CFD Day Trading

As a type of agreement that allows traders to speculate on the price of an underlying asset without owning it, contracts for difference (CFDs) are an ideal option for day traders. The market for CFDs has flourished since these derivatives became available to UK investors in the 1990s, with rapid growth in recent years bringing the monthly average number of UK CFD traders to over 560,000 in 2020. This guide will give investors all they need to know about CFD day trading in the UK, from strategies to the best online CFD brokers.

Top UK CFD Brokers List

-

In our recent assessment, Pepperstone remains a top-tier CFD broker, renowned for its speed and reliability. With execution times averaging 30ms and a remarkable 99.90% fill rate, traders benefit from a smooth experience free from requotes and dealing desk disruptions. Additionally, it offers extensive opportunities with access to more than 1,300 assets.

FTSE Spread GBPUSD Spread Leverage 1.0 0.4 1:30 (Retail), 1:500 (Pro) Stocks Spread FCA Regulated Platforms 0.02 Yes Pepperstone Trading Platform, MT4, MT5, cTrader, TradingView, AutoChartist -

XTB provides an extensive range of CFDs, including forex, indices, commodities, stocks, ETFs, and cryptocurrencies, subject to location. EU and UK clients have leverage up to 1:30, whereas global users and pro traders can obtain up to 1:500. XTB excels in offering valuable resources and tutorials for short-term CFD trading strategies.

FTSE Spread GBPUSD Spread Leverage 1.8 1.4 1:30 Stocks Spread FCA Regulated Platforms 0.2% Yes xStation -

IG provides over 17,000 CFDs, giving traders more opportunities than most brokers. Investors can trade long or short on key markets such as equities, forex, commodities, and cryptocurrencies. Additionally, customised price alerts and the IG Academy enrich the trading experience.

FTSE Spread GBPUSD Spread Leverage 1.0 0.9 1:30 (Retail), 1:222 (Pro) Stocks Spread FCA Regulated Platforms 0.02 Yes Web, L2 Dealer, MT4, TradingView, AutoChartist, TradingCentral, ProRealTime -

Trade leveraged CFDs on 1,000+ assets, benefiting from competitive spreads. Utilise the broker's integrated signals to decide optimal entry and exit points.

FTSE Spread GBPUSD Spread Leverage From 0.4 From 0.6 1:500 (entity dependent) Stocks Spread FCA Regulated Platforms Variable Yes TN Trader, MT4 -

The platform provides access to over 8,000 CFDs across stocks, indices, forex, and commodities. Suited for experienced traders, the TWS platform includes more than 100 order types and algorithms. It also delivers top-tier market data from trusted sources like Reuters and Dow Jones.

FTSE Spread GBPUSD Spread Leverage 0.005% (£1 Min) 0.08-0.20 bps x trade value 1:50 Stocks Spread FCA Regulated Platforms 0.003 Yes Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower -

Eightcap provides an extensive selection of trading options with over 800 CFDs covering equities, indices, bonds, commodities, and digital currencies, subject to regional availability. Traders can access leverage ranging from 1:30 to 1:500. The platform is distinguished by its sophisticated tools, including an AI-powered economic calendar that tracks over 25 countries with filters for varying impact levels. Despite these strengths, Eightcap's selection of commodities, especially softs such as cotton and wheat, along with its range of precious metals and energy assets, remains limited and could benefit from further development.

FTSE Spread GBPUSD Spread Leverage 1.2 0.1 1:30 Stocks Spread FCA Regulated Platforms 0.03 (Apple Inc) Yes MT4, MT5, TradingView -

With options for both long and short positions on over 5,500 CFDs in forex, stocks, indices, commodities, and cryptocurrencies, FOREX.com stands out. The platform's unique Web Trader delivers an outstanding experience, featuring more than 80 technical indicators and average execution speeds of merely 20 milliseconds, providing an ideal setting for dedicated traders.

FTSE Spread GBPUSD Spread Leverage 1.0 1.3 1:30 Stocks Spread FCA Regulated Platforms 0.14 Yes WebTrader, Mobile, MT4, MT5, TradingView

Safety Comparison

Compare how safe the CFD Day Trading are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✘ | ✔ | |

| XTB | ✔ | ✔ | ✔ | ✔ | |

| IG | ✔ | ✔ | ✔ | ✔ | |

| Trade Nation | ✔ | ✔ | ✘ | ✔ | |

| Interactive Brokers | ✔ | ✔ | ✘ | ✔ | |

| Eightcap | ✔ | ✔ | ✘ | ✔ | |

| Forex.com | ✔ | ✔ | ✘ | ✔ |

Payments Comparison

Compare which popular payment methods the CFD Day Trading support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| XTB | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| IG | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ |

| Trade Nation | ✔ | ✔ | ✔ | ✘ | ✔ | ✘ |

| Interactive Brokers | ✔ | ✔ | ✘ | ✘ | ✘ | ✘ |

| Eightcap | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| Forex.com | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

Mobile Trading Comparison

How good are the CFD Day Trading at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| Pepperstone | iOS & Android | ✘ | ||

| XTB | iOS & Android | ✔ | ||

| IG | iOS & Android | ✔ | ||

| Trade Nation | iOS & Android | ✘ | ||

| Interactive Brokers | iOS & Android | ✔ | ||

| Eightcap | iOS & Android | ✘ | ||

| Forex.com | iOS & Android | ✘ |

Beginners Comparison

Are the CFD Day Trading good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|---|---|---|---|---|

| Pepperstone | ✔ | $0 | 0.01 Lots | ||

| XTB | ✔ | $0 | 0.01 Lots | ||

| IG | ✔ | $0 | 0.01 Lots | ||

| Trade Nation | ✔ | $0 | 0.1 Lots | ||

| Interactive Brokers | ✔ | $0 | $100 | ||

| Eightcap | ✔ | £100 | 0.01 Lots | ||

| Forex.com | ✔ | $100 | 0.01 Lots |

Advanced Trading Comparison

Do the CFD Day Trading offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Pepperstone | Expert Advisors (EAs) on MetaTrader | ✔ | 1:30 (Retail), 1:500 (Pro) | ✔ | ✘ | ✔ | ✘ |

| XTB | - | ✔ | 1:30 | ✘ | ✘ | ✔ | ✘ |

| IG | Expert Advisors (EAs) on MetaTrader, build your own on ProRealTime | ✔ | 1:30 (Retail), 1:222 (Pro) | ✔ | ✔ | ✔ | ✔ |

| Trade Nation | Expert Advisors (EAs) on MetaTrader | ✘ | 1:500 (entity dependent) | ✘ | ✘ | ✘ | ✘ |

| Interactive Brokers | Capitalise.ai, TWS API | ✘ | 1:50 | ✘ | ✔ | ✔ | ✔ |

| Eightcap | TradingView Bots | ✘ | 1:30 | ✔ | ✘ | ✔ | ✘ |

| Forex.com | Expert Advisors (EAs) on MetaTrader | ✘ | 1:30 | ✔ | ✔ | ✔ | ✘ |

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the CFD Day Trading.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|---|---|---|---|---|---|---|---|---|

| Pepperstone | |||||||||

| XTB | |||||||||

| IG | |||||||||

| Trade Nation | |||||||||

| Interactive Brokers | |||||||||

| Eightcap | |||||||||

| Forex.com |

Our Take On Pepperstone

"Pepperstone is a premier trading platform, providing tight spreads, swift execution, and sophisticated charting tools for seasoned traders. Beginners benefit from no minimum deposit, comprehensive learning materials, and outstanding 24/7 support."

Pros

- Pepperstone offers rapid execution speeds of approximately 30ms, enabling swift order processing and execution, making it ideal for traders.

- Support for top-tier charting platforms such as MT4, MT5, TradingView, and cTrader. These tools accommodate different short-term trading methods, including algorithmic trading.

- Pepperstone presents itself as an economical choice for traders, offering spreads as low as 0.0 in its Razor account. The Active Trader programme provides rebates up to 30% on indices and commodities, plus $3 per lot on forex.

Cons

- Pepperstone's demo accounts remain active for 60 days. This duration might be insufficient to fully explore the platforms and trial various trading strategies.

- Pepperstone doesn't offer cTrader Copy, a favoured feature for copying trades found in the cTrader platform, which is available on other platforms such as IC Markets. However, Pepperstone has launched its own user-friendly copy trading app.

- Although its market range has improved, its crypto offerings remain limited compared to brokers specialising in this sector, lacking real coin investment options.

Our Take On XTB

"XTB excels for novice traders with its superb xStation platform, minimal trading costs, no required deposit, and outstanding educational resources, many of which are fully integrated into the platform."

Pros

- XTB offers a superb array of educational resources, such as training videos and articles, embedded within the platform to assist traders of all experience levels.

- XTB offers a diverse array of instruments, including CFDs on shares, indices, ETFs, commodities, forex, crypto, real shares, real ETFs, and share dealing, along with newly introduced Investment Plans. This allows XTB to serve both short-term traders and long-term investors efficiently.

- Top-notch customer support, available 24/5, includes a welcoming live chat with response times under two minutes during tests.

Cons

- Trading fees are competitive, with average EUR/USD spreads of about 1 pip. However, they are not as low as the most affordable brokers, such as IC Markets. Additionally, an inactivity fee applies after a year.

- The research tools at XTB are commendable but have the potential to excel further. Enhancing them with access to top-tier third-party services like Autochartist, Trading Central, and TipRanks would significantly elevate their offering.

- XTB lacks a raw spread account, a feature increasingly offered by competitors such as Pepperstone. This omission might not satisfy traders seeking the most competitive spreads.

Our Take On IG

"IG offers a complete package: an easy-to-use web platform, top-tier beginner education, enhanced charting via TradingView, up-to-date data, and strong trade execution for seasoned traders."

Pros

- The IG app provides an excellent mobile trading experience with an intuitive design, earning it the Runner Up position in our 'Best Trading App' award.

- IG secured a crypto asset license from the FCA, enabling its return to the UK market. It now offers buying, selling, and storage services for over 55 digital tokens with fees starting at 1.49%, all under FCA regulation.

- IG excels with its diverse instruments, offering stocks, forex, indices, commodities, and cryptocurrencies. Additionally, it provides US-listed futures, options, and an AI Index, ensuring varied diversification opportunities.

Cons

- In the UK and EU, negative balance protection is available. However, US clients lack account protection and guaranteed stop losses.

- Based on tests, stock and CFD spreads remain less competitive than the lowest-cost brokers, such as CMC Markets.

- IG has ended its swap-free account, diminishing its attractiveness to Islamic traders.

Our Take On Trade Nation

"Trade Nation is ideal for novice traders seeking diverse markets on an easy-to-use platform. It offers no minimum deposit, complimentary funding options, and robust educational resources."

Pros

- A variety of trading platforms and apps, such as MT4, make the brand suitable for experienced traders.

- Access a comprehensive selection of investments through leveraged CFDs, enabling both long and short strategies.

- Beginners benefit from a modest initial deposit.

Cons

- Reduced legal safeguards with an offshore entity.

Our Take On Interactive Brokers

"Interactive Brokers ranks highly for seasoned traders due to its robust charting platforms, live data, and bespoke layouts via the new IBKR Desktop app. Its competitive pricing and sophisticated order choices appeal to traders, and its wide equity options are industry-leading."

Pros

- IBKR consistently offers unparalleled access to global equities, with thousands of shares available across over 100 market centres in 24 countries, including the recently added Saudi Stock Exchange.

- Interactive Brokers has been awarded Best US Broker for 2025 by DayTrading.com. This accolade highlights its dedication to traders in the US, offering exceptionally low margin rates and access to global markets at minimal expense.

- The TWS platform is tailored for intermediate and advanced traders, featuring over 100 order types and a dependable real-time market data feed with exceptional uptime.

Cons

- Support can be sluggish and frustrating. Tests reveal that you may face challenges reaching customer service quickly, which could result in delays in issue resolution.

- The learning curve for TWS is quite steep, making it tough for novice traders to navigate and grasp all its features. In contrast, Plus500's web platform is far more accessible for those new to trading.

- IBKR offers a variety of research tools, but their inconsistent placement across trading platforms and the 'Account Management' webpage creates a confusing experience for users.

Our Take On Eightcap

"Eightcap excels for traders, offering diverse charting platforms, educational Labs, and AI tools. With over 120 crypto CFDs, it stands out in crypto trading and has won our 'Best Crypto Broker' award twice consecutively."

Pros

- Eightcap excels with a suite of advanced trading tools, such as MT4 and MT5, and has recently joined the 100-million-user social trading network, TradingView.

- In 2021, Eightcap enhanced its lineup, now providing an extensive range of cryptocurrency CFDs. It offers crypto/fiat and crypto/crypto pairs, along with crypto indices for comprehensive market exposure.

- Eightcap has excelled in all essential trading areas, surpassing all rivals to clinch our 'Best Overall Broker' award for 2024. It also earned the titles of 'Best Crypto Broker' and 'Best TradingView Broker' for 2025.

Cons

- Eightcap must enhance its range of over 800 instruments to rival top competitors like Blackbull Markets, which offers 26,000+ assets, especially improving its limited commodities selection.

- Despite the growing range of tools available, Eightcap lacks popular industry resources such as Autochartist and Trading Central. These provide advanced charting analytics, live news, and essential market insights for traders focused on short-term strategies.

- The demo account is available for 30 days, after which it requires a request for extension. This is less convenient than XM's offering, which provides an unlimited demo mode.

Our Take On Forex.com

"FOREX.com excels in serving traders of all levels, offering more than 80 currency pairs, spreads starting at 0.0 pips, and competitive commissions. Its robust charting platforms provide over 100 technical indicators and comprehensive research tools."

Pros

- The in-house Web Trader remains a top-tier platform for budding traders, featuring an elegant design and more than 80 technical indicators for market analysis.

- With more than two decades of expertise, strong regulatory governance, and numerous accolades, including a second-place finish in our 'Best Forex Broker' awards, FOREX.com is globally renowned as a reliable trading platform.

- FOREX.com provides top-tier forex rates beginning at 0.0 pips, along with attractive cashback rebates up to 15% for dedicated traders.

Cons

- US clients are not protected against negative balances, which means you could end up owing more than your initial deposit.

- Demo accounts are typically limited to 90 days, hindering effective strategy testing.

- FOREX.com's MT4 platform provides around 600 instruments, a notable reduction compared to the more than 5,500 options on its other platforms.

CFD Day Trading Basics

- Traders use CFDs to bet on price movements of an asset

- CFDs are a derivative, meaning traders do not take physical ownership of the underlying asset, for example gold

- CFDs are legal in the UK, regulated by the FCA, and are widely available on popular trading platforms

- Day traders typically speculate on short-term price fluctuations that happen within a single trading day

A CFD is an agreement between an investor and an issuer, which allows the investor to bet on whether the price of an underlying asset will rise or fall. Since CFDs allow traders to make leveraged bets on price movements of assets such as stocks, indexes and currencies without owning them, they are ideal for day traders looking to earn money on short-term trades without undertaking long-term exposure.

CFDs are available to UK investors through brokerages and trading platforms, including some of the country’s most widely used and trusted sites. One of the quickest and easiest ways to begin day trading CFDs is through a popular trading platform such as Pepperstone. Different platforms will give traders access to different markets, including stocks and shares, indices, commodities and forex.

CFDs operate on a margin basis, and most platforms and brokers will need a deposit of around 10 percent of the contract value when the trade is opened. Since CFD issuers often require a minimum deposit to be held in accounts, traders may need to top up their deposit if they make a loss on a trade.

Getting Started

To get started with CFD day trading, an investor must first decide on which asset they wish to speculate on and which direction they think the price will move.

If they think the FTSE is going to rise, for example, the trader can open a long position with an online broker. If they open a contract on FTSE shares worth £10,000 when the trade is opened, and the price has risen to £11,000 by the time the trade is closed, the broker will have to pay the investor the £1,000 difference minus any fees. If the trade goes against the investor, their losses will be deducted from their deposit.

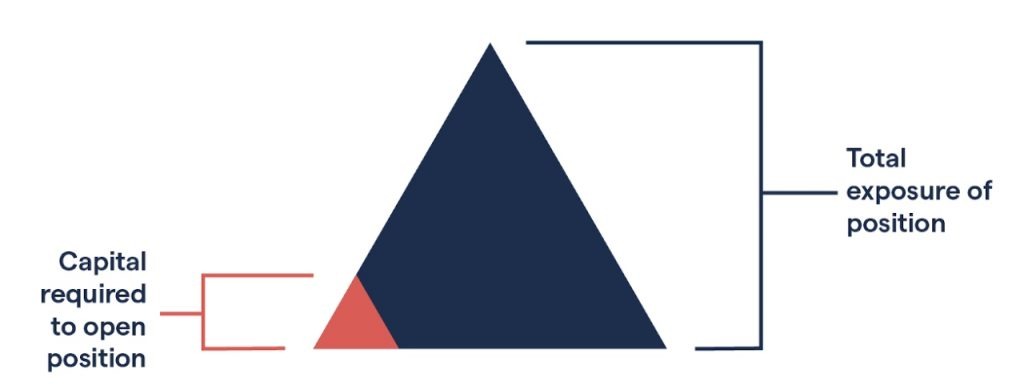

Leverage

As outlined above, many day traders use CFDs to make leveraged trades, meaning they can use borrowed funds to gain exposure to much larger trading positions than would normally be available to them. UK regulations limit the amount of leverage available to individual investors to 1:30 for currency trades and around 1:5 for stocks and shares. It’s worth pointing out that UK traders can access larger leverage rates if they day trade CFDs with an offshore, unregulated provider, though this brings with it additional risk.

Credit: IG

So, leverage can greatly increase gains made in a good trade, but it will also magnify losses to the same extent. Traders must be able to cover the entire contract value plus costs if a trade goes against them, so caution is advised when trading on high leverage. With astute use of leverage, however, CFDs can net large profits on relatively small price movements over a short time frame, making them an ideal option for day trading.

Note that if a trader keeps a leveraged trade going overnight or over a weekend, they may be required to pay an overnight or rollover fee, usually about 2-3 percent above the overnight fee charged by a bank.

Taxes

If they profit, traders are usually responsible for reporting their gains for tax purposes. In the UK, individual investors’ profit from CFDs is normally classed as capital gains and taxed accordingly. One advantage of CFDs is that, since the investor never actually purchases the underlying asset being traded, they are exempt from stamp duty. See our guide to trading taxes for more information.

CFD Day Trading Strategies

Like most investing, CFD day trading can be unpredictable. But by planning carefully and sticking to a few basic principles, traders can ensure they make the most of their good runs and limit their losses when trades turn against them. Some of the most important steps toward building a winning CFD day trading strategy are listed below.

- Choose the right trading broker and online investing platform

- Carefully research the market, for example currency pairs with GBP

- Develop an effective CFD day trading strategy

- Practice paper trades on a demo account

- Implement systems to limit risk

- Keep a trading journal

Choose the Right Broker

A wide range of brokers and platforms offer day trading on CFDs, and there may be a great difference in service and charges among any two. For example, typically brokers make money from the spread on forex and commodities trades, but some may also charge a commission. Another major difference is the range of assets available, as this limits the options available to traders who wish to deal with a particular stock or currency pair.

Besides these factors, it is important to choose a platform which is easy to use and provides all the necessary features. Investors who favour fast-paced trades will prefer a responsive system with minimal lag. Those who plan to trade CFDs alongside other investments may wish to find a flexible platform which allows them to keep their investments in one place and smoothly move funds around when the need arises.

Research the Market

Before a day trader thinks about putting their money at risk, they should have a good knowledge of the asset they are trading. Different assets will have different volatility levels and other characteristics, and these must be considered. Beginners are usually advised to stick to lower volatility assets, such as the GBP/USD currency pair.

Researching the asset’s price history is a great starting point, but investors should also closely follow market news and be sure they are aware of factors that could influence the price positively and negatively.

Choose a Strategy

Once investors are familiar with their CFD day trading platform and the asset they wish to trade, they can begin to research and practice different strategies. Some traders use technical analysis to predict an asset’s top and bottom price limits and trade on the swing between these two levels.

Others prefer to try to follow the momentum of price movements with a high volume of very short trades in a fast-paced strategy known as scalping.

Whichever strategy suits your style best, it is usually a good idea to get plenty of practice on a virtual account or with low-stakes trades before you move on to larger amounts and higher leverage.

Paper Trading

One of the most useful actions a trader can take is to spend time making paper trades before they start with real money. Many platforms allow users to open demo accounts and make paper trades on real assets without risking their cash. This gives new traders a chance to test their mettle before taking the plunge with a real day trade. It also allows more experienced traders to safely learn the ins and outs of a new platform so they can quickly and confidently hit the right buttons when the time comes to make a real CFD day trade.

Implement Risk Strategies

Leveraged CFD day trading can lead to large losses in a single unlucky trade, so it is vital for traders to plan carefully to limit risk. Most CFD platforms will automatically provide negative balance protection, which prevents a user from losing more than they hold in their online account. Investors should ensure they are aware of their platform’s policy before trading, but they should also implement their own measures with every trade.

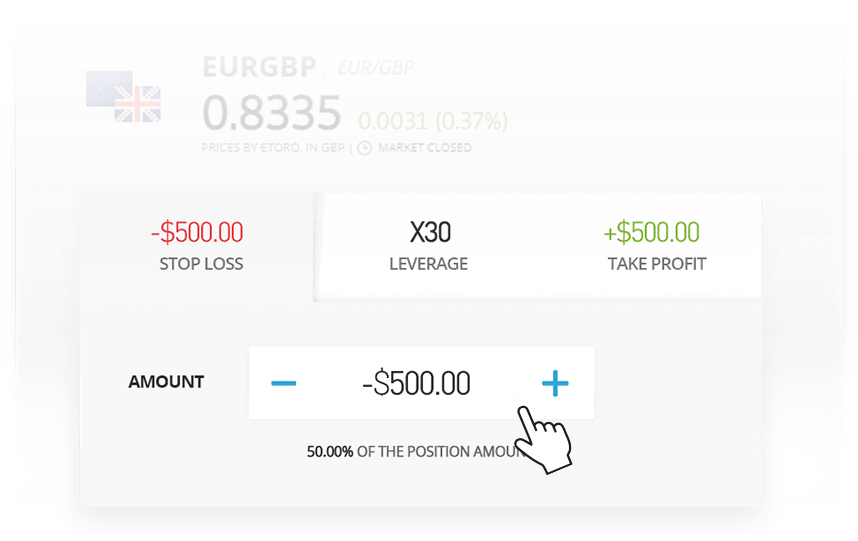

Credit: eToro

Many platforms allow users to set automated orders which will end a trade once the price reaches a predetermined level. Day traders should take full advantage of stop-loss orders to cut their losses when the price is moving unfavourably. For example, if a trader opens a short position on stocks of Company A at £100 with a stop-loss order set at £105, their position will automatically close when the price reaches £105. This is especially useful for leveraged trades in which even a small price movement in the wrong direction can lead to substantial losses.

Similarly, traders can set orders which will automatically close some or all of their position once they reach a certain level of profit. This counters the natural human tendency to get greedy when a trade is panning out well, ensuring that the CFD day trader will earn profit on the trade even if the price movement suddenly turns against them.

Keep a Journal

You may wish to simply forget about the CFD trades that don’t pay off, but noting them down alongside your successful trades in a journal can prove helpful for aspiring day traders. Your trading journal will not only allow you to analyse your past trades to see what worked (or didn’t), it will also serve as a record of your net profit or loss throughout the year so you are not stumped when the time comes to pay taxes.

Bottom Line on CFD Day Trading

CFDs are one of the most convenient ways to begin day trading in the UK, since they allow investors to make leveraged trades on a range of assets without having to own them. Since CFDs are FCA-regulated and available on reputable platforms with built-in risk-management systems, they are also a relatively secure way to trade. However, traders should always be wary of the risks involved in leveraged trades, since these multiply losses as well as profits.

FAQs

Is CFD Day Trading Legal In The UK?

Trading contracts for difference is both legal and popular in the UK, with CFDs available from many platforms on a range of assets from stocks to forex. However, cryptocurrency CFDs are not typically available in the UK, since the FCA has banned all crypto derivatives. Instead, British investors will need to register with an offshore provider to speculate on cryptos using CFDs.

What Is The Best Way To Day Trade CFDs?

Each trader will have their own requirements when day trading CFDs, so it is important to shop around to find the best broker or platform for your financial goals. Some may prefer the platform with the lowest fees, while others will look for one that has the quickest and most responsive interface for making fast-paced trades. See our list of the best CFD day trading brokers to get started.

Do CFD Day Traders Make Money?

In the end, CFDs like all derivatives are risky, and a bad trade coupled with high leverage can quickly wipe out a trader’s investment capital. By the same token, it is possible to make outsized returns when a CFD trade goes your way. Whether or not a trader makes money in the long run is largely determined by their ability to manage risk.

Is CFD Day Trading Good For Beginners?

There are several options for beginners who wish to start day trading with CFDs. The first and best is for them to invest their time in a virtual trading account, which will let them trade CFDs to their heart’s content without putting any real money at risk. Once they have a good grasp of trading on the platform and how to manage risks, they can move on to trading with real money.

Is CFD Day Trading Risky?

All day trades carry risks, but the leverage usually employed in CFD trades has the potential to multiply those risks many times over. The key to successful trading is to manage risks by carefully planning your trade and setting realistic stop-loss orders. Traders should also ensure they trade on a platform that has negative balance protection in case a trade wipes them out, and take profits regularly when the market moves in their favour.