Gold ETFs

Gold ETFs have been created to track the price of gold, or the inverse price of gold (for times when the investor believes the gold price will fall), or an index based on gold mining companies.

An Exchange Traded Fund (ETF) is a fund which is designed to reflect the movement in price of an underlying asset, or index, or basket of stocks. The shares of the fund are traded on a stock exchange in the same way as shares of publicly traded companies.

Best Gold ETF Brokers

-

Founded in 1974, IG is a part of IG Group Holdings Plc, a publicly listed brokerage (LSE: IGG). The company provides spread betting, CFD, and forex trading, offering access to over 17,000 markets. Its platforms and investing apps are notably user-friendly. Over the past 50 years, IG has consistently been an industry leader, excelling in all essential areas for traders.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM, JFSA Web, L2 Dealer, MT4, TradingView, AutoChartist, TradingCentral, ProRealTime Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:222 (Pro)

Safety Comparison

Compare how safe the Gold ETFs are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|---|---|---|---|---|

| IG | ✔ | ✔ | ✔ | ✔ |

Payments Comparison

Compare which popular payment methods the Gold ETFs support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|---|---|---|---|---|---|

| IG | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ |

Mobile Trading Comparison

How good are the Gold ETFs at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| IG | iOS & Android | ✔ |

Beginners Comparison

Are the Gold ETFs good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|---|---|---|---|---|

| IG | ✔ | $0 | 0.01 Lots |

Advanced Trading Comparison

Do the Gold ETFs offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| IG | Expert Advisors (EAs) on MetaTrader, build your own on ProRealTime | ✔ | 1:30 (Retail), 1:222 (Pro) | ✔ | ✔ | ✔ | ✔ |

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the Gold ETFs.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|---|---|---|---|---|---|---|---|---|

| IG |

Our Take On IG

"IG offers a complete package: an easy-to-use web platform, top-tier beginner education, enhanced charting via TradingView, up-to-date data, and strong trade execution for seasoned traders."

Pros

- IG is amongst the best in terms of its range of instruments, which includes stocks, forex, indices, commodities, and cryptocurrencies, plus added US-listed futures and options as well as an AI Index, providing diversification opportunities.

- IG provides a wide range of professional and engaging educational materials, such as webinars, articles, and analyses, tailored for traders.

- The IG app provides an excellent mobile trading experience with an intuitive design, earning it the Runner Up position in our 'Best Trading App' award.

Cons

- Based on tests, stock and CFD spreads remain less competitive than the lowest-cost brokers, such as CMC Markets.

- Beginners may find IG's fees complicated, as they vary depending on the trades or services. This could cause confusion and unexpected costs.

- In the UK and EU, negative balance protection is available. However, US clients lack account protection and guaranteed stop losses.

Why invest in a Gold ETF?

Whilst many investors buy and sell physical gold, it can be cumbersome and expensive to store. There is also a risk of burglary when storing gold, particularly if stored in the home. Selling gold accumulated can also prove to be worrisome, and time consuming. For those investors who want to trade in gold, either as a hedge, pure speculation, or as part of a diversified portfolio, such problems prove to be stumbling blocks.

Gold ETFs provide a quick and cost effective way to gain exposure to the price of gold for individual investment aims. Shares in gold ETFs can be bought and sold through a broker, and online, in a matter of seconds, so give immediacy to position taking in gold that is far more difficult to achieve by trading physical gold.

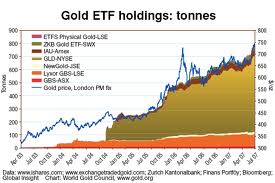

Gold ETF Chart

Different Kinds of Gold ETFs

Whether you believe the price of gold is going to rise or fall, there are ETFs to suit your view as well as your attitude to risk. ETFs are able to trade in any financial instrument, though what instruments each particular ETF may invest in will be declared in its prospectus and articles.

Some bull gold ETFs (that look to profit when the gold price is rising) are backed by physical gold. This means that they buy enough gold to hold in vaults to satisfy shareholders were the shares to be converted to the physical gold. Others trade in derivative instruments, futures and options, for example, to achieve their aims: this is particularly true of geared bull ETFs and bear ETFs.

Geared ETFs seek to make daily profits of a multiple of the amount that the gold price rises or falls, or a gold market index rise of fall. For example, an investor who is very bullish on the short term gold price might buy an ETF that aims to make 200% of the daily movement of the gold price. This means that any upside on the price of gold will be doubled by holding the ETF. However, it has to be remembered that any downside would also be doubled.

Diversified Gold Portfolio in a Single Trade

Some investors might wish to invest in gold mining stocks rather than physical gold. It might be that the gold mining sector is trading at a large discount to the gold price, and the investor expects this discrepancy to narrow: in other words, he expects the relative performance of gold mining stocks to be better than gold itself.

ETFs based on an index of gold mining stocks give the investor the possibility to take a position on his view with a single trade. The ETF will be invested either in the stocks or derivatives of the gold mining companies that are components of the index, and so the investor effectively opens a position that is immediately diversified across those stocks, and in the weights that will precisely reflect the index make-up.

Trading in a gold index ETF gives immediate exposure, saving time and expense.

Hedging Physical Gold with ETFs

For an investor who holds, say, gold bullion, but believes the short term price of gold will fall, a bear ETF gives an efficient way to hedge his physical gold position without having to sell it. Once the expected downward move in gold has happened, the investor can sell his bear ETF, which will have risen in price. This will give him a profit to bank against his paper loss on his bullion position.

In Conclusion

Gold ETFs offer investors a fast and efficient way to gain exposure to the gold price and gold mining companies. They can be used to initiate a speculative position, or for hedging purposes, and also to diversify existing portfolios. Of course, an investor should conduct due diligence and research before making any investment decision, and this should include being aware of the tax implications of investments made. Being publicly traded on an exchange, gold ETFs are very transparent, and can be traded in throughout the trading day.

List of Gold ETFs in the UK

- ETFS Gold ETF (BULL-LSE)

- ETFS Gold Sterling ETF (BULP-LSE)

- Leveraged ETF ETFS Leveraged Gold ETF (LBUL-LSE)

- ETFS Physical Gold ETF (PHAU-LSE)

- ETFS Physical Gold Sterling ETF (PHGP-LSE)

- ETFS Physical Swiss Gold ETC ETF (SGBS-LSE)

- Short/Bearish ETF ETFS Short Gold ETF (SBUL-LSE)

- Gold Bullion Securities ETC (Sterling) ETF (GBSS-LSE)

- Gold Bullion Securities ETF (GBS-LSE)

Listed in USA

- streetTRACKS Gold Shares ETF (GLD)

- AdvisorShares Gartman Gold/Euro ETF (GEUR)

- AdvisorShares Gartman Gold/Yen ETF (GYEN)

- Credit Suisse Gold Shares Covered Call ETN (GLDI)

- Leveraged ETF Direxion Daily Gold Bull 3x Shares ETF (BAR)

- ETFS Asian Gold Trust ETF (AGOL)

- ETFS Physical Swiss Gold Shares ETF (SGOL)

- ETRACS CMCI Gold ETN (UBG)

- ETRACS S&P 500 Gold-Hedged Index ETN (SPGH)

- iShares COMEX Gold Trust Fund (IAU)

- Leveraged ETF PowerShares DB Gold Double Long ETN (DGP)

- Leveraged ETF Short/Bearish ETF PowerShares DB Gold Double Short ETN (DZZ)

- PowerShares DB Gold Fund (DGL)

- Short/Bearish ETF PowerShares DB Gold Short ETN (DGZ)

- Leveraged ETF ProShares Ultra Gold ETF (UGL)

- Leveraged ETF Short/Bearish ETF ProShares UltraShort Gold ETF (GLL)

- RBS Gold Trendpilot ETN (TBAR)

- Leveraged ETF Short/Bearish ETF VelocityShares 3x Inverse Gold ETN (DGLD)

- Leveraged ETF VelocityShares 3x Long Gold ETN (UGLD)

Listed in Canada

- Leveraged ETF BetaPro COMEX Gold Bullion Bull+ ETF (HBU-TSX)

- Leveraged ETF Short/Bearish ETF Horizons BetaPro COMEX Gold Bullion Bear Plus ETF (HBD-TSX)

- Horizons COMEX Gold ETF (HUG-TSX)

- Horizons Gold Yield ETF (HGY-TSX)

- iShares COMEX Gold ETF US (IGT-TSX)

- iShares Gold Bullion ETF (CGL.C-TSX)

- iShares Gold Bullion ETF (CGL-TSX)