5 Alternatives To ISAs For Optimal Investment Growth

Dive into our selection of the 5 best alternatives to individual savings accounts (ISAs). We weigh the pros and cons of each investment option, considering the differing needs of UK investors.

Top 5 ISA Alternatives

- Self-Invested Personal Pensions (SIPPs)

- General Investment Accounts

- Regular Savings Accounts

- Fixed-Rate Bonds

- Premium Bonds

ISAs In Decline

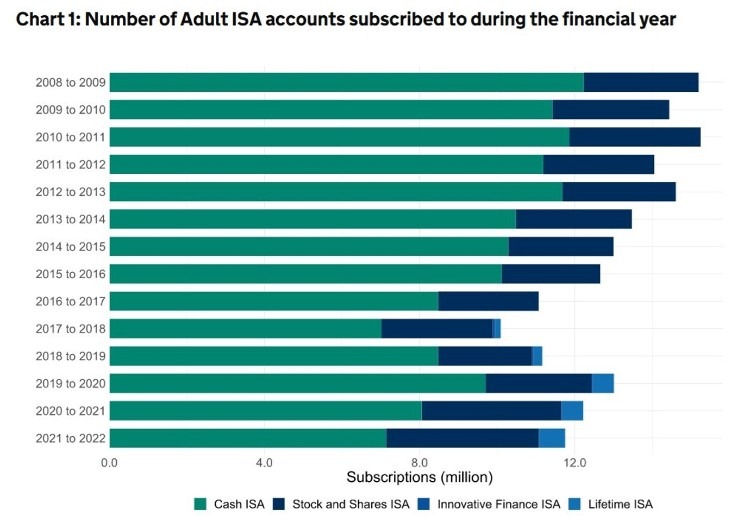

Individual savings accounts (ISAs) are highly popular investment vehicles in the UK. Figures from HM Revenue and Customs (HMRC) show that there were 11.8 million adult ISA accounts in the 2021/2022 tax year.

However, while the number of Stocks and Shares ISA accounts continues to grow strongly – up 345,000 in the aforementioned tax year – the total number of ISA accounts is in a steady downtrend.

Source: HM Revenue and Customs

This is being driven by a fall in the number of people using Cash ISAs. Indeed, the number of these savings accounts that were subscribed to plummeted by 920,000 in 2021/2022.

These popular ‘tax wrappers’ allow individuals to save or invest up to £20,000 each tax year. This can make them effective products to build long-term wealth without having the taxman chip away at your gains.

So why are they declining in popularity?

One reason is that Cash ISAs rarely offer the best interest rates out there. And the Personal Savings Allowance – which permits basic rate taxpayers to earn as much as £1,000 in annual interest before the taxman gets involved – is enough for millions of people, rendering the need for a tax wrapper redundant.

The tax advantages of ISAs are also offset by the better rates that are offered on many other savings products. And finally, Cash ISAs in recent years have been offering interest rates lower than the rate of inflation, meaning that the real value of peoples’ money has been eroding.

We believe that ISAs still have their place in today’s saving and investing landscape. But individuals can also select from a wide range of other financial products to try and build wealth. The one you select will depend on issues like how much you have to save and invest, and how easily you can access your cash.

Let’s talk through five of the most popular ISA alternatives…

1. Self-Invested Personal Pensions (SIPPs)

SIPPs are another popular product for individuals seeking protection from the UK taxman. Investment gains are not subject to capital gains tax (CGT) and income tax.

Individuals receive another tasty benefit in the form of tax relief. For basic rate taxpayers this is set at 20%, meaning that someone who puts £400 in their SIPP will receive a £100 government top-up to take the total to £500.

Higher-rate taxpayers can claim back even more tax relief (40% in total). Additional rate taxpayers, meanwhile, can enjoy relief of 45%. They would claim this back from HMRC later on via self-assessment.

To be eligible for this tax relief, however, an individual can only invest the equivalent of their annual salary. Those without employment can inject £3,600 into their SIPP per annum.

I like the high £60,000 allowance that SIPP investors receive each year. This trebles what ISA subscribers currently enjoy, though this includes contributions from you and your employer (if you have one).

As with ISAs, these products give investors the choice to invest in stocks, funds, or investment trusts, hold their money in cash savings, or select a combination of these. A big advantage is that, unlike Cash ISAs and Stocks & Shares ISAs, SIPPs can allow users to carry forward previous years’ unused allowances.

Result: someone with unused allowances could potentially make a whopping £180,000 contribution in the 2023/2024 tax year (annual allowances stood at £40,000 before the 2023/2024 tax year).

SIPPs allow individuals to access their retirement savings from the age of 55, though this threshold rises to 57 from 2028. Remember that ISA users are not subject to such age stipulations.

Tip: SIPPs can be good options for people who have multiple pension pots and wish to bring them together under one umbrella.

IG is one of our top-rated financial services providers that offers SIPPs. It stands out amongst the pack for its terrific platform, support and educational resources.

Visit IG2. General Investment Accounts

General investment accounts (GIAs) allow you to invest in the same sorts of assets as a Stocks & Shares ISA or SIPP.

The good news is that, unlike one of those tax wrappers, investors are not limited by annual contribution limits. If you want to invest £20,001 in any one tax year, for instance, you clearly have an advantage over an ISA subscriber.

The bad news is that this flexibility comes at a price in the form of – you guessed it – tax costs. CGT is applicable for any amount above £6,000, at which point basic rate taxpayers would pay at a rate of 10% and higher rate individuals/additional rate taxpayers at 20%.

Furthermore, income tax is also payable on dividends if total shareholder payouts exceed £1,000 in a tax year.

Due to their tax benefits, I think a good strategy is for eligible investors to use an ISA and/or SIPP and max out their annual allowances and deploy any extra cash they wish to invest using a GIA.

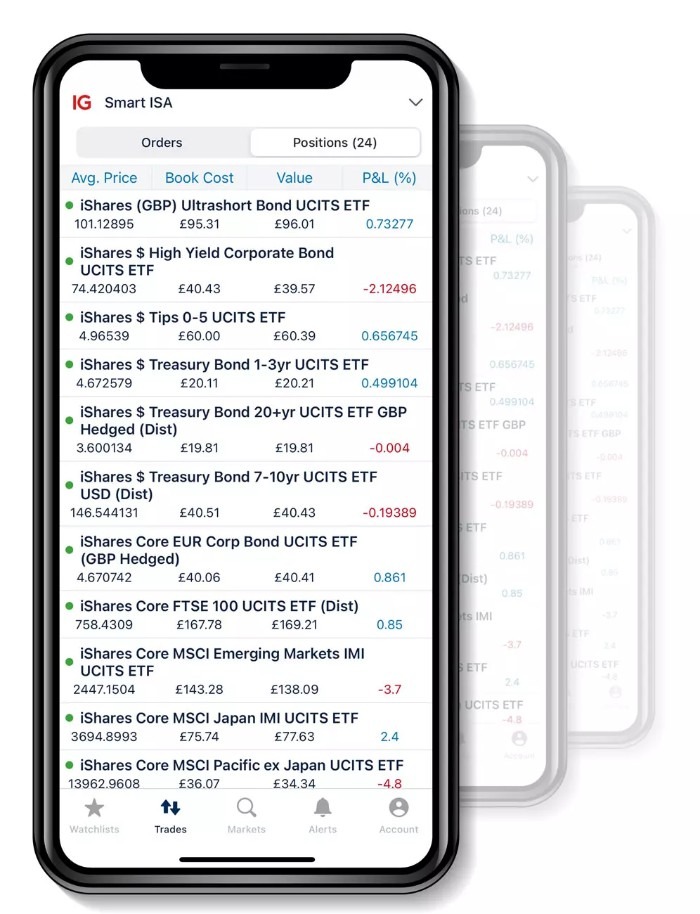

Year after year, IG excels as one of the best UK brokers for general investment accounts. You can deal in US and UK shares with a £0 commission and £3 commission, respectively. Thousands of stocks and ETFs are available on the broker’s user-friendly platform and app.

Visit IG

Source: IG Index

3. Regular Savings Accounts

Savers who can deposit regularly may wish to use savings accounts. They tend to offer some of the best interest rates on the market.

As with GIAs, these products do not provide the tax benefits of ISAs and SIPPs. A basic rate taxpayer has to ‘write a cheque’ to HMRC to cover any interest they earn above £1,000. For a higher rate individual this figure halves to £500.

On top of this, depositors are typically required to save a minimum amount each and every month, though there may be maximum limits. Bear in mind, though, that some accounts require as little as £10 to be deposited each month to stay operational.

There may also be restrictions on withdrawals.

On the plus side, these stipulations mean that regular savings accounts offer better interest rates than easy-access savings accounts. The lack of tax benefits means they also pay better compared with ISAs.

The savings market has been more competitive than ever in recent years, so I would suggest shopping around to get a really great rate.

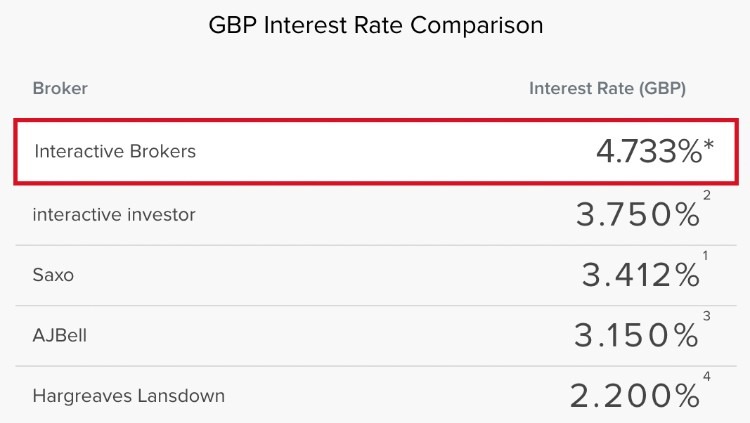

I would also consider firms like Interactive Brokers. They offer high interest on uninvested cash, as well as the opportunity to invest in 155 markets from 33 countries.

Visit Interactive Brokers

Source: Interactive Brokers

4. Fixed-Rate Bonds

Governments and companies that need to raise money can do this by issuing bonds. Investors who purchase these financial assets are in essence agreeing to loan this entity money for a fixed period.

These products are also known as fixed-income securities, and their owners will receive the entirety of their initial investment back at the end of the term in addition to regular interest payments over the term. These payouts are known as coupons.

The interest rate on fixed-term bonds remains unchanged throughout the product’s life. I believe this makes them better options than some savings accounts, where the rate may fluctuate in response to Bank of England monetary policy.

Bonds can come with a wide variety of different terms. The longer someone locks their money up for, the higher interest rate they can expect to receive. This reflects the threat of rising inflation that could erode returns; interest rate risk; and the danger associated with holding a financial asset for longer.

Credit rating agencies like Moody’s and Fitch provide assessments of the creditworthiness of bond issuers. Investors can also get better rates of interest from bonds issued by governments and businesses with lower ratings, which again reflects the higher level of risk they are accepting.

I believe risk-averse investors should probably avoid bonds with ratings below BBB- and Baa3. These fixed-income securities are considered “non-investment grade” or “junk” bonds.

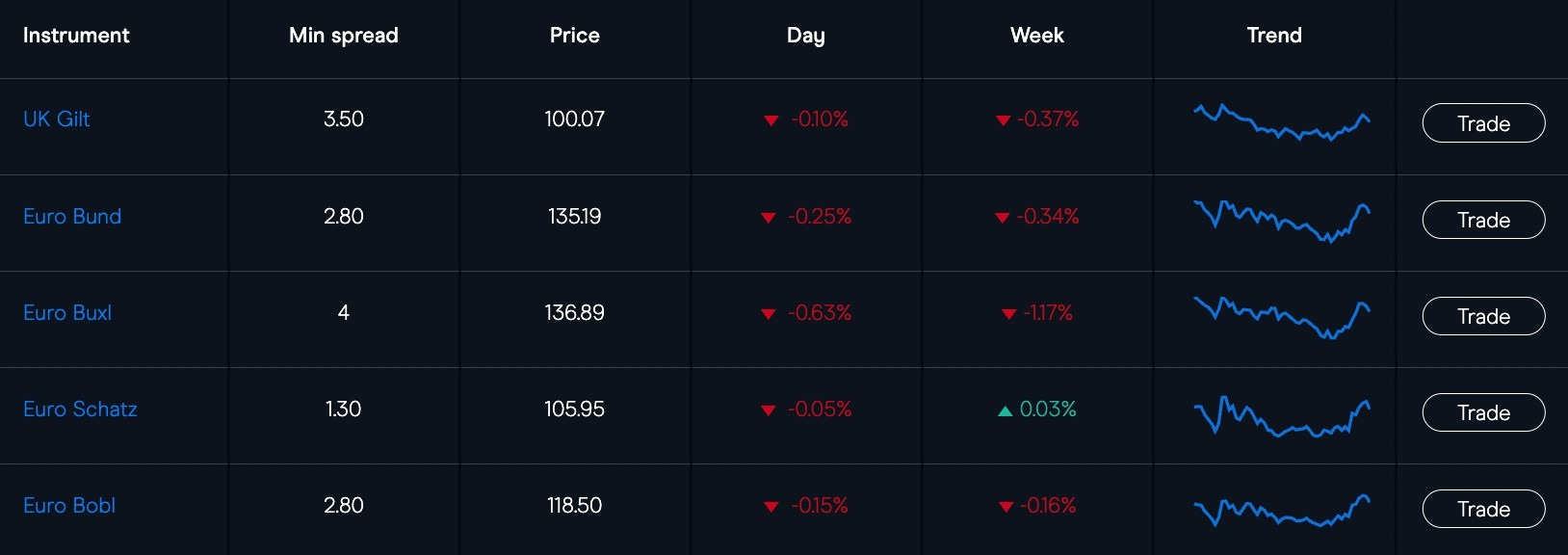

CMC Markets continues to offer a compelling option for bond traders in the UK. You can speculate on the price of 50+ bonds using derivatives like CFDs or spread betting to go long or short without buying the underlying bond.

Visit CMC Markets

Source: CMC Markets

5. Premium Bonds

In the context of this guide to ISA alternatives, premium bonds are undoubtedly the ‘wild card’ of the pack. They don’t provide interest or dividends. Nor can they generate capital gains.

Instead, these financial products provide UK savers with the opportunity to earn tax-free prizes from monthly prize draws. These lotteries are carried out by National Savings and Investments (NS&I), which is essentially a government-run bank.

The prize checker page on the Premium Bonds website. Source: National Savings and Investments.

Individuals can invest between £25 and £50,000 in Premium Bonds, and for every £1 invested, they receive a bond number which provides a chance of winning a prize. So the more money you save, the greater a chance you have of winning.

The odds of winning with Premium Bonds stand at 21,000 to 1 for every £1 bond.

Prizes range from £25 all the way up to £1 million. Winnings can be paid out in cash or reinvested into more bonds.

Article Sources

Commentary for Annual Savings Statistics: June 2023 – HM Revenue and Customs

Investment Accounts – IG Index

What is a General Investment Account? Aviva

Interest Rates on Uninvested Cash – Interactive Brokers