Binary Options Risk Management

For traders seeking to increase their chances of long-term success, binary options risk management is key. Introducing risk management to your strategies can be a simple task, however, you need to ensure you understand how each measure works and how it will impact your trading. This guide will consider why it is important and explain some potential methods of including risk management in trading binary options.

Binary Options Brokers UK

-

Pocket Option provides extremely short-term binary options starting at 3 seconds on an easy-to-use web platform ideal for novices. With payouts exceeding 90%, the 'Double Up' and 'Rollover' tools offer additional chances for profit.

Min Deposit Payout % Expiry Times $5 92% 3 seconds - 1 month Bonus MetaTrader 4 Markets 100% Deposit Bonus Yes Forex, Stocks, Crypto, Commodities -

IQCent provides binary options featuring exceptional payouts up to 98%. The platform, albeit with basic analysis tools, accommodates various timeframes ranging from 1 minute to 1 month, supporting both short and long-term trading strategies. However, it is worth noting that stock binaries are unavailable.

Min Deposit Payout % Expiry Times $250 98% 5 seconds - 1 month Bonus MetaTrader 4 Markets Monthly Giveaways (e.g. iPhones & Apple Watches) No CFD, Forex, Crypto, Commodities -

Capitalcore has broadened its range of trading products by adding binary options for forex, metals, and cryptocurrencies, offering returns of up to 95%. Designed for short-term traders, contract durations vary from 1 minute to 1 hour. The user-friendly web platform makes trading simple; just click 'Call' if you predict a price increase or 'Put' for a decrease.

Min Deposit Payout % Expiry Times $10 95% 1 minute - 1 hour Bonus MetaTrader 4 Markets - No CFD, Forex, Stocks, Crypto, Commodities -

CloseOption provides binary options trading on over 30 fiat and digital currencies via a user-friendly online platform. With 15 contract durations ranging from 30 seconds to 1 month, it caters to both short-term and long-term traders. New users receive a welcome bonus.

Min Deposit Payout % Expiry Times $5 95% 30 seconds - 1 month Bonus MetaTrader 4 Markets - No Forex, Crypto -

Videforex provides binary options with competitive returns, offering 20% payouts on cryptocurrencies and up to 98% on more stable assets. This outperforms many rivals. Traders can choose contracts ranging from 5 seconds to 1 month. Additionally, new users benefit from a welcome deposit bonus.

Min Deposit Payout % Expiry Times $250 98% 5 seconds - 1 month Bonus MetaTrader 4 Markets 100% Deposit Bonus No CFD, Forex, Stocks, Crypto, Commodities -

Engage in trading high-low binary options on currencies, metals, and cryptocurrencies, offering significant returns. Binary options provide a clear wager on the short-term movement of an asset.

Min Deposit Payout % Expiry Times $10 86% 1 minute - 48 hours Bonus MetaTrader 4 Markets - Yes CFD, Forex, Stocks, Crypto, Commodities -

RaceOption provides over 100 binary options with competitive returns of up to 95% and rapid expiries as short as 5 seconds. A minimum deposit of $200 allows clients free deposits and swift withdrawals.

Min Deposit Payout % Expiry Times $200 95% 5 seconds - 30 days Bonus MetaTrader 4 Markets 100% Deposit Bonus No CFD, Forex, Stocks, Crypto, Commodities

Safety Comparison

Compare how safe the Binary Options Risk Management are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|---|---|---|---|---|

| Pocket Option | ✘ | ✘ | ✘ | ✘ | |

| IQCent | ✘ | ✘ | ✘ | ✘ | |

| Capitalcore | ✘ | ✔ | ✘ | ✔ | |

| CloseOption | ✘ | ✘ | ✘ | ✔ | |

| Videforex | ✘ | ✔ | ✔ | ✘ | |

| Grand Capital | ✘ | ✘ | ✘ | ✔ | |

| Raceoption | ✘ | ✘ | ✘ | ✔ |

Payments Comparison

Compare which popular payment methods the Binary Options Risk Management support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|---|---|---|---|---|---|

| Pocket Option | ✘ | ✔ | ✔ | ✘ | ✘ | ✔ |

| IQCent | ✘ | ✔ | ✔ | ✘ | ✘ | ✔ |

| Capitalcore | ✘ | ✘ | ✘ | ✘ | ✘ | ✘ |

| CloseOption | ✘ | ✘ | ✘ | ✘ | ✘ | ✔ |

| Videforex | ✔ | ✘ | ✔ | ✔ | ✘ | ✔ |

| Grand Capital | ✔ | ✔ | ✔ | ✔ | ✘ | ✘ |

| Raceoption | ✔ | ✔ | ✔ | ✔ | ✘ | ✔ |

Mobile Trading Comparison

How good are the Binary Options Risk Management at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| Pocket Option | iOS & Android | ✘ | ||

| IQCent | iOS & Android | ✘ | ||

| Capitalcore | Android, Webtrader | ✘ | ||

| CloseOption | - | ✘ | ||

| Videforex | Android | ✘ | ||

| Grand Capital | ✔ | ✘ | ||

| Raceoption | iOS & Android | ✘ |

Beginners Comparison

Are the Binary Options Risk Management good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|---|---|---|---|---|

| Pocket Option | ✔ | $5 | $1 | ||

| IQCent | ✔ | $250 | $0.01 | ||

| Capitalcore | ✔ | $10 | 0.01 Lots (CFD/Forex), $1 (Binaries) | ||

| CloseOption | ✔ | $5 | $1 | ||

| Videforex | ✔ | $250 | $0.01 | ||

| Grand Capital | ✔ | $10 | 0.01 Lots | ||

| Raceoption | ✔ | $200 | $0.01 |

Advanced Trading Comparison

Do the Binary Options Risk Management offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Pocket Option | ✔ | ✘ | - | ✘ | ✔ | ✘ | ✘ |

| IQCent | ✔ | ✘ | 1:500 | ✘ | ✔ | ✘ | ✘ |

| Capitalcore | - | ✘ | 1:2000 | ✔ | ✘ | ✘ | ✘ |

| CloseOption | - | ✘ | - | ✘ | ✘ | ✘ | ✘ |

| Videforex | ✔ | ✘ | 1:2000 | ✘ | ✔ | ✘ | ✘ |

| Grand Capital | ✔ | ✘ | 1:500 | ✘ | ✘ | ✘ | ✘ |

| Raceoption | - | ✘ | 1:500 | ✘ | ✘ | ✘ | ✘ |

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the Binary Options Risk Management.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|---|---|---|---|---|---|---|---|---|

| Pocket Option | |||||||||

| IQCent | |||||||||

| Capitalcore | |||||||||

| CloseOption | |||||||||

| Videforex | |||||||||

| Grand Capital | |||||||||

| Raceoption |

Our Take On Pocket Option

"Pocket Option is a top choice for active traders due to its extensive binary assets and regular platform enhancements, such as 'AI Trading' and expanded expiry options from 3 seconds to 1 month."

Pros

- Over the years, Pocket Option has won several annual awards from DayTrading.com, including the notable 'Best Binary Broker 2025' after enhancing its trading tools.

- The variety of payment options surpasses most competitors, offering traders in numerous countries swift, secure, and convenient deposit processes.

- Pocket Option has launched an 'AI Trading' feature that evaluates signals, technical indicators, and trader insights to identify the best trade direction and expiry. Due to limited transparency, test cautiously with minimal stakes.

Cons

- Although binary brokers such as IQCent provide returns reaching 98% based on evaluations, others typically offer competitive payouts up to 92%.

- Pocket Option presents a streamlined version of MT4 and MT5, lacking the comprehensive charting tools that experienced traders seek.

- To gain access to over 250 assets, a deposit of $1000 is required. Without this deposit, traders will only have access to a selection of 130 assets.

Our Take On IQCent

"IQCent caters to traders seeking customised binary assets, offering over 150 products, such as ‘Hype Pool’ contracts for trending events. It features short-term expiries starting at 5 seconds and payouts reaching 95%, with a potential 3% boost. The TradingView charting package, complete with over 100 indicators, suits serious, quick-paced traders."

Pros

- New traders with a modest budget can start trading with a minimal stake of just $0.01.

- The broker offers quick and dependable customer support around the clock, usually responding in under a minute during tests.

- IQCent is a rare binary options broker providing a copy trading service for passive traders.

Cons

- Automated trading support is unavailable for algorithmic traders.

- The broker operates without oversight from a reputable regulator, which is typical for binary options companies.

- IQCent imposes a £10 monthly inactivity fee if a trader does not execute at least one trade each month.

Our Take On Capitalcore

"Capitalcore operates a leading binary options platform, ideal for those requiring sophisticated charting capabilities. Integration with TradingView provides over five chart types and 90 indicators. The 'double up' and 'rollover' features, allowing quick trade replication or extension, are superb for strategy enhancement."

Pros

- The support team is available around the clock and, during testing, offered prompt and helpful responses within minutes.

- Unlike the majority of brokers, Capitalcore provides a limitless demo account, which can be set up in less than five minutes.

- Capitalcore stands out as a broker offering zero swap fees, appealing to traders adhering to Islamic Finance principles.

Cons

- During testing, the web platform proved unreliable due to sporadic technical issues, causing the trading platform to fail loading at times.

- Capitalcore's limited education and research offerings fall significantly behind industry leaders like IG, rendering it less ideal for aspiring traders.

- Platform support is restricted to proprietary software, lacking integration with popular platforms like MetaTrader or cTrader. These industry-leading solutions provide integrated economic news and facilitate automated trading.

Our Take On CloseOption

"CloseOption ranks as the most accessible binary broker for novice traders. Registration is under five minutes, with a minimum deposit of $5 and a minimum stake of $1. It also caters to competitive traders with weekly tournaments offering cash prizes up to $1,300."

Pros

- The intuitive platform works seamlessly with nearly all web browsers.

- Various international payment options are accessible.

- Free practice account

Cons

- Clients must deposit over $50,000 to be eligible for the highest returns.

- Binary options are exclusively offered for both traditional currencies and cryptocurrencies.

- CloseOption lacks regulation by a reputable financial authority.

Our Take On Videforex

"Videforex offers an intuitive platform for traders speculating on market trends with binary options, focusing on cryptocurrencies and stocks, with numerous assets available. TradingView charts support technical analysis. However, the absence of regulation poses significant risk."

Pros

- Traders can gain payouts up to 98% on over 150 assets using the broker's binary options, matching rivals like IQCent.

- Videforex is among the select brokers offering round-the-clock multilingual video support, ensuring thorough assistance for active traders.

- Videforex frequently holds trading contests, providing both novice and seasoned traders with practice opportunities and cash prizes. Traders can participate with position sizes starting as low as 1 cent.

Cons

- The lack of educational resources is a significant disadvantage for novice traders. In contrast, leading firms offer blogs, videos, and live trading sessions.

- Based on recent tests, the client terminal requires enhancements, as its widgets occasionally become slow and unresponsive, which could affect traders' experience.

- Videforex is not licensed by a reputable regulator, leaving traders with minimal or no protection, such as segregated client accounts.

Our Take On Grand Capital

"Grand Capital is a solid choice for traders adept with MetaTrader and passive investors seeking copy trading and LAMM options. However, its regulatory standing falls short compared to rivals."

Pros

- High leverage up to 1:500

- Trading competitions offering cash prizes

- Micro account for beginners

Cons

- Elevated spreads on certain assets

- Basic education and market research

- Minimal regulatory supervision.

Our Take On Raceoption

"RaceOption ranks highly among binary firms, offering diverse assets, including US tech stocks and unique cryptocurrencies. It caters well to intraday traders with 5-second turbo contracts and tick charts via TradingView charts. Frequent contests enhance the binary trading experience."

Pros

- RaceOption simplifies account funding with no-fee, near-instant deposits through bank cards and cryptocurrencies. Withdrawals are processed within one hour, guaranteed.

- Returns on well-known assets such as EUR/USD can go up to 95%, outperforming many other options based on our analysis and boosting potential gains. Additionally, the initial three trades incur no risk in Silver and Gold accounts.

- RaceOption is among the select few brokers providing 24/7 multilingual video chat. However, our interactions suggest that their agents require better understanding of trading and regulatory matters.

Cons

- Though still accessible for numerous retail investors, the $200 minimum deposit heightens the entry barrier. This is particularly notable when compared to Deriv and World Forex, which cater to budget-conscious traders.

- RaceOption, lacking both a demo account and educational resources, is not ideal for novice traders.

- RaceOption operates as an unregulated broker, offering high-risk trading with no investor compensation or legal remedies if trading or withdrawal problems arise.

Binary Options 101

Binary options are a type of derivative, whose value derives from and is dependent on the value of an underlying asset. You predict what the price of an underlying asset will be relative to a strike price at an expiration time.

To open a binary options contract, you must stake an initial investment. Typically, returns are between 70-90% of this stake, however, brokers sometimes offer a greater profit percentage depending on the asset and the type of trade.

There are several different types of standard binary options contracts:

- High/Low – Predict whether the asset’s price will be greater or lower than a strike price when a contract expires

- Touch/No-Touch – Predict whether the asset’s price will reach or reduce to a strike price before a contract expires

- Boundary – Predict if the price of an asset will be between or outside of a given range at the expiration time of a contract . This is also known as range or tunnel binary options.

Example

At 10 am, Lloyds stock (LLOY.L) is valued at 42.62p.

A broker is offering a 75% return on a high/low binary options trade, with an expiry of two hours.

At midday, LLOY.L is trading at 42.93p.

If you staked £20 to open a call (high) binary options contract with a strike price of 42.70p, the broker would return £35 (£20 stake + £15 profit).

If you had instead placed a put (or low) binary options trade with the same stake and strike price, you would have lost your initial investment (£20).

What Is Risk Management?

No trade is ever without risk. There is always a chance of something going wrong, resulting in a loss. This is particularly so with a derivative as you never actually own the asset. With spot trading (the purchase or sale of a stock, foreign currency, crypto or commodity for immediate delivery), even if the asset decreases in value, you still own the security and can wait for its value to increase again.

Risk management, as its name suggests, refers to the techniques or measures implemented by traders to control the potential losses in a trade. More specifically, risk management in trading binary options is important due to their ‘all or nothing’ nature, whereby any trades ending out-of-the-money (meaning an option has no intrinsic value) result in the loss of the entire stake.

Risk Vs Reward

One key aspect of binary options trading risk management is risk vs reward. Consider this analogy. A colleague asks you to lend them £10 with the promise of returning £15 a few days later. For a potential reward of £5, this may not seem worthwhile. However, if they instead promise to return £30, the proposition is a lot more appealing and you may be willing to accept the risk due to the higher reward. You can apply the same risk vs reward premise to binary options trading.

Calculation

The risk/reward ratio is calculated by taking the possible net profit from the trade and dividing it by the total potential loss. This tells you the ratio of the potential profit per GBP that you risk. In the above example, the risk/reward ratio for the first proposition is 1:0.5 (risk £1 for every £0.50 of profit). In the second, more favourable proposition, the risk/reward ratio is 1:2 (risk £1 for every £2 profit).

Let’s use an example with binary options:

A broker offers a binary options trade on Tesco (TSCO.L) with an 80% return. You stake £50 on a call (high) binary option. The potential returns for this trade are £90 (£50 stake + £40 profit). The risk/reward here is 1:0.8 (risk £1 for every £0.80 profit).

If instead, you use a hedging strategy with two binary options such that one will always be in the money (an option that presents a profit opportunity due to the relationship between the strike price and the prevailing market price of the underlying asset), the risk/reward ratio could be instead 1:8 (risk £1 for every £8 profit).

The benefit of calculating the risk/reward ratio is gaining a quantifiable measure of how risk management strategies can help you.

Why Binary Options Risk Management Is Important

If you were to speak to an experienced trader, they would likely say that risk management is one of the most important aspects of active investing. Without risk management strategies in place, you can easily find yourself losing the funds you have deposited into your brokerage account. While applying a binary options risk management strategy could reduce your total possible profit, the benefit you gain by reducing the total loss per trade often makes it worthwhile.

A report from The European Securities and Markets Authority (ESMA) on binary options trading found that, across three firms offering binary options to retail traders, less than 30% of customers saw positive cumulative returns. This demonstrates clearly how difficult it is to find sustained success when trading binary options. Importantly, it also highlights the need for a considered approach to risk management.

How To Manage Risk With Binary Options

There are many ways to introduce risk management in binary options trading, be it that the underlying asset is forex or commodities. Consider researching each method to find which is best suited to your trading style. Keep in mind that the following strategies will not necessarily remove all risks involved though they may help to reduce them.

Diversify Your Trading

By diversifying your portfolio, you can spread your capital across several smaller investments rather than staking large portions on one or two trades. By doing this, a single trade ending out-of-the-money will have a reduced impact on your portfolio. This is particularly important if you want to place binary options trades with highly volatile assets such as cryptocurrencies as there is a greater potential for sudden swings.

Hedging

Hedging is a popular day trading risk management strategy for binary options. It works by opening two binary options contracts on the same underlying asset, both of which expire at the same time. One is a call (high) and the other is a put (low) – a call option gives the holder the right to buy an asset and a put option gives the holder the right to sell the asset.

The key point here is that the strike price for the call contract is lower than the strike price of the put contract, in essence creating a boundary binary options trade. Given how these are structured, at least one contract will always end in-the-money and therefore reduce the total losses you could make.

Let’s consider an example of how hedging with binary options works:

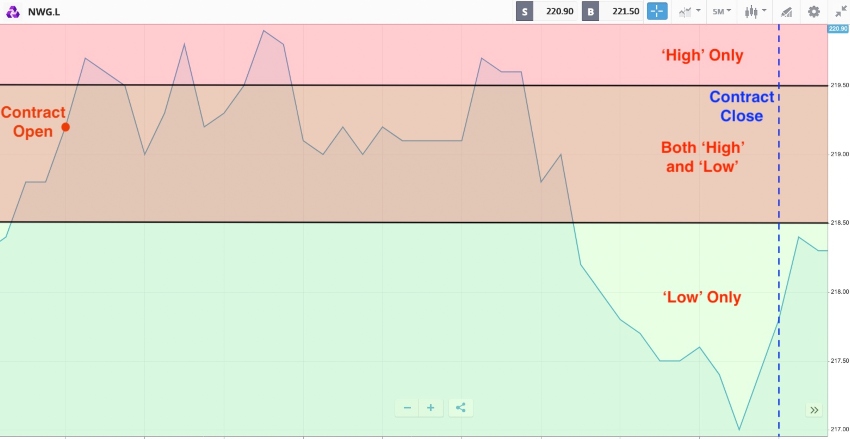

A broker offers a binary options contract on NatWest Group on the London Stock Exchange with a return of 80%. You stake £100 on a call with a strike price of 218.50p with an expiration time of 11am. As the price of NWG.L at 11am is below this strike price, you would lose the entire £100 stake. However, if you had also opened a put contract with a strike price of 219.50p, the net loss would be £20. This is because the put contract would end in-the-money and return a profit of £80, offsetting the £100 lost from the call contract.

If NWG.L was trading between 218.50p and 219.50p at 11am, both contracts would end in-the-money and you would have made a profit of £160.

The image below shows the NWG.L price history chart with indicators for how each contract could end in-the-money.

The One-Percent Rule

This method of managing risk is a strategy where you limit your investment on a single trade to only one percent of your funds. For example, if you have £1,000 deposited with your broker, you would only stake £10 on a binary options trade.

This is popular with day traders due to the high frequency they execute trades, however, it can still be used for longer-term trades such as swing trading.

The main benefit of this strategy is greater protection from losing large portions of your funds on a single trade that fails.

Emotions

This is not a strategy per se but a way to control and reduce unnecessary risk exposure. Being disciplined and not reacting emotionally to a potential trade, means you stick to your trading strategy and avoid rushing into a trade without completing thorough technical analysis and research.

To help with binary options risk management consider laying out your strategy and reviewing your performance by logging trades in books, journals or software such as Excel. If you regularly reflect on the trades you make and why you make them, you can learn to exclude excessively risky trades.

Bottom Line On Binary Options Risk Management

Learning how to include binary options risk management in your trading should be a priority when you register with a broker. It is important you understand the available tools and how they can be implemented into your trading activity. You could also try reading books, PDF guides and tutorials on risk management in trading binary options to boost your knowledge.

FAQs

What Is Binary Options Risk Management?

Binary options risk management aims to reduce the impact that a trade that ends out-of-the- money has on your portfolio. Using these measures can help to improve your returns over the long run. See our guide for more information.

How Will Binary Options Risk Management Impact My Profits?

Using binary options risk management techniques may reduce your potential profit per trade because you are trading in a more conservative manner. However, using these techniques could mean that you are more likely to see greater profits in the long run by reducing the magnitude or frequency of losses.

Which Is The Best Tool For Binary Options Risk Management?

The best solutions depends on the trader and their financial goals. Keep in mind that you do not need to limit yourself to only using one tool at a time. If you are very risk averse, you can implement several techniques at once to further reduce risk.

Where Can I Learn More About Binary Options Risk Management?

There are brokers and third-party education websites which provide binary options risk management support. You can find anything from training courses and tutorial videos to PDF guides and books which cover available methods. These guides will cover many strategies whether it is short-term, day trading or longer-term, swing trading.

Is There A Binary Options Risk Management Calculator?

You can find websites online which provide a calculator for determining the risk/reward ratio, however, it is also relatively easy to do the calculations yourself. Finding out how risk management strategies for binary options trading impact the risk/reward ratio does not even require an electronic calculator. Rather, you can just use pen and paper or software such as Excel.