Stop Loss Order

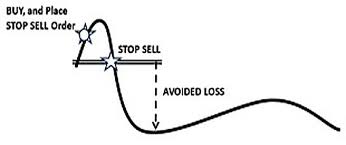

Stop loss orders are one of the order types that traders can execute on the financial markets. The name “stop loss” is self-explanatory: stop the losses before they get out of hand.

What is a stop loss? A stop loss order is an order or instruction given to the broker/dealer to automatically close a trade that has gone contrary to the trader’s position at a particular price level with the aim of preventing further losses if the adverse trade conditions persist.

Brokers With Stop Loss Orders

-

When we evaluated Pepperstone's MT4, execution was extremely swift with spreads starting at 0.1 pips, plus a $7 per lot commission on Razor accounts. The Smart Trader Tools plugin provided real benefits, including sentiment, mini-terminal, and trade management tools. EA automation operated seamlessly, and the mobile version replicated desktop performance in live trades.

Instruments Regulator Platforms CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB Pepperstone Trading Platform, MT4, MT5, cTrader, TradingView, AutoChartist Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:500 (Pro) -

When we tested IG’s MT4, execution was stable but a bit slower than their proprietary platform. Spreads averaged 0.6 pips on major pairs without commissions, supporting micro lots and dependable EA automation. Although MT4 did not include IG's exclusive tools, it provided robust mobile functionality and a wide asset range, including CFDs and forex.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM, JFSA Web, L2 Dealer, MT4, TradingView, AutoChartist, TradingCentral, ProRealTime Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:222 (Pro) -

Utilising Trade Nation’s MT4 provided the complete charting suite, familiar indicators, and drawing tools. EA automation functioned efficiently; the mobile MT4 was reliable. Although MT4 offers fewer instruments than the TN-Trader platform, copy-trading is available through the "TradeCopier" add-on.

Instruments Regulator Platforms Forex, CFDs, Indices, Shares, Commodities, Futures, Bonds, Spread Betting, Cryptos (Bahamas Entity Only) FCA, ASIC, FSCA, SCB, FSA TN Trader, MT4 Min. Deposit Min. Trade Leverage $0 0.1 Lots 1:500 (entity dependent) -

During testing, Eightcap’s MT4 offered swift execution and spreads starting at 0.0 pips on the Raw account. The commission was $3.50 per side for each standard lot, with an all-in cost of roughly 0.76 pips. The platform supports micro lots and provides smooth EA automation. The mobile MT4 was fast, and Capitalise.ai integration allowed for algorithmic trading without coding.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities ASIC, FCA, CySEC, SCB MT4, MT5, TradingView Min. Deposit Min. Trade Leverage £100 0.01 Lots 1:30 -

In our tests, FOREX.com's MT4 excelled with quick execution and a comprehensive set of custom indicators. The platform supports micro lots, EAs automation, and mobile trading. Integrated Trading Central and real-time news add-ons ensured seamless strategy testing and analysis.

Instruments Regulator Platforms Forex, CFDs, Stock CFDs, Indices, Commodities, Futures, Options, Crypto NFA, CFTC, CIRO, FCA, CYSEC, ASIC, SFC, FSA, MAS, CIMA WebTrader, Mobile, MT4, MT5, TradingView Min. Deposit Min. Trade Leverage $100 0.01 Lots 1:30 -

In our tests, Vantage's MT4 showed excellent performance, offering spreads as low as 0.0 pips on Raw/ECN and about 1.1 pips on Standard STP, with ECN commissions starting at around $3 per lot side and none for STP. Micro-lot trading and comprehensive EA automation were effective, complemented by robust mobile MT4 functionality.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Spread betting FCA, ASIC, FSCA, VFSC ProTrader, MT4, MT5, TradingView, DupliTrade Min. Deposit Min. Trade Leverage $50 0.01 Lots 1:30 -

Tickmill is a worldwide broker regulated by respected authorities like CySEC and FCA. It has attracted hundreds of thousands of traders, executing over 530 million trades. Its edge lies in sophisticated tools, informative resources, and competitive fees.

Instruments Regulator Platforms Forex, CFDs, stocks, indices, commodities, cryptocurrencies, futures, options, bonds FCA, CySEC, FSA, DFSA, FSCA Tickmill Webtrader, MT4, MT5, TradingView Min. Deposit Min. Trade Leverage $100 0.01 Lots 1:1000

Safety Comparison

Compare how safe the Stop Loss Order are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✘ | ✔ | |

| IG | ✔ | ✔ | ✔ | ✔ | |

| Trade Nation | ✔ | ✔ | ✘ | ✔ | |

| Eightcap | ✔ | ✔ | ✘ | ✔ | |

| Forex.com | ✔ | ✔ | ✘ | ✔ | |

| Vantage FX | ✔ | ✔ | ✘ | ✔ | |

| Tickmill | ✔ | ✘ | ✘ | ✔ |

Payments Comparison

Compare which popular payment methods the Stop Loss Order support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| IG | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ |

| Trade Nation | ✔ | ✔ | ✔ | ✘ | ✔ | ✘ |

| Eightcap | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| Forex.com | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| Vantage FX | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| Tickmill | ✔ | ✘ | ✘ | ✔ | ✔ | ✘ |

Mobile Trading Comparison

How good are the Stop Loss Order at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| Pepperstone | iOS & Android | ✘ | ||

| IG | iOS & Android | ✔ | ||

| Trade Nation | iOS & Android | ✘ | ||

| Eightcap | iOS & Android | ✘ | ||

| Forex.com | iOS & Android | ✘ | ||

| Vantage FX | iOS & Android | ✘ | ||

| Tickmill | ✔ | ✘ |

Beginners Comparison

Are the Stop Loss Order good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|---|---|---|---|---|

| Pepperstone | ✔ | $0 | 0.01 Lots | ||

| IG | ✔ | $0 | 0.01 Lots | ||

| Trade Nation | ✔ | $0 | 0.1 Lots | ||

| Eightcap | ✔ | £100 | 0.01 Lots | ||

| Forex.com | ✔ | $100 | 0.01 Lots | ||

| Vantage FX | ✔ | $50 | 0.01 Lots | ||

| Tickmill | ✔ | $100 | 0.01 Lots |

Advanced Trading Comparison

Do the Stop Loss Order offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Pepperstone | Expert Advisors (EAs) on MetaTrader | ✔ | 1:30 (Retail), 1:500 (Pro) | ✔ | ✘ | ✔ | ✘ |

| IG | Expert Advisors (EAs) on MetaTrader, build your own on ProRealTime | ✔ | 1:30 (Retail), 1:222 (Pro) | ✔ | ✔ | ✔ | ✔ |

| Trade Nation | Expert Advisors (EAs) on MetaTrader | ✘ | 1:500 (entity dependent) | ✘ | ✘ | ✘ | ✘ |

| Eightcap | TradingView Bots | ✘ | 1:30 | ✔ | ✘ | ✔ | ✘ |

| Forex.com | Expert Advisors (EAs) on MetaTrader | ✘ | 1:30 | ✔ | ✔ | ✔ | ✘ |

| Vantage FX | Myfxbook AutoTrade, Expert Advisors (EAs) on MetaTrader | ✘ | 1:30 | ✔ | ✘ | ✘ | ✘ |

| Tickmill | ✔ | ✘ | 1:1000 | ✘ | ✘ | ✘ | ✘ |

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the Stop Loss Order.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|---|---|---|---|---|---|---|---|---|

| Pepperstone | |||||||||

| IG | |||||||||

| Trade Nation | |||||||||

| Eightcap | |||||||||

| Forex.com | |||||||||

| Vantage FX | |||||||||

| Tickmill |

Our Take On Pepperstone

"Pepperstone is a premier trading platform, providing tight spreads, swift execution, and sophisticated charting tools for seasoned traders. Beginners benefit from no minimum deposit, comprehensive learning materials, and outstanding 24/7 support."

Pros

- Pepperstone presents itself as an economical choice for traders, offering spreads as low as 0.0 in its Razor account. The Active Trader programme provides rebates up to 30% on indices and commodities, plus $3 per lot on forex.

- In recent years, Pepperstone has significantly enhanced the deposit and withdrawal process. By 2025, clients can use Apple Pay and Google Pay, while 2024 saw the introduction of PIX and SPEI for customers in Brazil and Mexico.

- Pepperstone offers rapid execution speeds of approximately 30ms, enabling swift order processing and execution, making it ideal for traders.

Cons

- Although its market range has improved, its crypto offerings remain limited compared to brokers specialising in this sector, lacking real coin investment options.

- Pepperstone doesn't offer cTrader Copy, a favoured feature for copying trades found in the cTrader platform, which is available on other platforms such as IC Markets. However, Pepperstone has launched its own user-friendly copy trading app.

- Pepperstone's demo accounts remain active for 60 days. This duration might be insufficient to fully explore the platforms and trial various trading strategies.

Our Take On IG

"IG offers a complete package: an easy-to-use web platform, top-tier beginner education, enhanced charting via TradingView, up-to-date data, and strong trade execution for seasoned traders."

Pros

- The IG app provides an excellent mobile trading experience with an intuitive design, earning it the Runner Up position in our 'Best Trading App' award.

- IG excels with its diverse instruments, offering stocks, forex, indices, commodities, and cryptocurrencies. Additionally, it provides US-listed futures, options, and an AI Index, ensuring varied diversification opportunities.

- The web-based platform supports traders at every level, offering advanced charting tools and real-time market data vital for trading. Additionally, IG now includes TradingView integration.

Cons

- In the UK and EU, negative balance protection is available. However, US clients lack account protection and guaranteed stop losses.

- Beginners may find IG's fees complicated, as they vary depending on the trades or services. This could cause confusion and unexpected costs.

- IG has ended its swap-free account, diminishing its attractiveness to Islamic traders.

Our Take On Trade Nation

"Trade Nation is ideal for novice traders seeking diverse markets on an easy-to-use platform. It offers no minimum deposit, complimentary funding options, and robust educational resources."

Pros

- Access a comprehensive selection of investments through leveraged CFDs, enabling both long and short strategies.

- Trade Nation, a highly regarded and well-regulated broker, was formerly known as Core Spreads.

- Global traders can use accounts in various currencies.

Cons

- Reduced legal safeguards with an offshore entity.

Our Take On Eightcap

"Eightcap excels for traders, offering diverse charting platforms, educational Labs, and AI tools. With over 120 crypto CFDs, it stands out in crypto trading and has won our 'Best Crypto Broker' award twice consecutively."

Pros

- In 2026, Eightcap integrated TradeLocker, distinguishing itself as the premier regulated broker for TradeLocker. It continues to offer ultra-fast execution and competitive fees for active traders on the charting platform.

- Eightcap excels with a suite of advanced trading tools, such as MT4 and MT5, and has recently joined the 100-million-user social trading network, TradingView.

- In 2021, Eightcap enhanced its lineup, now providing an extensive range of cryptocurrency CFDs. It offers crypto/fiat and crypto/crypto pairs, along with crypto indices for comprehensive market exposure.

Cons

- Despite a helpful array of educational guides and e-books in Labs, Eightcap lags behind IG's extensive resources for aspiring traders. IG boasts a dedicated Academy app and features 18 diverse course categories.

- The demo account is available for 30 days, after which it requires a request for extension. This is less convenient than XM's offering, which provides an unlimited demo mode.

- Eightcap must enhance its range of over 800 instruments to rival top competitors like Blackbull Markets, which offers 26,000+ assets, especially improving its limited commodities selection.

Our Take On Forex.com

"FOREX.com excels in serving traders of all levels, offering more than 80 currency pairs, spreads starting at 0.0 pips, and competitive commissions. Its robust charting platforms provide over 100 technical indicators and comprehensive research tools."

Pros

- The in-house Web Trader remains a top-tier platform for budding traders, featuring an elegant design and more than 80 technical indicators for market analysis.

- With more than two decades of expertise, strong regulatory governance, and numerous accolades, including a second-place finish in our 'Best Forex Broker' awards, FOREX.com is globally renowned as a reliable trading platform.

- FOREX.com provides top-tier forex rates beginning at 0.0 pips, along with attractive cashback rebates up to 15% for dedicated traders.

Cons

- FOREX.com's MT4 platform provides around 600 instruments, a notable reduction compared to the more than 5,500 options on its other platforms.

- Demo accounts are typically limited to 90 days, hindering effective strategy testing.

- US clients are not protected against negative balances, which means you could end up owing more than your initial deposit.

Our Take On Vantage FX

"Vantage is an ideal choice for CFD traders looking for a well-regulated broker with access to the dependable MetaTrader platforms. With a swift sign-up process and a minimum deposit of $50, starting trading is simple and fast."

Pros

- Vantage upholds a high trust score through its solid reputation, backed by premier regulation from the FCA and ASIC.

- Vantage addresses the needs of passive investors through user-friendly social trading on ZuluTrade and Myfxbook.

- ECN accounts offer competitive terms, featuring spreads starting at 0.0 pips and a commission of $1.50 per trade side.

Cons

- It's unfortunate that some clients must register with the offshore firm, which provides reduced regulatory safeguards.

- To access optimal trading conditions, a substantial deposit of $10,000 is required. This includes a commission of $1.50 per transaction per side.

- Based on tests, average execution speeds of 100ms to 250ms are slower compared to other options.

Our Take On Tickmill

"Tickmill stands out for traders, particularly with the Raw account, offering nearly no pip spreads and exceptionally swift order execution."

Pros

- Tickmill holds licences from regulators such as the FCA and CySEC, ensuring tangible advantages. Client funds are segregated in secure accounts, and negative balance protection is in place. This guarantees you won't owe more than your deposit, offering reassurance during market fluctuations.

- With the Raw Spread account, spreads are remarkably tight, occasionally reaching zero pips, complemented by a clear per-trade commission. This arrangement minimises trading costs, offering a crucial benefit for frequent trades and eliminating hidden fees that erode profits.

- Drawing from our trading experience, Tickmill consistently executes orders rapidly—averaging around 59 milliseconds—with minimal slippage or requotes. This reliability ensures traders can trust their entry and exit prices without delay, safeguarding against potential costs in fast markets.

Cons

- If you prefer cTrader's interface and advanced order options, you won't find them here. Tickmill utilises MetaTrader 4 and 5, TradingView, and its own platform but lacks cTrader. This may hinder those who depend on cTrader's features or tools like cTrader Copy.

- Tickmill's demo accounts exclude certain platforms, including its proprietary one, complicating strategy practice. This limitation poses challenges for testing skills comprehensively, particularly with newer Tickmill tools, before engaging in live trading.

- Tickmill targets forex pairs, select stock CFDs, indices, and limited commodities. If you prefer trading across diverse asset classes like cryptocurrencies or a wider array of stocks, options here are restricted versus brokers offering thousands of instruments.

Common Mistakes Traders Make in Setting Stops

When choosing a price level to set a stop loss, are there any special considerations or are stop loss levels just set arbitrarily at the trader’s discretion? It is very unfortunate that many retail traders do not know the principles that guide the setting of a stop loss level, and the so-called forex trainers or seminar resource persons who run all the “intensive” seminars we see being advertised on the street corners and on the internet are not making things easier.

When choosing a price level to set a stop loss, are there any special considerations or are stop loss levels just set arbitrarily at the trader’s discretion? It is very unfortunate that many retail traders do not know the principles that guide the setting of a stop loss level, and the so-called forex trainers or seminar resource persons who run all the “intensive” seminars we see being advertised on the street corners and on the internet are not making things easier.

There is hardly a retail trader we come across who has been able to answer this question satisfactorily. Many believe that setting a stop loss is an arbitrary event. Worse still, there are a few who actually advocate not setting a stop loss so as to give the trade room to breathe. The first point of view supposes that all currency pairs and trades act alike and so there is nothing to consider when setting a stop loss level. The second standpoint presupposes that trades are predictable and in so far as the trader is on top of the action, there is no need for a stop loss.

Both standpoints are fundamentally flawed and will present major problems for the trader. The first standpoint is flawed because all currencies do not behave alike. Some have a greater intraday range and have more volatility than other currencies. So assigning the same stop loss or not considering the inherent characteristics of the currencies themselves when deciding to set stops will lead to either stops being so tight that the choke the trade, or to loose that they do not exert the necessary controls on any losses that may occur. The second standpoint assumes that the trader will always be on his computer to monitor open positions (which is impossible), or that the markets can always stay predictable without any sudden adverse market events occurring (which is also not the case). The end result is that adopting both trade standpoints when it comes to setting stop loss levels will eventually lead to catastrophic results.

Principles for Setting a Stop Loss

Setting a stop loss is a careful business which the trader should do with much consideration. There are factors to be considered when setting a stop loss. Some of these are:

1) Intraday price range of the currency asset.

2) Volatility index of the asset.

3) Presence or absence of any points of resistance or support within the immediate price area.

4) Time frame being traded.

5) News releases for the day/time period in view.

6) Trader’s margin.

The intraday price range of an asset is very important when considering where to set a stop loss. For a currency with a 100 pip intraday price range, a stop loss of about 50 pips is ok, depending on when the trade was executed and how close the trade is to key levels of support and resistance. However, you cannot set a 50 pip stop loss for an exotic currency pair with a 1000 pip price range, or for a commodity asset like gold that could sometimes move as much as 5,000 pips in a day. So currencies with lower ranges will require smaller stops, and larger stops must be used for currencies with larger price ranges. Similarly, a trader who intends to close an open position the same day it was opened would not need large stops when compared with another trader who used a daily chart for his analysis and is looking to keep the position open for weeks at a time.

Another consideration is the trader’s margin. It is foolhardy trying to trade assets with large moves on a small margin. The margin will restrict the trader and force him to use tight stops to choke the trade.

It is good practice to always consider where the key levels of support and resistance are located before opening a position. If a price level is in between a key support and resistance, the trader may be forced to use a larger stop to accommodate any drawdowns without closing the trade. Sometimes it is better to use pending orders that will allow the trade to gravitate towards a key level, and then tighter stops can be used knowing that prices will probably be held back by the key levels before triggering a stop loss.

Another factor to be considered is the volatility index of the currency pair to be traded. For instance, the GBP/JPY currency pair is known to be an extremely volatile currency pair, with a spread of at least 8 pips (or $80 on a standard lot position). It has a tendency of bouncing around before finally deciding where it is going. If a trader is trading this pair on an account margin in the lower range of thousands, then the trader must be very careful when setting stops. Too tight a stop will cause the trade to be closed prematurely. There is nothing more frustrating than seeing a trade closed out prematurely, only for the position to eventually end up in the predicted direction of the trade.

Finally, it is always noteworthy considering news trades when setting stop loss levels. This is especially important for traders who are trading medium to long term. A news trade can cause a position that has probably been in profits for a few days to give every dime of profit up in a few short minutes.

Setting a stop loss is serious business, and if traders pay attention to the details that have been discussed above, they will be able to make more informed decisions when giving the stop loss instructions to their broker.