

| Interactive Brokers | Capitalise.ai, TWS API | ✘ | 1:50 | ✘ | ✔ | ✔ | ✔ |

| IC Trading | Expert Advisors (EAs) on MetaTrader, cBots on cTrader | ✘ | 1:500 | ✔ | ✘ | ✔ | ✘ |

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the Day Trading Demo.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|---|---|---|---|---|---|---|---|---|

| XTB | |||||||||

| FXCC | |||||||||

| Vantage FX | |||||||||

| IC Markets | |||||||||

| Pepperstone | |||||||||

| Interactive Brokers | |||||||||

| IC Trading |

Our Take On XTB

"XTB excels for novice traders with its superb xStation platform, minimal trading costs, no required deposit, and outstanding educational resources, many of which are fully integrated into the platform."

Pros

- XTB processes withdrawals swiftly, paying within 3 business days, subject to the method and amount.

- Setting up an XTB account is straightforward and fully online, requiring only a few minutes. This simplicity eases new traders into the world of trading.

- XTB offers a diverse array of instruments, including CFDs on shares, indices, ETFs, commodities, forex, crypto, real shares, real ETFs, and share dealing, along with newly introduced Investment Plans. This allows XTB to serve both short-term traders and long-term investors efficiently.

Cons

- It is frustrating that XTB products do not allow traders to modify the default leverage level. Manually adjusting leverage can greatly reduce risk in forex and CFD trading.

- Trading fees are competitive, with average EUR/USD spreads of about 1 pip. However, they are not as low as the most affordable brokers, such as IC Markets. Additionally, an inactivity fee applies after a year.

- The research tools at XTB are commendable but have the potential to excel further. Enhancing them with access to top-tier third-party services like Autochartist, Trading Central, and TipRanks would significantly elevate their offering.

Our Take On FXCC

"FXCC remains a top choice for forex traders, offering over 70 currency pairs, very tight spreads from 0.0 pips in tests, and high leverage up to 1:500 with the ECN XL account."

Pros

- FXCC is a trusted and licensed broker under the regulation of CySEC, a leading European authority ensuring excellent safeguarding standards.

- The complimentary education section, featuring the 'Traders Corner' blog, provides a wide array of resources suitable for traders of all experience levels.

- FXCC offers competitive and transparent ECN spreads starting from 0.0 pips, with no commissions. This makes it one of the most cost-effective forex brokers available.

Cons

- The variety of currency pairs surpasses most options, but the choice of other assets is limited. Notably, stocks are absent.

- The range of research tools, such as Trading Central and Autochartist, is quite limited. Leading platforms in this category, like IG, offer more advanced features.

- While the MetaTrader suite excels in technical analysis, its outdated design detracts from the overall trading experience, particularly when contrasted with contemporary platforms such as TradingView.

Our Take On Vantage FX

"Vantage is an ideal choice for CFD traders looking for a well-regulated broker with access to the dependable MetaTrader platforms. With a swift sign-up process and a minimum deposit of $50, starting trading is simple and fast."

Pros

- Vantage addresses the needs of passive investors through user-friendly social trading on ZuluTrade and Myfxbook.

- ECN accounts offer competitive terms, featuring spreads starting at 0.0 pips and a commission of $1.50 per trade side.

- Vantage upholds a high trust score through its solid reputation, backed by premier regulation from the FCA and ASIC.

Cons

- Regrettably, cryptocurrencies are accessible solely to clients in Australia.

- Based on tests, average execution speeds of 100ms to 250ms are slower compared to other options.

- To access optimal trading conditions, a substantial deposit of $10,000 is required. This includes a commission of $1.50 per transaction per side.

Our Take On IC Markets

"IC Markets provides excellent pricing, swift execution, and easy deposits. With cutting-edge charting tools like TradingView and the Raw Trader Plus account, it continues to be a preferred option for intermediate and advanced traders."

Pros

- Access over 2,250 CFDs across diverse markets like forex, commodities, indices, shares, bonds, and cryptocurrencies. This variety enables traders to employ diversified strategies.

- In 2025, IC Markets earned DayTrading.com's accolade for 'Best MT4/MT5 Broker' due to its top-tier MetaTrader integration. This achievement highlights the broker's continuous refinement over the years to enhance the platform experience.

- As a well-regulated and reputable broker, IC Markets focuses on client safety and transparency to provide a dependable global trading experience.

Cons

- The tutorials, webinars, and educational resources require enhancement, lagging behind competitors such as CMC Markets, which diminishes their appeal to novice traders.

- IC Markets provides metals and cryptocurrencies for trading through CFDs, though the selection is narrower compared to brokers such as eToro. This limits opportunities for traders focused on these asset classes.

- Certain withdrawal methods incur fees, including a $20 charge for wire transfers. These costs can reduce profits, particularly with frequent withdrawals.

Our Take On Pepperstone

"Pepperstone is a premier trading platform, providing tight spreads, swift execution, and sophisticated charting tools for seasoned traders. Beginners benefit from no minimum deposit, comprehensive learning materials, and outstanding 24/7 support."

Pros

- Pepperstone offers rapid execution speeds of approximately 30ms, enabling swift order processing and execution, making it ideal for traders.

- Over the years, Pepperstone has consistently garnered recognition from DayTrading.com’s annual awards. Recently, it was honoured as the 'Best Overall Broker' in 2025 and was the 'Best Forex Broker' runner-up the same year.

- Pepperstone presents itself as an economical choice for traders, offering spreads as low as 0.0 in its Razor account. The Active Trader programme provides rebates up to 30% on indices and commodities, plus $3 per lot on forex.

Cons

- Pepperstone's demo accounts expire after 30 days, which may not provide sufficient time to explore various platforms and evaluate trading strategies.

- Although its market range has improved, its crypto offerings remain limited compared to brokers specialising in this sector, lacking real coin investment options.

- Pepperstone doesn't offer cTrader Copy, a favoured feature for copying trades found in the cTrader platform, which is available on other platforms such as IC Markets. However, Pepperstone has launched its own user-friendly copy trading app.

Our Take On Interactive Brokers

"Interactive Brokers ranks highly for seasoned traders due to its robust charting platforms, live data, and bespoke layouts via the new IBKR Desktop app. Its competitive pricing and sophisticated order choices appeal to traders, and its wide equity options are industry-leading."

Pros

- The TWS platform is tailored for intermediate and advanced traders, featuring over 100 order types and a dependable real-time market data feed with exceptional uptime.

- IBKR offers an economical environment for traders, featuring low commissions, narrow spreads, and a clear fee structure.

- While initially targeting seasoned traders, IBKR has recently widened its appeal by eliminating its $10,000 minimum deposit requirement.

Cons

- The learning curve for TWS is quite steep, making it tough for novice traders to navigate and grasp all its features. In contrast, Plus500's web platform is far more accessible for those new to trading.

- Support can be sluggish and frustrating. Tests reveal that you may face challenges reaching customer service quickly, which could result in delays in issue resolution.

- You are limited to a single active session per account, meaning you cannot use both your desktop programme and mobile app at the same time. This restriction can occasionally lead to a frustrating experience for traders.

Our Take On IC Trading

"IC Trading offers an ideal environment, featuring top-tier execution speeds of around 40 milliseconds, extensive liquidity, and advanced charting tools, perfect for scalpers, traders, and algorithmic traders."

Pros

- IC Trading offers top-tier spreads, with some major currency pairs like EUR/USD featuring spreads as low as 0.0 pips, making it an excellent choice for traders.

- The streamlined digital account setup allows traders to commence trading swiftly, eliminating lengthy paperwork. Testing shows the process takes mere minutes.

- IC Trading provides exceptional flexibility, allowing traders to open as many as 10 live accounts and 20 demo accounts. This enables the management of distinct profiles for various activities, including manual and algorithmic trading.

Cons

- The educational materials require significant enhancement unless accessed via the IC Markets website. This limitation is particularly disadvantageous for beginners seeking a thorough learning experience, especially when compared to industry leaders such as eToro.

- Although IC Trading operates under the reputable IC Markets group, it is licensed by the FSC in Mauritius, a regulator known for its limited financial transparency and lack of robust safeguards.

- Customer support was inadequate during testing, with multiple live chat attempts going unanswered and emails ignored. This raises significant concerns regarding their capacity to manage urgent trading issues.

What Is A Day Trading Demo Account?

Day trading demo accounts are offered by online brokers and allow users to practise investing risk-free with virtual funds. They simulate live market conditions, normally giving traders access to a brokerage’s full suite of assets, such as stocks, forex, commodities, and cryptos.

Traders can download the broker’s desktop investing software or iOS and Android mobile app, login and start exploring the various day trading tools available. Demo accounts for online day trading are also useful for testing different strategies and trade setups.

Leading demo day trading software, such as XTB, come with a virtual bankroll of around £100,000. After this has expired, traders can usually request more funds.

The best demo accounts for online day trading are available for an unlimited time. With that said, some brokerages only provide access to paper trading profiles for a fixed period, usually around 30 days.

Importantly, profits and losses made in a day trading demo account are not real. However, users can upgrade to a live day trading account when they feel ready and start investing real money.

Demo Trading Vs Live Trading

Day trading demo accounts often provide access to the same platforms, trading apps and financial instruments. For this reason, they closely mirror the live day trading experience.

With that said, there are a couple of key differences:

- Slippage – Trading spreads, commissions and swaps are usually the same on both demo day trading accounts and live investing software. However, live trades are executed in the market via liquidity providers while demo day trades are not – they take place on the server side. As a result, simulator accounts do not experience the slippage that can take place on live profiles (the difference between the price you request and the actual price the trade is executed at).

- Psychology – Demo day trading accounts do not factor in the trading psychology that comes with investing actual money. You won’t feel the same level of risk and pressure when trading with fake money. As a result, profits generated in demo day trading accounts often do not translate when investors upgrade to real-money profiles.

Pros Of Day Trading Practise Simulators

- Trial a new day trading broker, platform or app

- Practise online day trading in a risk-free environment

- Develop intraday trading strategies without risking funds

- Some brokerages run demo trading competitions with cash prizes

- Explore new financial markets and portfolio diversification opportunities

Cons Of Day Trading Practise Simulators

- Any profits generated cannot be withdrawn

- Day trading demo accounts do not account for slippage

- Brokers sometimes limit demo account access to a finite period and bankroll

- Software for online day trading cannot emulate the pressure of investing with real money

- Some demo accounts offer more competitive spreads and fees than those available in live accounts

How To Compare Day Trading Demo Accounts

Time Limit

Some brokers, such as eToro, offer an unlimited day trading demo account where you can invest in forex, stocks, commodities and other markets with no need to reset the account.

However, other brokers impose an expiry time on the demo account, typically around four weeks. For example, the IG UK demo accounts expire after 30 days. Alternatively, if you sign up with CityIndex, your day trading demo account will expire after 120 days.

Tip: you can often extend the time limit or reset the demo profile by contacting the broker.

Platform & App

Day trading demo accounts are ideal for practising with a new platform you have not used before. This is relevant whether you are using proprietary platforms such as with CMC Markets or popular third-party platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

Day traders can test technical indicators, drawing tools, instant and pending order types, plus risk management parameters. Users can also customise graphs, charts and widgets so they are familiar with the interface and navigation when they start day trading with real money.

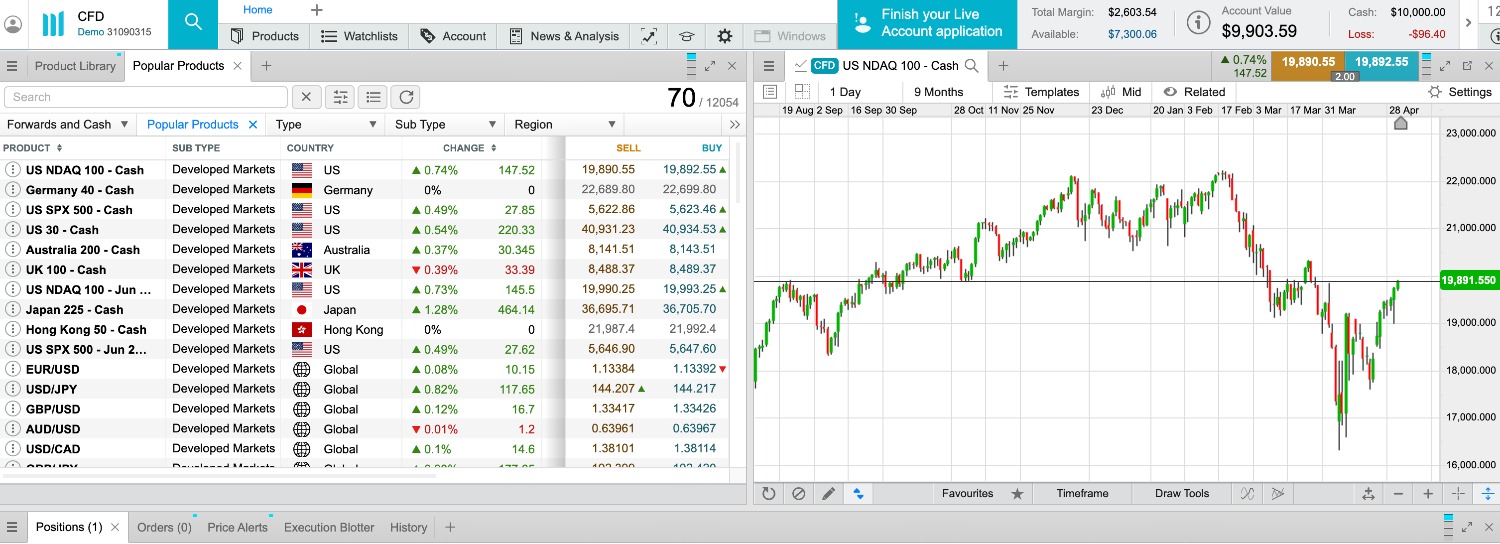

CMC Markets Demo Platform

Virtual Funds

Typically, you can expect paper trading accounts with several thousands of simulated currency. For example, CMC Markets demo accounts have £10,000, Pepperstone accounts have £50,000, and eToro accounts have £80,000.

Often, brokers will permit clients to either reset their funds or create another demo day trading account when funding drops below a certain threshold. For instance, Plus500 automatically resets demo accounts once the virtual funds drop to less than £200. For this reason, the amount of virtual funds provided is not the most important factor when evaluating day trading demo accounts.

Assets & Instruments

If you already have an idea of what you want to day trade and how, for example, forex CFDs, then check the broker offers these instruments before signing up for a demo day trading profile. CFDs, spread betting and binary options are all popular among day traders in the UK.

If you do not yet know what you want to trade, opt for a well-rounded brokerage that offers demo day trading on a range of markets, from stocks and shares to metals, energies, and forex. XTB is a good pick here with more than 2000 assets available.

Restrictions

It is worth checking that the day trading strategies you want to use are permitted. For example, some firms do not allow scalping and arbitrage.

Equally, if you are planning to day trade with leverage, check the rules and availability around trading on margin. For example, most FCA-regulated brokers can only offer leverage up to 1:30 to retail traders in the UK.

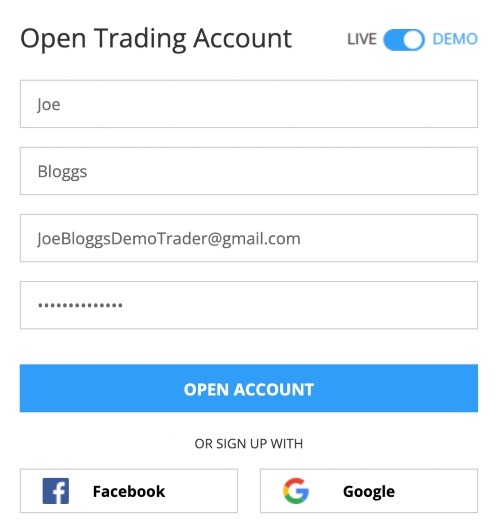

Sign Up Requirements

To register for a day trading demo account, brokers require clients to complete a few steps. Usually, this involves providing a name, email address and password, however, some online brokers ask for more detailed information which can delay the sign-up process. For instance, Pepperstone requires clients to sign up for a live account before they can access the demo day trading mode.

Note, the brokers with the best demo day trading accounts do not ask for payment details until you register for a live account.

How To Sign Up For A Demo Account

FXCC Demo Registration

The best brokers with day trading demo accounts make it easy to register for a practice profile:

- Go to the broker’s website or investing app

- Click on the ‘Sign Up’ or similar button

- Enter your name, email, contact number, password and any other information requested

- Choose the platform you want to use, for example, MT4 or MT5

- Select the type of day trading demo account (if applicable), for example, CFD, forex, stock

- Complete any verification steps, such as email confirmation or one-time mobile passcode

- Download the desktop software or mobile app. Alternatively, open the web terminal

- Sign in with your demo credentials and start day trading

Note, the top demo day trading accounts allow you to get set up and started in less than five minutes.

How To Upgrade To A Live Account

To switch to a real-money day trading account, you may need to provide additional information such as documents showing proof of identification and address. You will also need to make a deposit, taking note of any minimum transfer requirements.

The process of switching to a live day trading account may also vary between brokers. At eToro, for example, you only need to click the ‘Switch to Real’ button on the homepage, deposit funds and start trading. At CMC Markets, you need to submit an online form to customer support to request a live account. At Pepperstone, day traders must complete an appropriateness test to determine if they can trade derivatives.

Bottom Line On Day Trading Demo Software

Day trading with a demo account is one of the best ways to build up experience while testing a prospective broker’s instruments, platforms and tools. The top-rated day trading simulator profiles offer mobile app compatibility, trading contests and no time limit.

To get started, use our ranking of the best demo day trading accounts in the UK.

FAQ

Where Can I Practice Day Trading?

You can practise day trading using an online demo account, also known as simulator software. Often free, a demo account comes with virtual funds so you can test out day trading strategies without making a deposit. Importantly, profits generated in the demo account cannot be withdrawn. There may also be a time limit and cap on the virtual bankroll, often around 30 days and £10,000, respectively.

Should I Open A Day Trading Demo Account?

Day trading simulators can be an effective way to trial a potential broker before investing real funds. Paper trading profiles can also be used to test the features of a new platform or app, such as technical indicators, risk management tools, and order types. For day traders new to a volatile market, such as crypto, demo accounts for day trading can also be a helpful way to try a new strategy before risking real money.

Which Is The Best Demo Day Trading Account?

The best demo day trading account will depend on your requirements. With that said, look for simulator accounts with a long expiry (30 days+), a large bankroll (£10,000+), and full access to the broker’s suite of instruments and trading tools, such as MT4 and MT5. Alternatively, choose from our list of the top day trading accounts for UK investors.

Do Day Trading Demo Accounts Expire?

Some brokers, such as FXPrimus, impose an expiration or time limit on demo day trading accounts, often around the one-month mark. Other platforms, including Forex.com and City Index, offer a longer demo period of three months and four months, respectively.

Note, the best demo brokerage accounts can also be reset when the expiry period is over.

What Can I Trade Using A Day Trading Demo Account?

A range of markets is usually available on day trading demo accounts, including forex, commodities such as gold, stocks, indices and ETFs. The selection of trading vehicles will also depend on the brokerage but often includes CFDs. Some UK firms also offer demo spread betting and binary options trading.

How Do I Open A Day Trading Demo Account?

To open a day trading demo account you will need to go to your chosen broker’s website and navigate to the demo account sign-up page. You will typically need to input some basic contact information, including your name, email address and chosen password. Then, download the desktop software or mobile app from the broker – you should see download links on the brand’s website for the Android and iOS applications.

Note, if you already have a live day trading account, no additional registration is required. Instead, just log into your account and request a paper trading profile.