Binary Options Moving Average Strategy

Solid, data-backed analysis is often key to building a winning binary options strategy. This tutorial will explain how to use a binary options moving average strategy, from indicators and charts to tactics and examples. We also review the pros and cons of trading binary options using moving average strategies.

Top Binary Options Brokers

Moving Average Strategies 101

Binary options moving average (MA) indicators use historical data to provide medium to long-term trend lines. Binary options investors can overlay these indicators onto charts to compare to live price data and generate trading signals.

Traders can customise moving average indicators to add or reduce price “lag”, which is the responsiveness to new price movements. Binary options traders can also use data from a shorter time frame to reduce lag and make an indicator more responsive to recent trends.

Conversely, using a longer-term data set, such as a 90-day or even 6 months moving average strategy, will smooth over short-term trends and give a longer-term view of an asset’s price movement.

Types Of Moving Average Indicators

Several binary options indicators use moving averages to model their signals. Here is the definition of four key variants:

Simple Moving Average

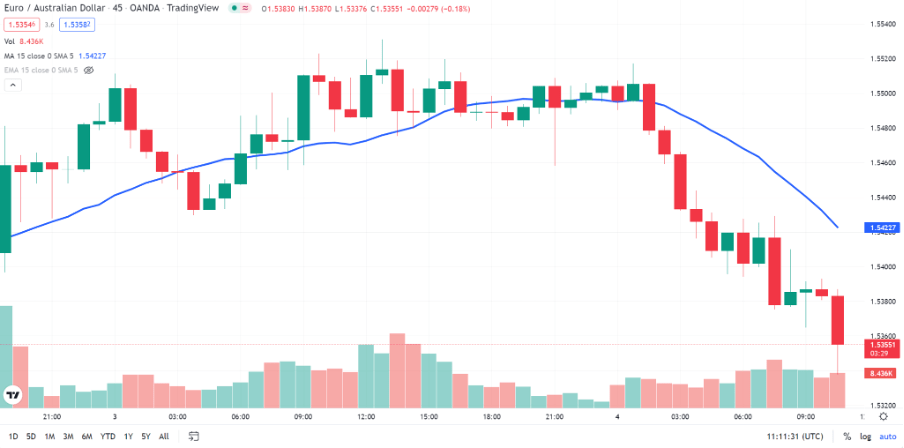

The binary options simple moving average, or SMA, indicator takes the mean value of an asset’s price over a specified period. These values are then overlaid onto a price graph using a line chart. Here is an example of a simple moving average line chart using a data range of 15 time periods:

Simple Moving Average

Due to the equal weighting of all collected price data, the SMA is often used to provide a longer-term trend analysis of an asset.

Exponential Moving Average

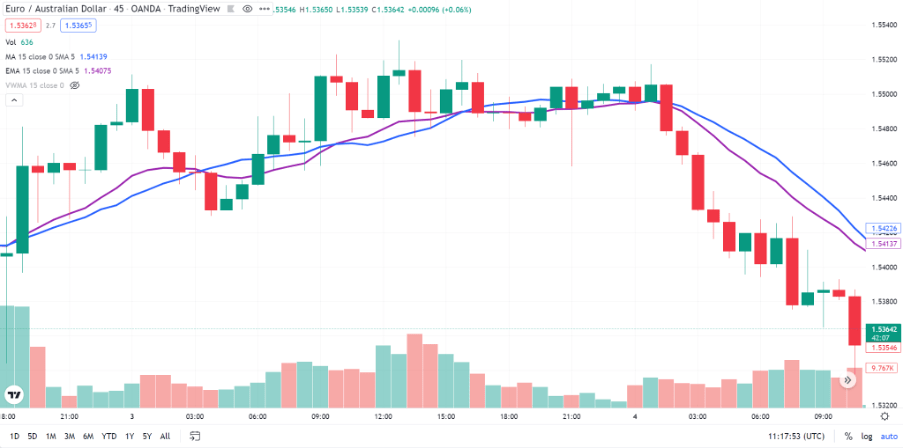

For traders who wish to focus on short-term momentum-based movements, an exponential moving average indicator (EMA) could enhance their binary options moving average strategy.

The EMA uses a more complex equation to plot its line graph, giving a greater weighting to more recent closing quotes. This can be seen in the chart below, where the exponential moving average (shown as a purple line) responds more quickly to price changes than the simple moving average (SMA), represented by the blue line.

Exponential Moving Average

Volume-Weighted Moving Average

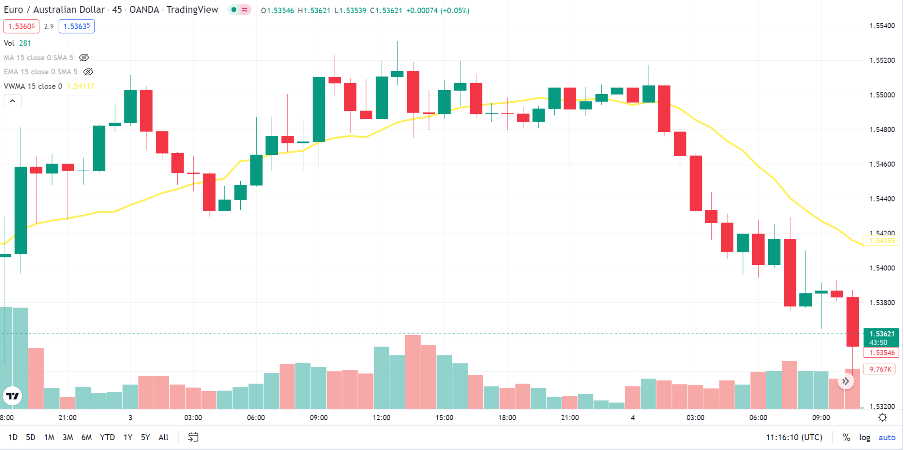

The volume-weighted moving average indicator, or VWMA, is similar to the exponential moving average in that the indicator has a greater weighting to closing prices based on a separate variable.

With the VWMA indicator, price intervals with higher volume are given greater weighting towards the trend line to produce a better picture of more significant price trends– i.e. those with substantial capital and volume behind them.

In the graph below, a volume-weighted moving average line with a data range of 15 time periods is shown in yellow:

Volume-Weighted Moving Average

Moving Average Convergence/Divergence Indicator

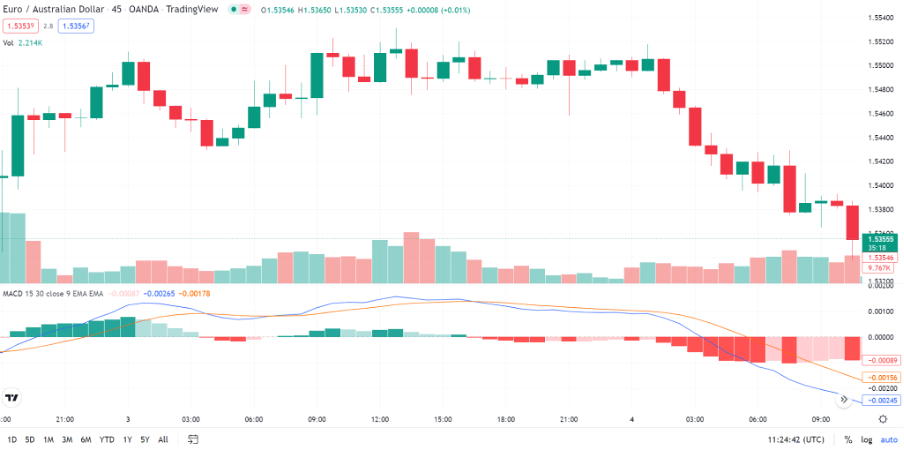

Our final binary options moving average strategy indicator is the moving average convergence/divergence (MACD) indicator.

Though its data is drawn from two exponential moving average (EMA) calculations, this indicator differs from the previous three in that it is not an overlay but a separate chart, known as a histogram.

The bars of the histogram graph shows the difference between the MACD line (in blue) and the signal line (in orange). The indicator gives binary options traders a buy, or long trade signal when the histogram is above the zero line, portrayed by a green bar. Conversely, the MACD confers a sell, or short trade signal when red bars dip below the zero line.

The moving average convergence/divergence indicator is a complex indicator capable of producing additional signals.

Moving Average Convergence/Divergence Indicator

Using A Moving Average Strategy In Binary Options

With moving average indicators, the algorithms are designed to take into account longer-term trends that play out over several days, weeks or even months. As a result, these values are not as sensitive to short-term price movements.

Due to this, these indicators are not always the best strategy for short-term day trading products, such as binary options. However, the data put into moving average calculations can be tweaked with a shorter time frame leading to the development of better signals for short-term binaries.

In addition, the altered model of the exponential moving average (EMA) indicator is more sensitive to short-term price development. The EMA often represents a better analysis option for binary options investors than SMA or VWMA strategies.

A moving average indicator can be part of an effective binary options strategy using these altered systems or when combined with other, more momentum-based indicators.

Examples & Use Cases

To help illustrate a binary options moving average strategy in action, our experts have outlined three examples.

For our first use case, Trader A is using the volume-weighted moving average (VWMA) indicator on a stock, Apple (AAPL).

They have been following the stock over the last few hours. As the dip in price has been substantially below the 20-period volume-weighted moving average, Trader A believes that a rebound is on its way.

Despite the upwards price movement from 18:14, Trader A is waiting for the VWMA line to return to a positive gradient before opening a position to ensure the move is backed by significant trading volume.

At 18:22, the gradient returns to a positive value and they open a binary options contract going long on APPL using a 5-minute binary options strategy.

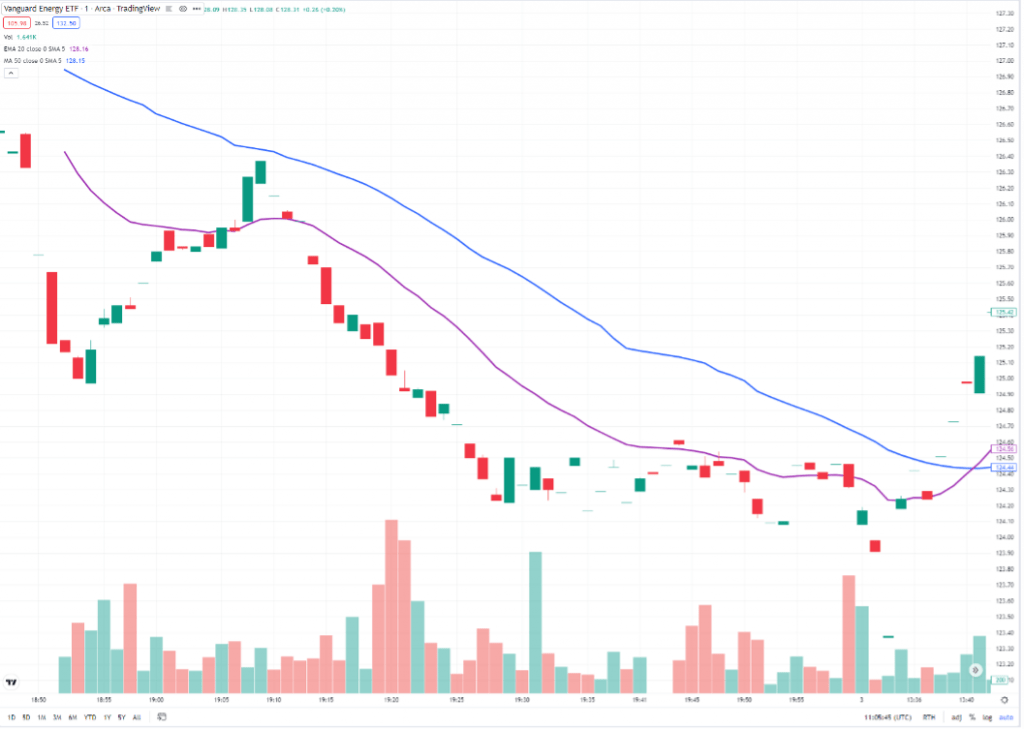

Trader B uses an alternative implementation of a binary options moving average strategy, combining the simple moving average (SMA) and exponential moving average (EMA) indicators. The SMA uses a data range of 50 time periods, while the EMA draws from the last 20.

The combination of two moving average indicators with short- and long-term outlooks can yield a signal known as a “golden cross, ” indicating a strong bullish sentiment.

At 13:41, they see the short-term EMA cross over the long-term SMA, which could constitute a buy signal. As a result, Trader B opens a long binary options contract using a 2-minute binary options strategy.

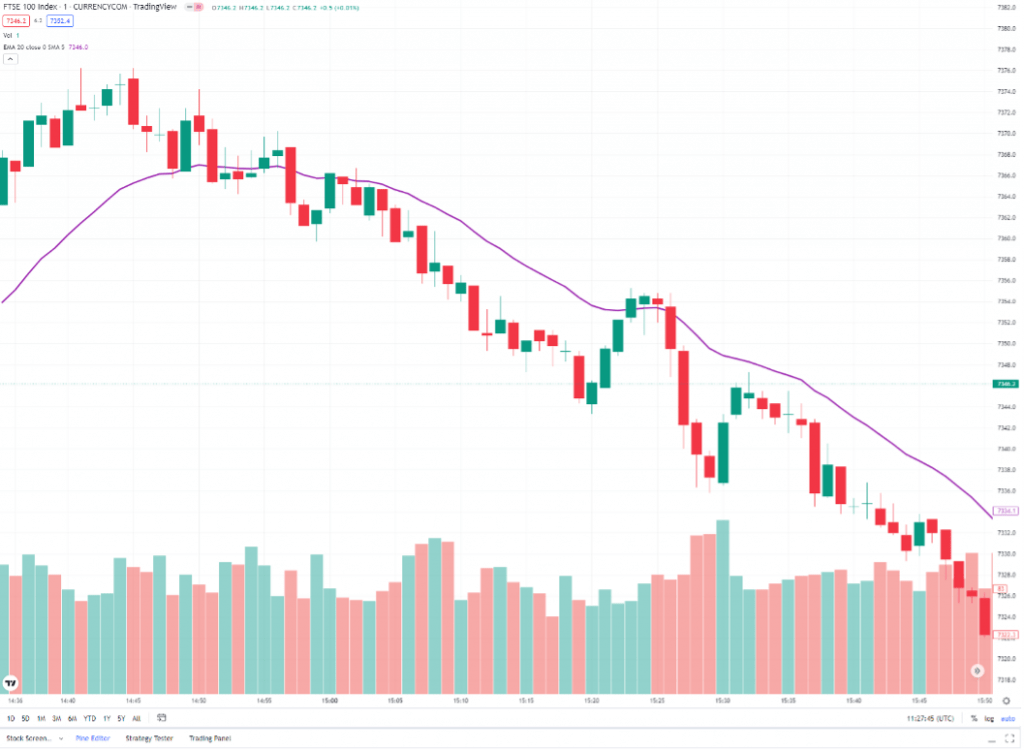

Trader C has been following the UK economy in the last few weeks. They know that the FTSE 100 index correlates with the UK’s overall economic outlook and the Pound Sterling.

They use an exponential moving average (EMA) indicator to follow the trend, ready to open a short binary options position on the FTSE 100. As the downward trend is only increasing, shown by the steepening negative gradient in the EMA, Trader C opens a short binary options contract at 15:50 on the UK100.

Availability

Most binary options brokers’ proprietary platforms and popular third-party programs, such as MT4, MT5 and NinjaTrader, support moving average indicators and strategies. Our tested brokers and groups offered SMA, EMA, VWMA and MACD indicators and several more advanced moving average options.

As a result, whether you wish to use a simple, web-based platform or download more complex software, a binary options moving average strategy is practical for most traders.

Pros Of The Binary Options Moving Average Strategy

- Simple to read – Binary options moving average indicators such as the SMA, EMA and VMA are easy to read, with no need for a lengthy course.

- Accessible – The comprehensive support for moving average indicators across binary options platforms makes this strategy easy to implement.

- Combine well – Moving average indicators combine well with each other, such as in a golden cross signal, as well as with other indicators.

- Customisable – Traders can tweak the periods on moving options indicators depending on whether they’re using a short-term, medium-term or long-term binary options strategy.

Cons Of The Binary Options Moving Average Strategy

- Weak signals – When using simple moving average indicators alone, their signals do not always predict future price movements particularly accurately.

- Long-term focus – Despite their customisability, moving average indicators are designed more for long-term investing and are not best suited to ultra-short-term strategies and trading products, such as binary options.

- Lack of detail – Simple binary options moving average indicators provide little more than trend lines, with no additional information or signals for analysis.

Strategies

We have also put together a handful of strategy examples. You can take inspiration from these ideas to do your own research and develop a winning binary options moving average strategy.

Trend Strategy

Online trading on trends is a straightforward form of speculation. In this binary options strategy, investors use moving average indicators such as the SMA, EMA or VWMA to compare live price data with trend lines.

A price following this trend closely suggests that it will continue to do so in the short term. In contrast, prices that deviate from moving average trends without news or border market movements may return to their price trend in the medium to long term.

This strategy is not the most accurate when trading binary options, as moving averages are generated from long-term past prices. The EMA, which gives greater weighting to more recent price data in its model, can help with this.

Support & Resistance Strategy

Another way to use daily indicators in a binary options moving average strategy is as support or resistance levels. This is possible when a moving average line consistently stays either below or above an asset price and attempts of the trading price to break out past this line are unsuccessful.

Support and resistance trading is often a medium to long-term binary options strategy, as short-term breakouts beyond a support or resistance level are expected. Investors can also consider using binary options variants with this strategy, such as boundary or one-touch contracts.

Crossover Strategy

A moving average crossover strategy provides binary options traders with actionable signals regarding the price of an asset.

A crossover involves using a short-term and long-term time frame moving average indicator, as Trader B did in our earlier example. Traders can use any combination of moving average indicators in this model, though using an EMA line for the short-term indicator is particularly effective.

Investors have a buy signal when a short-term line rises above a long-term moving average. Conversely, a short-term moving average line dropping below a long-term indicator is a sell signal.

The moving average crossover strategy is well suited to binary options as it indicates short-term movements. As a result, traders may want to use a one, two or five-minute binary options strategy after seeing this signal. Furthermore, investors may wish to double up on existing positions when seeing this indicator.

Overbought & Oversold Strategy

Our final binary options moving average strategy uses the MACD indicator to signal when a stock or asset is overbought or oversold. Traders can use these potential reversal signals to place short-to medium-term binary options contracts on an asset.

Due to the inclusion of a histogram on MACD indicators, this pattern is relatively easy to spot. Long candles that extend far above or below the zero line can suggest overbuying or overselling. These signals indicate that investors may want to open a position in the opposite direction pending a correction.

How To Set up A Binary Options Moving Average Strategy

Setting up a binary options moving average strategy is relatively straightforward:

Broker Sign-in

First up, sign into your preferred binary options trading account. If it’s your first time using moving average indicators, we suggest heading to a demo account and learning the nuances of different signals before staking real funds.

Adding The Indicator

Navigate to your preferred trading instrument and set up your chart’s time frame to encapsulate all the data you need.

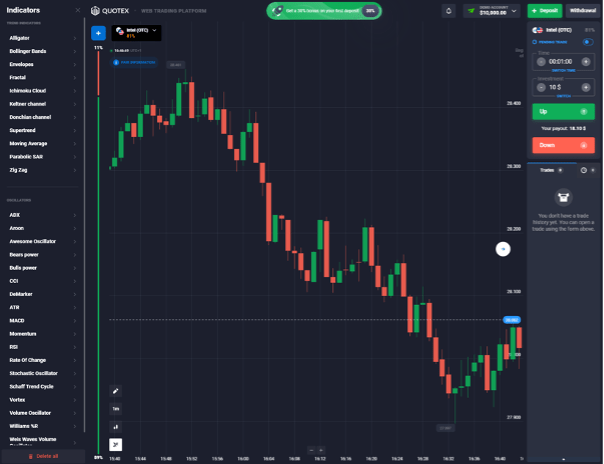

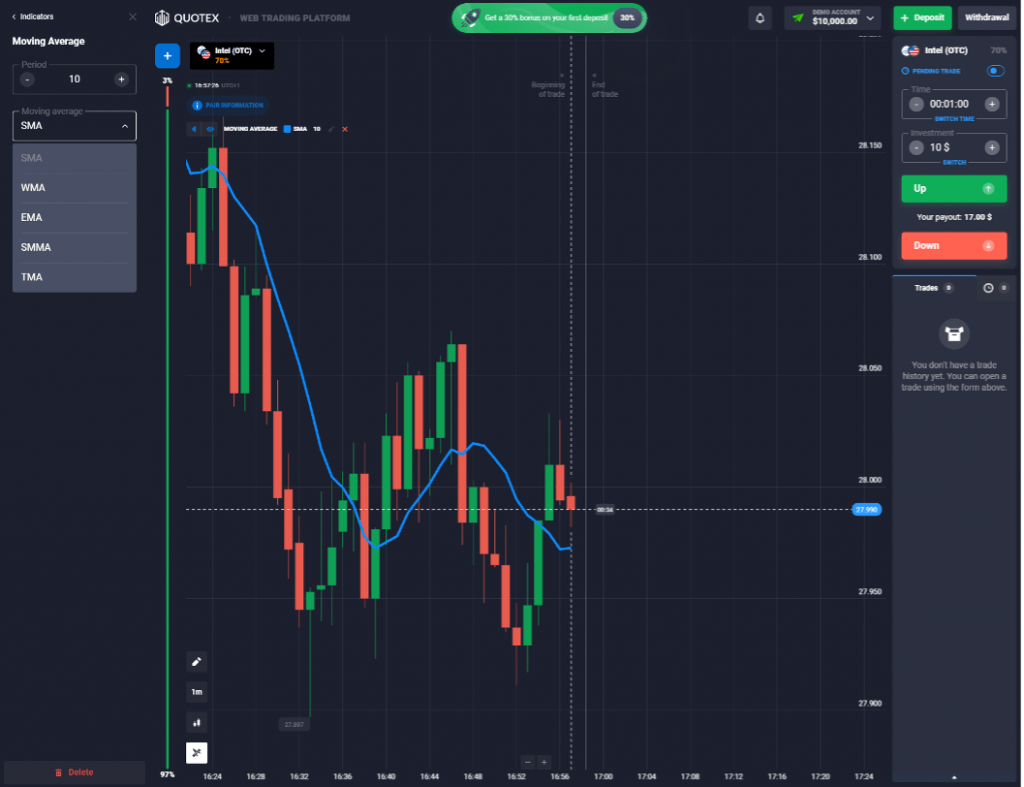

Now, you can add your chosen moving average indicator(s). In the example below, the indicators section is located at the bottom left of the screen. This button is often easy to find on proprietary platforms such as this.

Quotex MA Setup

Investors that wish to combine two or more moving average indicators can do this now. While the SMA, EMA and VWMA are all contained within this indicator, traders that wish to use the moving average convergence/divergence indicator need to select “MACD” instead.

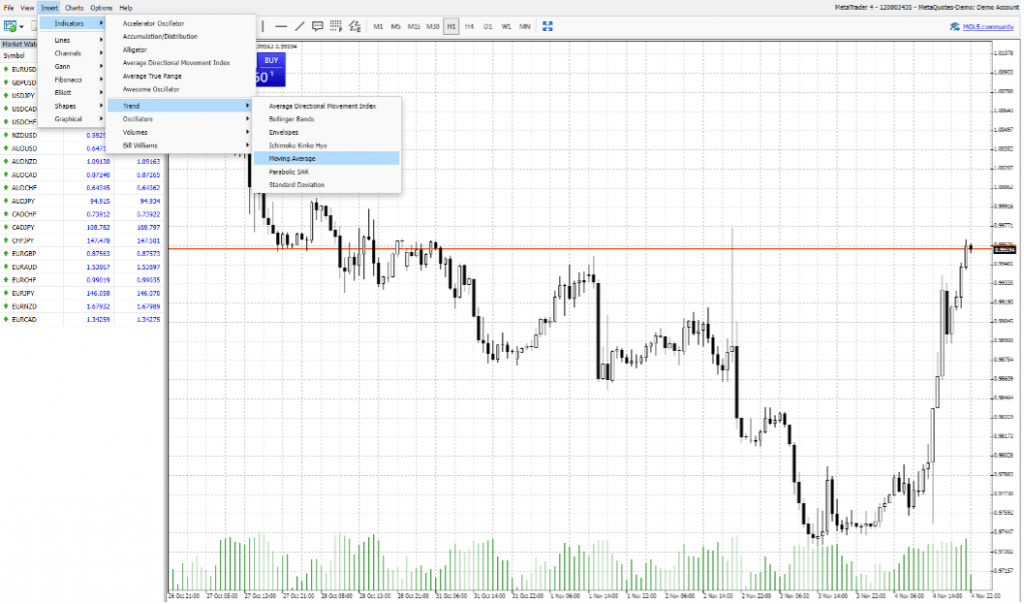

More complex platforms, such as MT4 or MT5, require investors to take a slightly different route. Traders need to select “Insert” from the top menu, then “Indicators”, “Trend”, and “Moving Average”.

Choose Your Values

Now is the time to tweak the type of moving average you wish to use and the time periods from which your moving average model is drawn. Depending on whether you’re operating for a short, medium or long-term binary options moving average strategy, you may wish to alter the time period.

Monitor The Markets

Now you are all set up. All that is left to do is monitor the markets for your chosen pattern. Whether you are looking for a strong trend, crossover or support level emergence, keep your eyes on the market until you spot an actionable signal.

Place A Trade

Once you have spotted a trading opportunity, use the binary options platform to place a trade. Select a contract length depending on your specific approach and method, as no time period can be used for all binary options moving average strategies.

Bottom Line On Trading Binaries Using A MA Strategy

In summary, using a moving average strategy for binary options has its perks. The approach is simple, easy to read and well-supported by proprietary and third-party download software alike. However, these indicators are not ready-made winning binary options strategies, as signals of the more simple indicators are often weak and have a long-term focus. This said, with the right alterations and combination of indicators, this strategy can be helpful for binary options traders.

Head to our list of the best binary options brokers to get started.

FAQs

Can I Use A Binary Options Moving Average Strategy On Stocks?

Many binary options providers offer stock speculation as well as forex, indices, crypto and other markets. Investors can use moving average strategies on any of these assets, including equities.

Is Moving Average A Proven Binary Options Strategy?

Under the right circumstances, using a moving average strategy can give investors valuable information about an asset’s trends, buying levels, price resistance and more.

Can I Change A Binary Options Moving Average Strategy Algorithm?

Investors can tweak the data range and indicator type of a moving average indicator to make it better suited for binary options trading.

What If My Binary Options Moving Average Strategy Is Not Working?

If a binary options moving average strategy is not working, we suggest combining several indicators or using a different contract length to let long-term trends play out. You can also turn to a binary options demo account to refine your approach.

Is There A Binary Options Moving Average Strategy Simulator?

Most binary options platforms offer a risk-free demo account where investors can sign up and practice trading with demo funds.