Best Low Minimum Deposit Binary Options Brokers 2026

Binary options is a simple and exciting yet risky trading vehicle due to its ‘all or nothing’ approach. Using low minimum deposit binary options brokers enables traders to reduce that risk by starting small.

Dig into our selection of the top low deposit binary options brokers – tested by UK traders.

Best Low Minimum Deposit Binary Options Brokers

Safety Comparison

Compare how safe the Best Low Minimum Deposit Binary Options Brokers 2026 are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|

Payments Comparison

Compare which popular payment methods the Best Low Minimum Deposit Binary Options Brokers 2026 support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|

Mobile Trading Comparison

How good are the Best Low Minimum Deposit Binary Options Brokers 2026 at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|

Beginners Comparison

Are the Best Low Minimum Deposit Binary Options Brokers 2026 good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|

Advanced Trading Comparison

Do the Best Low Minimum Deposit Binary Options Brokers 2026 offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the Best Low Minimum Deposit Binary Options Brokers 2026.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|

How Investing.co.uk Chose The Lowest Deposit Binary Brokers

Our team investigated and recorded each binary broker’s minimum deposit requirement, in some cases confirming the figure directly with customer support to ensure accuracy. We then tested the platforms first-hand, reviewing usability, tools, and payouts.

Finally, we ranked the brokers by overall ratings – factoring in our test results along with verified data points such as deposit thresholds, payout percentages, and bonus terms – to highlight the best options for binary traders seeking the lowest entry point.

What To Look For In A Broker

Fees

One of the main reasons why many traders lose money when investing in binary options is because the payouts are usually smaller than losses, so you should look for a binary broker with high payouts.

Let’s say you make a losing binary options trade. The ‘all or nothing’ nature of binary options means you lose 100% of your money. Your next trade of equal size is successful, however, because the broker has to take their cut, the profit is only 90% of your position size.

In other words, despite having one winning trade and one losing trade with an equal investment, you end up with a 10% loss. Therefore, when comparing low minimum deposit binary options brokers, you need to be sure the payout is as high as possible.

I always make sure I check other fees, such as deposit and withdrawal charges. Some may charge a flat fee or a percentage of the amount you are adding to or taking out of your account, while others charge inactivity fees and currency conversion costs if using GBP. All of these add up to a significant slice of your profits, so be aware.

- World Forex has one of the most favourable pricing structures for binary options traders, with payouts up to 100% of the stake on American contracts and up to 85% on European. With no deposit charges and a minimum initial deposit of just $1, it’s one of the most affordable brokers to access.

Underlying Markets

Binary options can be traded on a range of underlying markets such as forex, commodities, indices, stocks and crypto. The wider the range of markets offered by particular low minimum deposit binary options brokers, the better, as this allows you to diversify your portfolio more and manage risk.

It also means you can focus on the markets of which you have more knowledge, whether that’s the FTSE 100 or the GBP/USD currency pair.

- A $10 initial deposit to Grand Capital brings access to trading on a wide range of binary options assets including forex, stocks, cryptocurrencies and commodities as well as CFDs.

Choice of Binary Options

Although many traders stick with high/low binary options for simplicity (where you speculate on whether the price will be trading higher or lower than the current market price at the expiry time), some venture into more complex contracts.

These may include boundary binary options (used to forecast whether an asset price will remain within a predetermined range) and ladder binary options (where the strikes are preset and you choose whether it will close higher or lower than the chosen strikes).

Trading Platform

Most binary options brokers now have their own in-house trading platforms. There’s only a few binary options brokers that use MT4.

Whatever trading platform you choose, ensure it has the range of indicators, timeframes and charts that you need to undertake technical analysis. Some trading platforms may also allow for automated trading, helping to remove the emotion from your trading activity.

- AZA Forex‘s proprietary Mobius Platform is a streamlined option tailor made for binary options trading that comes with built-in tools and indicators to rival big names like MT4.

Demo Account

As outlined above, binary options is ultimately a risky endeavour so you should have an effective trading strategy in place before using real money.

Binary demo accounts are a wise way to test your trading strategies on real markets without risking your capital. Those new to the binary options market will also benefit from demo accounts.

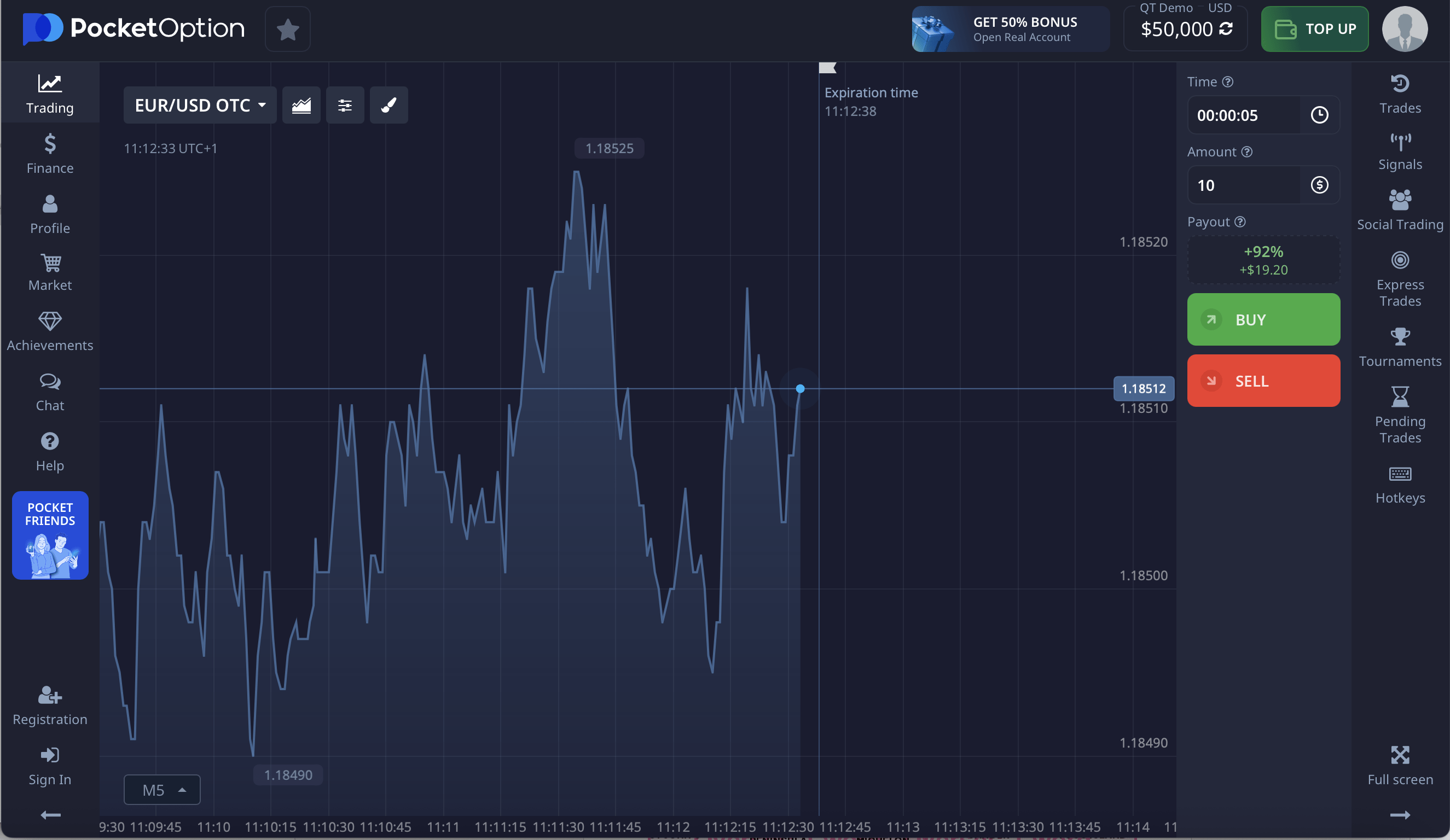

Pocket Option offers a browser-based demo account

- Capitalcore‘s unlimited-duration demo account allows traders to practice and refine their strategies with virtual funds for as long as they need, unlike many brokers that only provide this service for a few months.

Promotions

Some regulators, such as the FCA, have cracked down on various promotions advertised by brokers, but you’ll find that many low minimum deposit binary options platforms do still offer deposit bonuses and other incentives to entice traders.

Investigate which brokers have the most attractive offers, and whether they are permitted, but note that there will usually be terms and conditions attached.

- Pocket Option regularly offers bonuses and incentives to traders, such as matching 50% of initial deposits or providing a ‘no-deposit’ incentive to new forex traders.

Regulation & Trust

Some regulators have restricted the sale of binary options, so you need to take special care when selecting a provider to ensure it is reliable.

For example, in March 2019, the UK FCA banned the selling, marketing and distributing of binary options to retail consumers. This means that most low deposit binary brokers will be registered offshore and may not offer the same protections.

Look for binary trading platforms that have a long track record in the industry without reports of scams or fraudulent behaviour and which serve large numbers of clients as signs of reliability.

Customer Support

If there is a technical issue with your account or you have a query about a particular trade, you’ll need to easily access customer service advisors.

Ideally, you should seek brokers who have responsive online, live chat features, in addition to phone and email contacts.

You can usually test a broker’s customer service yourself before signing up by contacting its live support team or opening a ticket online – we do. Ask questions about the deposit process and any dispute resolution system to gauge how knowledgeable and helpful the staff are.

- Close Option‘s customer service channels including phone, live chat and email are open 24/7, meaning traders of crypto and other 24-hour assets can reach support quickly and conveniently.

What Is A Minimum Deposit?

A minimum deposit is the amount a trader must pay into their live account before they begin trading. Some binary brokers offer minimum deposits of around £5, others in excess of £1,000.

Importantly, a minimum deposit is not the same as a minimum trade size. For example, brokers may require a minimum deposit of £100 but a minimum trade size of £.10. The minimum deposit is how much traders need to put into their accounts. The minimum trade size is how much is needed to open a position. Traders need to be aware of both.

The minimum deposit normally covers the broker’s costs of opening the trading account for the customer. Higher minimum deposits may result in customers opening larger positions, leading to higher profits for the broker.

However, they can also deter potential customers, which is why the expansion of the retail trading market is associated with the rise of brokers offering low minimum deposit binary options.

Account Types

Most binary options brokers have different minimum deposit amounts, depending on the account chosen.

For example, there may be a Bronze, Silver and Gold account structure, as there is with RaceOption. Its Bronze account has a minimum deposit of $250, the Silver account $1,000, and the Gold account $3,000. So, some binary options brokers have both high and low minimum deposits.

Accounts with higher minimum deposits usually come with more features and benefits, such as a personal account manager or ‘risk-free’ trades.

Traders looking for a simple but cost-effective trading experience would be best suited to accounts with fewer features and a lower minimum deposit.

Benefits of Low Minimum Deposit Binary Options Brokers

Start Small

Binary options are notoriously risky. Although able traders can profit from them, 70-90% will typically lose money. The reason for this may in part be because some traders jump into the binary options market without a robust strategy and lose a lot of money in a short space of time.

Binary options brokers with high minimum deposits may encourage this less cautious approach. In contrast, low minimum deposit binary options brokers encourage a more conservative position, where traders start small and increase their risk based on strategies that appear to work.

Diversification

Some traders like to spread their capital across multiple trading platforms or brokers but high minimum deposits make this more difficult. Choosing low minimum deposit binary options brokers allows traders to spread the risk and purchasing power across different brokers.

Accessibility

Binary options brokers who stipulate high minimum deposit amounts, particularly those above £250, may be making their platform less accessible to many retail traders. Some retail traders have relatively modest funds so the existence of low minimum deposit binary options brokers allows these clients to invest in the same markets as more established traders.

Often, it is not the minimum trade size that acts as a barrier but rather the minimum deposit.

Drawbacks of Low Minimum Deposit Binary Options Brokers

Fewer Features

Low minimum deposit binary options brokers sometimes offer fewer features and tools. For example, they may have a smaller deposit bonus. This is because it is often not viable for the broker to offer expensive features and promotions if the trader is only depositing relatively small amounts.

Scams

Beware of scams from online brokers who promise large returns. There are reputable low deposit binary firms but make sure to differentiate these from other brokerages who entice traders in but then charge extortionate fees or do not honour their obligations.

If something looks too good to be true, it probably is and it is always good practice to ensure that the broker is regulated and trustworthy.

Bottom Line

Low minimum deposit binary options brokers make trading accessible to a wider range of investors and can help retail clients manage risk by encouraging them to start with smaller positions.

The good news is that many binary options brokers give clients a choice of account types so that they can find the balance of the low minimum deposits they require, with their preference of account features.

FAQ

Why Do Binary Options Brokers Have Minimum Deposits?

Online brokers incur costs to open and maintain accounts on behalf of their clients. Minimum deposits help to cover these costs by ensuring traders invest more money into their accounts and – hopefully – open more or take larger positions.

Does A Low Minimum Deposit Indicate That The Binary Options Broker Is Untrustworthy?

Not necessarily. Although some binary options brokers offering extremely low minimum deposits may be scams, there are genuine binary options brokerages with low entry requirements.

The key to ensuring a broker is trustworthy is by checking who it is regulated by and also by reading reviews and ratings.