Halal Binary Options

Binary options offer a fixed payout if a trader correctly predicts whether the price of a security will rise or fall. But is binary options trading halal or haram? We provide an overview of Islamic finance principles and consider how they align with binary options trading. We also list the best Islamic-friendly binary options accounts in 2026.

Halal Binary Options Brokers

Safety Comparison

Compare how safe the Halal Binary Options are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|

Payments Comparison

Compare which popular payment methods the Halal Binary Options support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|

Mobile Trading Comparison

How good are the Halal Binary Options at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|

Beginners Comparison

Are the Halal Binary Options good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|

Advanced Trading Comparison

Do the Halal Binary Options offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the Halal Binary Options.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|

Islamic Trading Principles

The key pillars of Sharia Law are social justice, ethics, and using finance to help build communities. But whether binary options falls within the remit of Islamic trading principles is not immediately clear. With that said, aspiring traders should pay particular attention to the following Islamic finance rules:

- Gambling is not permitted

- It is prohibited to act with greed

- Earning via interest/riba is not allowed

Below we look at how each of these principles aligns with binary options and whether trading should be considered halal or haram.

Interest

Some binary options brokers offer market rate interest on uninvested cash balances. However, this is not permitted under halal values. To alleviate this challenge, many brokerages now offer Islamic trading accounts, whereby no interest can be charged or earned on trading capital.

To comply with Islamic investing principles, trading accounts must also offer instant execution of trades and the immediate settlement of transaction costs.

Greed

Not acting under the influence of greed is another important Islamic finance principle. This raises a challenge when trading binary options as emotions can run high and the temptation to chase greater profits can be difficult to resist.

To help tackle this challenge, many traders utilise risk management alerts and tools, available at supporting brokers. These allow you to lock in profits when a predetermined threshold has been met.

The 1% rule can also help prevent traders from over-investing. This straightforward concept suggests never putting more than 1% of your total trading capital into a single trade.For example, let’s say I have £5,000 in my binary options account; my stake and potential loss on a single position should not exceed £50 (£5,000 x 1%).

Gambling

Sharia Law does not permit participation in activities where there is excessive risk or uncertainty. This involves speculation or gambling. This raises another interesting question when considered alongside binary options trading.

Some argue that because binary options strategies are often based on assumptions, they are haram. They also believe that because each contract or trade must have a ‘winner’ and a ‘loser’, all parties cannot profit, or extract value, from the position.

However, there is another school of thought that believes the key consideration should be around the approach taken by the trader. Wild speculation with no plan or strategy would indeed contradict Sharia Law.

However, a carefully considered trading system with a robust strategy underpinning it is arguably halal. So, if the trader approaches binary options in a disciplined manner, then it may not be haram.

Halal Binary Options Trading In The UK

According to the Office for National Statistics (ONS) 6.5% of the UK population is Muslim as of 2021. It is believed this figure will increase to 17% by 2050. So unsurprisingly, the number of individuals turning to trading, including those making investments in binary options, is rising. In fact, Islamic finance and trading opportunities are one of the fastest-growing financial services sectors in the UK.

In 2018, the first Sharia-compliant robo-advisor, Wahed Invest, was launched in the United Kingdom, supporting investments in various markets, including ethically responsible stocks and Islamic Sukuk bonds. And we expect to see more innovative investment solutions becoming available in the future, including Islamic-friendly binary options trading accounts.

Halal Binary Options Trading Accounts

Today, several binary options brokers offer Islamic trading accounts for investors who follow the principles of Sharia Law. These are also known as swap-free accounts. In many cases, investors will be able to convert standard live accounts to Islamic-friendly profiles by contacting the broker’s customer service team.

Important features of these account profiles are that transactions are settled immediately and that interest cannot accumulate based on the funds held in the client’s account. True Islamic-friendly binary options accounts will not permit the following:

- Trading on margin – Leveraged binary options trading is also not permitted. This means capital borrowed from a brokerage or exchange to buy or sell securities

- Overnight rollover charges – Receiving swap points on positions held after the trading day has concluded is forbidden, for example, positions on companies listed on the London Stock Exchange closing at 4 PM (GMT)

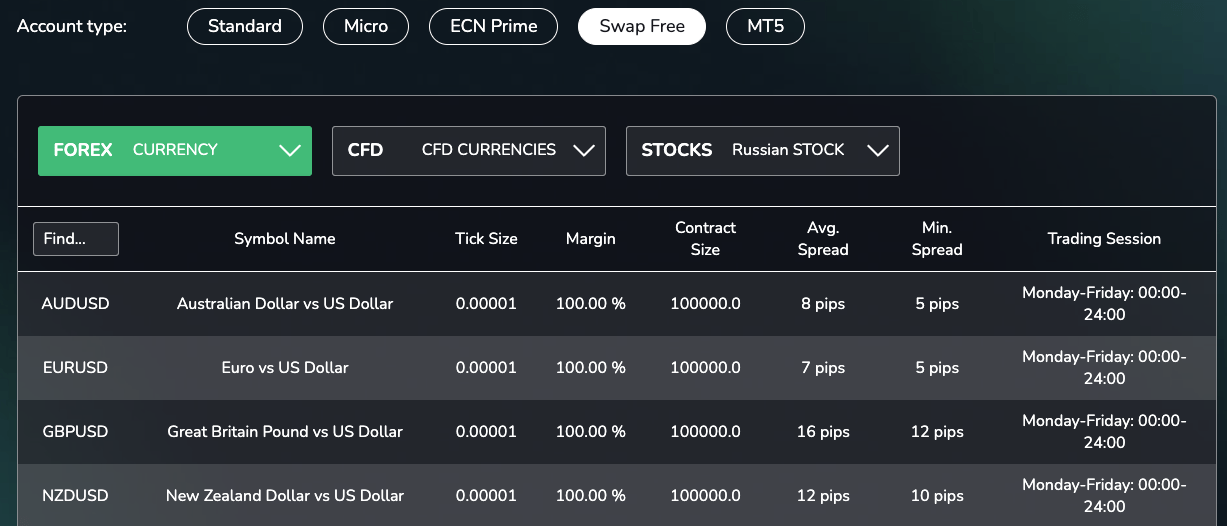

Grand Capital – Swap Free Conditions

Benefits Of Halal Binary Options Accounts

There are some notable advantages of using a Halal binary options account:

- UK investors can follow Islamic trading principles while still speculating on traditional and emerging financial markets with binary options.

- Halal accounts encourage a disciplined approach to investing, with thought-through strategies that prevent greedy or hasty trading decisions.

- Halal investing discourages overly frequent short-term speculation which could be viewed as a form of gambling.

Getting Started

Choosing A Binary Options Broker

The most important step to trading halal binary options is to find a broker that offers an Islamic-friendly trading account. As binary options are banned by the Financial Conduct Authority (FCA), British traders will need to turn to overseas or unregulated organisations.

Unfortunately, using an unregulated broker can increase the risk of scams, including the notable binary options scandal in 2022, which cost UK victims £1.2 million.

With this in mind, make sure you choose a trustworthy broker that offers access to a range of markets, competitive payouts, plus a transparent pricing schedule and on-hand customer support.

Study The Market

Haram binary options contracts may involve speculating on companies associated with alcohol or tobacco, among other prohibited industries.

With this in mind, I recommend utilising halal screening tools. The Islamic Finance Guru offers several courses and tools for identifying Sharia-compliant companies as investment opportunities.

Bottom Line On Halal Binary Options

Whether binary options are considered halal or haram will vary depending on who you ask. Fortunately, several online brokers have introduced Islamic-friendly trading accounts which aim to comply with Sharia finance principles. See our list of recommended brands to start trading today. And for further guidance, consult a local religious leader.

Note, this article should not be construed as religious advice. Consult a local religious leader for individual guidance.

FAQ

What Are Halal Binary Options?

A halal binary options strategy refers to the investment of money in accordance with Islamic finance principles. Muslim traders should avoid investing in companies from haram industries, such as tobacco, alcohol and gambling. Investors should also ensure there are no interest charges.

Are Binary Options Halal?

Some argue that trading binary options is halal if investments are executed following the principles of Sharia Law. The key values centre around avoiding gambling, greed or earning interest. Dedicated Islamic trading accounts aim to provide an investing environment that complies with these principles.

Are Binary Options Haram?

Some critics view binary options trading as haram due to their speculative nature. Commentators argue that binary options contracts are often based on assumptions, with an outcome dependent on future events, which is not permitted under Islamic law. However, others believe that you can use binary options products while complying with Islamic finance principles. Consult a local religious leader for further guidance.

How Can UK Investors Trade Halal Binary Options?

British traders will need to find an offshore broker that offers Islamic-friendly trading accounts. A popular platform in 2026 is Grand Capital.

Are Halal Binary Options Legal In The UK?

The FCA has banned the marketing and sale of binary options products in the UK. However, investors can still open halal binary options trading accounts with offshore providers. See our list of recommended brokers here.

Article Sources

Islamic Finance Guru – Courses

Religion Census, England and Wales 2021 – ONS

Islamic Finance – Corporate Finance Institute