Best Brokers With No-Deposit Bonuses In The UK 2026

Please note that FCA-regulated brokers can no longer offer deposit bonuses or no-deposit bonuses to UK retail clients.

No-deposit bonuses can look appealing – they let you test trading without risking your own money, but their size and rules depends on the broker you choose.

We’ve rounded up the top brokers with no-deposit bonuses in the UK, reviewed by traders who’ve actually used them.

The UK may have regulations that restrict no deposit trading bonuses. Check the latest requirements before claiming any offers.

Top Brokers With No Deposit Bonuses

Safety Comparison

Compare how safe the Best Brokers With No-Deposit Bonuses In The UK 2026 are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|

Payments Comparison

Compare which popular payment methods the Best Brokers With No-Deposit Bonuses In The UK 2026 support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|

Mobile Trading Comparison

How good are the Best Brokers With No-Deposit Bonuses In The UK 2026 at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|

Beginners Comparison

Are the Best Brokers With No-Deposit Bonuses In The UK 2026 good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|

Advanced Trading Comparison

Do the Best Brokers With No-Deposit Bonuses In The UK 2026 offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the Best Brokers With No-Deposit Bonuses In The UK 2026.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|

How Investing.co.uk Chose The Biggest No Deposit Bonus Brokers

We reviewed the market to identify brokers currently offering verified no deposit bonuses, checking each promotion’s size, eligibility, and withdrawal terms.

We then applied Investing.co.uk’s rating framework – covering regulation, fees, platforms, product range, and support – to assess overall quality. This allowed us to rank brokers by no deposit bonus size but also by their overall ratings, so only reputable, well-reviewed platforms made our list.

What Is A No Deposit Trading Bonus?

A no-deposit bonus is a type of trading promotion that’s essentially free credit that a broker gives you when you open an account. You don’t put in your own money first. Brokers use it to attract new traders.

You can place trades with the bonus, but withdrawing profits is usually tied to conditions. This bonus is not ‘free cash’ you can pocket straight away.

It’s also worth noting that most no-deposit bonuses are small. They are not designed to replace real trading capital. Instead, think of them as a testing tool. If you treat the bonus as free practice capital, you’ll avoid the common trap of overestimating its value.

What To Look For In A Broker Offering A No Deposit Bonus

Understand The Bonus Rules

Every no-deposit bonus comes with terms. You need to read them closely. Look out for:

- Withdrawal conditions: Some brokers only let you withdraw profits after trading a certain volume.

- Expiry dates: No deposit bonuses often expire if you don’t use them in time.

- Trading restrictions: Some products or strategies may not be allowed when using the bonus.

- Maximum profit caps: A broker may limit how much profit you can withdraw from bonus funds.

For example, you might earn £50 profit from a £25 no deposit bonus, but the broker only allows you to withdraw £20 of it. Others may require you to place dozens of trades before any withdrawal is possible.

These rules matter more than the size of the bonus. A £25 no deposit bonus with fair terms is more useful than a £100 bonus with impossible conditions.

When I first tried a no-deposit bonus, I realised the hard part wasn’t making trades – it was meeting the withdrawal rules. Reading the terms closely saved me from wasting time chasing profits I couldn’t actually take out.

Look At The Trading Platform

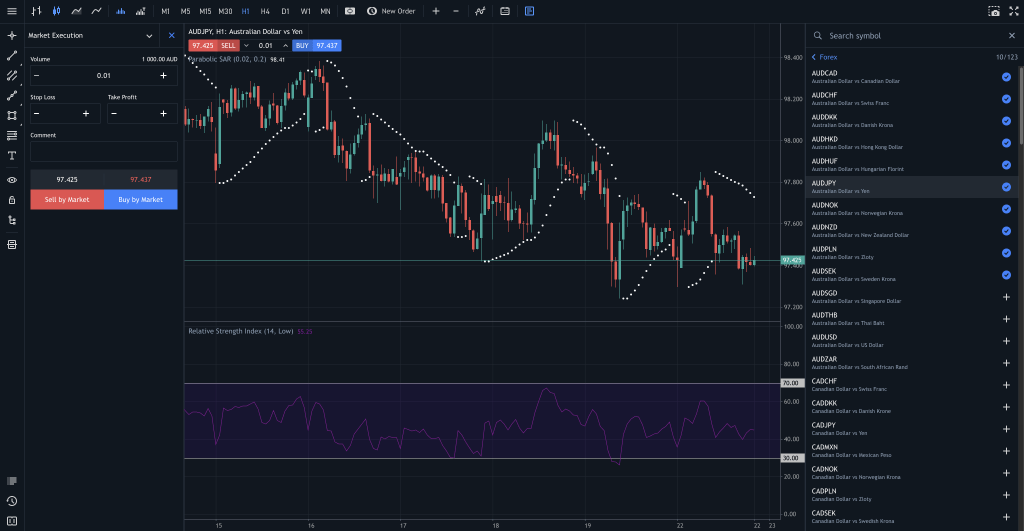

You’ll be trading with the broker’s platform, not just the no deposit welcome bonus. Make sure the platform is stable and easy to use. Most brokers offer MetaTrader 4 (MT4) or MetaTrader 5 (MT5), while others have their own software.

Always try out the demo trading account where available. The goal isn’t just to use the free trading credit – it’s to see if the broker is one you’d want to trade with in the long term.

If the platform is clunky, slow, or prone to crashing, the bonus won’t matter. A smooth experience is worth more than a one-time incentive.

MT5 Web Trader lets you trade forex, stocks, and futures from any browser on any OS

Check The Available Assets

No deposit bonuses don’t always cover all products. Some brokers limit them to forex or certain CFDs. If you plan to trade stocks, indices, or commodities, check if the trading credit applies. Otherwise, you might be locked into markets you don’t want to trade.

Let’s say you want to test oil or gold trading. If the bonus only applies to forex, you won’t get the experience you’re after. Always read the fine print to avoid surprises.

Understand Leverage & Risk

No deposit bonuses often come with high leverage. This can make trading feel exciting, but it increases risk. A small move in the market can wipe out the bonus quickly.

Don’t treat the bonus as free money. Approach it like a standard trading account: set limits, manage risk, and avoid oversized positions.

Think of leverage as a double-edged sword. With £25 of bonus funds and 1:100 leverage, you could control £2,500 worth of trades. But a 1% market move could wipe out the entire bonus. That’s why discipline is key.

When I tried a no-deposit bonus to trade oil, the leverage made small trades move the balance fast, but one sudden swing wiped it out in minutes. It showed me these bonuses aren’t free money – they’re a test of risk control.

Watch For Hidden Fees

Even with a no-deposit bonus, you could still face costs. Check for:

- Withdrawal fees: Some brokers charge for taking money out.

- Inactivity fees: If you stop trading, you may be charged.

- Spreads & commissions: The ‘free bonus’ can be offset if trading costs are too high.

Always compare fees with other FCA-regulated brokers. The no deposit sign-up bonus is only worth it if costs don’t eat into potential profits. A spread that’s double the market average can make the offer far less attractive.

Check The Broker’s Regulation

The first thing to confirm is whether the broker is regulated in the UK. In practice, that means the broker should be authorised by the Financial Conduct Authority (FCA).

If they are not, you may not get the same protection for your funds or fair treatment, even if you are only using a bonus, regulation matters. It shows the brokerage is accountable.

That said, most offers online come from offshore brokers due to regulatory restrictions on promotions in the UK. This makes using no deposit bonuses high risk for British traders.

Check The Support Quality

If you have trouble withdrawing bonus profits, support matters. Test how quickly the broker answers questions. Try live chat or email before you commit. If support is slow or unclear, that’s a red flag.

Fast, helpful support is often overlooked, but it can make a significant difference when issues arise. If you can’t get straight answers, think twice about using that broker.

Avoid Chasing The Biggest Bonus

It’s tempting to go for the broker offering the biggest no deposit bonus. But size doesn’t matter if you can’t actually use or withdraw it. Focus on:

- Regulation

- Fair bonus rules

- Platform quality

- Range of assets

- Reasonable fees

These matter more than whether the bonus is £25 or £100. A smaller, fair offer from a trusted brokerage beats a big, unrealistic one from an offshore firm.

Be Realistic About Profits

No deposit bonuses are often small compared to real trading capital. They can give you a chance to practice in live conditions, but they won’t make you rich.

If you want to grow as a trader, think of the bonus as training, not income. Use it to learn how the platform works, test strategies, and understand the broker. If you earn some profit, that’s a bonus on top.

You might hear stories online about traders making large sums from a no-deposit bonus. These are rare exceptions. For most, the trading credit serves best as a stepping stone into real trading.

Using a no-deposit bonus taught me that big profits are rare – most of the value comes from learning the platform and testing strategies, not cashing out windfalls.

Bottom Line

No-deposit bonuses can be helpful if you know the rules. They let you test a broker without risking your own money.

But focus on regulation, terms, and trading conditions. A fair, transparent broker with a small bonus is better than a risky one with a huge offer.

In the end, the best use of a no-deposit bonus is as a learning tool. If you gain some profit along the way, consider it extra. But the real value lies in testing the broker, the platform, and your own trading approach.

With the right mindset, you can use the bonus to build confidence before committing real funds.