CMC Markets Review 2026

CMC Markets is an online brokerage, offering spread betting and CFD trading across major global markets. Traders can access thousands of assets including forex, commodities, indices and stocks. Our review of CMC Markets covers the online trading platforms, UK regulation, deposit options, fees and more.

About CMC Markets

CMC Markets was established in 1989, offering global trading services from central headquarters in London. The company is a well-regarded UK broker, listed on the London Stock Exchange and authorised by the Financial Conduct Authority (FCA). Today, there are over 90,000 active traders. CMC boasts trading awards for platform engineering and software features, supported by many positive user reviews.

Trading Platforms

The CMC Markets group offers two online trading platforms; suitable for both new and experienced traders. You can find terminal tutorials and access guidance on the broker’s website.

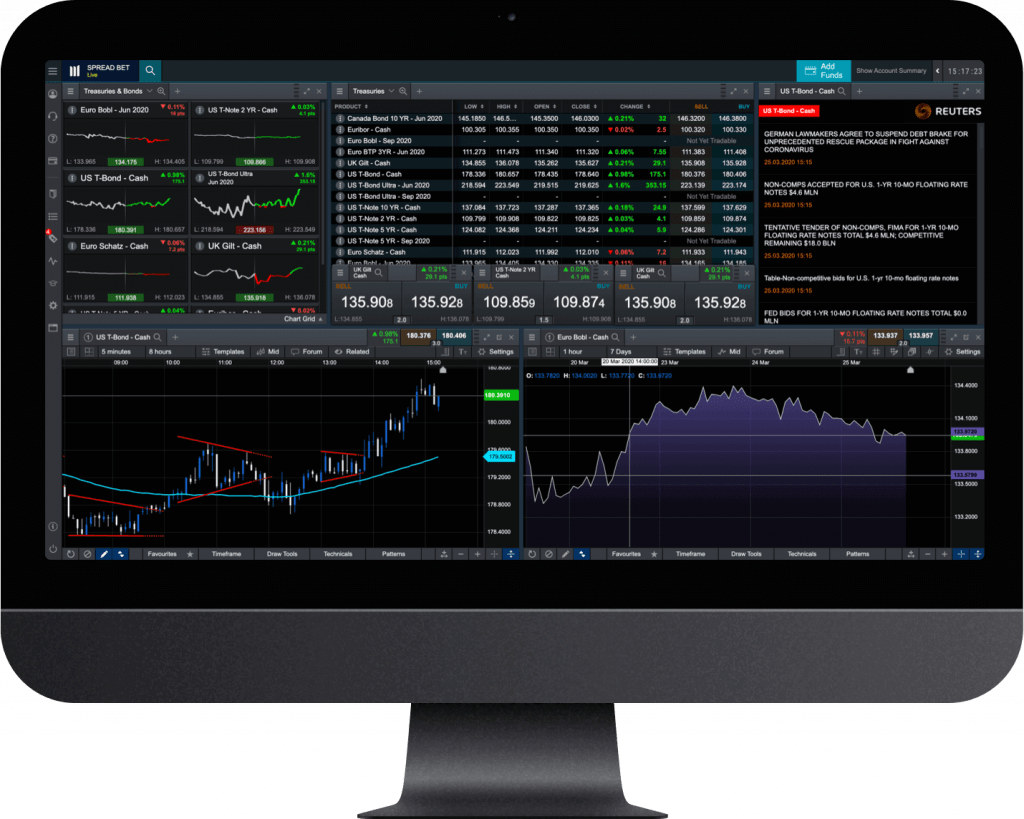

Next Generation

The Next Generation platform is a user-friendly browser-based solution for trading CFDs and spread betting:

- 20-year price history

- Price projection tool

- Client sentiment tool

- 115+ technical indicators

- Trade directly from charts

- 70+ chart patterns & 35+ drawing tools

- Fully customisable to suit all trading styles

- Copy-trading from analysts or other traders

- Chart intervals ranging from 1 second to 1 month

- Online forum access for platform help and discussion

Next Generation

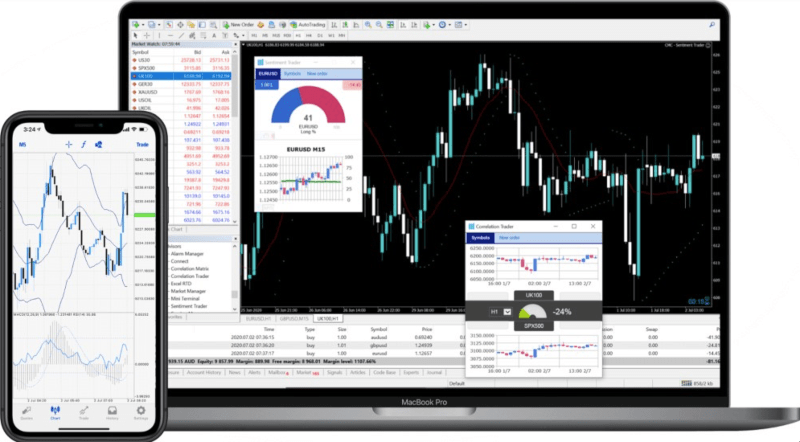

MetaTrader 4

The industry favourite platform for trading forex and CFDs, MT4 can be downloaded to computers and offers:

- Trading signals

- Sentiment trader

- Micro lots from 0.01

- Customisable interface

- Range of charts and tools

- 2,500 pre-built trading robots

- Thousands of indicators & signals

- Build custom algorithmic trading solutions and expert advisors (EAs)

MT4

Note, the CMC Markets MT4 platform does not offer trading in shares – you will need to use the broker’s proprietary solution to trade stocks.

Assets

CMC Markets offers clients live trading opportunities on over 10,000 assets:

- Forex – 330+ forex pairs, majors, minors and exotics

- Indices – 80+ cash and forward indices including FTSE 100

- Commodities – 100+ commodities including gold and crude oil

- ETFs – 1,000+ instruments across sectors or within an index such as S&P 500

- Rates & bonds – 50+ government bonds and interest rates including UK Gilt

- International shares – 8,000+ global shares including Apple, Amazon and Boeing

- Share baskets – 28 exclusive CFD portfolios tracking emerging markets including autonomous driving and cybersecurity

Trading Fees

The broker offers competitive floating spreads. Typical spreads on major currency pairs such as EUR/USD and USD/JPY are 0.7 pips. Indices including UK100 and Germany30 are offered at 1.0. A full list of spreads per instrument can be found on the broker’s website.

CMC Markets charges a commission on CFD share trading. Fees vary but are generally charged at 0.10%. Notably, stock CFD fees are higher vs other brokers such as Trading 212 that doesn’t charge commissions.

Other costs include a £10 monthly inactivity fee after a year of no trading plus a guaranteed stop-loss order premium.

Leverage Review

UK traders can access leverage up to 1:30, in line with ESMA regulations. Forex leverage is available up to 1:30, indices are offered at 1:20 while shares and commodity trading are capped at 1:5. Users trading on margin should utilise risk management tools such as stops and limits to minimise risk exposure.

Mobile Trading

CMC Markets offers mobile-friendly trading software for both platforms. Available for free, the apps can be downloaded to iOS and Android devices. The applications promise an interactive trading experience while retaining most of the desktop platform functionality:

- Built-in ID verification

- Customisable dashboard

- Open, close and modify trades

- Alerts and instant notifications

- 40+ technical indicators & drawing tools

- Mobile optimised trading with 5 chart types

- Market news, insights & an economic calendar

Mobile app

Deposits

There is no minimum deposit requirement to open a live CMC Markets account. Deposits are free however bank charges may apply. Accepted payment methods include:

- PayPal – instant

- E-wallet – instant

- Bank wire transfer – up to 3 working days

- Credit/debit card – instant though Amex is not accepted

Withdrawals

There are no charges for withdrawing profits. UK withdrawal requests are processed on the same day if submitted before 2 pm. To withdraw funds from your CMC Markets account, select the payment option within the platform interface, choose the desired payment method, and input the withdrawal amount. Note you may need to submit security documents in line with the broker’s KYC checks.

Demo Account

The broker offers a demo account with access to virtual funds. Registration is simple, requiring a valid email address and phone number. Demo accounts are a good way to understand platform features and to test strategies in a risk-free environment. The practice account simulates real trading conditions with floating market spreads. There is no time limit or expiry on the CMC Markets demo account.

CMC Markets Bonuses

At the time of writing, CMC Markets does not offer any promotions or rebate deals to new or existing clients, this includes no deposit bonuses. This is aligned with ESMA trading regulations that restrict incentivising UK traders with bonuses and competitions.

Regulation Review

CMC Markets UK Plc is licensed by the Financial Conduct Authority (FCA). The FCA is a highly respectable regulatory body responsible for overseeing the UK’s financial markets. As per regulatory conditions, the broker segregates client funds in top-tier banks, offers negative balance protection and FSCS protection up to £85,000.

Additional Features

Our CMC Markets review was pleased to see multiple support features for clients. This includes international trading insights, details of company earnings, day trading guides, online videos and tutorials, courses, plus forum access. Education topics include CFD trading, automated platforms, bonds and social investing. CMC Markets also runs live virtual webinar events available to register at no charge and downloadable podcasts.

Trading Accounts

The broker offers two account types for spread betting or CFD trading.

Features of both accounts include:

- Account netting

- Fractional trade sizes

- Spreads from 0.3 pips

- Risk management tools

- Positions on rising and falling markets

- Free access to education, webinars, market insights and news

With the CMC Markets CFD account, hedging is available but clients may have to pay market data fees, share trading commissions and capital gains tax.

Benefits

- FCA regulated

- Demo account

- 24/5 customer service

- 10,000+ tradable assets

- High-quality mobile apps

- Negative balance protection

- No minimum deposit requirement

Drawbacks

- High CFD stock fees

- £10 monthly inactivity fee

- No binary options trading

- No cryptos such as Bitcoin

Trading Times

CMC Markets follows standard office hours. CFD and spread betting hours run from Sunday 9 pm to Friday 10 pm. Note, timings may vary by instrument. Also, public holiday dates such as Easter can cause changes to trading hours, though these are reflected within the platform and highlighted in economic calendars.

Customer Support

CMC Markets offers a range of customer support options, available 24/5:

- Live chat – logo on website

- Telephone – +44(0)20 7170 8200

- Email – clientmanagement@cmcmarkets.co.uk

- UK address – CMC Markets UK PLC, 133 Houndsditch, London, EC3A 7BX

User reviews show high levels of satisfaction with the customer support offered. The team can help with a range of issues such as a forgotten trading pin or login problems.

Client Safety

The broker is fully GDPR compliant and all personal data is encrypted. Two-factor authentication can be added to all accounts as a mandatory step in the login process or when making an online payment. We’re satisfied the broker provides a relatively secure trading environment.

Should You Choose CMC Markets?

CMC Markets offers CFD trading and spread betting opportunities across thousands of assets. UK traders can be assured of the FCA regulation, free demo account and extensive educational resources. Our review was also pleased to see powerful platform options including mobile apps. Overall, the broker is a great option for beginners and experienced investors.

FAQ

Does CMC Markets Offer A Demo Account?

Yes, CMC Markets offers a demo account for both online trading platform options. Practice your day trading strategy with access to interactive charts, pending orders and dozens of technical indicators. You can also test automated trading strategies with zero risk.

What Is CMC Markets Trading Platform Options?

CMC Markets offers the established MT4 solution as well as its proprietary Next Generation platform. Both are excellent trading terminals that are also available as mobile apps. Once you have opened a spread betting or stockbroking trading account with CMC Markets, you can use the platforms for free.

Is CMC Markets Regulated?

Yes, the broker is regulated by the UK Financial Conduct Authority (FCA) under registration number 173730. This is a promising sign the brokerage is trustworthy. Client fund segregation, leverage caps and negative balance protection are just some of the benefits of UK regulation. See our review for more details.

What Are CMC Markets UK Trading Hours?

CMC Markets trading hours are industry standard. Currency pairs and indices, for example, are available from Sunday 9 pm to Friday 10 pm. Outside of standard trading hours, users may see wider spreads due to reduced trading volumes.

How Can I Reset My CMC Markets Account Password?

Select ‘forgot password’ on the CMC Markets live trading account login page. Reset instructions will be sent to the registered email address. The password reset process only takes a few minutes.

Top 3 CMC Markets Alternatives

These brokers are the most similar to CMC Markets:

- IG - Founded in 1974, IG is a part of IG Group Holdings Plc, a publicly listed brokerage (LSE: IGG). The company provides spread betting, CFD, and forex trading, offering access to over 17,000 markets. Its platforms and investing apps are notably user-friendly. Over the past 50 years, IG has consistently been an industry leader, excelling in all essential areas for traders.

- City Index - Founded in 1983, City Index is a prestigious broker, now under the Nasdaq-listed StoneX Group. It excels in forex, CFDs, and spread betting. With access to over 13,500 instruments, City Index provides a dynamic Web Trader platform, exceptional educational materials, and round-the-clock support five days a week, ensuring a thorough trading experience.

- Pepperstone - Founded in Australia in 2010, Pepperstone is a highly regarded broker specialising in forex and CFDs. Serving more than 400,000 clients globally, it provides access to over 1,300 financial instruments through popular platforms like MT4, MT5, cTrader, and TradingView. Its fee structure is both low and transparent. With regulation by reputable bodies such as the FCA, ASIC, and CySEC, Pepperstone guarantees a safe trading environment for traders at every level.

CMC Markets Feature Comparison

| CMC Markets | IG | City Index | Pepperstone | |

|---|---|---|---|---|

| Rating | 4.7 | 4.5 | 4.4 | 4.8 |

| Markets | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Treasuries, Custom Indices, Spread Betting | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Futures, Options, Bonds, Interest Rates,ETFs,Spread Betting | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting |

| Minimum Deposit | $0 | $0 | $0 | $0 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | FCA, ASIC, MAS, CIRO, BaFin, FMA, DFSA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM, JFSA | FCA, ASIC, CySEC, MAS | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB |

| Education | Yes | Yes | Yes | Yes |

| Platforms | MT4 | MT4 | MT4 | MT4, MT5, cTrader |

| Leverage | 1:30 (Retail), 1:500 (Pro) | 1:30 (Retail), 1:222 (Pro) | 1:30 | 1:30 (Retail), 1:500 (Pro) |

| Visit | 67% of retail CFD accounts lose money. |

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. |

72% of retail investor accounts lose money when trading CFDs |

|

| Review | CMC Markets Review |

IG Review |

City Index Review |

Pepperstone Review |

Trading Instruments Comparison

| CMC Markets | IG | City Index | Pepperstone | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | No | No | No | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | Yes | Yes | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | No | No | Yes |

| Futures | No | Yes | Yes | No |

| Options | Yes | Yes | Yes | No |

| ETFs | Yes | Yes | Yes | Yes |

| Bonds | Yes | Yes | Yes | No |

| Warrants | No | Yes | No | No |

| Spreadbetting | Yes | Yes | Yes | Yes |

| Volatility Index | Yes | Yes | Yes | Yes |

CMC Markets vs Other Brokers

Compare CMC Markets with any other broker by selecting the other broker below.

Popular CMC Markets comparisons:

|

|

CMC Markets is #33 in our rankings of CFD brokers. |

| Top 3 alternatives to CMC Markets |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Treasuries, Custom Indices, Spread Betting |

| Demo Account | Yes |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Regulated By | FCA, ASIC, MAS, CIRO, BaFin, FMA, DFSA |

| Trading Platforms | MT4 |

| Leverage | 1:30 (Retail), 1:500 (Pro) |

| Mobile Apps | iOS & Android |

| iOS App Rating | |

| Android App Rating | |

| Payment Methods | Credit Card, Debit Card, Mastercard, PayPal, Visa, Wire Transfer |

| Copy Trading | No |

| Auto Trading | Expert Advisors (EAs) on MetaTrader |

| Signals Service | Yes |

| Islamic Account | Yes |

| Commodities | Cannabis, Coffee, Copper, Gasoline, Gold, Livestock, Natural Gas, Nickel, Oil, Orange Juice, Palladium, Platinum, Precious Metals, Silver, Soybeans, Steel, Sugar, Wheat |

| CFD FTSE Spread | 1 pt |

| CFD GBPUSD Spread | 0.9 |

| CFD Oil Spread | 3.5 |

| CFD Stocks Spread | 0.02 |

| GBPUSD Spread | 0.9 |

| EURUSD Spread | 0.7 |

| GBPEUR Spread | 1.1 |

| Assets | 300+ |

| Currency Indices | AUD, CAD, CHF, EUR, GBP, JPY, NZD, USD |