CFD Trading Signals

Providers of CFD trading signals help their clients find trade opportunities that satisfy predetermined requirements. Their service is a helpful tool that both novices and more experienced traders can utilise. This guide will review how UK traders can use CFD trading signals, explaining how they work and comparing the top providers in 2026. We also list the pros and cons of CFD trading signals.

CFD Brokers with Signals

Safety Comparison

Compare how safe the CFD Trading Signals are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|

Payments Comparison

Compare which popular payment methods the CFD Trading Signals support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|

Mobile Trading Comparison

How good are the CFD Trading Signals at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|

Beginners Comparison

Are the CFD Trading Signals good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|

Advanced Trading Comparison

Do the CFD Trading Signals offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the CFD Trading Signals.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|

What Are CFD Trading Signals?

CFD trading signals are live alerts which notify a trader when they should execute a trade. The alerts can be customised to give instructions on when to open a position and whether to go long or short on the underlying asset. They can also give instructions on position sizes and risk management parameters, among other criteria.

Importantly, trading signals for CFDs exist across many markets ranging from forex, stocks and cryptocurrencies to commodities such as gold and oil.

CFD Trade Signal Example

A typical CFD trading signal might look like the following:

- Asset: Gold

- Current Price: £1,825.62

- Trade: Short

- Take Profit: £1,824.62

- Stop Loss: £1,825.97

Some providers such as SMART Signals, an engine that automatically monitors over 36 major global markets for emerging price action patterns, include a timeframe to give an estimation of how long the signal is valid for after it is initially received. Also, certain signals include the indicators that have been used to create the alert.

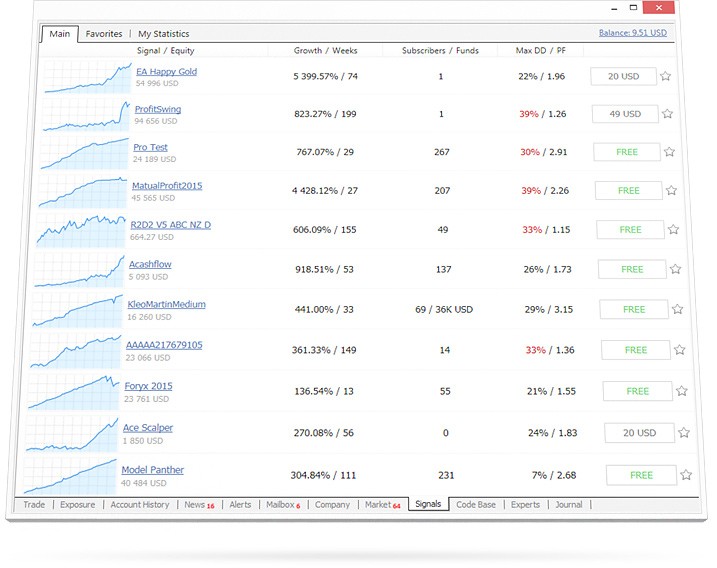

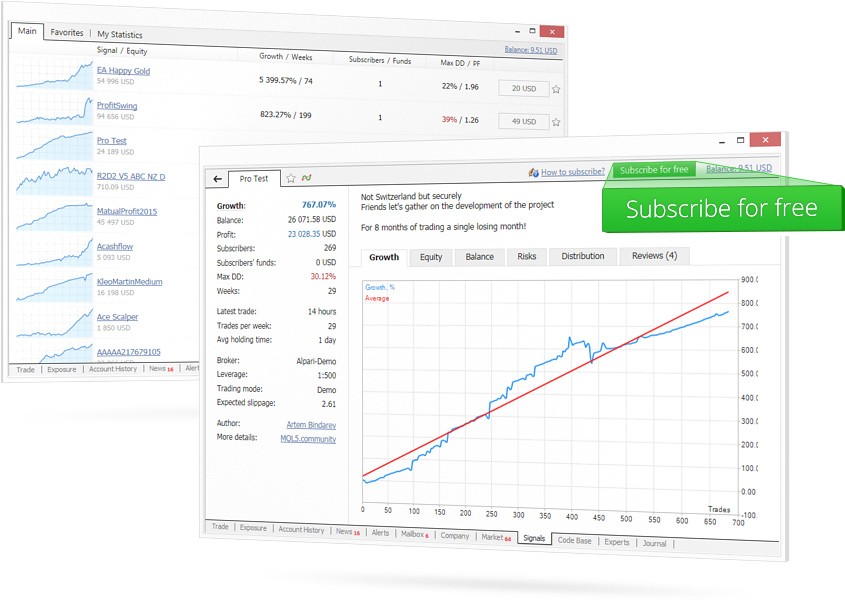

CFD Signals on MetaTrader

How Does it Work?

CFD trading signals are derived from analysis completed either by professional traders or by a series of algorithms. Both will likely use technical indicators and data from price history charts as well as news and announcements to make predictions on future price trends.

Providers allow their clients to personalise their CFD trading signals to suit certain strategies, which may include risk tolerance, a focus on particular instruments or going long or short. To tailor the alerts to your needs, there is a range of inputs that you can change. Examples of common inputs include:

- Volatility – Many indicators measure volatility such as Bollinger Bands (a tool used to determine entry and exit points for a trade), average true range (an indicator that shows how much an asset moves, on average, during a given time frame) and the Keltner Channel (a technical analysis indicator showing a central moving average line plus channel lines at a distance above and below). Each can be used to demonstrate when there is high market volatility vs low volatility and which relates to a higher or lower risk CFD contract.

- Breakout Levels – Each asset has a resistance level and a support level which help to indicate potential market trends. If the price reaches its resistance level, you may receive a signal to open a short contract, assuming the price will decrease, and vice versa for a support level.

- Trading Volume – The trade volume refers to the amount that a security is exchanged over a period of time, meaning if there is a sudden and rapid increase in trade volume, there is potential for a swing in price.

Toolkit to Get Started

Where To Find CFD Trading Signals

There are many providers of UK CFD trading signals online. Several are brokers with which trades can automatically be made, for example, eToro.

Others, such as Learn2Trade, are companies that provide trading support. In addition to alerts, they may offer education services through trade tutorial videos and PDF guides. Many sources provide trade signals but not all will necessarily be for CFDs. They may offer signals for binary options, spot investing, futures or spread betting and include the order type (long vs short), as well as the inclusion of guaranteed stop loss and take profit orders.

How To Compare CFD Signals Providers

There is no handbook or official manual that will definitively state if a provider is good or bad. It is important to weigh up the following factors to determine whether a CFD signals provider is the right fit for you.

Price

It is possible to find free of charge CFD trading signals with no/zero commissions, however, the majority of high-quality, reliable signals come with a fee. Subscription costs should, of course, be taken into account when budgeting for your trading, but there are several signal providers with accessible prices.

Examples include FxPremiere and Learn2Trade, which are available for £14 and £21.50 per month, respectively.

Security & Reliability

It is worth verifying a CFD trade signals provider by checking their performance over previous weeks or months to determine their success rate. Many providers such as ForexSignals.com offer free trials so you can test its CFD signals before purchasing a subscription. This is a great way to road test CFD signals while establishing a provider’s reliability.

Trading Platform

To optimise the reaction time between a signal and your trade execution, you may want to find a signals provider that links with your trading platform. One-click trading will enable you to execute the trade as soon as you receive the notification.

Some CFD trading signal providers do link their services with platforms, for example, XTB which provides signals for its proprietary trading platform, xStation5. If you want to source signals from multiple providers, you could be better placed using a third-party platform such as MetaTrader 4 or MetaTrader 5.

MT4 CFD Signals

Accessibility

A CFD trading signals provider will detail on their website how you receive the information. Time is of the essence when using trade signals, so you need to have frequent or constant access to the provider’s insights. It may urge you to download software such as a mobile app to receive notifications. Alternatively, you could receive signals via SMS text message, email or through third-party apps such as Discord and Telegram.

Customer Support

If you are having issues receiving your CFD trading signals notifications or they are not working or showing up, you will need to contact the provider’s support team, ideally accessible 24 hours a day via an online live chat or a telephone hotline.

Schedule

It is worth selecting a provider that releases signals aligned with your trading schedule. For example, if you are in the UK, seeking a provider with UK daily operating hours. This can, however, be market-dependent, for example, if you want to trade digital assets – cryptocurrency markets are open 24/7, including weekends.

How To Avoid Scams 101

Use A Demo Account

A shrewd way to trial a provider’s CFD trading signals is by implementing the trades on a demo account, which uses simulated funds rather than real capital. Many brokers such as CMC Markets allow free registration for a paper trading account to test CFD trading strategies.

Once you have spent time making trades according to signals and you are happy with the success rate, then you can move onto a live trading account.

Reviews

Read customer reviews before relying on a service that provides CFD trading signals. Reviews and ratings from customers who have experience with a provider will give you a better idea regarding the reliability and quality of its signals. You can find reviews on websites like TrustPilot or on social media channels, for example, Reddit and YouTube.

Regulator Warning Lists

The Financial Conduct Authority (FCA) holds a warning list of firms to avoid. These are brokers and companies which have engaged in questionable or fraudulent activity. Beware any CFD trading signals provider on this, especially those that target traders on social media channels like Instagram.

Trust Your Instinct

Some scams may be advertised as having impeccable success rates and potential for massive profits, but trading comes with risk and none have a 100% chance of success. When a website or advert seems too good to be true, it probably is.

Free CFD Signals

Pros of Using CFD Trading Signals

- CFD trading signals reduce the time you have to spend researching assets

- They seek out trades which are best suited to your strategy and risk appetite

- They reduce the emotion involved with trading CFDs and in essence put it on a more evidence-based footing

Risks of Using CFD Trading Signals

- You are dependent on the signals provider being accurate and trustworthy – nothing is guaranteed

- Accuracy of the CFD trading signals decreases over time, so you need to act promptly

- There is limited regulatory governance of CFD signal providers, groups and websites

- Some brokers have steep minimum deposit requirements

- Not all commentators believe CFD trading is halal

Bottom Line on CFD Signals

CFD trading signals can be a helpful aid due to the time and effort that can be saved in research. However, nothing will completely remove risk from the process, be it expert traders or online robots; even those which are identifying potential opportunities many times a day. CFDs can also be risky when trading on margin (borrowing money from a brokerage firm in order to carry out trades) because this can easily amplify any losses. Finally, as with all other trading, bear in mind the tax you may have to pay on any income you earn in the UK.

FAQs

How Do I Make Money With CFD Trading Signals?

It is possible to make money using CFD trading signals but there is a high risk involved. Research into CFDs and the underlying asset is key, to fully appreciate how they work. Online sources such as Wikipedia, YouTube’s trading channels and the education sections of brokerage websites are all useful for understanding trading concepts. You should determine a strategy and style to use such as long-term vs short-term and develop your trading skills using a demo account. It may be worthwhile keeping a journal to track your progress and once you feel comfortable with a demo account, move on to a live trading account.

How Do CFD Trading Signals Work?

A simple definition of CFD trading signals is that they are a snapshot of information sent to clients regarding a possible trade opportunity. The premise is that the provider completes technical or fundamental analysis to find CFD trades with potential for profitability and a client then executes the trade.

Is There A List Of The Best CFD Trading Signals Providers?

There is no definitive list of the best CFD trading signals providers in 2026 available. Conduct your own research by reading app reviews and customer ratings. Also consider creating your own database of providers to compare their services and find which system best suits your needs. Alternatively, see our list of trusted and reliable brands above.

Are Paid-For CFD Trade Signals Better Than Free?

Generally, high-quality CFD trading signals providers require a paid subscription to access their services, however, it is still possible to find good providers who do not charge. Rather than forming an opinion solely on cost, use the aforementioned factors in this guide to determine how good or bad a provider is.

Are CFD Trading Signals Legal In The UK?

Yes, CFD trading signals are legal in the UK. The only rules on restrictions surrounding CFDs involve protective measures and limits on leverage. When you login to your account with brokers, such as Interactive Brokers, there are limits on the maximum leverage, ranging from 1:30 for forex vs 1:5 for stocks and 1:2 for cryptocurrencies. Some firms also offer trading without leverage or spreads.