FXDD Review 2025

FXDD has been a significant player in the forex and CFD space since its inception in 2002 and continues to offer a competitive trading environment 20 years later. Clients can choose between several account types with the option of the MT4 and MT5 trading platforms, resulting in a service designed to fit every trader. This 2025 FXDD broker review covers the crucial elements of the company’s services, such as its withdrawal and deposit methods, regulation, demo account support and contact details. Read on to discover whether you should register with this firm today.

About FXDD

In 2002, FXDD was founded in New York by CEO Joseph Botkier, who has grown the company over the last 20 years into a globally recognised broker. Now based at a head office address in Malta, the firm provides the MetaTrader 4 and 5 platforms to forex and CFD traders.

The company runs a Mauritius-based brokerage with higher leverage and trading bonuses to international clients. However, EU and UK traders are restricted to the Malta Financial Services Authority-regulated entity.

The Malta-based broker complies with ESMA regulations regarding leverage rates and bonuses, alongside providing additional financial protection to its clients.

Markets

FXDD offers four asset classes: forex, indices, commodities and US stocks. All financials are traded via CFDs, with alternative instruments like equity investing and binary options not supported.

Forex

With almost 70 forex markets available for speculation, FXDD clients are generously provided for in terms of currency pairs. Major, minor and exotic pairs are all well represented, with instruments as varied as GBP/AUD and USD/DKK.

The spreads on forex markets are variable for both standard and ECN account holders, starting from as low as 0.2 pips.

Indices

Twelve indices are offered by the firm from exchanges in the US, Europe and Australia. While the US dollar index is supported, the VIX volatility index is a popular product that is unfortunately unavailable.

Commodities

FXDD provides a solid selection of metals and energies CFDs, allowing investors to speculate on some of the most volatile global commodity markets. Gold and silver are supported in both USD and EUR pair forms, while UK and US oil markets are also available. However, soft commodity instruments such as cotton and cocoa are notably absent.

Stocks

More than 40 of the most significant US exchange-listed equities are supported, with stocks such as Apple, Amazon and Tesla all provided for CFD speculation.

Leverage

Due to ESMA regulations, the maximum leverage rates facilitated by the broker are heavily restricted. FXDD margin levels may be familiar to experienced traders as they mirror the structure of leverage constraints imposed by the FCA.

The maximum leverage available on each asset type is as follows:

- 1:30 on major forex pairs

- 1:20 on minor forex markets, major indices and gold

- 1:10 on minor indices and all other commodities

- 1:5 on stocks and up to 1:5 on exotic currency pairs

Account Types

FXDD provides a standard and ECN account to clients, giving users the option of either zero-commission investing or raw spreads. As a no-dealing-desk (NDD) broker, the company does not take positions against clients, all trades are instead passed on to liquidity providers.

The standard account utilises the STP execution model to provide commission-free trading and low slippage on entry orders. However, clients with a standard account cannot trade through the WebTrader platform.

An ECN account provides tight spreads of as low as 0.2 pips in exchange for commissions. A fee of around £2.50 per side per lot is levied on major forex pairs, rising to £4 per side per lot on other tradable assets excluding stocks (more on this later).

The ECN and Standard accounts are both available as swap-free Islamic variants, allowing clients to partake in halal financial speculation. However, a fixed maintenance charge is added to these accounts.

Demo Account

Prospective clients can preview a broker’s forex and CFD trading conditions using a demo account and practise new strategies and EAs. FXDD offers demo account access to both its MT4 and MT5 platforms, allowing users to paper trade in a risk-free, simulated environment.

Trading Platforms

FXDD investors have two options for trading platforms: MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

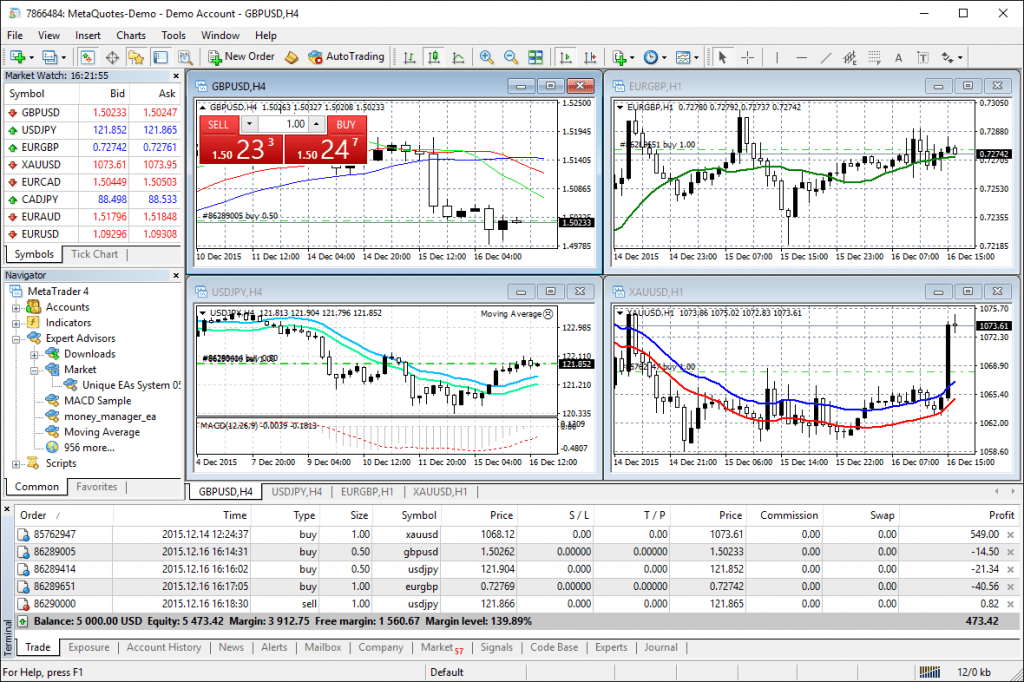

MetaTrader 4

MetaTrader 4

MetaTrader 4 retains the title of the most popular retail trading platform more than 15 years after its initial release. The platform is an institution and sits as the standard for forex and CFD brokers due to its exceptional and simple automated trading integration, comprehensive historical data backtesting abilities and heavily customisable interface.

On top of nine timeframes and thirty stock indicators, users can leverage custom indicators and expert advisors (EAs) to sharpen their trading. The MQL4 marketplace features thousands of these MetaTrader 4 tools to download and loan. Skilled programmers can even create their own code.

MetaTrader 4 is available to download on Windows, Mac and Linux or in mobile app form on iOS and Android devices.

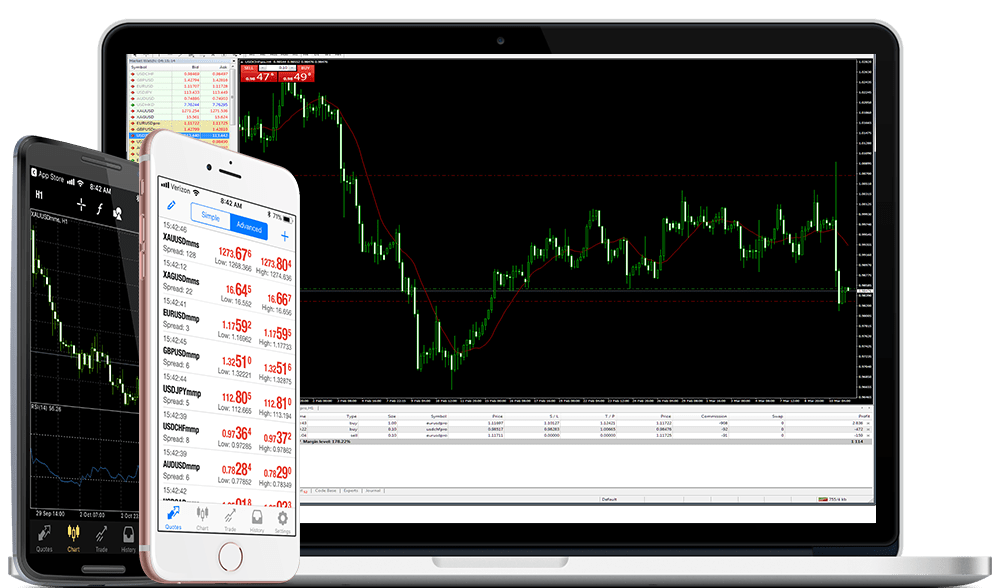

MetaTrader 5

MetaTrader 5

FXDD also supports MetaTrader 5, the most up-to-date platform from MetaQuotes. Upgrades over MT4 include support for hedging and netting, two additional order types, depth of market data integration and an embedded economic calendar that displays upcoming and current market news.

MT5 features 21 time frames and 38 stock indicators for technical analysis, providing users with the best chance to recognise opportunities. The platform was designed for easier non-forex trading and boasts updated backtesting functionality and a new MQL5 coding language.

MetaTrader 5 is available to download on Windows, Mac, Linux, or iOS and Android mobile devices. Alternatively, users can reach the platform through the browser-based WebTrader for added accessibility.

Mobile Apps

In addition to the MT4 and MT5 apps, FXDD offers a proprietary mobile app. With over 180 technical indicators, custom alerts support and chart-based order management, clients can trade on the go with confidence and ease.

Payment Methods

The broker supports a competitive selection of deposit and withdrawal methods, including PayPal, credit and debit card payments, Skrill, Neteller, UnionPay and bank wire transfers. UK traders will be pleased to learn that GBP deposits and withdrawals are accepted.

E-wallet and card payments process instantly, while bank wire transfers take between 3-5 business days to clear. FXDD clients must fill out the redemption form in the customer portal to withdraw funds. Withdrawals may be subject to additional processing time before funds are released.

The broker requires no minimum deposit amount and clients can withdraw up to the total deposited amount for each payment method. Investors must withdraw any additional profit through bank wire transfers.

Deposit & Withdrawal Fees

There are no charges to deposit funds with FXDD and clients can make one fee-free withdrawal each month. However, subsequent withdrawals are subject to a significant £30 fee, while a £20 charge is imposed on all wire withdrawals under £80. Some e-wallet providers may also impose their own charges and bank wire transfers may be subject to independent bank fees.

Trading Fees

Trading fees often have a considerable influence on an investor’s decision to open an account with a particular broker. To this end, prospective clients will be disappointed to learn that FXDD levies an inactivity fee of £25 on accounts that sit dormant for 90 days.

ECN trading commissions vary with the asset class, standing at £2.50 per side per lot for major forex pairs, rising to £4 per side per lot on all other instruments, excluding share CFDs. Stock CFDs are subject to a £6.50 per side per lot commission for standard and ECN account traders alike.

FXDD charges individual rollover rates on positions held overnight, which can be found via either the MT4 or MT5 trading platform or on the broker’s website. Of course, swap-free Islamic accounts are not charged these rates and pay an account management fee instead.

Security & Regulation

The best way for traders to protect their funds and personal information is to pick a well-regulated broker that employs safety measures such as two-factor authentication (2FA) and segregation of client funds.

FXDD clients in the EU and UK are served by the Malta-based arm of the brokerage rather than the Mauritius Financial Services Commission Regulated Division. The EU and UK broker holds a Class 2 licence from the Malta Financial Services Authority.

With this, leverage is restricted to levels set by ESMA and client funds are held in segregated bank accounts from company funds. Additionally, a fund protection scheme covering balances up to £17,000 in case of company insolvency is provided.

Unfortunately, the firm does not support two-factor authentication (2FA), a measure that provides enhanced security to the customer login portal. However, clients are covered by negative balance protection, which keeps investors safe from trading losses exceeding total deposited capital when using leverage.

Customer Support

Customer service is prioritised by FXDD, with a dedicated support team available to contact 24 hours a day, five days a week.

Whether you are having login or withdrawal problems or want guidance on how to download MetaTrader 4 on your device, the live chat feature on the broker’s website provides real-time assistance.

FXDD also operates two support phone lines and a dedicated email address to help clients. However, there is no UK phone number available. Mail enquires can also be made by posting your query to the broker’s Malta location.

- Support Phone Number – (+356) 2013 3933

- Trading Phone Number – (+356) 2013 3939

- Support Email Address – support@fxdd.com.mt

- Trading Email Address – sales@fxdd.com.mt

The FXDD website also features an FAQ section with information on many topics such as demo accounts, trading hours and deposits and withdrawals.

Educational Content

FXDD provides a daily market research blog detailing current economic and trading trends put together by its lead strategist. In addition, guides on the different currency pairs available through the firm are available as free PDF downloads.

The broker has also partnered with Trading Central to provide fundamental and technical market analysis from its experts to active clients.

Advantages Of FXDD

- Free VPS access

- ECN & STP accounts

- MT4 and MT5 access

- NDD business model

- Islamic account support

- Large range of forex markets

- No minimum deposit or withdrawal limits

Disadvantages Of FXDD

- Inactivity fees

- Mid-tier regulation

- Limited leverage rates

- Limited free withdrawals

- High commissions on stock CFD

Additional Features

In addition to its partnership with Trading Central, FXDD provides several other competitive services to clients.

A comprehensive trading calculator, which allows clients to preview position size, margin requirements and potential profits, is available on the ‘Calculator’ tab of the broker’s website. In addition, an economic calendar complete with important trading dates and events such as dividend payments, contract expiries and earnings reports is provided.

Qualifying traders can also take advantage of free VPS hosting for 24/5 EA automated trading. The VPS service is offered in three levels, with clients needing to trade either five, seven or ten round lots per month to gain free access to each tier.

While many broker reviews claim that FXDD supports copy trade platform ZuluTrade, this service appears to have been discontinued for UK and EU clients.

Trading Hours

FXDD follows the standard 24/5 forex trading hours. However, indices and stock CFDs are limited to the trading hours of their local exchanges.

Clients can access the customer portal at any time via the broker’s website or proprietary app to make deposits and withdrawals or manage their accounts.

FXDD Verdict

This review has found FXDD to be a solid brokerage for UK investors. The firm employs best practices for trader safety, such as the segregation of client funds and negative balance protection. Investors have the option of a standard STP or ECN account to fit their trading style. The lack of minimum deposit and withdrawal requirements for most payment methods also stands the broker in good stead. However, high commissions on stock CFDs and significant account fees may dissuade some potential users, while the lack of FCA regulation could also put off cautious traders.

FAQ

Is FXDD Regulated Or A Scam?

The FXDD Malta broker that serves UK traders is licensed by the Malta Financial Services Authority (MFSA) and follows ESMA regulations on leverage and promotional programs.

Does FXDD Offer Binary Options?

No, FXDD does not offer binary options. Instead, the broker provides more than 100 CFD instruments to clients.

Who Is The Owner Of FXDD?

FXDD’s owner is its founder and CEO, Joseph Botkier.

Is FXDD Safe?

FXDD takes several measures to protect customers. These include a fund protection scheme covering balances up to £17,000, holding client funds in segregated bank accounts and employing negative balance protection. The firm is also regulated by the MFSA.

Does FXDD Offer A No Deposit Bonus?

Due to ESMA regulations, FXDD does not offer any promotions such as a welcome or no deposit bonus to UK traders.

Top 3 FXDD Alternatives

These brokers are the most similar to FXDD:

- Swissquote - Founded in 1996, Swissquote is a prominent Swiss bank and broker, providing online trading opportunities for an impressive portfolio of three million products, including forex, CFDs, futures, options, and bonds. Renowned for its reliability, Swissquote has earned a solid reputation through pioneering trading solutions. It was the first bank to introduce cryptocurrency trading in 2017, and has since expanded its offerings to include fractional shares and the Invest Easy service.

- IG Index - Founded in 1974, IG is a part of IG Group Holdings Plc, a publicly listed brokerage (LSE: IGG). The company provides spread betting, CFD, and forex trading, offering access to over 17,000 markets. Its platforms and investing apps are notably user-friendly. Over the past 50 years, IG has consistently been an industry leader, excelling in all essential areas for traders.

- IronFX - IronFX, established in 2010, is a highly regulated broker specialising in forex and CFDs. This acclaimed company provides access to over 500 markets for more than 1.5 million clients in 180 countries. Traders benefit from multiple account options with competitive rates via the MT4 platform, alongside 24/5 customer support available in 30 languages.

FXDD Feature Comparison

| FXDD | Swissquote | IG Index | IronFX | |

|---|---|---|---|---|

| Rating | 4 | 4 | 4.7 | 3.8 |

| Markets | Forex, CFDs, Indices, Stocks, Commodities | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Forex, Indices, Shares, Futures, Commodities, Metals (all CFDs) |

| Minimum Deposit | $200 | $1,000 | $0 | $100 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | MFSA, FSC, LFSA, SBS | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM | CySEC, FCA, FSCA, BMA / Bermuda |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | MT4, MT5 | MT4, MT5 | MT4 | MT4 |

| Leverage | 1:500* Leverage varies depending on the region | 1:30 | 1:30 (Retail), 1:222 (Pro) | 1:30 (FCA), 1:30 (CySEC), 1:500 (FSCA), 1:1000 (BM) |

| Visit | 70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. |

|||

| Review | FXDD Review |

Swissquote Review |

IG Index Review |

IronFX Review |

Trading Instruments Comparison

| FXDD | Swissquote | IG Index | IronFX | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | No | No | No | No |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | No | No | Yes |

| Futures | No | Yes | Yes | Yes |

| Options | No | Yes | Yes | No |

| ETFs | No | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | No | Yes | No |

| Volatility Index | No | Yes | Yes | No |

FXDD vs Other Brokers

Compare FXDD with any other broker by selecting the other broker below.

Popular FXDD comparisons:

|

|

FXDD is #31 in our rankings of CFD brokers. |

| Top 3 alternatives to FXDD |

| Pros |

|

|---|---|

| Cons |

|

| Awards |

|

| Instruments | Forex, CFDs, Indices, Stocks, Commodities |

| Demo Account | Yes |

| Minimum Deposit | $200 |

| Minimum Trade | 0.01 Lots |

| Regulated By | MFSA, FSC, LFSA, SBS |

| Trading Platforms | MT4, MT5 |

| Leverage | 1:500* Leverage varies depending on the region |

| Mobile Apps | Yes |

| iOS App Rating | |

| Android App Rating | |

| Payment Methods | Credit Card, Wire Transfer, Visa, Mastercard, Neteller, Skrill & other PSP providers depending on the region. |

| Copy Trading | No |

| Auto Trading | Expert Advisors (EAs) on MetaTrader. Entity dependent. |

| Signals Service | Yes |

| Islamic Account | Yes |

| Commodities | Gold, Oil, Silver |

| CFD FTSE Spread | 2.30 |

| CFD GBPUSD Spread | 0.4 |

| CFD Oil Spread | 6.0 |

| CFD Stocks Spread | Variable |

| GBPUSD Spread | 0.4 |

| EURUSD Spread | 0.5 |

| GBPEUR Spread | 1.6 |

| Assets | 90+ |