Forex Trading On Margin

Forex trading on margin lets investors increase position sizes with a small capital outlay. Here we look at the meaning of leveraged trading, along with definitions and examples. We also explain how to start forex trading using margin, including UK leverage levels and FCA requirements.

Forex Brokers with Margin Trading

What Is Forex Trading With Margin?

Leveraged FX trading is when clients borrow capital from their broker in return for a small deposit. The leveraged funds can then be used to take much larger positions on the FX market to generate greater profits.

Forex trading on margin is available at most online brokers in the UK. However, leverage levels at FCA-regulated brokers are capped at 1:30. So if you put down £100 you’d be able to start trading with a maximum of £3,000, for example.

Key Definitions Explained

- Leverage is the mechanism used to increase market exposure. It is the idea of putting down a small amount of capital to get access to a larger pot. Leverage levels are displayed in ratios at most forex brokers.

- Margin is the amount of money that needs to be put down. A margin call is issued by a forex broker when there is a requirement to deposit further funds to cover potential losses. If a margin call is not met, the broker may close out your forex position to limit the loss.

Forex Trading On Margin Example

Let us assume the trader thinks the EUR is going to strengthen against the GBP:

| Forex Trading Without Margin | Forex Trading With Margin |

|---|---|

| Trader puts down £1,000 | Trader puts down £1,000 with 1:30 leverage to secure £30,000 |

| Trader buys £1,000 worth of EUR at 1.200 | Trader buys £30,000 worth of EUR at 1.200 |

| EUR moves up to 1.210 | EUR moves up to 1.210 |

| Trader sells at 1.210 making £10 profit | Trader sells at 1.210 making £300 profit |

Pros & Cons of Forex Trading On Margin

Trading FX with margin offers several benefits:

- Leveraged trading reduces the amount of money needed to start trading forex. This is good news for beginners.

- By taking larger positions, traders can amplify their profits. A trade that may have returned you £100 using your original capital could instead make you 10x more.

- Traders can diversify their portfolio and hedge risk by taking multiple positions on the forex market simultaneously.

Forex trading on margin also has downsides:

- Whilst profit potential may be amplified so too are losses. It’s therefore important that traders utilise risk management tools, such as stops and limits to protect profits and curtail losses. The danger of large losses is also why the UK’s Financial Conduct Authority caps leverage levels to 1:30.

- Investors are not in full control of the trade, meaning a broker may close out your position if a margin call is issued. As a result, traders need to carefully plan forex trading strategies.

- Risk can be increased further if traders are tempted to keep depositing further funds when margin calls are issued. Investors can quickly find they are on the line for large sums of money.

- Trading forex on margin may also incur an interest fee charged by the broker. Interest rates vary between forex brokers but are usually charged on the amount borrowed and can cut into profits.

Pros & Cons of Forex Trading With No Margin

It’s also worth considering the benefits of trading forex without margin:

- Investors are in full control of the trade. Traders keep 100% of the profits, less any commission fees or spreads charged by the broker. Of course, this also means the trader owns 100% of losses.

- Zero broker involvement means no margin calls. Traders can operate without the risk of the broker pulling the plug on a forex trade.

- Instead of forex trading on margin, unleveraged investing may reduce stress levels for some traders. Using borrowed funds if the forex market moves against you can be unsettling. As a result, trading FX without margin may offer a more leisurely form of investing.

- There are fewer fees when trading without margin. Investors don’t need to worry about additional fees charged on borrowed funds.

Downsides of trading forex without margin include:

- Beginners or those with limited capital will be constrained in terms of position sizes and profits. For novices or those without resources, forex trading on margin may be the quickest way to accumulate profits.

- With fewer capital resources, traders aren’t able to pursue other investments to grow their portfolio, especially if all of an investor’s capital is tied up in the forex market.

- While trading forex without margin may be considered the safer route, it can increase the time it takes to grow your investing account. Gains are smaller and growth is curtailed.

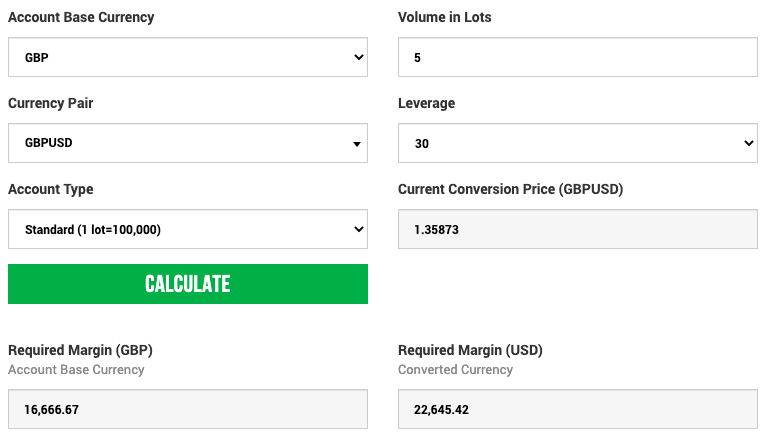

Forex Leverage Calculator

A free leverage calculator is available at most top UK brokers and lets you quickly understand your margin requirements before you place a trade. Simply enter your account and trade details and the leverage calculator will do the rest.

Should I Start Forex Trading On Margin?

For traders with a careful approach to risk and for those willing to spend the time crafting an effective strategy, leveraged forex trading may prove worthwhile. Many retail traders utilise leverage to maximise profits and increase the number and breadth of their forex trades. Margin trading can prove particularly useful for beginners. With that said, investors must start forex trading on margin with their eyes open to the risks.

FAQ

How Does FX Margin Trading Work?

Traders with limited financial resources can use leveraged capital from their broker to take larger positions on the forex market. This can bring greater returns, though it can also increase losses. Margin trading is particularly popular among UK retail traders.

Do UK Brokers Offer Forex Trading On Margin?

Yes, most online forex brokers operating in the UK offer leveraged trading. However, the FCA does limit leverage levels to 1:30 for retail traders. This is to protect clients from incurring larger losses than they can afford. Professional traders can access greater leverage levels.

What Is Leverage In Forex Trading?

Leverage is the rate at which the trader can borrow capital from a broker. For example, if a broker offers leverage up to 1:30, investors can borrow £30 for every £1 they put down. So if you put in £1,000, you can borrow up to £30,000.

Is Forex Trading On Margin Risky?

There is an element of risk with all types of trading. With that said, leveraged forex trading is particularly risky. If a margin call is issued, you’ll need to deposit additional funds or your broker may close out your FX position.

What Is A Margin Call In Forex Trading?

A margin call happens when the trader’s position falls below the amount the broker is willing to lose. When a margin call is issued, traders should receive a notification in their platform or via SMS, email or another communication channel. Investors will have then a limited amount of time to meet the margin call before the position is closed.