Firstrade Review 2025

Firstrade is a global equities broker with a history that spans almost 40 years. The firm specialises in stocks, ETFs, mutual funds, fixed-income securities, options and cryptos. This 2025 review will examine Firstrade’s trading platforms, fees, securities, visa debit card payment options and customer service options.

What Is Firstrade?

Founded in 1985, Firstrade has since established a reputation as a low-cost broker that offers access to some of the world’s most popular markets. Its objective is to empower customers with advanced technology to make it simpler to execute their investment strategies.

The location of the broker’s headquarters is Flushing, New York (the full address is shown on its website). Its founder and CEO are John Liu and the company has won multiple awards, including ‘Best in Class’ by StockBrokers.com’s 2019 online broker review. Note that its securities business (Firstrade Securities Inc.) is a different entity from its crypto trading business (Firstrade Crypto LLC).

Our experts found no available details of this broker’s total assets under management.

Trading Platforms

Details of the Firstrade Navigator and dedicated options desktop platforms are below. In addition to these, we found that traders have access to a real-time streaming watchlist/quotes, automated trade alerts, stock reports and advanced order types, as well as market data, news and commentary. There is a 0.1-second trade execution guarantee provided by the firm.

Firstrade Navigator

- Real-time market data

- Advanced technical charting

- Various ETF & asset list filters

- Pie graphs provide insight into your account

- Adjustable layout ensures the platform is intuitive and accessible

Options Wizard

- Trading signals

- 65+ technical indicators

- Powered by OptionsPlay

- Support/resistance levels

- Profit and loss simulations

- 40+ complex options strategies

- 1-month and 6-month trend indicators

- Feedback on the value and likelihood of success on options trades

Markets & Assets

Although no forex or futures are available on Firstrade, the following assets can be used to invest:

- 2,200+ ETFs

- 11,000+ mutual funds

- 30+ crypto coins (including Bitcoin, Ethereum and Dogecoin)

- Stocks (including the Nasdaq, NYSE, AMEX and other OTC markets)

- Options (including index options such as the FTSE 100 and S&P 500)

- Fixed-income securities (including CDs, US Treasury Bills and municipal bonds)

Firstrade Markets Webpage

Fees

There are no commission or contract fees on Firstrade, making trading cheaper compared to other brokers. This includes OTC and penny stocks. There is also no account maintenance charge, though fees may be charged for mutual funds as these are actively managed by financial professionals.

Fixed-income securities are generally charged a fee on a net-yield basis, apart from primary market CDs, which have a fee of $30.

There is a short-term redemption fee of $19.95 for mutual fund shares held for less than 90 days. Redemptions less than $500 incur the same fee unless the entire value of the fund is below $500.

Other fees may apply, including regulator and short borrow fees. There is no account inactivity fee on Firstrade. While we are not aware of any hidden fees, be aware that some charges may be stated in the small print.

Leverage

Leverage is available with your Firstrade account. The initial margin requirement for stocks when opening a position is 50%. The maintenance margin requirement is 25% for existing positions, which allows for some fluctuation in the market price. Margin can increase the profits from your portfolio but it can equally magnify the losses, too.

Note that US pattern day trading rules apply for margin investors and any infringements may lead to Good Faith Violations. For example, accounts completing a certain number of day trades in a given period must meet specified equity requirements.

The margin rates on Firstrade (i.e the cost of using leverage) vary between 8.25% and 12.25%.

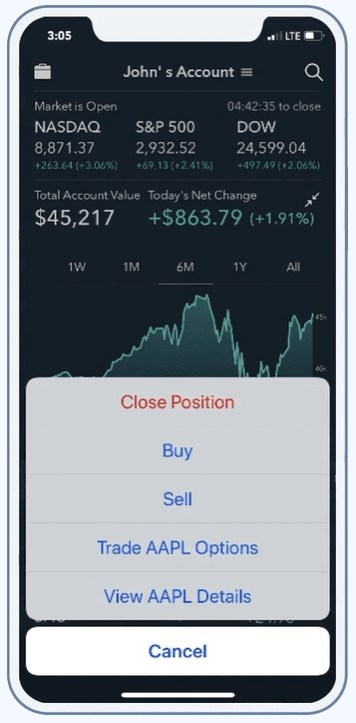

Mobile Trading

Firstrade has a mobile app on Apple and Android. With an intuitive layout and similar functions to the desktop platform, the mobile app provides an excellent alternative to the Navigator platform for clients that want to invest on the go. It is possible to fund your account, trade and see your order history via this platform. There are also short mobile app education videos on the website.

Firstrade Mobile Platform

Payment Methods

How To Transfer Money To Firstrade

There is no minimum deposit and no cost imposed by Firstrade to fund your account. The following deposit options are available:

- Cheque

- Wire transfer

- ACH funds transfer

Online money transfer services like Wise (formerly TransferWise), PayPal and Revolut are not available. Debit and credit cards like Visa and Mastercard are also not an option.

It typically takes 2-3 business days to set up an ACH profile and then the initial deposit can take up to four business days to clear. The linked account for an ACH transfer must be with a US bank. Firstrade gives instant cash buying power of up to $1,000 while waiting for your initial ACH deposit to clear.

Wire transfers may incur third-party fees, which can be expensive. That said, Firstrade may cover the cost (see the Bonuses & Promos section for further details).

All cheques must be payable in US dollars and be through a US bank. This method can be slower than ACH and wire transfers.

Another option for traders is to transfer an existing account from another financial institution, which usually takes 5-7 business days.

How To Withdraw Money From Firstrade

The methods to withdraw money are the same as the deposit options. Electronic transfers out of your Firstrade account are processed the same day if received before 13:00 ET and should be transferred within 1-2 business days. There is a $50,000 withdrawal limit per day for ACH transfers. Note that wire transfers have a $25 fee.

Demo Account

While using the Firstrade platform, we found that there is no demo or paper trading account to help investors understand how to buy stocks or set a stop-loss or limit order, for example. This is unusual as most reputable brokers have one. Our experts, therefore, recommend that beginners start small with limited risk given that they are unable to test their strategies with virtual funds.

Bonuses & Promos

There is a deposit sign-up bonus promotion for up to $4,000 on Firstrade but this is only open to US customers. Other offers include credit for the account transfer fee that other brokers sometimes charge. The broker will also cover the wire transfer deposit fees up to $25 per transfer (one per month maximum) if the deposit amount is over $25,000. Previous promotions have included giving away 3 free stocks.

Regulation

Firstrade is a member of the Financial Industry Regulatory Authority (FINRA) and the Securities Investor Protection Corporation (SIPC). The objective of FINRA is to protect investors and safeguard market integrity. It is a government-authorised not-for-profit organisation that helps ensure that the customers of its members are treated fairly and honestly.

The SIPC insures funds for up to $500,000 (crypto holdings are not insured). Additional insurance coverage is available through the Apex Clearing Corporation.

Account Types

In addition to the standard investing account, there are other choices with various tax implications. Further detail of these account types are provided below but investors should ensure they read all the terms and conditions on the Firstrade website before choosing their account.

- Regular Investing Account – a traditional or joint brokerage account

- Individual Retirement Account – includes a traditional IRA, Roth IRA and Rollover IRA with no annual fee

- Custodial Account – gift tax advantages may apply for this account, which is managed for a minor’s benefit until they reach the age of majority

- International Account – this account is available to open for non-US citizens without a Social Security Number (SSN), on the approved/supported countries list

- Firstrade Cash Management Account – comes with a debit card so you can spend, save and trade all from one account (no annual fee but account equity requirement is $25,000)

- ESA Education Planning Account – a maximum $2,000 contribution per child is allowed free of federal taxes and withdrawals are also tax-free if they meet certain requirements

How To Trade On Firstrade

1) Open An Account

Accounts can be opened in just three minutes. To sign-up for Firstrade, traders must fill out online forms and send these to the firm via email or fax. New customers will also usually need to upload images of their passports as part of KYC requirements. Once registration is complete, it may take 1-2 business days for the broker to review this information before the account is fully authorised.

2) Deposit Funds

For many UK traders and other non-US residents, the only option available to deposit funds on Firstrade is through an international wire transfer or by transferring assets from an existing external brokerage account. Depositing funds can be done under Fund Transfer in the Accounts section of your profile.

3) Open A Position

There is no demo account on Firstrade, so we recommend starting with low-value positions on stable assets and not using leverage until you are more familiar with the platform. Charts and indicators can be used for technical analysis. Those using fundamental analysis on medium to long-term positions should look to assess the growth potential of assets by assessing data such as the P/E ratio, which can help indicate whether a stock is overvalued or undervalued. When opening a position, traders may want to use advanced order types like a stop loss, stop limit or trailing stop for more automatic investing.

Benefits Of Firstrade

- Regulated by FINRA

- Extended trading hours

- Excellent education section

- Fractional cryptocurrencies

- Zero commission or contract fees

- 40 years of experience in the industry

- Advanced options signals and technical analysis tools

Drawbacks Of Firstrade

- No demo account

- No forex or futures

- No MetaTrader 4 or 5

- Limited deposit and withdrawal options

- Some funding options and promotions are only available to US customers

Additional Features

When we used Firstrade, we found the education section to be strong, with live webinars, free e-books, tutorial videos and articles. These cover instructions on how to trade options (including how traders buy, sell and exercise options), options strategies (including the covered call) and how to short a stock, plus much more. There is also a glossary to assist investors with trading jargon and a blog that provides information on popular shares and ETFs, alongside details of some new features on the platform.

Those wanting to invest more in assets can use the free Dividend Reinvestment Plan (DRIP). There is also the Firstrade Securities Lending Income Program, which allows traders to lend out stocks they own and increase their total account cash value by earning passive income. Investors may also be eligible to earn an interest rate on their cash balances.

The upcoming IPOs section is another place where investors may find profitable opportunities.

The e-document storage system keeps account statements and tax documents for up to 10 years in one convenient place. There is also the Tax Center, where investors can access tax forms, learn about tax-related issues, use calculators and more.

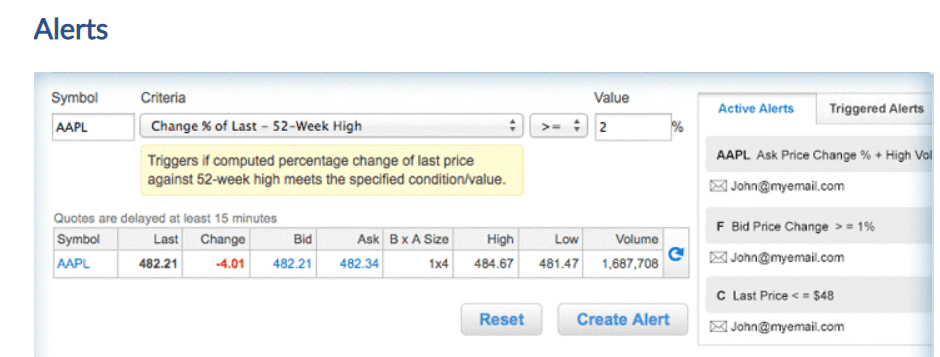

Firstrade Custom Alerts System

Trading Hours

Extended trading hours (also referred to as before and after-hours trading) is available at Firstrade. This means that trading hours run from 08:00-20:00 EST for the NYSE, Nasdaq and AMEX markets, which includes the pre-market and post-market periods.

The crypto market is open 24/7.

Customer Support

Whether you have a login problem, the trading platform is not working correctly or you are having issues with your username/user ID and password, customer support is available in English, Mandarin and Cantonese. The extensive Firstrade FAQs section provides guidance on how to close your account, how to set up a beneficiary, why cash buying power is different from settled funds and the consequences of Good Faith Violations strikes. The market holiday schedule can also be found in the Help Center.

The following customer service options are available:

- Live Chat

- Online Contact Form

- Phone: 1-718-961-6600

- Email Address: service@firstrade.com

Customer service hours for telephone support are 08:00-18:00 ET. Firstrade also has a presence on Facebook, Twitter, YouTube and LinkedIn.

Security

Account security can be bolstered by enabling two-factor authentication (2FA) when you login to access your securities. Data encryption and servers that have SSL technology also help protect personal data. In addition, those completing wire transfers may receive a phone call to verify the transaction. When transferring money, always ensure you have got the account details, including the bank routing number, from legitimate sources.

Firstrade may contact you if they detect fraudulent activity on your account, so ensure that your contact details are kept up-to-date.

Information on the broker’s privacy policy can be found on the website. Further queries on this can be found upon contact with customer service.

Should You Sign Up With Firstrade?

Traders seeking a low-cost way of accessing a long list of stocks, ETFs, mutual funds, options, fixed-income securities and cryptos should look to Firstrade. The broker offers intuitive trading platforms to various countries, as well as excellent educational resources and customer support options. While Firstrade is tailored more to the US market, our evaluation of this broker is that UK customers can still benefit greatly from its services with strong security and international customer support.

FAQs

Is Firstrade Safe & Legit?

Firstrade has a long history as a broker and is regulated by FINRA. This means its customers are afforded more protections than with an unregulated alternative.

Is Firstrade A Good Broker?

One of Firstrade’s biggest strengths is its zero-commission fee structure. It also has a range of fundamental and technical analysis tools for investing, although it lacks a demo account.

Does Firstrade Charge Fees?

Although Firstrade does not charge commissions, it does charge some fees like short-term redemption fees if you hold a mutual fund share for less than 90 days.

Is Firstrade Available In The UK?

Yes. The UK is a supported country, although some payment methods and promotions are only available to US customers.

Is Firstrade A Chinese Company?

No. Firstrade is a US company with its headquarters in Flushing, New York.

Who Owns Firstrade Securities Inc.?

The official company name of Firstrade is Firstrade Securities Inc. John Liu is the founder and current CEO. Firstrade Holding Corporation is its parent company.

Does Firstrade Offer Cryptocurrency?

Yes. Firstrade offers over 30 cryptocurrencies, including Bitcoin and altcoins.

Does Firstrade Offer Fractional Shares?

Firstrade does not offer fractional share trading, although dividend reinvestment may result in investors owning fractional shares. Traders can buy fractions of cryptocurrencies.

Top 3 Firstrade Alternatives

These brokers are the most similar to Firstrade:

- Interactive Brokers - Interactive Brokers (IBKR), a leading brokerage, offers access to 150 markets across 33 countries and provides extensive investment services. With more than 40 years of experience, this Nasdaq-listed company complies with strict regulations from the SEC, FCA, CIRO, and SFC. It is among the most reliable brokers worldwide for traders.

- Swissquote - Founded in 1996, Swissquote is a prominent Swiss bank and broker, providing online trading opportunities for an impressive portfolio of three million products, including forex, CFDs, futures, options, and bonds. Renowned for its reliability, Swissquote has earned a solid reputation through pioneering trading solutions. It was the first bank to introduce cryptocurrency trading in 2017, and has since expanded its offerings to include fractional shares and the Invest Easy service.

- IG Index - Founded in 1974, IG is a part of IG Group Holdings Plc, a publicly listed brokerage (LSE: IGG). The company provides spread betting, CFD, and forex trading, offering access to over 17,000 markets. Its platforms and investing apps are notably user-friendly. Over the past 50 years, IG has consistently been an industry leader, excelling in all essential areas for traders.

Firstrade Feature Comparison

| Firstrade | Interactive Brokers | Swissquote | IG Index | |

|---|---|---|---|---|

| Rating | 4 | 4.3 | 4 | 4.7 |

| Markets | Stocks, ETFs, Options, Mutual Funds, Bonds, Cryptos, Fixed | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting |

| Minimum Deposit | $0 | $0 | $1,000 | $0 |

| Minimum Trade | $1 | $100 | 0.01 Lots | 0.01 Lots |

| Demo Account | No | Yes | Yes | Yes |

| Regulators | SEC, FINRA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM |

| Bonus | - | - | - | - |

| Education | Yes | Yes | Yes | Yes |

| Platforms | - | - | MT4, MT5 | MT4 |

| Leverage | - | 1:50 | 1:30 | 1:30 (Retail), 1:222 (Pro) |

| Visit | 69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. |

|||

| Review | Firstrade Review |

Interactive Brokers Review |

Swissquote Review |

IG Index Review |

Trading Instruments Comparison

| Firstrade | Interactive Brokers | Swissquote | IG Index | |

|---|---|---|---|---|

| CFD | No | Yes | Yes | Yes |

| Forex | No | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | Yes | No | No |

| Commodities | No | Yes | Yes | Yes |

| Oil | No | No | Yes | Yes |

| Gold | No | Yes | Yes | Yes |

| Copper | No | No | Yes | Yes |

| Silver | No | No | Yes | Yes |

| Corn | No | No | No | No |

| Futures | No | Yes | Yes | Yes |

| Options | Yes | Yes | Yes | Yes |

| ETFs | Yes | Yes | Yes | Yes |

| Bonds | Yes | Yes | Yes | Yes |

| Warrants | No | Yes | Yes | Yes |

| Spreadbetting | No | No | No | Yes |

| Volatility Index | No | No | Yes | Yes |

Firstrade vs Other Brokers

Compare Firstrade with any other broker by selecting the other broker below.

Popular Firstrade comparisons:

|

|

Firstrade is #51 in our rankings of UK brokers. |

| Top 3 alternatives to Firstrade |

| Pros |

|

|---|---|

| Cons |

|

| Awards |

|

| Instruments | Stocks, ETFs, Options, Mutual Funds, Bonds, Cryptos, Fixed |

| Demo Account | No |

| Minimum Deposit | $0 |

| Minimum Trade | $1 |

| Regulated By | SEC, FINRA |

| Mobile Apps | iOS & Android |

| iOS App Rating | |

| Android App Rating | |

| Payment Methods | ACH Transfer, Cheque, Wire Transfer |

| Copy Trading | No |

| Islamic Account | No |

| Crypto Coins | ADA, ALGO, ATOM, AVAX, BAT, BCH, BTC, CRO, CRV, DOGE, ETC, ETH, FTM, GRT, LINK, LRC, LTC, MANA, MATIC, REN, SHIB, SOL, SUSHI, UNI, XLM, YFI |

| Crypto Spreads | Variable |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |