Fastest Execution Brokers In The UK 2025

Looking to gain an edge in the markets? Whether you’re a day trader chasing momentum or an investor seeking minimal slippage, execution speed can make or break your returns.

We reveal the fastest execution brokers in the UK – so your trades hit the market when you want, not after it’s too late.

Best Execution Speed Brokers

-

Global Prime, a fully regulated trading broker, provides access to over 150 markets. Traders can begin with a minimum deposit of $200 and utilise leverage up to 1:100. Renowned for its reliability, the company holds a strong reputation and is licensed by ASIC.

Instruments Regulator Platforms Forex, indices, commodities, cryptocurrencies, shares, bonds ASIC, VFSC, FSA MT4, TradingView, AutoChartist Min. Deposit Min. Trade Leverage A$200 0.01 Lots 1:200 -

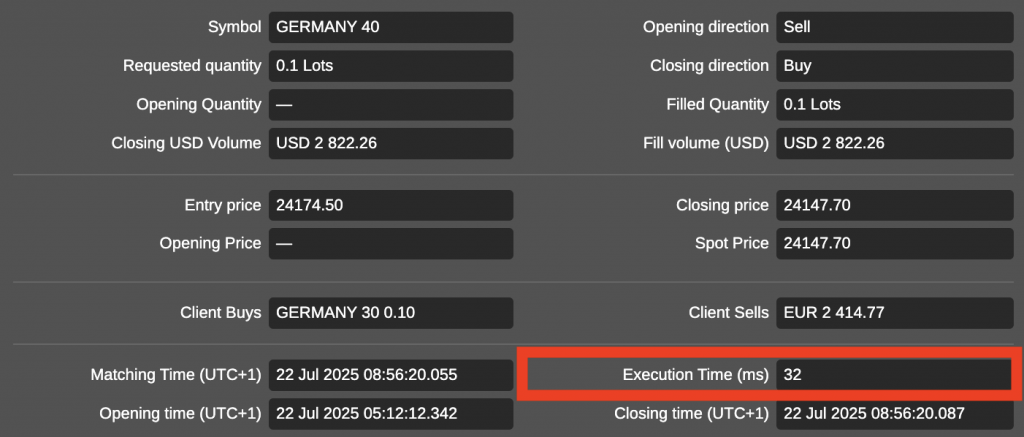

When we evaluated IC Trading, execution was consistently rapid, often under 40ms on their Raw Spread account. No requotes, minimal slippage, and genuine ECN connectivity ensured smooth, precise fills during news spikes. It proved to be one of the most dependable brokers for high-speed, high-frequency trading.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, Bonds, Cryptos, Futures FSC MT4, MT5, cTrader, AutoChartist, TradingCentral Min. Deposit Min. Trade Leverage $200 0.01 Lots 1:500 -

IC Markets excelled with its rapid execution, averaging under 40ms on the Raw Spread account. Slippage was rare, and requotes were absent, even in volatile periods. Its excellent liquidity and ECN setup position it as a premier option for scalpers and algorithmic traders.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto ASIC, CySEC, FSA, CMA MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade, Quantower Min. Deposit Min. Trade Leverage $200 0.01 Lots 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) -

Our tests show Interactive Brokers offers excellent execution speed, with trades typically completed in under 40ms on major markets. Slippage remains low, even amid volatility. Its direct market access and smart routing consistently secure optimal prices, appealing to precise and active traders.

Instruments Regulator Platforms Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower Min. Deposit Min. Trade Leverage $0 $100 1:50 -

In our evaluations, Pepperstone provided exceptionally rapid order execution without requotes and minimal slippage, even amid high volatility. Orders on Razor accounts were regularly completed in under 50 milliseconds, and spreads remained narrow. This accuracy facilitated scalping and high-frequency strategies more effectively than many of the competitors we assessed.

Instruments Regulator Platforms CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade, Quantower Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:500 (Pro) -

In our trials with BlackBull's order execution, it was rapid and dependable, averaging 35–50ms on the ECN Prime account. Orders filled efficiently, with minimal slippage and no requotes, even in volatile markets. Thanks to Equinix NY4 server integration and low-latency routing, it’s ideal for scalpers and traders.

Instruments Regulator Platforms CFDs, Stocks, Indices, Commodities, Futures, Crypto FMA, FSA BlackBull Invest, BlackBull CopyTrader, MT4, MT5, cTrader, TradingView, AutoChartist Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:500 -

In our recent assessments, Eightcap provided swift and reliable execution, with market orders usually filled within 60ms on the Raw account. We observed negligible slippage and no requotes, even in volatile conditions. Execution was consistent on both MetaTrader and TradingView, catering well to manual and algorithmic traders.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities ASIC, FCA, CySEC, SCB MT4, MT5, TradingView Min. Deposit Min. Trade Leverage £100 0.01 Lots 1:30

Safety Comparison

Compare how safe the Fastest Execution Brokers In The UK 2025 are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|---|---|---|---|---|

| Global Prime | ✘ | ✔ | ✘ | ✘ | |

| IC Trading | ✘ | ✘ | ✘ | ✔ | |

| IC Markets | ✘ | ✔ | ✘ | ✔ | |

| Interactive Brokers | ✔ | ✔ | ✘ | ✔ | |

| Pepperstone | ✔ | ✔ | ✘ | ✔ | |

| BlackBull Markets | ✘ | ✔ | ✘ | ✔ | |

| Eightcap | ✔ | ✔ | ✘ | ✔ |

Payments Comparison

Compare which popular payment methods the Fastest Execution Brokers In The UK 2025 support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|---|---|---|---|---|---|

| Global Prime | ✔ | ✘ | ✔ | ✔ | ✔ | ✘ |

| IC Trading | ✔ | ✔ | ✔ | ✔ | ✘ | ✘ |

| IC Markets | ✔ | ✘ | ✔ | ✔ | ✔ | ✘ |

| Interactive Brokers | ✔ | ✔ | ✘ | ✘ | ✘ | ✘ |

| Pepperstone | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| BlackBull Markets | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| Eightcap | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

Mobile Trading Comparison

How good are the Fastest Execution Brokers In The UK 2025 at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| Global Prime | iOS & Android | ✘ | ||

| IC Trading | iOS & Android | ✘ | ||

| IC Markets | iOS & Android | ✘ | ||

| Interactive Brokers | iOS & Android | ✔ | ||

| Pepperstone | iOS & Android | ✘ | ||

| BlackBull Markets | iOS & Android | ✘ | ||

| Eightcap | iOS & Android | ✘ |

Beginners Comparison

Are the Fastest Execution Brokers In The UK 2025 good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|---|---|---|---|---|

| Global Prime | ✔ | A$200 | 0.01 Lots | ||

| IC Trading | ✔ | $200 | 0.01 Lots | ||

| IC Markets | ✔ | $200 | 0.01 Lots | ||

| Interactive Brokers | ✔ | $0 | $100 | ||

| Pepperstone | ✔ | $0 | 0.01 Lots | ||

| BlackBull Markets | ✔ | $0 | 0.01 Lots | ||

| Eightcap | ✔ | £100 | 0.01 Lots |

Advanced Trading Comparison

Do the Fastest Execution Brokers In The UK 2025 offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Global Prime | ✔ | ✘ | 1:200 | ✔ | ✔ | ✔ | ✘ |

| IC Trading | Expert Advisors (EAs) on MetaTrader, cBots on cTrader | ✘ | 1:500 | ✔ | ✘ | ✔ | ✘ |

| IC Markets | Expert Advisors (EAs) on MetaTrader, cBots on cTrader, Myfxbook AutoTrade | ✘ | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) | ✔ | ✘ | ✔ | ✘ |

| Interactive Brokers | Capitalise.ai & TWS API | ✘ | 1:50 | ✘ | ✔ | ✔ | ✔ |

| Pepperstone | Expert Advisors (EAs) on MetaTrader | ✔ | 1:30 (Retail), 1:500 (Pro) | ✔ | ✘ | ✔ | ✘ |

| BlackBull Markets | Expert Advisors (EAs) on MetaTrader, cTrader Automate | ✘ | 1:500 | ✔ | ✔ | ✔ | ✘ |

| Eightcap | TradingView Bots | ✘ | 1:30 | ✔ | ✘ | ✔ | ✘ |

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the Fastest Execution Brokers In The UK 2025.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|---|---|---|---|---|---|---|---|---|

| Global Prime | |||||||||

| IC Trading | |||||||||

| IC Markets | |||||||||

| Interactive Brokers | |||||||||

| Pepperstone | |||||||||

| BlackBull Markets | |||||||||

| Eightcap |

Our Take On Global Prime

"Global Prime is ideal for novice and experienced traders, offering superb market access, competitive fees, and diverse tools, including copy trading."

Pros

- Segregated client funds

- Round-the-clock customer support

- Diverse deposit methods available without any charges.

Cons

- The selection of account types is limited.

- Clients from the United States and Canada are ineligible.

- No integration with MetaTrader 5.

Our Take On IC Trading

"IC Trading offers an ideal environment, featuring top-tier execution speeds of around 40 milliseconds, extensive liquidity, and advanced charting tools, perfect for scalpers, traders, and algorithmic traders."

Pros

- Trading Central and Autochartist provide valuable technical analysis and actionable ideas. These tools are readily available within the account area or on the cTrader platform.

- IC Trading provides exceptional flexibility, allowing traders to open as many as 10 live accounts and 20 demo accounts. This enables the management of distinct profiles for various activities, including manual and algorithmic trading.

- The streamlined digital account setup allows traders to commence trading swiftly, eliminating lengthy paperwork. Testing shows the process takes mere minutes.

Cons

- The educational materials require significant enhancement unless accessed via the IC Markets website. This limitation is particularly disadvantageous for beginners seeking a thorough learning experience, especially when compared to industry leaders such as eToro.

- Unlike IC Markets, IC Trading lacks support for social trading via the IC Social app or the ZuluTrade platform.

- Although IC Trading operates under the reputable IC Markets group, it is licensed by the FSC in Mauritius, a regulator known for its limited financial transparency and lack of robust safeguards.

Our Take On IC Markets

"IC Markets provides excellent pricing, swift execution, and easy deposits. With cutting-edge charting tools like TradingView and the Raw Trader Plus account, it continues to be a preferred option for intermediate and advanced traders."

Pros

- Access over 2,250 CFDs across diverse markets like forex, commodities, indices, shares, bonds, and cryptocurrencies. This variety enables traders to employ diversified strategies.

- IC Markets provides reliable 24/5 support, especially for account and funding queries, drawing from direct experience.

- IC Markets provides some of the industry's narrowest spreads, offering 0.0-pip spreads on major currency pairs. This makes it an extremely cost-effective choice for traders.

Cons

- Although there are four top-tier third-party platforms available, the absence of in-house software or a trading app tailored for novice traders is notable.

- IC Markets provides metals and cryptocurrencies for trading through CFDs, though the selection is narrower compared to brokers such as eToro. This limits opportunities for traders focused on these asset classes.

- Certain withdrawal methods incur fees, including a $20 charge for wire transfers. These costs can reduce profits, particularly with frequent withdrawals.

Our Take On Interactive Brokers

"Interactive Brokers ranks highly for seasoned traders due to its robust charting platforms, live data, and bespoke layouts via the new IBKR Desktop app. Its competitive pricing and sophisticated order choices appeal to traders, and its wide equity options are industry-leading."

Pros

- The TWS platform is tailored for intermediate and advanced traders, featuring over 100 order types and a dependable real-time market data feed with exceptional uptime.

- Interactive Brokers has introduced ForecastTrader, an innovative product offering zero-commission trading with yes/no Forecast Contracts on political, economic, and climate events. It features fixed $1 contract payouts, 24/6 market access, and a 3.83% APY on positions held.

- Interactive Brokers has been awarded Best US Broker for 2025 by DayTrading.com. This accolade highlights its dedication to traders in the US, offering exceptionally low margin rates and access to global markets at minimal expense.

Cons

- IBKR offers a variety of research tools, but their inconsistent placement across trading platforms and the 'Account Management' webpage creates a confusing experience for users.

- You are limited to a single active session per account, meaning you cannot use both your desktop programme and mobile app at the same time. This restriction can occasionally lead to a frustrating experience for traders.

- Support can be sluggish and frustrating. Tests reveal that you may face challenges reaching customer service quickly, which could result in delays in issue resolution.

Our Take On Pepperstone

"Pepperstone is a premier trading platform, providing tight spreads, swift execution, and sophisticated charting tools for seasoned traders. Beginners benefit from no minimum deposit, comprehensive learning materials, and outstanding 24/7 support."

Pros

- Pepperstone offers rapid execution speeds of approximately 30ms, enabling swift order processing and execution, making it ideal for traders.

- In recent years, Pepperstone has significantly enhanced the deposit and withdrawal process. By 2025, clients can use Apple Pay and Google Pay, while 2024 saw the introduction of PIX and SPEI for customers in Brazil and Mexico.

- Pepperstone now offers spread betting via TradingView, delivering a streamlined and tax-efficient trading experience with sophisticated analytical tools.

Cons

- Pepperstone doesn't offer cTrader Copy, a favoured feature for copying trades found in the cTrader platform, which is available on other platforms such as IC Markets. However, Pepperstone has launched its own user-friendly copy trading app.

- Although its market range has improved, its crypto offerings remain limited compared to brokers specialising in this sector, lacking real coin investment options.

- Pepperstone's demo accounts expire after 30 days, which may not provide sufficient time to explore various platforms and evaluate trading strategies.

Our Take On BlackBull Markets

"Following the upgrade to Equinix servers in New York, London, and Tokyo, BlackBull has reduced latency, making it a clear choice for stock CFD trading using ECN pricing."

Pros

- BlackBull provides three ECN-powered accounts—Standard, Prime, and Institutional—to cater to traders of all experience levels, from novices to seasoned professionals. The variety of account types allows for flexible options tailored to individual trading needs and available capital.

- After collaborating with ZuluTrade and Myfxbook, upgrading its CopyTrader, and activating cTrader Copy, BlackBull provides an exceptionally thorough trading experience.

- BlackBulls's research excels, particularly in the daily 'Trading Opportunities' articles. These publications simplify complex market dynamics into clear insights, enabling traders to effectively capitalise on emerging trends.

Cons

- BlackBull does not offer its own trading platform, instead utilising MetaTrader, cTrader, and TradingView. Although these platforms are highly regarded, some brokers, such as eToro, provide proprietary platforms with distinct features that cater well to novice traders.

- Despite an expanding range of over 26,000 assets, including new additions to Asia Pacific indices, their offerings are primarily equities. The selection of currency pairs and indices remains average.

- Unlike many leading brokers, BlackBull imposes a bothersome $5 fee for withdrawals. This charge can reduce the overall cost-effectiveness, particularly for traders who regularly transfer funds.

Our Take On Eightcap

"Eightcap excels for traders, offering diverse charting platforms, educational Labs, and AI tools. With over 120 crypto CFDs, it stands out in crypto trading and has won our 'Best Crypto Broker' award twice consecutively."

Pros

- With spreads starting at 0 pips, minimal commission charges, and leverage up to 1:500 for select clients, Eightcap delivers affordable and flexible trading opportunities. These conditions suit various strategies, such as trading and scalping.

- In 2021, Eightcap enhanced its lineup, now providing an extensive range of cryptocurrency CFDs. It offers crypto/fiat and crypto/crypto pairs, along with crypto indices for comprehensive market exposure.

- Eightcap excels with a suite of advanced trading tools, such as MT4 and MT5, and has recently joined the 100-million-user social trading network, TradingView.

Cons

- Eightcap must enhance its range of over 800 instruments to rival top competitors like Blackbull Markets, which offers 26,000+ assets, especially improving its limited commodities selection.

- The demo account is available for 30 days, after which it requires a request for extension. This is less convenient than XM's offering, which provides an unlimited demo mode.

- Despite the growing range of tools available, Eightcap lacks popular industry resources such as Autochartist and Trading Central. These provide advanced charting analytics, live news, and essential market insights for traders focused on short-term strategies.

How We Picked The Top Brokers For Execution Speed

All brokers were tested in the UK and assessed using our own Execution benchmark, which looks at speed, reliability, and order accuracy.

We measured key performance factors including execution time, slippage, and requotes, where possible.

We also considered:

- Broker-published stats, where available, to check transparency

- Ongoing market research to keep insights current and relevant

Brokers were then individually rated for their execution speed and quality, and ranked, with the top UK platforms delivering fast, stable, and accurate trade execution.

Why Does My Broker’s Execution Speed Matter?

In trading, milliseconds can make a measurable difference. Execution speed refers to the speed at which a broker can process and fill an order at the market price.

For UK investors trading fast-moving assets—such as FTSE 100 stocks, UK-listed ETFs, or forex pairs involving the GBP—this matters more than you might think.

Fast execution isn’t just about speed—it’s about consistency. For UK traders, selecting brokers with reliable, low-latency connections during peak London market hours helps avoid unpredictable delays that can erode gains, especially when trading large-cap stocks or popular GBP forex pairs.

When prices are volatile, even a slight delay between clicking ‘Buy’ or ‘Sell’ and your order being executed can result in slippage—where you get a worse price than expected. Over time, slippage erodes returns, particularly for short-term or high-frequency strategies.

For example, imagine I place a buy order for 1,000 shares of BAE Systems priced at £1,500 each. If my order is executed at £1,500.10 instead of £1,500, the 10p difference per share means I end up paying an extra £100 due to slippage (£0.10 x 1,000 shares). Ouch.

How Is Broker Execution Speed Measured?

Broker execution speed is measured in milliseconds (ms)—the time it takes from when you place a trade to when it’s filled.

In our view, a good execution speed is anything under 100ms. If it’s over 200ms, you’re more likely to experience slippage, where your order is filled at a worse price than expected.

The best brokers usually publish their average execution times to showcase their speed. For example, Pepperstone completes most trades in under 0.03 seconds (30ms), while IG reports that 97.93% of orders are filled in 0.027 seconds (27ms) or less.

TopFX’s deep and consistent liquidity helps it deliver fast execution speeds

What Factors Affect Broker Execution Speed?

- Business model: UK brokers primarily operate as either Dealing Desk (Market Makers) or Non-Dealing Desk (NDD) providers. Market Makers can offer fast execution by internalising trades but may delay orders if liquidity in UK-listed stocks, such as FTSE 100 shares, is insufficient. NDD brokers, including ECN and STP types, route orders directly to liquidity pools, such as those of LSE members or major banks, enabling quicker fills and tighter spreads due to direct market access.

- Liquidity: Liquidity reflects how easily UK assets, such as FTSE shares or GBP currency pairs, can be traded without affecting their price. High liquidity during London’s trading hours means that orders for popular assets, such as GBP/USD or Lloyds Banking Group shares, are matched quickly with minimal slippage. In contrast, thinly traded or less popular UK stocks may experience slower fills and price fluctuations due to limited counterparty activity.

- Price: Execution speed depends on the depth of the order book around your chosen price. UK brokers provide Level 2 market data showing real-time bids and asks beyond the best prices, allowing you to position orders strategically within the LSE order flow, thereby improving chances of immediate execution near your desired price.

- Order type: Market orders prioritise speed and are executed at the best available UK market price, which is essential during fast-moving sessions such as the London open. Limit orders set specific price thresholds and may remain unfilled if the asset’s price doesn’t reach your limit, potentially causing delays, especially for less liquid UK assets.

- Order size: Larger orders in UK stocks or GBP forex pairs can take longer to fill, particularly if there isn’t enough volume at your target price. For example, placing a large buy order on a smaller AIM-listed stock may result in partial fills. Checking Level 2 order book data can help you adjust order sizes to match the available liquidity, resulting in faster execution.

- Time of day: UK market activity peaks during core hours (08:00 – 16:30 GMT), particularly in the first hour after the LSE opens, resulting in faster order execution. Forex pairs involving GBP experience heightened liquidity when the UK and US markets overlap (around 13:00 – 16:00 GMT), which improves trade speed for GBP/USD and similar pairs.

- Market volatility: During high-volatility periods—such as UK economic announcements or geopolitical events—price swings in assets like FTSE 100 futures or GBP currency pairs can widen spreads and slow order fills, increasing slippage risk as brokers struggle to match orders at desired prices quickly.

- Internet speed: Low-latency connections to brokers with servers physically located near London exchanges are crucial for minimising execution delays. A broadband speed of at least 25 Mbps is recommended, with higher speeds (up to 100 Mbps) being beneficial for active traders or scalpers who execute frequent trades on platforms like Interactive Brokers or CMC Markets.

- Your device: Trade execution depends partly on the performance of your computer or mobile device. Platforms like MetaTrader 5 benefit from 64-bit processing and faster data handling compared to MetaTrader 4. Keeping your system updated and optimised ensures your orders are sent promptly and reduces lag during crucial London market hours.

From my experience trading UK markets, the fastest execution brokers aren’t just those with the best tech—they’re the ones that blend cutting-edge infrastructure with deep local market connectivity.This combination consistently delivers the speed and precision needed to stay ahead in London’s highly competitive trading environment.

Bottom Line

Fast execution speeds are crucial for capitalising on market opportunities and reducing costly slippage.

Selecting brokers with advanced technology, direct market access, and robust liquidity will help ensure that your trades are executed swiftly and accurately.

Understanding factors like broker type, market hours, and order size will also help you optimise your trading experience for the fastest fills.

To get started, see our rankings of the fastest execution brokers in the UK.