Turbo Binary Options

Turbo binary options are ideal for traders looking to make multiple short-term trades throughout the day. Expiry times can be as short as 5 seconds and payouts can exceed 100%. Turbos also often have a knock-out level designed to limit potential losses. This guide to trading turbo binary options explains how they work, shares strategy tips and lists the best brokers in 2025.

Binary Options Brokers

-

Pocket Option provides extremely short-term binary options starting at 3 seconds on an easy-to-use web platform ideal for novices. With payouts exceeding 90%, the 'Double Up' and 'Rollover' tools offer additional chances for profit.

Min Deposit Payout % Expiry Times $5 92% 3 seconds - 1 month Bonus MetaTrader 4 Markets 100% Deposit Bonus Yes Forex, Stocks, Crypto, Commodities -

IQCent provides binary options featuring exceptional payouts up to 98%. The platform, albeit with basic analysis tools, accommodates various timeframes ranging from 1 minute to 1 month, supporting both short and long-term trading strategies. However, it is worth noting that stock binaries are unavailable.

Min Deposit Payout % Expiry Times $250 98% 5 seconds - 1 month Bonus MetaTrader 4 Markets Monthly Giveaways (e.g. iPhones & Apple Watches) No CFD, Forex, Crypto, Commodities -

Capitalcore has broadened its range of trading products by adding binary options for forex, metals, and cryptocurrencies, offering returns of up to 95%. Designed for short-term traders, contract durations vary from 1 minute to 1 hour. The user-friendly web platform makes trading simple; just click 'Call' if you predict a price increase or 'Put' for a decrease.

Min Deposit Payout % Expiry Times $10 95% 1 minute - 1 hour Bonus MetaTrader 4 Markets - No CFD, Forex, Stocks, Crypto, Commodities -

CloseOption provides binary options trading on over 30 fiat and digital currencies via a user-friendly online platform. With 15 contract durations ranging from 30 seconds to 1 month, it caters to both short-term and long-term traders. New users receive a welcome bonus.

Min Deposit Payout % Expiry Times $5 95% 30 seconds - 1 month Bonus MetaTrader 4 Markets - No Forex, Crypto -

Videforex provides binary options with competitive returns, offering 20% payouts on cryptocurrencies and up to 98% on more stable assets. This outperforms many rivals. Traders can choose contracts ranging from 5 seconds to 1 month. Additionally, new users benefit from a welcome deposit bonus.

Min Deposit Payout % Expiry Times $250 98% 5 seconds - 1 month Bonus MetaTrader 4 Markets 100% Deposit Bonus No CFD, Forex, Stocks, Crypto, Commodities -

Engage in trading high-low binary options on currencies, metals, and cryptocurrencies, offering significant returns. Binary options provide a clear wager on the short-term movement of an asset.

Min Deposit Payout % Expiry Times $10 86% 1 minute - 48 hours Bonus MetaTrader 4 Markets - Yes CFD, Forex, Stocks, Crypto, Commodities -

RaceOption provides over 100 binary options with competitive returns up to 95% and rapid expiry times starting at 5 seconds. A minimum deposit of $200 grants clients free transactions, speedy withdrawals, and various trading bonuses.

Min Deposit Payout % Expiry Times $200 95% 5 seconds - 30 days Bonus MetaTrader 4 Markets 100% Deposit Bonus No CFD, Forex, Stocks, Crypto, Commodities

Safety Comparison

Compare how safe the Turbo Binary Options are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|---|---|---|---|---|

| Pocket Option | ✘ | ✘ | ✘ | ✘ | |

| IQCent | ✘ | ✘ | ✘ | ✘ | |

| Capitalcore | ✘ | ✔ | ✘ | ✔ | |

| CloseOption | ✘ | ✘ | ✘ | ✔ | |

| Videforex | ✘ | ✔ | ✔ | ✘ | |

| Grand Capital | ✘ | ✘ | ✘ | ✔ | |

| Raceoption | ✘ | ✘ | ✘ | ✔ |

Payments Comparison

Compare which popular payment methods the Turbo Binary Options support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|---|---|---|---|---|---|

| Pocket Option | ✘ | ✔ | ✔ | ✘ | ✘ | ✔ |

| IQCent | ✘ | ✔ | ✔ | ✘ | ✘ | ✔ |

| Capitalcore | ✘ | ✘ | ✘ | ✘ | ✘ | ✘ |

| CloseOption | ✘ | ✘ | ✘ | ✘ | ✘ | ✔ |

| Videforex | ✔ | ✘ | ✔ | ✔ | ✘ | ✔ |

| Grand Capital | ✔ | ✔ | ✔ | ✔ | ✘ | ✘ |

| Raceoption | ✔ | ✔ | ✔ | ✔ | ✘ | ✔ |

Mobile Trading Comparison

How good are the Turbo Binary Options at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| Pocket Option | iOS & Android | ✘ | ||

| IQCent | iOS & Android | ✘ | ||

| Capitalcore | Android, Webtrader | ✘ | ||

| CloseOption | - | ✘ | ||

| Videforex | Android | ✘ | ||

| Grand Capital | ✔ | ✘ | ||

| Raceoption | iOS & Android | ✘ |

Beginners Comparison

Are the Turbo Binary Options good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|---|---|---|---|---|

| Pocket Option | ✔ | $5 | $1 | ||

| IQCent | ✔ | $250 | $0.01 | ||

| Capitalcore | ✔ | $10 | 0.01 Lots (CFD/Forex), $1 (Binaries) | ||

| CloseOption | ✔ | $5 | $1 | ||

| Videforex | ✔ | $250 | $0.01 | ||

| Grand Capital | ✔ | $10 | 0.01 Lots | ||

| Raceoption | ✔ | $200 | $0.01 |

Advanced Trading Comparison

Do the Turbo Binary Options offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Pocket Option | ✔ | ✘ | - | ✘ | ✔ | ✘ | ✘ |

| IQCent | ✔ | ✘ | 1:500 | ✘ | ✔ | ✘ | ✘ |

| Capitalcore | - | ✘ | 1:2000 | ✔ | ✘ | ✘ | ✘ |

| CloseOption | - | ✘ | - | ✘ | ✘ | ✘ | ✘ |

| Videforex | ✔ | ✘ | 1:2000 | ✘ | ✔ | ✘ | ✘ |

| Grand Capital | ✔ | ✘ | 1:500 | ✘ | ✘ | ✘ | ✘ |

| Raceoption | - | ✘ | 1:500 | ✘ | ✘ | ✘ | ✘ |

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the Turbo Binary Options.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|---|---|---|---|---|---|---|---|---|

| Pocket Option | |||||||||

| IQCent | |||||||||

| Capitalcore | |||||||||

| CloseOption | |||||||||

| Videforex | |||||||||

| Grand Capital | |||||||||

| Raceoption |

Our Take On Pocket Option

"Pocket Option is a top choice for active traders due to its extensive binary assets and regular platform enhancements, such as 'AI Trading' and expanded expiry options from 3 seconds to 1 month."

Pros

- Traders with a deposit of over $1,000 may receive a 2% or higher payout increase, access to more assets, and enjoy exclusive benefits.

- The web platform excels in its simple design and ease of use, attracting novice traders interested in speculating on leading markets with minimal effort.

- The variety of payment options surpasses most competitors, offering traders in numerous countries swift, secure, and convenient deposit processes.

Cons

- To gain access to over 250 assets, a deposit of $1000 is required. Without this deposit, traders will only have access to a selection of 130 assets.

- Pocket Option presents a streamlined version of MT4 and MT5, lacking the comprehensive charting tools that experienced traders seek.

- Although binary brokers such as IQCent provide returns reaching 98% based on evaluations, others typically offer competitive payouts up to 92%.

Our Take On IQCent

"IQCent caters to traders seeking customised binary assets, offering over 150 products, such as ‘Hype Pool’ contracts for trending events. It features short-term expiries starting at 5 seconds and payouts reaching 95%, with a potential 3% boost. The TradingView charting package, complete with over 100 indicators, suits serious, quick-paced traders."

Pros

- IQCent has expanded its offerings by adding over 60 new assets. This includes popular cryptocurrencies like TON and SHIB, high-ranking stock CFDs such as TSLA and NVDA, and unique FX pairs like THB and HUF.

- CFD trading fees are competitive, with major forex pairs like EUR/USD incurring costs from just 0.7 pips.

- Enthusiastic traders may participate in competitions that offer cash prizes.

Cons

- The market analysis provides only fundamental details, offering limited technical summaries and insights from analysts.

- Automated trading support is unavailable for algorithmic traders.

- The broker operates without oversight from a reputable regulator, which is typical for binary options companies.

Our Take On Capitalcore

"Capitalcore operates a leading binary options platform, ideal for those requiring sophisticated charting capabilities. Integration with TradingView provides over five chart types and 90 indicators. The 'double up' and 'rollover' features, allowing quick trade replication or extension, are superb for strategy enhancement."

Pros

- Capitalcore stands out as a broker offering zero swap fees, appealing to traders adhering to Islamic Finance principles.

- Unlike the majority of brokers, Capitalcore provides a limitless demo account, which can be set up in less than five minutes.

- The Capitalcore platform offers advanced charting tools and over 150 technical indicators, perfect for in-depth market analysis.

Cons

- Platform support is restricted to proprietary software, lacking integration with popular platforms like MetaTrader or cTrader. These industry-leading solutions provide integrated economic news and facilitate automated trading.

- Capitalcore's limited education and research offerings fall significantly behind industry leaders like IG, rendering it less ideal for aspiring traders.

- During testing, the web platform proved unreliable due to sporadic technical issues, causing the trading platform to fail loading at times.

Our Take On CloseOption

"CloseOption ranks as the most accessible binary broker for novice traders. Registration is under five minutes, with a minimum deposit of $5 and a minimum stake of $1. It also caters to competitive traders with weekly tournaments offering cash prizes up to $1,300."

Pros

- The intuitive platform works seamlessly with nearly all web browsers.

- New traders can begin with just a £5 minimum deposit.

- Various international payment options are accessible.

Cons

- Binary options are exclusively offered for both traditional currencies and cryptocurrencies.

- CloseOption lacks regulation by a reputable financial authority.

- Clients must deposit over $50,000 to be eligible for the highest returns.

Our Take On Videforex

"Videforex offers an intuitive platform for traders speculating on market trends with binary options, focusing on cryptocurrencies and stocks, with numerous assets available. TradingView charts support technical analysis. However, the absence of regulation poses significant risk."

Pros

- Videforex frequently holds trading contests, providing both novice and seasoned traders with practice opportunities and cash prizes. Traders can participate with position sizes starting as low as 1 cent.

- Traders can gain payouts up to 98% on over 150 assets using the broker's binary options, matching rivals like IQCent.

- Videforex is among the select brokers offering round-the-clock multilingual video support, ensuring thorough assistance for active traders.

Cons

- Based on recent tests, the client terminal requires enhancements, as its widgets occasionally become slow and unresponsive, which could affect traders' experience.

- Videforex is not licensed by a reputable regulator, leaving traders with minimal or no protection, such as segregated client accounts.

- The lack of educational resources is a significant disadvantage for novice traders. In contrast, leading firms offer blogs, videos, and live trading sessions.

Our Take On Grand Capital

"Grand Capital is a solid choice for traders adept with MetaTrader and passive investors seeking copy trading and LAMM options. However, its regulatory standing falls short compared to rivals."

Pros

- Minimum deposit as low as £10.

- Swift and straightforward account setup

- Six accounts tailored to various trading styles and strategies.

Cons

- Basic education and market research

- Minimal regulatory supervision.

- Elevated spreads on certain assets

Our Take On Raceoption

"RaceOption ranks highly among binary firms, offering diverse assets, including US tech stocks and unique cryptocurrencies. It caters well to intraday traders with 5-second turbo contracts and tick charts via TradingView charts. Frequent contests enhance the binary trading experience."

Pros

- Returns on well-known assets such as EUR/USD can go up to 95%, outperforming many other options based on our analysis and boosting potential gains. Additionally, the initial three trades incur no risk in Silver and Gold accounts.

- RaceOption simplifies account funding with no-fee, near-instant deposits through bank cards and cryptocurrencies. Withdrawals are processed within one hour, guaranteed.

- RaceOption is among the select few brokers providing 24/7 multilingual video chat. However, our interactions suggest that their agents require better understanding of trading and regulatory matters.

Cons

- RaceOption, lacking both a demo account and educational resources, is not ideal for novice traders.

- RaceOption operates as an unregulated broker, offering high-risk trading with no investor compensation or legal remedies if trading or withdrawal problems arise.

- Though still accessible for numerous retail investors, the $200 minimum deposit heightens the entry barrier. This is particularly notable when compared to Deriv and World Forex, which cater to budget-conscious traders.

What Are Turbo Binary Options?

Turbos are derivative products that track the price of an underlying asset, such as the GBP/USD forex pair. Traders then make a bet as to whether the price of the asset will rise or fall by the expiry time, for example, 30 seconds.

If the prediction is correct, the position ends ‘in-the-money’ and the initial stake is returned to the trader plus a fixed payout. The payout is normally a predetermined percentage of the initial investment, usually between 60% to 90%, however, this varies between brokers and assets. Pocket Option, for example, offers payouts of up to 218%. If the prediction is incorrect, the contract ends ‘out-of-the-money’ and the trader loses their initial investment.

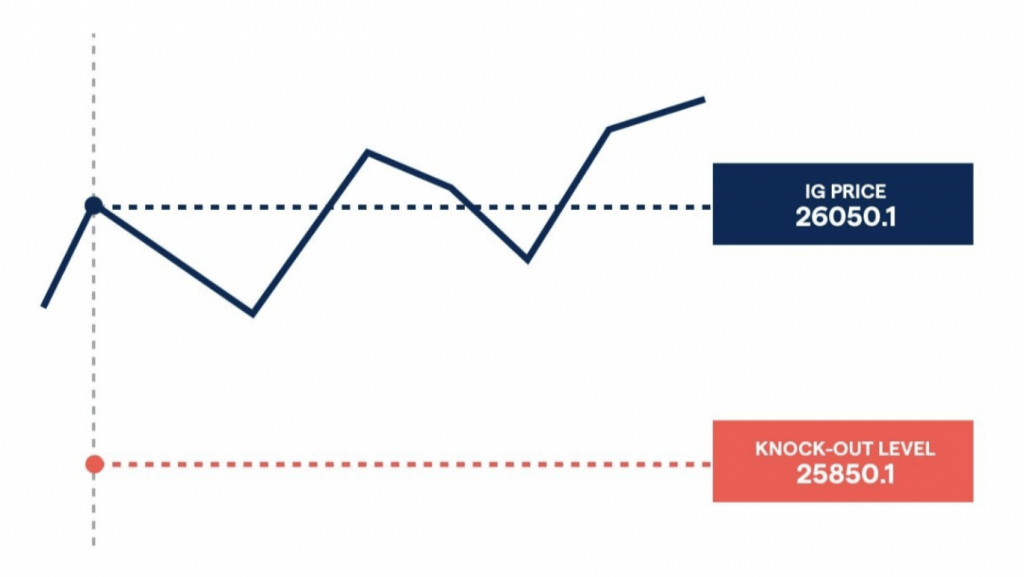

Importantly, turbos are usually ultra-fast trades that allow investors to speculate on short-term price fluctuations, sometimes just a matter of seconds. With that said, some brands, including IG, offer turbos with longer expiries of up to 24 hours. The IG Group also offers leveraged trading on its turbo contracts with built-in knock-out levels. This means clients can increase their purchasing power for a small capital outlay and can identify a price point at which the position is automatically closed, limiting potential losses.

Knock Out Levels On IG Turbos

How a Trade Works

Let’s look at an example of a turbo binary options trade…

Stock A is currently trading at £50. However, the company has just announced that its CEO is stepping down and you expect the share price to drop in the wake of the news. Your broker offers a turbo with an expiry time of 30 seconds and a payout of 60% if the share price drops to £49.50. You stake £200.

30 seconds later, the share price is £49.48 so your trade finishes in the money. As a result, your account is credited with £320 (£200 stake + £120 profit).

If the price had been £49.52 after 30 seconds, you would have lost your £200 stake.

Variations

Importantly, online brokers offer different payouts and expiries on their turbos. Some brokerages’ turbo products also have different characteristics. For example, IG offers leveraged trading opportunities, knock-out levels and longer expiries. With standard binary options brokers though, the following contract types are usually available:

- High/Low: The most common and straightforward type of turbo option. This contract is a question of ‘will the underlying asset be greater than or less than the strike price at expiry?’

- Ladder: A contract formed of several staggered strike prices at equal distance with increasing payouts. It works akin to having a series of high/low contracts.

- Boundary: Two strike prices are used to create upper and lower price levels for a contract. You predict if the underlying asset’s price will be between or outside of the price boundaries at expiration. Some brokers also call these range or in/out binaries.

- Touch/No-Touch: You predict if the asset’s value will reach a certain price before the expiration. Different from other binary options, it is not the price at expiry that matters. Rather, the asset only needs to ‘touch’ the price before expiring.

Trading Tips

Comparing Indicators

To build a successful strategy for turbo binary options trading, some investors turn to charts and indicators. Because turbo contracts often expire so quickly, you cannot always rely on fundamental analysis. Keep in mind that you don’t need to rely on a single indicator – your strategy can involve several.

Moving Average

A moving average (MA) indicator is used to identify trend momentum from previous periods. There are several different types of MA indicators, such as exponential and linear weighted, but the example below uses a simple moving average.

Typically, you set up a chart with a series of MA indicators, each with different time periods. In the example below, the blue line uses data from the past five days, the black line uses information from the past 10 days and the red line uses the past 20 days. Specific time frames can be changed for greater or less sensitivity. As turbo binary options are short-term, you may want to use shorter time frames.

When a shorter-term MA line increases past a longer-term MA line, you can assume a positive price movement will follow. This is called a bullish crossover. The opposite is called a bearish crossover and predicts a negative price movement. Examples of both can be seen in the chart for the GBP/JPY forex pair below.

GBP/JPY Moving Average Chart

Relative Strength Index

The relative strength index (RSI) is used to indicate when an asset is overbought or oversold using a 0-100 scale. The RSI is particularly useful for turbo binary options trading as it helps to tell investors when a trend reversal is likely so they can capitalise on short-term swings.

An example of how the RSI indicates price movement can be seen below. In this image, an RSI of 70 or higher indicates an asset is overbought and an RSI of 30 or lower indicates overselling. Just before 10:12, National Express stock is overbought and the RSI stays above 70 for several minutes, after which there is a large downtrend. At 10:36, the RSI drops below 30 for a short period of time, which precedes a small stock price uptrend.

National Express Relative Strength Index Chart

Bollinger Bands

Bollinger Bands are indicators of volatility. This is helpful for day traders executing turbo binary options as highly volatile assets are likely to see larger and more frequent price swings. The bands are created by finding the simple moving average and then calculating two standard deviations away in both positive and negative directions. The result is a bubble-like shape that expands and contracts to indicate higher and lower volatility.

An example can be seen below using the natural gas price history chart. As you can see, when the distance between the two bands is smaller, the fluctuations are not as large. When the boundaries are further apart, the price fluctuations are greater.

Natural Gas Bollinger Bands Chart

Comparing Brokers

Finding the right turbo binary options broker is not an easy task. With that in mind, consider the factors listed below.

Payouts & Expiries

How competitive are the payouts offered on turbo binary options contracts? Some brands offer over 100%. Also look at contract expiries. Do they start from 5 seconds, 15 seconds, 30 seconds or 1 minute? Finally, look at the underlying assets that turbo options are available on. Can you speculate on stocks, forex, commodities and cryptocurrencies?

Fee Structure

Look out for transaction fees, account subscription costs and any deposit or withdrawal charges. Check that the broker is clear about all trading and non-trading fees. If the broker tries to hide information about fees or a price schedule is not available, steer clear.

Reliability

In 2019, the Financial Conduct Authority introduced a ban that said FCA-licensed brokers are prohibited from offering binary options contracts to retail traders. Because of this, you will need to open an account with an offshore or unregulated brokerage.

This makes it particularly important to sign up with a trusted and reputable trading platform. Check user reviews and ratings on social trading forums. Alternatively, choose from our list of recommended brands.

Customer Support

If there are any problems with your account, it is important to have access to prompt support. The best turbo binary options brokers have multilingual and accessible support teams that are contactable 24/7 or 24/5 via live chat, phone hotline or social media.

Demo Account

Free demo accounts are a great place to test turbos and develop strategies in a risk-free environment. They are also a good way to try other binary options contracts and to get comfortable with a new online broker’s tools and products.

Trading Platform

Is there a high-quality trading platform available such as MetaTrader 4 or MetaTrader 5? If the broker offers a proprietary platform (as many binary options brokers do), check the range of indicators and drawing tools to accommodate technical analysis. Also find out if the broker provides additional support like mobile alerts, real-time signals and trading robots.

Deposit & Withdrawal Rules

You should avoid turbo binary options brokers with excessively high minimum deposit limits and withdrawal thresholds, such as £1,000+. This, in addition to only permitting deposits via crypto, are indicators of a potentially shady trading platform. The best brokers will offer low, beginner-friendly deposit limits and hassle-free withdrawals.

Pros of Turbos

- Simple instrument to understand

- Potential for high rewards with large payouts

- Multiple trading opportunities available throughout the day

- Avoids risk associated with longer-term trends and trading positions

Cons of Turbos

- High-risk investments

- Losses can quickly rack up

- Traders must use offshore brokers

Bottom Line on Trading Binary Options

Turbo binary options are high risk and trading such a product demands discipline and preparation if you want to boost your chances of success. It is also important that you understand how turbos work before getting started with a live account, so make the most of any demo trading environment offered by your broker. Check out our list of recommended brands to get started.

FAQs

Are Turbo Binary Options Legal In The UK?

Licensed brokers in the UK cannot offer any kind of binary options product to retail traders. That does not mean, however, that traders cannot access them. To trade turbo binaries, you will need to sign up with either offshore or unregulated brokerages.

How Short Are Turbo Binary Options?

Turbo binary options often expire after just 30 seconds. With that said, some platforms offer products that expire after 15 seconds or even 5 seconds. IG, on the other hand, offers 24-hour turbos.

When Can I Trade Turbo Binary Options?

This is dependent on the underlying asset you want to trade. For example, if you want to trade stocks on the London Stock Exchange, you are limited to trading between 8:00 AM and 4:30 PM GMT. However, if you are interested in cryptocurrency, you can trade turbo binary options 24/7.

Can Beginners Trade Turbo Binary Options?

Yes, novices can trade turbo binary options. If you are a day trader interested in executing short-term trades, then turbos could suit your needs. See our list of top brokers to get started.

Can Trading Turbo Binary Options Be Profitable?

Yes, turbo binary options trading can be profitable, however, no investment is without risk. A careful approach to risk and money management is required. It is also worth pointing out that most retail binary options traders lose money in the long run.