CFD Trading Software

The best CFD trading software helps users make informed investment decisions. In this review, we have rounded up the top software for budding traders, from copy trading and automated bots to sophisticated charting and analysis tools. We also explain how to compare various trading platforms, from usability and compatibility to cost and security. Find out which CFD trading software you should download in 2026.

Top CFD Trading Software

-

In our recent assessment, Pepperstone remains a top-tier CFD broker, renowned for its speed and reliability. With execution times averaging 30ms and a remarkable 99.90% fill rate, traders benefit from a smooth experience free from requotes and dealing desk disruptions. Additionally, it offers extensive opportunities with access to more than 1,300 assets.

FTSE Spread GBPUSD Spread Leverage 1.0 0.4 1:30 (Retail), 1:500 (Pro) Stocks Spread FCA Regulated Platforms 0.02 Yes MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade, Quantower -

XTB provides an extensive range of CFDs, including forex, indices, commodities, stocks, ETFs, and cryptocurrencies, subject to location. EU and UK clients have leverage up to 1:30, whereas global users and pro traders can obtain up to 1:500. XTB excels in offering valuable resources and tutorials for short-term CFD trading strategies.

FTSE Spread GBPUSD Spread Leverage 1.8 1.4 1:30 Stocks Spread FCA Regulated Platforms 0.2% Yes xStation -

FXCC provides a modest selection of CFDs beside forex, including metals, energies, indices, and cryptos. Nevertheless, it distinguishes itself by offering high leverage of up to 1:500. This feature appeals to seasoned traders wishing to enhance their purchasing power while betting on market fluctuations.

FTSE Spread GBPUSD Spread Leverage Variable 1.0 1:500 Stocks Spread FCA Regulated Platforms NA No MT4, MT5 -

Trade over 2,250 CFDs anytime from Monday to Friday across key markets, including forex, commodities, indices, stocks, and bonds. IC Markets leverages deep liquidity and cutting-edge bridge technology to offer ideal trading conditions for scalpers, hedgers, and algorithmic traders.

FTSE Spread GBPUSD Spread Leverage 1.0 0.23 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) Stocks Spread FCA Regulated Platforms 0.02 No MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade, Quantower -

The platform provides access to over 8,000 CFDs across stocks, indices, forex, and commodities. Suited for experienced traders, the TWS platform includes more than 100 order types and algorithms. It also delivers top-tier market data from trusted sources like Reuters and Dow Jones.

FTSE Spread GBPUSD Spread Leverage 0.005% (£1 Min) 0.08-0.20 bps x trade value 1:50 Stocks Spread FCA Regulated Platforms 0.003 Yes Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower -

IC Trading excels in CFD trading, offering more than 2,250 assets across popular markets such as forex, commodities, indices, stocks, and bonds. With advanced bridge technology and substantial liquidity, the broker ensures favourable conditions for traders seeking leveraged short-term opportunities.

FTSE Spread GBPUSD Spread Leverage 2.133 0.23 1:500 Stocks Spread FCA Regulated Platforms Variable No MT4, MT5, cTrader, AutoChartist, TradingCentral -

Trade leveraged CFDs on 1,000+ assets, benefiting from competitive spreads. Utilise the broker's integrated signals to decide optimal entry and exit points.

FTSE Spread GBPUSD Spread Leverage From 0.4 From 0.6 1:500 (entity dependent) Stocks Spread FCA Regulated Platforms Variable Yes MT4

Safety Comparison

Compare how safe the CFD Trading Software are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✘ | ✔ | |

| XTB | ✔ | ✔ | ✔ | ✔ | |

| FXCC | ✘ | ✔ | ✘ | ✔ | |

| IC Markets | ✘ | ✔ | ✘ | ✔ | |

| Interactive Brokers | ✔ | ✔ | ✘ | ✔ | |

| IC Trading | ✘ | ✘ | ✘ | ✔ | |

| Trade Nation | ✔ | ✔ | ✘ | ✔ |

Payments Comparison

Compare which popular payment methods the CFD Trading Software support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| XTB | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| FXCC | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| IC Markets | ✔ | ✘ | ✔ | ✔ | ✔ | ✘ |

| Interactive Brokers | ✔ | ✔ | ✘ | ✘ | ✘ | ✘ |

| IC Trading | ✔ | ✔ | ✔ | ✔ | ✘ | ✘ |

| Trade Nation | ✔ | ✔ | ✔ | ✘ | ✔ | ✘ |

Mobile Trading Comparison

How good are the CFD Trading Software at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| Pepperstone | iOS & Android | ✘ | ||

| XTB | iOS & Android | ✔ | ||

| FXCC | iOS & Android | ✘ | ||

| IC Markets | iOS & Android | ✘ | ||

| Interactive Brokers | iOS & Android | ✔ | ||

| IC Trading | iOS & Android | ✘ | ||

| Trade Nation | iOS & Android | ✘ |

Beginners Comparison

Are the CFD Trading Software good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|---|---|---|---|---|

| Pepperstone | ✔ | $0 | 0.01 Lots | ||

| XTB | ✔ | $0 | 0.01 Lots | ||

| FXCC | ✔ | $0 | 0.01 Lots | ||

| IC Markets | ✔ | $200 | 0.01 Lots | ||

| Interactive Brokers | ✔ | $0 | $100 | ||

| IC Trading | ✔ | $200 | 0.01 Lots | ||

| Trade Nation | ✔ | $0 | 0.1 Lots |

Advanced Trading Comparison

Do the CFD Trading Software offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Pepperstone | Expert Advisors (EAs) on MetaTrader | ✔ | 1:30 (Retail), 1:500 (Pro) | ✔ | ✘ | ✔ | ✘ |

| XTB | - | ✔ | 1:30 | ✘ | ✘ | ✔ | ✘ |

| FXCC | Expert Advisors (EAs) on MetaTrader | ✘ | 1:500 | ✔ | ✘ | ✔ | ✘ |

| IC Markets | Expert Advisors (EAs) on MetaTrader, cBots on cTrader, Myfxbook AutoTrade | ✘ | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) | ✔ | ✘ | ✔ | ✘ |

| Interactive Brokers | Capitalise.ai, TWS API | ✘ | 1:50 | ✘ | ✔ | ✔ | ✔ |

| IC Trading | Expert Advisors (EAs) on MetaTrader, cBots on cTrader | ✘ | 1:500 | ✔ | ✘ | ✔ | ✘ |

| Trade Nation | Expert Advisors (EAs) on MetaTrader | ✘ | 1:500 (entity dependent) | ✘ | ✘ | ✘ | ✘ |

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the CFD Trading Software.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|---|---|---|---|---|---|---|---|---|

| Pepperstone | |||||||||

| XTB | |||||||||

| FXCC | |||||||||

| IC Markets | |||||||||

| Interactive Brokers | |||||||||

| IC Trading | |||||||||

| Trade Nation |

Our Take On Pepperstone

"Pepperstone is a premier trading platform, providing tight spreads, swift execution, and sophisticated charting tools for seasoned traders. Beginners benefit from no minimum deposit, comprehensive learning materials, and outstanding 24/7 support."

Pros

- In recent years, Pepperstone has significantly enhanced the deposit and withdrawal process. By 2025, clients can use Apple Pay and Google Pay, while 2024 saw the introduction of PIX and SPEI for customers in Brazil and Mexico.

- Support for top-tier charting platforms such as MT4, MT5, TradingView, and cTrader. These tools accommodate different short-term trading methods, including algorithmic trading.

- Pepperstone presents itself as an economical choice for traders, offering spreads as low as 0.0 in its Razor account. The Active Trader programme provides rebates up to 30% on indices and commodities, plus $3 per lot on forex.

Cons

- Pepperstone's demo accounts expire after 30 days, which may not provide sufficient time to explore various platforms and evaluate trading strategies.

- Pepperstone doesn't offer cTrader Copy, a favoured feature for copying trades found in the cTrader platform, which is available on other platforms such as IC Markets. However, Pepperstone has launched its own user-friendly copy trading app.

- Although its market range has improved, its crypto offerings remain limited compared to brokers specialising in this sector, lacking real coin investment options.

Our Take On XTB

"XTB excels for novice traders with its superb xStation platform, minimal trading costs, no required deposit, and outstanding educational resources, many of which are fully integrated into the platform."

Pros

- XTB processes withdrawals swiftly, paying within 3 business days, subject to the method and amount.

- Top-notch customer support, available 24/5, includes a welcoming live chat with response times under two minutes during tests.

- XTB offers a superb array of educational resources, such as training videos and articles, embedded within the platform to assist traders of all experience levels.

Cons

- It is frustrating that XTB products do not allow traders to modify the default leverage level. Manually adjusting leverage can greatly reduce risk in forex and CFD trading.

- The demo account lasts only four weeks, posing a challenge for traders wanting to fully explore the xStation platform and refine short-term strategies before investing actual money.

- XTB lacks a raw spread account, a feature increasingly offered by competitors such as Pepperstone. This omission might not satisfy traders seeking the most competitive spreads.

Our Take On FXCC

"FXCC remains a top choice for forex traders, offering over 70 currency pairs, very tight spreads from 0.0 pips in tests, and high leverage up to 1:500 with the ECN XL account."

Pros

- FXCC offers competitive and transparent ECN spreads starting from 0.0 pips, with no commissions. This makes it one of the most cost-effective forex brokers available.

- FXCC has introduced MT5, which in our evaluations, mirrored the trading conditions of MT4 by offering swift execution, improved charting, and market depth tools.

- The complimentary education section, featuring the 'Traders Corner' blog, provides a wide array of resources suitable for traders of all experience levels.

Cons

- The variety of currency pairs surpasses most options, but the choice of other assets is limited. Notably, stocks are absent.

- The range of research tools, such as Trading Central and Autochartist, is quite limited. Leading platforms in this category, like IG, offer more advanced features.

- Unaware traders might face steep withdrawal fees, such as a notable $45 for bank transfers.

Our Take On IC Markets

"IC Markets provides excellent pricing, swift execution, and easy deposits. With cutting-edge charting tools like TradingView and the Raw Trader Plus account, it continues to be a preferred option for intermediate and advanced traders."

Pros

- In 2025, IC Markets earned DayTrading.com's accolade for 'Best MT4/MT5 Broker' due to its top-tier MetaTrader integration. This achievement highlights the broker's continuous refinement over the years to enhance the platform experience.

- As a well-regulated and reputable broker, IC Markets focuses on client safety and transparency to provide a dependable global trading experience.

- Access over 2,250 CFDs across diverse markets like forex, commodities, indices, shares, bonds, and cryptocurrencies. This variety enables traders to employ diversified strategies.

Cons

- IC Markets provides metals and cryptocurrencies for trading through CFDs, though the selection is narrower compared to brokers such as eToro. This limits opportunities for traders focused on these asset classes.

- The tutorials, webinars, and educational resources require enhancement, lagging behind competitors such as CMC Markets, which diminishes their appeal to novice traders.

- Although there are four top-tier third-party platforms available, the absence of in-house software or a trading app tailored for novice traders is notable.

Our Take On Interactive Brokers

"Interactive Brokers ranks highly for seasoned traders due to its robust charting platforms, live data, and bespoke layouts via the new IBKR Desktop app. Its competitive pricing and sophisticated order choices appeal to traders, and its wide equity options are industry-leading."

Pros

- Interactive Brokers has been awarded Best US Broker for 2025 by DayTrading.com. This accolade highlights its dedication to traders in the US, offering exceptionally low margin rates and access to global markets at minimal expense.

- The TWS platform is tailored for intermediate and advanced traders, featuring over 100 order types and a dependable real-time market data feed with exceptional uptime.

- The new IBKR Desktop platform combines the top features of TWS with customised tools such as Option Lattice and MultiSort Screeners, providing an impressive trading experience for traders of all skill levels.

Cons

- You are limited to a single active session per account, meaning you cannot use both your desktop programme and mobile app at the same time. This restriction can occasionally lead to a frustrating experience for traders.

- Support can be sluggish and frustrating. Tests reveal that you may face challenges reaching customer service quickly, which could result in delays in issue resolution.

- The learning curve for TWS is quite steep, making it tough for novice traders to navigate and grasp all its features. In contrast, Plus500's web platform is far more accessible for those new to trading.

Our Take On IC Trading

"IC Trading offers an ideal environment, featuring top-tier execution speeds of around 40 milliseconds, extensive liquidity, and advanced charting tools, perfect for scalpers, traders, and algorithmic traders."

Pros

- Trading Central and Autochartist provide valuable technical analysis and actionable ideas. These tools are readily available within the account area or on the cTrader platform.

- IC Trading offers top-tier spreads, with some major currency pairs like EUR/USD featuring spreads as low as 0.0 pips, making it an excellent choice for traders.

- IC Trading provides exceptional flexibility, allowing traders to open as many as 10 live accounts and 20 demo accounts. This enables the management of distinct profiles for various activities, including manual and algorithmic trading.

Cons

- Customer support was inadequate during testing, with multiple live chat attempts going unanswered and emails ignored. This raises significant concerns regarding their capacity to manage urgent trading issues.

- Although IC Trading operates under the reputable IC Markets group, it is licensed by the FSC in Mauritius, a regulator known for its limited financial transparency and lack of robust safeguards.

- The educational materials require significant enhancement unless accessed via the IC Markets website. This limitation is particularly disadvantageous for beginners seeking a thorough learning experience, especially when compared to industry leaders such as eToro.

Our Take On Trade Nation

"Trade Nation is ideal for novice traders seeking diverse markets on an easy-to-use platform. It offers no minimum deposit, complimentary funding options, and robust educational resources."

Pros

- Beginners benefit from a modest initial deposit.

- A variety of trading platforms and apps, such as MT4, make the brand suitable for experienced traders.

- Trade Nation, a highly regarded and well-regulated broker, was formerly known as Core Spreads.

Cons

- Reduced legal safeguards with an offshore entity.

Background: CFD Trading

A CFD, or contract for difference, is a derivative contract that stipulates an agreement between the buyer and seller to exchange the difference between the current price of an asset and the value at the time the contract expires. So if BP’s share price increases after a CFD is purchased, the trader can make a profit from the exchange.

CFDs essentially allow traders to make predictions about price fluctuations without actually owning the underlying asset. CFDs are also normally leveraged, meaning only a small deposit is needed to open a position.

Leveraging provides the potential for much higher profits, but there is also a risk of greater losses. As a result, UK-regulated CFD brokers limit retail leverage to 1:30 and offer negative balance protection, ensuring traders can’t lose more than their account balance.

CFD Trading Software

CFD trading software is essentially a platform or application that allows investors to trade on the financial markets using the internet. On the best platforms, users can scan the markets for potential opportunities, and then execute buy and sell orders with the click of a button. Platforms often include charts and graphs that provide historical and real-time price data, alongside live quotes.

With that said, CFD trading software can come in all shapes and sizes. While some comprehensive trading platforms offer a one-stop shop for managing trading portfolios, other tools specialise in a particular function. For example, some software packages provide advanced technical analysis tools and pattern recognition technology. Other applications focus on developing and deploying automated trading algorithms.

Which software package you download will ultimately depend on your financial goals, trading style and budget.

Types of Applications

When it comes to CFD trading software, there are several popular types of applications:

- Computer software – This is where you download software to your computer. This kind of trading platform is often the most reliable and the fastest as it is less reliant on your web browser. However, downloadable software may come with hardware requirements and isn’t a good option if you trade on the go.

- Web-based platforms – This kind of platform is gaining popularity with modern traders. Platforms can be opened and used via an internet browser, and the data is normally stored in the cloud, offering flexibility in return for a stable internet connection. Browser-based solutions are a particularly good option for beginners getting started with CFDs.

- Mobile apps – Again, these are gaining popularity as they facilitate CFD trading from any location. On the downside, mobile or tablet applications typically offer reduced functionality versus their desktop counterparts. As a result, mobile apps are often best for keeping tabs on open orders as opposed to conducting in-depth technical analysis.

Best CFD Trading Software 2026

Below is a review of the best CFD trading platforms available today.

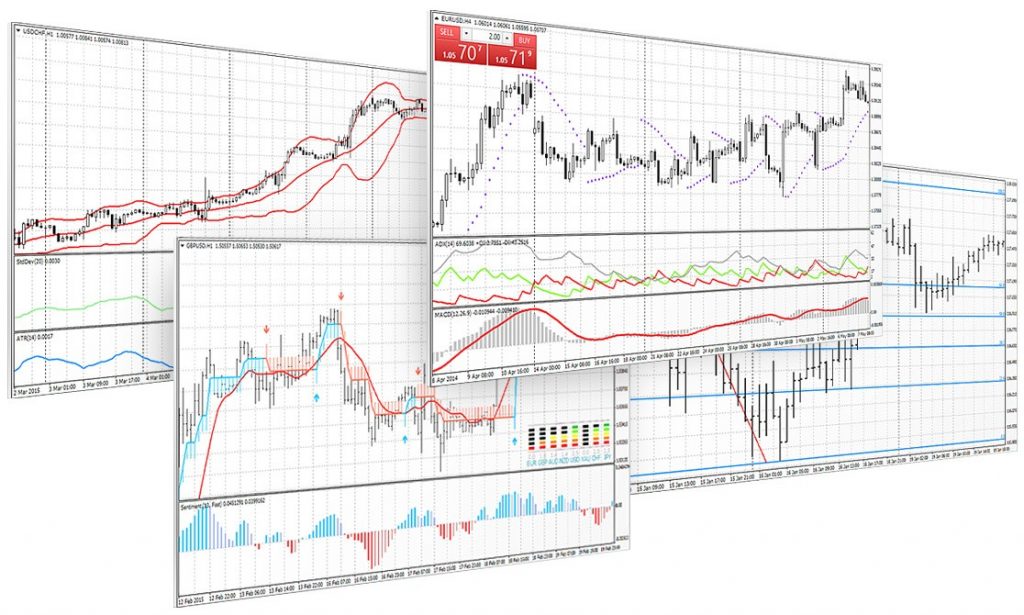

MetaTrader 4

MT4 is the platform offered by most CFD brokers because it provides a good range of analysis tools alongside a selection of instant and pending orders. In fact, MetaTrader 4 offers 3 execution modes, 2 market orders, 4 pending orders, 2 stop orders and a trailing stop. Users also benefit from 30 integrated indicators, over 2,000 custom indicators, plus 700 paid options.

MT4 also has a user-friendly and customisable interface, so it’s perfect for both beginner and advanced traders. In addition, its expert advisors feature allows for automated trading, so you can open and close trades according to pre-programmed rules.

MetaTrader 4

Pepperstone is one of the best CFD brokers that offers the MetaTrader 4 software.

MetaTrader 5

MT5 is another of the most popular platforms for trading CFDs, also developed by the creators of MT4. It is more advanced than MT4, with sophisticated charts, indicators and tools available.

Users benefit from separate accounting of orders and trades, support for all types of orders and execution modes, plus a Market Depth feature. 38 technical indicators are available, alongside 44 analytical objects, 21 timeframes, 1-minute history and an unlimited number of charts. MT5 also supports algorithmic trading.

This platform is a good option for experienced CFD traders looking for a step up from the MT4 software.

MetaTrader 5

Pepperstone is one of the top-rated CFD brokers that offer MetaTrader 5.

ProRealTime

ProRealTime is designed for automation and technical analysis. This is an advanced CFD trading software that is great for experienced traders looking for powerful market analysis tools.

The platform offers more than 100 technical indicators, market scanning, automated trend detection, plus tick and volume analysis. The software also offers real-time news, strategy backtesting, a scalping mode, plus 4 order book display modes.

Clients can choose from a free end-of-day subscription or a real-time solution. Some brokers also offer the terminal as part of their CFD trading package.

ProRealTime

IG is one of the best CFD brokerages that offer access to ProRealTime.

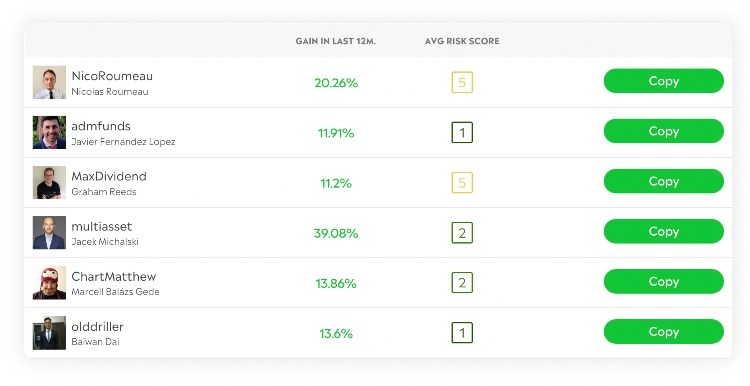

eToro CopyTrader

eToro offers CFD trading software that allows you to learn from and follow successful traders. Copy trading has become increasingly popular in recent years, offering access to a large community of experienced investors.

The platform hosts thousands of traders, and users can mirror their strategies and positions with ease, choosing a master trader that is aligned to their financial goals and risk appetite.

The firm’s leaderboard shows traders’ average gain over the last 12 months and applies a standardised risk score. There are also no management fees, making it popular with CFD beginners.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

eToro CopyTrader

Platform & Software Comparison

There are some features that nearly all platforms provide, which are essential to basic CFD trading, but the availability of more advanced tools can vary between providers, as will the costs for using said features.

So, there is a lot to think about for investors seeking a platform to trade CFDs, especially for beginners getting started. To help you find the right application for your needs, here are some questions to ask yourself:

What Markets Are You Looking To Speculate On?

Platforms offer varying access to underlying markets and assets. Do you want to trade forex pairs with the GBP? Perhaps you want to speculate on FTSE-listed stocks like Diageo or BAE Systems. Alternatively, do you want to trade CFDs on major cryptocurrencies such as Bitcoin?

Note, if you’re not sure which markets you want to trade on, sign up with a software provider that offers access to a wide range of underlying assets.

What Functions Do You Need?

Brokers sometimes charge more for advanced features, so if you don’t need a virtual private server or AI-powered market scanners then you could save yourself money by choosing a beginner-friendly platform.

Software packages like MetaTrader 4 and MetaTrader 5 offer a good balance of features while being relatively straightforward to get to grips with.

What Are You Willing To Spend?

Some CFD trading software is free, for example, the standard platform your online broker will provide, while advanced tools and functionality may come at an extra cost.

Decide what your budget is and remember that you will need to pay off all overheads, including software subscriptions, before you make a profit from CFD trading.

It’s also worth considering the following:

- Leverage – Much of the popularity that CFDs have gained is because they can be traded with leverage. Does the provider offer leverage up to 1:30 on the assets you’re interested in? What are the margin requirements and stop-out levels? It is also worth keeping in mind that CFDs are a high-risk instrument, and if you are new to investing then leveraged trading can lead to large losses.

- Ease of Use – A good trading platform, whether you’re a beginner or expert trader, should be easy to use and navigate. Look for a platform with an intuitive and slick design. Also check for customisation options so you can build a view that works for you.

- Access – The best CFD trading platforms offer broad market access, including stocks and shares, major indices, currency pairs, hard and soft commodities, plus cryptos. It’s also worth noting that a diverse portfolio can help spread risk.

- Features – CFD trading software comes with different features. Which tools will bolster your trading experience? Do you need forex heat maps or machine learning-powered market scanners? Do you want to build your own robot for automated trading? If you want to carry out detailed technical analysis then maybe you need a stand-alone charting package.

Bottom Line On CFD Trading Software

CFD trading software connects investors with popular financial markets. Platforms and applications vary in functionality, from offering technical and fundamental analysis alongside trade execution, to niche products that specialise in automated investing.

A useful tip is to check if a software provider or brokerage offers a free demo account so you can try a tool before opening a live account or spending money.

To get started trading CFDs today, use our list of leading brokers and software providers.

FAQs

What Is CFD Trading Software?

CFD trading software is used by traders to analyse the financial markets and make buy and sell decisions. Most top brokers offer comprehensive trading software via a desktop platform or downloadable mobile app. Standard software packages are usually free when you open a live CFD trading account.

What Is The Best CFD Trading Platform?

There are lots of great CFD trading platforms out there, and the best one will depend on the individual trader’s needs. However, the platforms that offer the most to all traders, beginners and experienced, are MT4 and MT5, due to their user-friendly interfaces and wide range of tools.

How Do I Compare CFD Trading Software?

The best way to begin choosing CFD trading software is to get clear on what you need from a platform or application. Do you need advanced charting? Do you want access to the latest financial news and economic releases? Perhaps you want to copy the trades of more experienced investors. Use our guide to choosing CFD trading software to find the right package for your requirements.

What Is The Best CFD Trading Platform For Beginners?

If you are a beginner trader looking for the perfect CFD platform, then one of the best options is MetaTrader 4 (MT4). Available across the world at most leading brokers, this platform offers user-friendly analysis features, instant and pending orders, automated trading, live signals, and more.