CFD Trading vs Share Trading

CFD trading or shares trading both offer excellent opportunities to profit from rising and/or falling prices in the financial markets. If you’re weighing up CFD trading vs share trading, we can help you determine the key differences to make an informed investment decision. We also run through the best brokers for trading CFDs or stocks.

Before we look at the CFD trading vs share trading debate, what is CFD investing and share dealing?

What Is CFD Trading?

CFD (contract for difference) trading involves speculating on the price movement of a financial instrument. Traders can take a position on rising prices (going long) or falling prices (going short). As CFDs are a derivative product, you do not take ownership of the underlying asset.

You can trade CFDs in numerous global markets, including forex pairs, stock indices, commodities, options and shares. CFD products are also leveraged, which gives you full market exposure without needing to deposit the full value of the trade.

Best CFD Brokers UK

What Is Share Trading?

Share trading, or investing, is a longer-term form of trading, whereby you take ownership of stocks and profit from price movements. Compared to CFDs, it’s harder to go short to speculate on falling prices with share trading.

When investing in company shares or Exchange Traded Funds (ETFs), traders cannot access leverage, so the full value of the trade must be put down.

Best Stock Brokers UK

CFD Trading vs Share Trading – Differences

Ownership

When considering CFD trading vs stock or share trading, one of the key differences lies in whether the underlying asset is owned by the trader. With CFDs, you do not own the underlier, whereas share trading does involve taking ownership.

Market Access

When choosing between CFD trading vs share trading, you may also want to consider which markets you wish to access. CFDs allow you to trade a variety of instruments, including forex pairs, indices, commodities, options, futures and shares, whereas share trading only gives you access to shares and ETFs.

Financing

Another notable difference between buying shares vs CFD trading is the costs to open a position. For CFDs, trades are leveraged, which means you only need to deposit a percentage of the total position size to gain full exposure to the asset. When investing in shares, the full value of the position is paid upfront.

Trading Hours

When looking at CFD trading vs share trading, CFDs come with the benefit of 24-hour investing on many major assets. This is because you get access to a range of global markets, meaning it is possible to trade around the clock. With share trading, however, you can only really trade during the stock exchange’s opening hours.

Fees & Charges

Whether you’re trading CFD products or stocks, your positions will be subject to fees. In most CFD markets, pricing is determined by the spread, though CFD shares are often subject to a commission. With share trading, you usually just pay a commission and any conversion fees, if applicable. Overnight funding fees will also apply to CFDs but not to share trades.

UK Taxes

The CFD trading vs normal shares trading argument can also be characterised by their tax implications. In the UK, CFDs are exempt from stamp duty because there is no ownership involved. Note that any profits from CFDs are still subject to capital gains tax. With share trading, both stamp duty and capital gains tax are payable.

Find out more about UK trading and investing taxes.

Trading Platforms

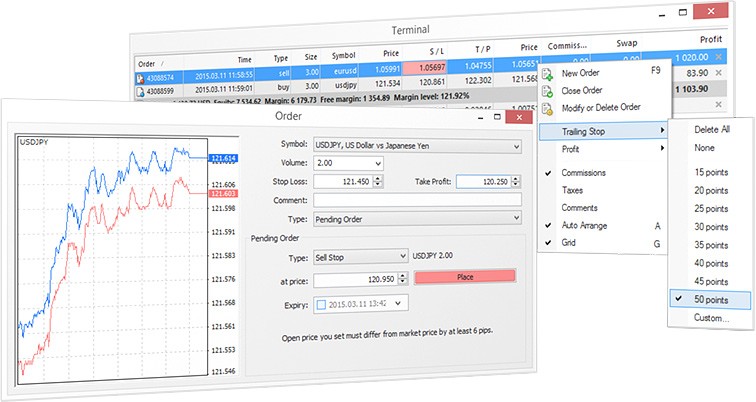

Fortunately, when considering CFD trading vs share trading, both are usually available on desktop and mobile trading applications. Most brokers offer popular platforms such as the MetaTrader suite, or their own proprietary software. Traders should take advantage of any demo accounts offered to test out the features.

Other Considerations

Other key characteristics in the CFD trading vs share trading debate are:

- Expiries – There are generally no expiry dates when trading a CFD or share, however, assets such as CFD futures and options do have expiries. These are usually on a monthly basis, but make sure to check with your broker for details.

- Shareholder privileges – Whilst no shareholder privileges are available when trading CFDs, you can benefit from dividends and in some cases, voting rights, when investing in shares and ETFs.

- CFD trading vs share trading strategies – The timeframe in which you wish to trade may also determine your decision with trading shares vs CFDs. CFDs are usually best for short-term, intra-day and medium-term strategies, whereas share trading is ideal for long-term buy and hold investments.

Best UK Brokers For CFD Trading

There is a good selection of CFD brokers available in the UK, offering award-winning features such as competitive spreads or top-notch research tools. The best option for you will depend on your preferences and experience level. eToro, for example, offers both CFD vs stock trading and is a great broker for beginners.

See our list of top CFD trading brokers.

Best UK Brokers For Stock Trading

If you’re stock trading, you’ll want to consider a broker that offers a wide range of shares and ETFs. Traders using IG, for example, have thousands of CFD vs shares instruments to choose from, as well as other attractive features such as extended trading hours for shares.

See our list of top share trading brokers.

CFD Trading Vs Share Trading – Which One Is Right For Me?

When it comes to CFD trading vs share trading, it’s important the weigh up the various benefits and risks and how they apply to you. CFDs give you access to a wider range of markets than share trading. But whilst leveraged CFDs can be profitable, they can also lead to substantial losses. As a result, less experienced traders may want to consider trading shares to start with, as they don’t involve as much leverage risk and are less complicated. In any case, make sure to test out the broker’s platforms and practice your strategies in a demo account first.

FAQs

What Is The Difference Between CFD Trading Vs Real Stock Trading?

CFDs involve speculating on price movements either way and are derivative products, meaning you do not own the underlying asset. CFDs are also leveraged, which means you can gain exposure to the market by putting down just a fraction of the full trade. Stock trading on the other hand, allows you to take ownership of the asset, whereby you profit from upward price movements. Stock trading is not leveraged, so you must put down the whole trade value.

Buying CFDs Vs Buying Stocks: What Are The Differences With Fees?

Generally, CFDs and share trades are subject to spreads and commissions, respectively. If you take CFD shares vs actual shares, however, both are usually subject to commissions. There are also overnight financing fees on CFDs and conversion fees on shares, if applicable.

How Do I Open A CFD Or Investing Account?

To open an account, you will need to complete the online application process at your chosen broker. You may be asked to verify your identity before setting up your account login credentials. When looking at a CFD vs investing account, its worth comparing the broker’s fees and funding methods to see which best suit your requirements.

Should I Trade CFDs Or Shares?

The decision to either trade CFDs or stocks will depend on your risk appetite and other trading requirements. CFDs can be great for more seasoned traders who understand, and have experience with, leveraged trading. Share trading is less risky and works well for beginners, though you won’t get access to a wide range of markets.

Are CFD And Share Trading Safe?

Both forms of trading are generally safe, but traders should consider a regulated broker who will provide a good level of fund safety and security. New traders should also carry out their own research into the risks of leveraged trading.