Binary Options Pricing

Binary options pricing models vary. Some brokers use the $0 to $100 method derived from the Black Scholes formula while others take a fixed payout approach. This article walks through both binary options pricing models, uncovering the pros and cons of each. We also explore other ways that binary options brokers make money.

Top Binary Options Brokers

Fixed Payout

Most providers adopt a fixed payout approach.

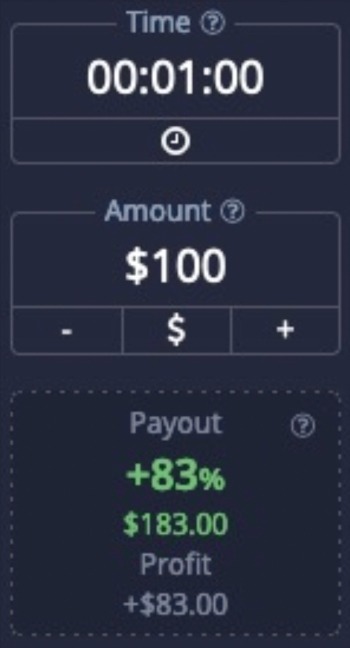

With this binary options pricing system, platforms simply pay out a percentage of the stake on winning trades. For example, if you bet $100 that the value of the FTSE will rise in 1 minute and your broker offers an 83% payout, then you will:

- Make $83 if the price of the FTSE is higher than the current price in 60 seconds

- Lose $100 if the price of the FTSE is lower than the current price in 60 seconds

Fixed Payout Binary Pricing – Pocket Option

With this binary options pricing model, brokers make their money through the difference in what they pay out in winning trades and the amount they take from losing trades.

Helping binary options brand to make a profit is the fact that payouts typically don’t exceed 100%. This means traders would need to win more than half of their trades to stay in the black.

It’s also worth noting that payouts on volatile markets, such as digital currencies, are usually lower at around 60%. Average payouts on more stable and popular assets, such as major forex pairs and stocks, are normally between 70% and 95%.

This binary options pricing system is the easiest to understand, making it popular with beginners. As a result, many of the top binary options brokers today follow this pricing model, including Pocket Option.

$0 To $100

Some binary options platforms use an alternative pricing system. This approach is primarily available in the US, but it’s still helpful to understand how it works.

With this pricing model, digital options are always priced between $0 and $100 and there is a bid-ask spread to take into account.

Let’s say your binary options broker asks; will Shell’s share price be higher than $2,350 at midday?

- If you think the price will be above $2,350 then you would place a buy order

- If you think the price will be below $2,350 then you would place a sell order

The binary option has a bid price of $45 and an ask price of $47.50. This means:

- If you buy the contract now you will pay $45 (less any fees)

- If you sell the contract now you will pay $47.50 (less any fees)

The potential outcomes if you place a buy order are:

- At midday Shell’s share price is higher than $2,350 – your binary option finishes in-the-money and expires at $100 giving you a profit of $55 ($100 – $45)

- At midday Shell’s share price is lower than $2,350 – your binary option finishes out-of-the-money and expires at $0 costing you $45 as well as any fees

Importantly, the bid and ask prices will continue to change until the binary expires. And unlike the fixed payout binary options pricing model above, traders can exit their position at any time.

The key benefit of trading with this binary options pricing model is that the payouts can be greater relative to the initial investment.

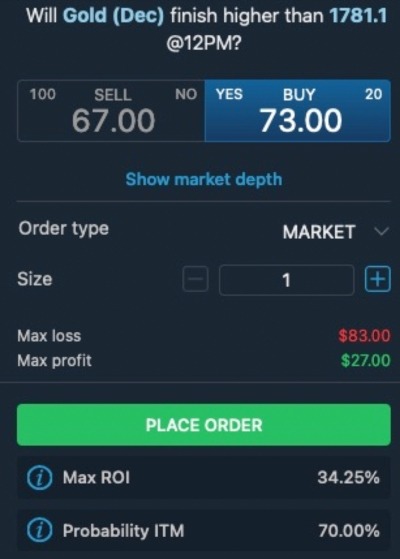

The example below shows the order window for another $0 to $100 trade. Here, you can see the current value of the underlying asset, expiry time, bid-ask spread, order size, profit and loss.

$0 To $100 Binary Options Pricing – Nadex

How Do Binary Options Brokers Make Money?

While taking counterparty positions is the primary way binary options brokers generate revenue, there are other methods too:

Deposits & Withdrawals

Some binary options providers charge deposit and withdrawal fees, where the exact amount varies depending on the transfer method.

IQCent, for example, accepts deposits made via Visa and Mastercard debit and credit cards as well as cryptocurrencies such as Bitcoin and Ethereum. Using a debit or credit card comes with a 5% charge while crypto transactions are free.

You may also need to consider currency conversion charges. Some binary options brokers, such as Videforex, only allow clients to deposit, withdraw and hold funds in USD. While this will not be an issue for traders based in the US, investors from the UK will need to account for any conversion fees.

Trading Conditions & Tools

Binary options pricing models can also include charging extra for certain features and tools, such as priority support, access to expert market analysis and increased maximum trade sizes. Signals, alerts, and robots can also come at an extra cost.

Pocket Option, for example, caps the maximum contract value at $1,000 with the lowest level account whereas the highest account tier allows users to make trades up to $5,000.

Early Contract Exit

While uncommon, some binary options brokers allow traders to close contracts early. To do so, there is typically a fee charged.

Traders may want to close a contract early to secure a winning position or minimise losses.

Bottom Line On Binary Options Pricing

Binary options pricing models differ between brokers. Both the fixed payout approach and the $0 to $100 model have their advantages. However, the fixed payout approach is the most common among binary options brokers that accept UK traders.

A useful tip for beginners is to register for a demo account. This will help you get a feel for a brand’s pricing system. Alternatively, sign up with one of our top-rated binary options brokers to get started today.

FAQs

How Does Binary Options Pricing Work?

There are two key binary options pricing systems. The most common is the fixed payout model whereby brokers pay out a percentage of the initial investment on winning trades. Alternatively, some brands follow the $0 to $100 model where options expire either at $0 or $100 alongside a bid-ask spread which determines the size of wins and losses.

How Do Binary Options Brokers Make Money?

Binary options brokers primarily make a profit by subtracting the amount paid out on winning trades from the amount generated on losing trades. Brands can also charge for deposits and withdrawals, plus premium trading tools and account features.

What Impacts The Price And Payout Of A Binary Option?

Binary options contract pricing is impacted by several factors, such as the underlying asset, its volatility, and the expiry time. Brokers ultimately use a range of formulas and calculations to inform payouts.

Is Binary Options Trading Profitable?

Binary options can be profitable, but many investors lose money. To help improve your chances, make sure you understand how binary options are priced and use a strategy that aligns with your financial aims and risk tolerance.

What Is The Black-Scholes Options Pricing Model?

The Black-Scholes options pricing model is a formula used by brokerages to determine what the prices of call and put contracts should be. The formula uses information such as contract length, strike price and the value of the underlying asset at open.