ZacksTrade Review 2025

Zacks Trade is an international investment broker that offers competitive margin rates and free subscriptions to reputable research and market analysis. This 2025 broker review covers commission rates and account fees, regulatory licences and the firm’s robust trading platform. Read on to find out how to make the most of your investing with Zacks Trade.

Company Details

Headquartered in Chicago and founded in 1978, Zacks Trade is a US-based broker boasting over 40 years of investment research. The brokerage was created following the success of Len Zacks’ influential paper on predicting stock movements using Analyst Estimate Revisions.

Zacks Trade is now a division of LBMZ Securities Inc., a broker-dealer and member of the Securities Investor Protection Corporation (SIPC), ensuring protection for the firm’s clients.

LBMZ Securities is authorised and regulated by the US Securities and Exchange Commission (SEC) and Financial Industry Regulatory Authority (FINRA).

Trading Platform

Zacks Trade offers one online trading platform, Zacks Trade Pro. The broker’s proprietary platform is free to all its clients and supports investing in options contracts from over 19 countries from one single account.

Our experts found the following key features:

- Multiple watchlists

- 120+ technical indicators

- Trade directly from charts

- Customisable interface and charts

- Strategy builder for advanced order spreads

- Real-time alerts based on volume, market, price and time

You can download ZacksTrade Pro for Windows, Mac OS and Linux computers. The broker also provides a dedicated client portal, a single access point for those wishing to manage positions, access account subscriptions and tinker with their settings.

Products & Markets

Zacks Trade offers a variety of securities and assets for options and margin traders:

- ETFs

- Forex

- Bonds

- Options

- Mutual Funds

- Stocks (including penny stocks and over-the-counter (OTC) stocks)

Zacks Trade Fees

While using Zacks Trade, we found that customers can expect varying levels of commission rates:

- Stocks and ETFs > 88p – £0.0088 per share (88p minimum)

- Stocks and ETFs < 88p – 1% of trade value (88p minimum)

- Options – first contract 88p and 66p thereafter

- Mutual Funds – £24.17 on every position

- Corporate Bonds < £8,800 – 0.1% times the face value plus an additional £2.64 per bond

- US Government Bonds < £8,800 – 0.025% times the face value plus an additional £2.64 per bond

Zacks Trade also charges an inactivity fee of £13.18 a month for customers with an account balance of less than £22,000.

Also, whilst your first withdrawal is free of charge, there is a fee of £7 per additional wire in the same month.

Margin Trading

Zacks Trade offers clients the opportunity to increase their purchasing power with margin trading. The level of margin available is dependent on your account balance and requires consultation with the firm.

The online broker uses a tiered rate schedule, in which the margin rates are subject to your margin loan balance, as per the below:

- Tier 1: 7.33% up to £80,000

- Tier 2: 6.83% up to £800,000

- Tier 3: 6.58% up to £40,000,000

- Tier 4: 6.33% above £40,000,000

The firm uses a blended rate schedule. This means that the first £80,000 of the account balance is charged at the tier 1 rate, while the next £720,000 is charged at the tier 2 rate, and so on.

Margin privileges can be added during the application process or in the account management area at any time.

Portfolio margins are also available to traders with a balance of £90,000 in Net Liquidation Value.

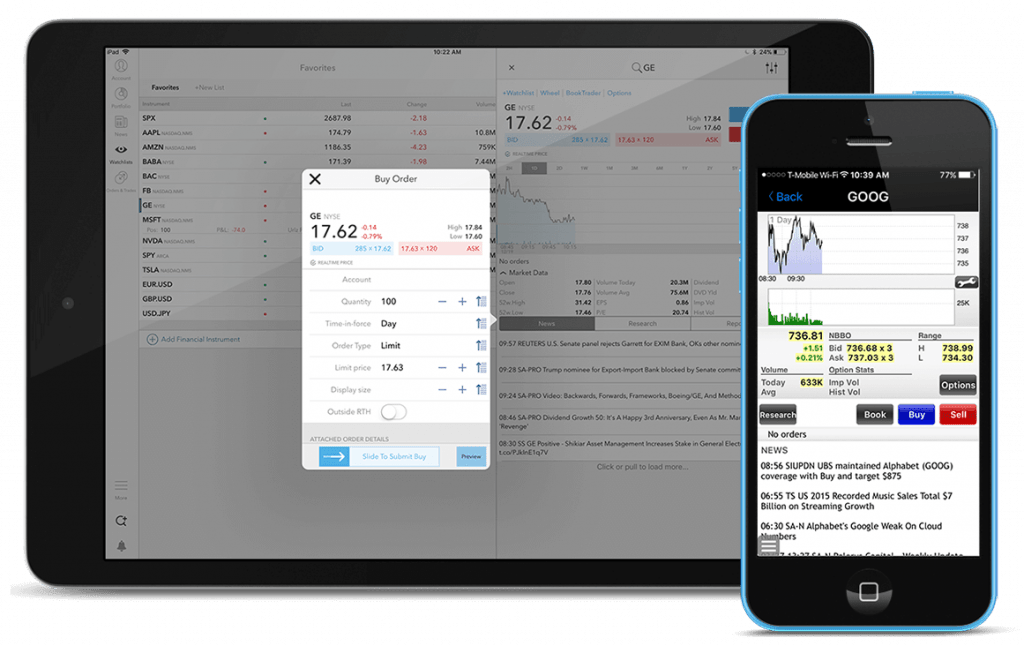

Mobile Apps

The Handy Trader application provides Zacks Trade clients mobile access to various products in the global markets and supports the creation of several watchlists, great for those on the move. Investors can monitor their portfolios and receive real-time news on their open positions wherever an internet connection is available.

Mobile App

When we used ZacksTrade’s app, we found it to be intuitive and comprehensive, allowing users to invest and exercise outstanding option positions in a secure environment.

The Handy trader app is compatible with both Apple (iOS) and Android (APK) devices.

Payment Methods

The firm accepts the following payment methods with zero deposit fees:

- Wire Notification

- Bank Cheque Notification

- Online Bill Pay Notification

- Personal Cheque Notification

- ACH (Automated Clearing House)

How To Invest With Zacks Trade

Create An Account

To open an account with Zacks Trade, navigate to the top-right-hand corner of the web page and click on Open an Account. Enter your first and last name, email address and phone number and proceed to the next step. You will then be prompted to choose your account type, followed by a username and password, plus confirmation of your email address.

Once security and trading experience questions have been answered, you will need to complete the identification process, which requires you to show proof of identity and residency and, finally, sign a virtual contract.

Account approval is based on annual net income, liquid net worth and investing history, where you must have completed a minimum of 100 live trades.

Make A Deposit

Once your account has been verified, you can log in and deposit funds into your account. Click on Transfer & Pay, found under Account Management on the left-hand side of the page and then head to the Transfer Funds section.

On this page, select the transaction type, the currency and the method. Note that wire notification is the quickest method, where you will be credited immediately once the broker receives the funds from your bank. You will be prompted to enter your bank account details, which you will have the option of saving.

Place An Order

To begin investing at Zacks Trade, navigate to the top-left-hand corner of the platform. In the order entry window, type in your chosen stock symbol and click enter.

Once selected, in the drop-down menu, click on a product and exchange and click on Buy. You can then decide your quantity of shares and the order type.

When you have submitted your order, a preview screen will pop up, allowing you to review your order before submission.

The same process can be used to close your position when you are ready. However, click Sell after selecting the desired product.

Demo Account

Zacks Trade offers a paper trading account for both new and existing investors. This allows the customer to familiarise themselves with the proprietary platform, explore new markets and test new strategies.

Deals & Promotions

Welcome bonuses and loyalty promotions are fairly limited. However, if you switch to Zacks Trade by filling out an account transfer reimbursement request, the company will cover the fee (up to £130) for transfers of at least £4,400.

Regulation

Zacks Trade is regulated by the US financial authorities, SEC and FINRA, via LBMZ Securities. These are highly-rated financial regulators and a good indication that the online broker is trustworthy. So whilst Zacks Trade is not regulated by the UK’s FCA, oversight from tier-one US agencies is a good sign.

In addition, account protection of up to £500,000 is provided by the Securities Investor Protection Corporation (SIPC).

Additional Tool

The following are powerful analysis and investing tools available to Zacks Trade clients:

- SpreadTrader – allows investors to easily manage complex options orders

- Volatility Lab – real-time measurement and forecasting of financial volatility

- Probability Lab – allows investors to analyse options probability distributions in various markets

- Algos – ready-built automated trading bots that include time-weighted average price (TWAP) and volume-weighted average price (VWAP)

- Basket Trader – quickly and effectively purchase and sell predefined groups of securities

- Market Scanners – free stock, options and fund screeners

- Options Strategy Lab – generate strategies by entering price or volatility forecasts

- Rebalance Portfolio – stay on track by automatically changing the weightings of your assets based on your goals and risk approach

Whilst Zacks Trade does not offer an education section, it does have an extensive library of research subscriptions. These include many from third parties plus some from its own proprietary department, Zacks Investment Research.

Live Accounts

The broker offers several account types, making it an attractive firm for investors with varying levels of experience.

The following account types require a minimum deposit of £2,200 and the Reg T Margin account requires you to maintain a capital balance of £1,800.

- Joint

- Trust

- SEP IRA

- Roth IRA

- Custodial

- Individual

- Corporate

- Partnership

- Rollover IRA

- Traditional IRA

- Reg T Margin

- Unincorporated Business

- Limited Liability Corporation

A Portfolio Margin account is also available for a minimum deposit of £96,700. However, there are restrictions in place if your capital drops below £87,900.

Benefits Of Zacks Trade

- Penny stocks

- Free demo account

- Suite of analysis tools

- Ready-made algo bots

- Zero maintenance fees

- Competitive margin rates

- Free research subscriptions

Drawbacks Of Zacks Trade

- Inactivity fees

- No 24/7 customer support

- High minimum account balance

- No MetaTrader 4 or MetaTrader 5

Trading Hours

ZacksTrade’s regular opening hours are Monday to Friday, 09:30 to 16:00 EST. However, the firm allows its customers to engage in extended trading outside of traditional market times.

Bear in mind that there are risks to extended hours investing, including lower liquidity and greater volatility, which can result in partially executed positions or no execution at all.

Customer Service

Zacks Trade customer service is available Monday to Friday, during regular business hours 09:00-18:00 EST. When we used Zacks Trade, our experts found that the support team were friendly and clearly answered any queries we had.

You can reach customer support via email (support@zackstrade.com) or by dialling the following telephone numbers:

- Fax – 312.265.9547

- Local – 312.265.9406

- Toll-Free – 888.979.2257

The broker’s live chat is only available after you have started the account opening process and have provided a valid email address.

The company’s headquarters address is 10 S. Riverside Plaza, Suite 1600, Chicago, IL 60606.

Client Security

ZacksTrade is dedicated to ensuring the highest security and protection for its trading accounts. You will receive a security code device, which will generate a unique number that you will need every time you log in.

Our experts found the following additional security features that safeguard users’ assets:

- Automatic Logoff – after a specified period of inactivity, the firm will automatically log you off

- 128-bit SSL Encryption – secures the connection between the online broker and your computer

- Failed Login Attempts – after a specified number of failed login attempts, Zacks Trade will automatically restrict your account

Should You Trade With ZacksTrade?

Zacks Trade offers competitive margin rates, cutting-edge tools and actionable research, all of which provide a comprehensive and advanced investment experience. Clients can buy, sell and trade across 19 international exchanges to expand their portfolio performance and gain experience in the global markets.

FAQ

Does Zacks Trade Offer A Demo Account?

Zacks Trade offers a free demo account, which allows prospective clients to try new strategies or simply practise investing.

Is Zacks Trade Safe?

Prospective clients should be reassured that their investments and accounts are protected by the SIPC, alongside regulation by the SEC and FINRA, two top regulatory authorities.

What Research Subscriptions Are Available To Zacks Trade Clients?

Zacks Trade offers 20 free research subscriptions for non-professional and professional investors. These comprehensive resources are available through the Interactive Brokers Information System (IBIS), which is an add-on to Zacks Trade Pro. Customers can explore market news with Zacks Investment Research, Morningstar equity, ETF and credit reports, Thomas Reuters Worldwide Fundamentals and more. Premium newswires are also made available to clients at a monthly fee.

Does Zacks Trade Charge For Inactivity?

Zacks Trade does not charge inactivity fees unless your account balance is less than £22,000, in which case customers are charged £13 each month.

What Stocks Does Zacks Trade Offer?

Zacks Trade offers a wide range of stocks, including penny and OTC stocks, allowing clients to trade on a range of exchanges with low prices and high liquidity.

Top 3 ZacksTrade Alternatives

These brokers are the most similar to ZacksTrade:

- Interactive Brokers - Interactive Brokers (IBKR), a leading brokerage, offers access to 150 markets across 33 countries and provides extensive investment services. With more than 40 years of experience, this Nasdaq-listed company complies with strict regulations from the SEC, FCA, CIRO, and SFC. It is among the most reliable brokers worldwide for traders.

- Swissquote - Founded in 1996, Swissquote is a prominent Swiss bank and broker, providing online trading opportunities for an impressive portfolio of three million products, including forex, CFDs, futures, options, and bonds. Renowned for its reliability, Swissquote has earned a solid reputation through pioneering trading solutions. It was the first bank to introduce cryptocurrency trading in 2017, and has since expanded its offerings to include fractional shares and the Invest Easy service.

- IG Index - Founded in 1974, IG is a part of IG Group Holdings Plc, a publicly listed brokerage (LSE: IGG). The company provides spread betting, CFD, and forex trading, offering access to over 17,000 markets. Its platforms and investing apps are notably user-friendly. Over the past 50 years, IG has consistently been an industry leader, excelling in all essential areas for traders.

ZacksTrade Feature Comparison

| ZacksTrade | Interactive Brokers | Swissquote | IG Index | |

|---|---|---|---|---|

| Rating | 3.9 | 4.3 | 4 | 4.7 |

| Markets | Stocks, ETFs, Cryptos, Options, Bonds | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting |

| Minimum Deposit | $2500 | $0 | $1,000 | $0 |

| Minimum Trade | $3 | $100 | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | FINRA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | - | - | MT4, MT5 | MT4 |

| Leverage | - | 1:50 | 1:30 | 1:30 (Retail), 1:222 (Pro) |

| Visit | 70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. |

|||

| Review | ZacksTrade Review |

Interactive Brokers Review |

Swissquote Review |

IG Index Review |

Trading Instruments Comparison

| ZacksTrade | Interactive Brokers | Swissquote | IG Index | |

|---|---|---|---|---|

| CFD | No | Yes | Yes | Yes |

| Forex | No | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | Yes | No | No |

| Commodities | No | Yes | Yes | Yes |

| Oil | No | No | Yes | Yes |

| Gold | No | Yes | Yes | Yes |

| Copper | No | No | Yes | Yes |

| Silver | No | No | Yes | Yes |

| Corn | No | No | No | No |

| Futures | No | Yes | Yes | Yes |

| Options | Yes | Yes | Yes | Yes |

| ETFs | Yes | Yes | Yes | Yes |

| Bonds | Yes | Yes | Yes | Yes |

| Warrants | No | Yes | Yes | Yes |

| Spreadbetting | No | No | No | Yes |

| Volatility Index | No | No | Yes | Yes |

ZacksTrade vs Other Brokers

Compare ZacksTrade with any other broker by selecting the other broker below.

Popular ZacksTrade comparisons:

|

|

ZacksTrade is #77 in our rankings of UK brokers. |

| Top 3 alternatives to ZacksTrade |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | Stocks, ETFs, Cryptos, Options, Bonds |

| Demo Account | Yes |

| Minimum Deposit | $2500 |

| Minimum Trade | $3 |

| Regulated By | FINRA |

| Mobile Apps | iOS & Android |

| iOS App Rating | |

| Android App Rating | |

| Payment Methods | ACH Transfer, Cheque, Wire Transfer |

| Copy Trading | No |

| Auto Trading | Yes (algos) |

| Islamic Account | No |

| Crypto Spreads | 0.18% fee per trade |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |