2017 Mid-Year Recap, Part 2: The Euro, S&P500 & European Equities.

We’ve reached the half-way point of 2017. Let’s take a look at a few markets and see how they’ve performed, and where they may head from here. Part 2 takes a brief overview of the Euro, the S&P500 and European equities.

The Euro.

Back from the dead.

The Euro has made a significant turnaround this year. The political concerns have been put to bed for the time being, and data out of the Eurozone has been strong and improving. The Euro has show resilience in the face of Draghi and the ECB talking down inflation forecasts this week.

I am looking at Euro crosses in the FX market, especially against fundamentally weaker countries. Buying the dips seems like a solid play at this stage.

Now, structural risks still exist and they haven’t really been addressed. The can continues to be kicked down the road, however that method does seem to be working at this stage.

S&P500.

You have to be brave to short US equities.

Once again, US equities have put in a stellar performance this year. Some commentators are calling market tops. Perhaps Friday’s move in the NASDAQ is the start of something bigger, perhaps not.

It’s impossible to say when the bull market will end. Any correction is met with buying right now. It’s definitely difficult to find value stocks at current levels, but I’m not brave enough to call a top. The bears have been run over for too many years now. Sure, it may correct this year as rising rates finally put a dampener on the economy. There’s always political risks, and Trump. But even with those risks, US equity exposure is still attractive.

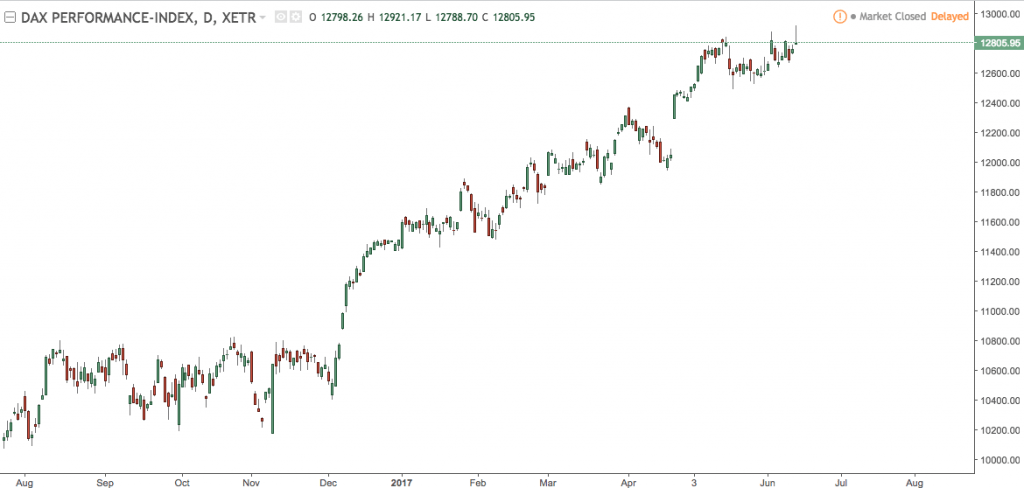

European Equities.

This is the story of 2017.

Equity markets across the Eurozone are looking very good, and have great growth potential relative to the US from a valuation perspective.

There’s definitely still downside risk, however. The threat of terrorism is very real across Europe, and many of the problems that gave the right their fuel still exist. For the time being, however, these have taken a break and things are looking rather rosy. The DAX is making record highs, and other markets are looking very good.

As always, do your own research and manage your risk appropriately.