Position Trading

Position trading is a favoured strategy amongst investors of all experience levels and can be adopted across asset classes. This technique requires less maintenance and time commitment than other forms of cash and market investing, however, there are other pros and cons to consider, which we explore below. We also provide a position trading definition, a comparison to other investing styles, key steps to follow and, an explanation of specific position trading strategies.

Trading Brokers

-

Founded in Australia in 2010, Pepperstone is a highly regarded broker specialising in forex and CFDs. Serving more than 400,000 clients globally, it provides access to over 1,300 financial instruments through popular platforms like MT4, MT5, cTrader, and TradingView. Its fee structure is both low and transparent. With regulation by reputable bodies such as the FCA, ASIC, and CySEC, Pepperstone guarantees a safe trading environment for traders at every level.

Instruments Regulator Platforms CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB Pepperstone Trading Platform, MT4, MT5, cTrader, TradingView, AutoChartist Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:500 (Pro) -

Established in Poland in 2002, XTB caters to over a million clients worldwide. This forex and CFD broker offers a robust regulatory framework, a diverse range of assets, and prioritises trader satisfaction. It provides an intuitive proprietary platform equipped with excellent tools to support aspiring traders.

Instruments Regulator Platforms CFDs on shares, Indices, ETFs, Raw Materials, Forex currencies, cryptocurrencies, Real shares, Real ETFs FCA, CySEC, KNF, DFSA, FSC xStation Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 -

Founded in 1974, IG is a part of IG Group Holdings Plc, a publicly listed brokerage (LSE: IGG). The company provides spread betting, CFD, and forex trading, offering access to over 17,000 markets. Its platforms and investing apps are notably user-friendly. Over the past 50 years, IG has consistently been an industry leader, excelling in all essential areas for traders.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM, JFSA Web, L2 Dealer, MT4, TradingView, AutoChartist, TradingCentral, ProRealTime Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:222 (Pro) -

Trade Nation is a leading FX and CFD broker regulated in the UK and Australia, among other places. The company provides competitively priced fixed and variable spreads on over 1,000 assets. Traders benefit from advanced platforms and comprehensive training materials. Additionally, the Signal Centre offers valuable trade ideas.

Instruments Regulator Platforms Forex, CFDs, Indices, Shares, Commodities, Futures, Bonds, Spread Betting, Cryptos (Bahamas Entity Only) FCA, ASIC, FSCA, SCB, FSA TN Trader, MT4 Min. Deposit Min. Trade Leverage $0 0.1 Lots 1:500 (entity dependent) -

Interactive Brokers (IBKR), a leading brokerage, offers access to 150 markets across 33 countries and provides extensive investment services. With more than 40 years of experience, this Nasdaq-listed company complies with strict regulations from the SEC, FCA, CIRO, and SFC. It is among the most reliable brokers worldwide for traders.

Instruments Regulator Platforms Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, Cryptocurrencies, CFDs FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower Min. Deposit Min. Trade Leverage $0 $100 1:50 -

Eightcap, an acclaimed broker regulated by the FCA, offers exceptionally low trading costs. Recognised as the top-rated brand by TradingView's vast user base of 100 million, traders can directly access the platform. UK traders can open a live account with a minimum deposit of just £100.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities ASIC, FCA, CySEC, SCB MT4, MT5, TradingView Min. Deposit Min. Trade Leverage £100 0.01 Lots 1:30 -

Established in 1999, FOREX.com is now integrated into StoneX, a prominent financial services entity catering to more than one million clients globally. The broker is regulated in numerous jurisdictions, including the US, UK, EU, and Australia. It offers a vast array of markets beyond forex, delivering competitive pricing on state-of-the-art trading platforms.

Instruments Regulator Platforms Forex, CFDs, Stock CFDs, Indices, Commodities, Futures, Options, Crypto NFA, CFTC, CIRO, FCA, CYSEC, ASIC, SFC, FSA, MAS, CIMA WebTrader, Mobile, MT4, MT5, TradingView Min. Deposit Min. Trade Leverage $100 0.01 Lots 1:30

Safety Comparison

Compare how safe the Position Trading are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✘ | ✔ | |

| XTB | ✔ | ✔ | ✔ | ✔ | |

| IG | ✔ | ✔ | ✔ | ✔ | |

| Trade Nation | ✔ | ✔ | ✘ | ✔ | |

| Interactive Brokers | ✔ | ✔ | ✘ | ✔ | |

| Eightcap | ✔ | ✔ | ✘ | ✔ | |

| Forex.com | ✔ | ✔ | ✘ | ✔ |

Payments Comparison

Compare which popular payment methods the Position Trading support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| XTB | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| IG | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ |

| Trade Nation | ✔ | ✔ | ✔ | ✘ | ✔ | ✘ |

| Interactive Brokers | ✔ | ✔ | ✘ | ✘ | ✘ | ✘ |

| Eightcap | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| Forex.com | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

Mobile Trading Comparison

How good are the Position Trading at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| Pepperstone | iOS & Android | ✘ | ||

| XTB | iOS & Android | ✔ | ||

| IG | iOS & Android | ✔ | ||

| Trade Nation | iOS & Android | ✘ | ||

| Interactive Brokers | iOS & Android | ✔ | ||

| Eightcap | iOS & Android | ✘ | ||

| Forex.com | iOS & Android | ✘ |

Beginners Comparison

Are the Position Trading good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|---|---|---|---|---|

| Pepperstone | ✔ | $0 | 0.01 Lots | ||

| XTB | ✔ | $0 | 0.01 Lots | ||

| IG | ✔ | $0 | 0.01 Lots | ||

| Trade Nation | ✔ | $0 | 0.1 Lots | ||

| Interactive Brokers | ✔ | $0 | $100 | ||

| Eightcap | ✔ | £100 | 0.01 Lots | ||

| Forex.com | ✔ | $100 | 0.01 Lots |

Advanced Trading Comparison

Do the Position Trading offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Pepperstone | Expert Advisors (EAs) on MetaTrader | ✔ | 1:30 (Retail), 1:500 (Pro) | ✔ | ✘ | ✔ | ✘ |

| XTB | - | ✔ | 1:30 | ✘ | ✘ | ✔ | ✘ |

| IG | Expert Advisors (EAs) on MetaTrader, build your own on ProRealTime | ✔ | 1:30 (Retail), 1:222 (Pro) | ✔ | ✔ | ✔ | ✔ |

| Trade Nation | Expert Advisors (EAs) on MetaTrader | ✘ | 1:500 (entity dependent) | ✘ | ✘ | ✘ | ✘ |

| Interactive Brokers | Capitalise.ai, TWS API | ✘ | 1:50 | ✘ | ✔ | ✔ | ✔ |

| Eightcap | TradingView Bots | ✘ | 1:30 | ✔ | ✘ | ✔ | ✘ |

| Forex.com | Expert Advisors (EAs) on MetaTrader | ✘ | 1:30 | ✔ | ✔ | ✔ | ✘ |

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the Position Trading.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|---|---|---|---|---|---|---|---|---|

| Pepperstone | |||||||||

| XTB | |||||||||

| IG | |||||||||

| Trade Nation | |||||||||

| Interactive Brokers | |||||||||

| Eightcap | |||||||||

| Forex.com |

Our Take On Pepperstone

"Pepperstone is a premier trading platform, providing tight spreads, swift execution, and sophisticated charting tools for seasoned traders. Beginners benefit from no minimum deposit, comprehensive learning materials, and outstanding 24/7 support."

Pros

- Support for top-tier charting platforms such as MT4, MT5, TradingView, and cTrader. These tools accommodate different short-term trading methods, including algorithmic trading.

- Pepperstone now offers spread betting via TradingView, delivering a streamlined and tax-efficient trading experience with sophisticated analytical tools.

- Pepperstone presents itself as an economical choice for traders, offering spreads as low as 0.0 in its Razor account. The Active Trader programme provides rebates up to 30% on indices and commodities, plus $3 per lot on forex.

Cons

- Pepperstone's demo accounts remain active for 60 days. This duration might be insufficient to fully explore the platforms and trial various trading strategies.

- Although its market range has improved, its crypto offerings remain limited compared to brokers specialising in this sector, lacking real coin investment options.

- Pepperstone doesn't offer cTrader Copy, a favoured feature for copying trades found in the cTrader platform, which is available on other platforms such as IC Markets. However, Pepperstone has launched its own user-friendly copy trading app.

Our Take On XTB

"XTB excels for novice traders with its superb xStation platform, minimal trading costs, no required deposit, and outstanding educational resources, many of which are fully integrated into the platform."

Pros

- XTB offers a superb array of educational resources, such as training videos and articles, embedded within the platform to assist traders of all experience levels.

- Setting up an XTB account is straightforward and fully online, requiring only a few minutes. This simplicity eases new traders into the world of trading.

- The xStation platform stands out with its user-friendly design and intuitive tools, such as adaptable news feeds, sentiment heatmaps, and a trader calculator. These features streamline the learning process for new traders.

Cons

- The research tools at XTB are commendable but have the potential to excel further. Enhancing them with access to top-tier third-party services like Autochartist, Trading Central, and TipRanks would significantly elevate their offering.

- XTB has stopped supporting MT4, restricting traders to its own platform, xStation. This decision may discourage experienced traders accustomed to using the MetaTrader suite.

- The demo account lasts only four weeks, posing a challenge for traders wanting to fully explore the xStation platform and refine short-term strategies before investing actual money.

Our Take On IG

"IG offers a complete package: an easy-to-use web platform, top-tier beginner education, enhanced charting via TradingView, up-to-date data, and strong trade execution for seasoned traders."

Pros

- The ProRealTime advanced charting platform remains free, provided traders meet modest monthly activity requirements.

- IG secured a crypto asset license from the FCA, enabling its return to the UK market. It now offers buying, selling, and storage services for over 55 digital tokens with fees starting at 1.49%, all under FCA regulation.

- IG provides a wide range of professional and engaging educational materials, such as webinars, articles, and analyses, tailored for traders.

Cons

- In the UK and EU, negative balance protection is available. However, US clients lack account protection and guaranteed stop losses.

- IG has ended its swap-free account, diminishing its attractiveness to Islamic traders.

- IG imposes a monthly inactivity fee of $12 after two years, discouraging occasional traders.

Our Take On Trade Nation

"Trade Nation is ideal for novice traders seeking diverse markets on an easy-to-use platform. It offers no minimum deposit, complimentary funding options, and robust educational resources."

Pros

- Beginners benefit from a modest initial deposit.

- Access a comprehensive selection of investments through leveraged CFDs, enabling both long and short strategies.

- Global traders can use accounts in various currencies.

Cons

- Reduced legal safeguards with an offshore entity.

Our Take On Interactive Brokers

"Interactive Brokers ranks highly for seasoned traders due to its robust charting platforms, live data, and bespoke layouts via the new IBKR Desktop app. Its competitive pricing and sophisticated order choices appeal to traders, and its wide equity options are industry-leading."

Pros

- IBKR consistently offers unparalleled access to global equities, with thousands of shares available across over 100 market centres in 24 countries, including the recently added Saudi Stock Exchange.

- IBKR offers an economical environment for traders, featuring low commissions, narrow spreads, and a clear fee structure.

- Interactive Brokers has introduced ForecastTrader, an innovative product offering zero-commission trading with yes/no Forecast Contracts on political, economic, and climate events. It features fixed $1 contract payouts, 24/6 market access, and a 3.83% APY on positions held.

Cons

- IBKR offers a variety of research tools, but their inconsistent placement across trading platforms and the 'Account Management' webpage creates a confusing experience for users.

- Support can be sluggish and frustrating. Tests reveal that you may face challenges reaching customer service quickly, which could result in delays in issue resolution.

- You are limited to a single active session per account, meaning you cannot use both your desktop programme and mobile app at the same time. This restriction can occasionally lead to a frustrating experience for traders.

Our Take On Eightcap

"Eightcap excels for traders, offering diverse charting platforms, educational Labs, and AI tools. With over 120 crypto CFDs, it stands out in crypto trading and has won our 'Best Crypto Broker' award twice consecutively."

Pros

- With spreads starting at 0 pips, minimal commission charges, and leverage up to 1:500 for select clients, Eightcap delivers affordable and flexible trading opportunities. These conditions suit various strategies, such as trading and scalping.

- In 2026, Eightcap integrated TradeLocker, distinguishing itself as the premier regulated broker for TradeLocker. It continues to offer ultra-fast execution and competitive fees for active traders on the charting platform.

- Eightcap has excelled in all essential trading areas, surpassing all rivals to clinch our 'Best Overall Broker' award for 2024. It also earned the titles of 'Best Crypto Broker' and 'Best TradingView Broker' for 2025.

Cons

- Despite a helpful array of educational guides and e-books in Labs, Eightcap lags behind IG's extensive resources for aspiring traders. IG boasts a dedicated Academy app and features 18 diverse course categories.

- Eightcap must enhance its range of over 800 instruments to rival top competitors like Blackbull Markets, which offers 26,000+ assets, especially improving its limited commodities selection.

- Despite the growing range of tools available, Eightcap lacks popular industry resources such as Autochartist and Trading Central. These provide advanced charting analytics, live news, and essential market insights for traders focused on short-term strategies.

Our Take On Forex.com

"FOREX.com excels in serving traders of all levels, offering more than 80 currency pairs, spreads starting at 0.0 pips, and competitive commissions. Its robust charting platforms provide over 100 technical indicators and comprehensive research tools."

Pros

- An abundance of educational resources is available, such as tutorials, webinars, and an extensive YouTube channel, designed to enhance your understanding of financial markets.

- FOREX.com provides top-tier forex rates beginning at 0.0 pips, along with attractive cashback rebates up to 15% for dedicated traders.

- With more than two decades of expertise, strong regulatory governance, and numerous accolades, including a second-place finish in our 'Best Forex Broker' awards, FOREX.com is globally renowned as a reliable trading platform.

Cons

- US clients are not protected against negative balances, which means you could end up owing more than your initial deposit.

- FOREX.com's MT4 platform provides around 600 instruments, a notable reduction compared to the more than 5,500 options on its other platforms.

- Demo accounts are typically limited to 90 days, hindering effective strategy testing.

Position Trading Defined

This strategy involves holding a position over a period of time expecting a change in value that will generate profits. Holding an asset in the hope its price rises is called a long position, holding an asset in the hope it falls is called a short position. Both are held in the long-term and less importance is placed on short-term indicators, information and fundamentals.

Position trading is a popular strategy in all asset classes including forex, company stocks, futures, commodities, and cryptocurrency like Bitcoin. It is a good starting point for beginners but may also play an important part of an experienced trader’s portfolio.

Position Trading Vs Other Strategies

It is worth understanding the key differences and effects of position trading vs other investing styles:

- Position Trading vs Day Trading – Day traders tend to buy and sell assets on the same day, whereas position traders hold assets for longer periods.

- Position Trading vs Swing Trading – Similar to day trading, swing traders try to earn profits by realising gains in a short period, though often longer than a single day.

- Position Trading Vs Trend Following – Position traders tend to take a limited number of large positions while trend followers typically take a select number of smaller positions.

- Position Trading vs Buy and Hold – Buy and hold investing refers to positions held for longer periods, for example, into retirement.

Steps To Start Position Trading

Below is a guide for aspiring position traders.

Choose A Broker

There are a number of important broker qualities to consider when beginning position trading. These include the platform options, the range of assets on offer, the fees charged, and the level of business regulation.

A UK-licensed broker is bound to provide some degree of market security by segregating retail trading funds and offering negative balance protection, meaning if your trade enters a negative net position, there will be a limit to potential losses. If trading with no zero-balance protection then there are no limits to potential losses.

Choose A Market

Brokers offer a range of assets for position trading. Most provide a number of forex pairs, stocks and commodities, noting crypto CFDs are now banned in the UK. If you don’t know what asset you want to invest in, you can make use of a demo account first.

Fund Your Position

Once you have chosen your broker, you need to add funds to your account to start position trading. Most reputable brokers offer a range of finance methods but take note of any minimum deposit and withdrawal amounts. Typically, this is a fair amount but ensure you are aware of the limits before signing up.

Execute A Strategy

There are several specific position trading strategies that investors can implement; these are discussed in the next section. To support these setups, traders should make use of any fundamental and technical analysis tools provided, often integrated into platforms.

Position trading tools can help users develop charting skills, determine when to open a position and understand where to set stop losses. Most tools are available on desktop or via mobile trading apps.

Some position traders may wish to use algorithm-based strategies. These are available on platforms such as MetaTrader 5 via APIs.

Utilise Resources

Some brokers offer additional resources to support their customers when position trading. These include public forums and training course videos. Forums are a great resource for building knowledge by discussing topics from how to close a short position to how to analyse a business’s accounting statements. eToro has a forum that is popular amongst position traders.

Traders can purchase strategy management books online or download PDFs to increase their knowledge. A good example of this is Trading for Dummies. Alternatively, there are extensive resources available on third-party websites to help develop investors’ core position trading strategies. Sites including YouTube and TradingView offer valuable insights for strategy development too.

Use Risk Management

Regardless of whether you are entering a long or short position, risk management is a key aspect of position trading. Financial markets can be unpredictable, traders should make use of position size calculators and implement their own trading rules to ensure strategies are aligned to their risk appetite.

Position Trading Strategy

There are a number of specific position trading strategy setups that can be adopted. It’s also useful for traders to understand the basics of other techniques such as moving averages on weekly, monthly and yearly charts.

Support & Resistance

Support and resistance (S&R) is the most common position trading strategy, often used in forex. Traders analyse price charts and patterns to determine the direction of the market along with entry and exit points.

The support line refers to the point that the price shouldn’t fall beyond while the resistance line indicates the level that price is unlikely to rise beyond. S&R lines, therefore, are key for determining where to set opening and closing positions.

Support and resistance

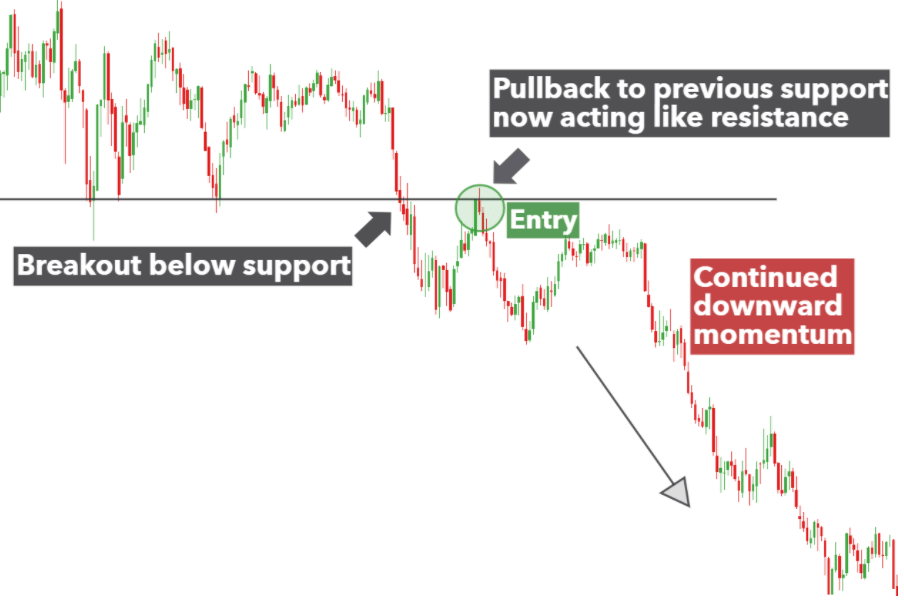

Breakouts

New price trends are often referred to as breakouts. If the price breaks the support line, traders can open a short position. If the price breaks the resistance line, traders can open a long position.

Breakouts provide traders with the opportunity to capitalise on market volatility and begin position trading at the start of a new trend. Chart analysis using support and resistance lines can form a triangle shape, if this occurs traders should expect a breakout and therefore the start of a new trend.

One of the risks of this strategy is if the breakout only has a temporary effect and the momentum isn’t strong enough to start a new trend. This is called a false breakout and patient traders wait for a pullback towards the support or resistance line before beginning to trade. An example of this is demonstrated below.

Breakouts

Trendlines

Traders can analyse the trend on a chart by identifying the peaks and troughs of an asset’s price over a period of time. By connecting the lows in an upward trend or the highs in a downward trend, traders can set support and resistance lines respectively.

In a strong trend, the price will fluctuate back to the trendline and move in the direction of an asset. The trader then enters the market when the price hits either trendline.

Note: a trendline strategy is subject to the volatility of the asset. A stable asset may not demonstrate peaks and troughs but a highly volatile asset may not travel in a consistent direction.

Benefits Of Position Trading

- Less maintenance and stress – Position trading does not require daily monitoring and is arguably, therefore, a less stressful form of trading.

- Easy to understand – Position trading is relatively straightforward and popular with both beginners and experienced investors.

- Potential returns – A patient trader may reap the benefits if they can act on a long-term market trend that moves in the desired direction.

- Relatively low risk – Some individuals use position trading strategies to diversify their risk while utilising other investing techniques. Position traders often tend to have a lower risk appetite.

- Educational resources available – Due to its popularity, there is a selection of position trading strategy books available to buy or download to PDF.

Drawbacks Of Position Trading

- High swap fees – Some brokers charge fees for positions held overnight on certain asset classes. Costs can accumulate and erode margins.

- Fast-changing trends – If the trend changes quickly, or if the trader goes against the trend, the value of the trade may promptly turn to a loss.

- Fewer wins – Position trading refers to holding a position over a longer time frame; therefore, the number of wins is lower vs other types of trading such as day trading or swing trading.

- More suitable for bull markets – Holding a trading position in a bull market can be more effective than a bear market. The former is where the market is on the rise, the latter where the market is on the decline.

Position Trading Terminology

When starting out in the financial markets, some of the terminology used can be confusing. Fortunately, we have compiled a list of key definitions.

- Position parking trading – An illegal form of trading where the owner of a stock is concealed by buying and selling a share between two parties in quick succession.

- Delta – A ratio measuring the change in price of an underlying asset compared to the change in price of the derivative or option. The rate of change in delta is known as gamma.

- Call option – A contract that gives the trader the option (but not the right) to buy an asset within a specific time frame and at a certain price.

- ROI (return on investment) – Simply the expected profit from an investment. This is calculated by dividing the return expected by the initial investment.

- Episodic pivots – Significant events throughout a stock’s life. Position trading using episodic pivots works particularly well with support and resistance or breakout strategies.

Final Word On Position Trading

We’ve looked at what position trading means and explained that it is relatively easy to understand and implement compared to other investing systems. Traders should have a good understanding of the market, utilise technical analysis tools, and make use of demo accounts.

Investors new to position trading can use our guide to understand the pros and cons of position trading, along with how to get started.

FAQ

What Is Position Trading?

By definition, position trading is when investors open and hold a position over a long period of time with the expectation that the asset will move in the desired direction. If the trader expects the price to fall, they will enter a short position while if the trader expects the price to rise, they will enter a long position.

What Is A Position Trading Firm?

A position trading firm is a broker or business which provides tradeable assets on the financial markets. The assets available to trade, platforms offered, and fees incurred vary from broker-to-broker so consult the provider’s website before signing up.

How Can I Learn To Position Trade?

There are a number of position trading books, company forums, tips, and information on broker websites. Some brokerages also offer position trading courses; however, this is subject to availability.

What Is The Best Position Trading Strategy?

Investors must develop their strategy based on risk appetite and personal trading preference. It is important to utilise demo accounts to test position trading strategies before putting capital at risk. Most top brokers offer demo accounts and additional features to support clients.

Is Position Trading Suitable For Beginners?

Yes, position trading is suitable for beginners. It can demand less time vs other trading methods such as day trading and users do not have to stress over short-term fluctuations. However, all trading comes with risk and it is important to ensure each trading position is supplemented with risk management tools.