Best Brokers With Welcome Bonuses In The UK 2026

Under the FCA’s rules, brokers selling CFDs and spread bets to retail clients in the UK cannot offer cash bonuses or trading credit that incentivise you to open an account. If you see deposit matches or “free trading money”, it’s most likely from a broker that is not licensed by the FCA, which means no FCA oversight and no FSCS protection if something goes wrong.

Welcome bonuses can make a broker more appealing. A free credit, matched deposit, or extra trading perks can help you get started. But the details matter – bonuses often come with rules, limits, or conditions that are easy to miss.

This guide reveals the brokers with the best welcome offers and the details UK traders should check before signing up.

Top Brokers For Welcome Bonuses

-

Founded in 1974, IG is a part of IG Group Holdings Plc, a publicly listed brokerage (LSE: IGG). The company provides spread betting, CFD, and forex trading, offering access to over 17,000 markets. Its platforms and investing apps are notably user-friendly. Over the past 50 years, IG has consistently been an industry leader, excelling in all essential areas for traders.

Bonus: Transfer cashback up to £3,000 - submit a transfer form by 5 April and keep 1 position open to 31 October.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM, JFSA Web, L2 Dealer, MT4, TradingView, AutoChartist, TradingCentral, ProRealTime Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:222 (Pro) -

Eightcap, an acclaimed broker regulated by the FCA, offers exceptionally low trading costs. Recognised as the top-rated brand by TradingView's vast user base of 100 million, traders can directly access the platform. UK traders can open a live account with a minimum deposit of just £100.

Bonus: Fund an Eightcap account and unlock a TradingView Plus plan worth £33.95 per month

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities ASIC, FCA, CySEC, SCB MT4, MT5, TradingView Min. Deposit Min. Trade Leverage £100 0.01 Lots 1:30 -

PU Prime operates as a forex and CFD broker, providing direct market access to forex, commodities, stocks, bonds, indices, and ETFs. It caters to traders of all levels with four account types: Cent, Standard, Prime, and ECN. Platforms include MetaTrader and the bespoke PU Prime app, designed for active trading.

Bonus: 100% cashback up to $10,000

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, Metals, Crypto, Bonds, ETFs ASIC, FSCA, CMA, FSA, FSC PU Prime App, PU Web Trader, PU Social, MT4, MT5, AutoChartist Min. Deposit Min. Trade Leverage $20 0.01 Lots 1:1000 -

4xCube operates as an online forex and CFD broker, licensed in the Cook Islands. Clients have the opportunity to engage in trading across key financial markets. They can select from three account types, tailored to their capital and chosen trading strategy.

Bonus: 50% first deposit bonus

Instruments Regulator Platforms Forex, CFDs, metals, indices, cryptocurrencies FSC Cook Islands MT4, MT5 Min. Deposit Min. Trade Leverage $10 0.01 Lots 1:400 -

AdroFx, an offshore ECN/STP brokerage, has been providing CFD trading services since 2018. It offers over 100 assets for trading on the widely-used MetaTrader 4 platform and also on the Allpips web trader. There are eight live account options available, with no limitations on trading strategies.

Bonus: 100% Deposit Bonus up to $10,000

Instruments Regulator Platforms Forex, CFDs, Indices, Shares, Metals, Cryptos VFSC, FSA, BSSLA Allpips, MT4 Min. Deposit Min. Trade Leverage $25 0.0001 Lots 1:500 -

InstaForex, established in 2007, is a forex and CFD brokerage. It provides extensive market access to millions of traders, featuring traditional assets such as currencies and shares. The broker also offers intriguing options like IPO investments.

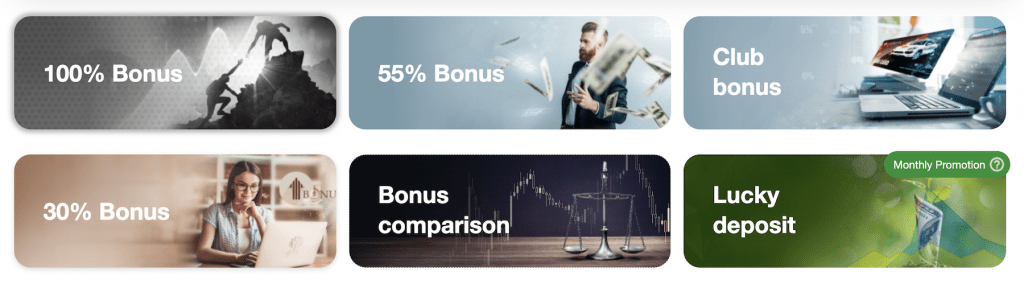

Bonus: Choose between: Club Bonus, 30 %, 55 % and 100 % bonuses

Instruments Regulator Platforms Currencies, Cryptocurrencies, Stocks, Indices, Metals, Oil and Gas, Commodity Futures and InstaFutures BVI FSC MT4, MT5 Min. Deposit Min. Trade Leverage $1 0.10 of the lot (0.0001 of market lot for Cent.Standard and Cent.Eurica) 1:30 for retail clients, 1:500 for professional

Safety Comparison

Compare how safe the Best Brokers With Welcome Bonuses In The UK 2026 are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|---|---|---|---|---|

| IG | ✔ | ✔ | ✔ | ✔ | |

| Eightcap | ✔ | ✔ | ✘ | ✔ | |

| PU Prime | ✘ | ✔ | ✘ | ✔ | |

| 4xCube | ✘ | ✘ | ✘ | ✘ | |

| AdroFX | ✘ | ✔ | ✘ | ✔ | |

| InstaForex | ✘ | ✔ | ✘ | ✔ |

Payments Comparison

Compare which popular payment methods the Best Brokers With Welcome Bonuses In The UK 2026 support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|---|---|---|---|---|---|

| IG | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ |

| Eightcap | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| PU Prime | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ |

| 4xCube | ✘ | ✔ | ✔ | ✔ | ✔ | ✘ |

| AdroFX | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| InstaForex | ✘ | ✘ | ✘ | ✔ | ✔ | ✘ |

Mobile Trading Comparison

How good are the Best Brokers With Welcome Bonuses In The UK 2026 at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| IG | iOS & Android | ✔ | ||

| Eightcap | iOS & Android | ✘ | ||

| PU Prime | iOS & Android | ✘ | ||

| 4xCube | ✔ | ✘ | ||

| AdroFX | iOS &; Android | ✘ | ||

| InstaForex | iOS and Android + browser based platform | ✘ |

Beginners Comparison

Are the Best Brokers With Welcome Bonuses In The UK 2026 good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|---|---|---|---|---|

| IG | ✔ | $0 | 0.01 Lots | ||

| Eightcap | ✔ | £100 | 0.01 Lots | ||

| PU Prime | ✔ | $20 | 0.01 Lots | ||

| 4xCube | ✔ | $10 | 0.01 Lots | ||

| AdroFX | ✔ | $25 | 0.0001 Lots | ||

| InstaForex | ✔ | $1 | 0.10 of the lot (0.0001 of market lot for Cent.Standard and Cent.Eurica) |

Advanced Trading Comparison

Do the Best Brokers With Welcome Bonuses In The UK 2026 offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| IG | Expert Advisors (EAs) on MetaTrader, build your own on ProRealTime | ✔ | 1:30 (Retail), 1:222 (Pro) | ✔ | ✔ | ✔ | ✔ |

| Eightcap | TradingView Bots | ✘ | 1:30 | ✔ | ✘ | ✔ | ✘ |

| PU Prime | Expert Advisors (EAs) on MetaTrader | ✘ | 1:1000 | ✔ | ✘ | ✔ | ✘ |

| 4xCube | Expert Advisors (EAs) on MetaTrader | ✘ | 1:400 | ✘ | ✘ | ✘ | ✘ |

| AdroFX | Expert Advisors (EAs) on MetaTrader | ✘ | 1:500 | ✔ | ✘ | ✘ | ✘ |

| InstaForex | Expert Advisors (EAs) on MetaTrader | ✘ | 1:30 for retail clients, 1:500 for professional | ✔ | ✘ | ✘ | ✘ |

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the Best Brokers With Welcome Bonuses In The UK 2026.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|---|---|---|---|---|---|---|---|---|

| IG | |||||||||

| Eightcap | |||||||||

| PU Prime | |||||||||

| 4xCube | |||||||||

| AdroFX | |||||||||

| InstaForex |

Our Take On IG

"IG offers a complete package: an easy-to-use web platform, top-tier beginner education, enhanced charting via TradingView, up-to-date data, and strong trade execution for seasoned traders."

Pros

- IG excels with its diverse instruments, offering stocks, forex, indices, commodities, and cryptocurrencies. Additionally, it provides US-listed futures, options, and an AI Index, ensuring varied diversification opportunities.

- The web-based platform supports traders at every level, offering advanced charting tools and real-time market data vital for trading. Additionally, IG now includes TradingView integration.

- The ProRealTime advanced charting platform remains free, provided traders meet modest monthly activity requirements.

Cons

- IG has ended its swap-free account, diminishing its attractiveness to Islamic traders.

- Beginners may find IG's fees complicated, as they vary depending on the trades or services. This could cause confusion and unexpected costs.

- IG imposes a monthly inactivity fee of $12 after two years, discouraging occasional traders.

Our Take On Eightcap

"Eightcap excels for traders, offering diverse charting platforms, educational Labs, and AI tools. With over 120 crypto CFDs, it stands out in crypto trading and has won our 'Best Crypto Broker' award twice consecutively."

Pros

- In 2021, Eightcap enhanced its lineup, now providing an extensive range of cryptocurrency CFDs. It offers crypto/fiat and crypto/crypto pairs, along with crypto indices for comprehensive market exposure.

- In 2026, Eightcap integrated TradeLocker, distinguishing itself as the premier regulated broker for TradeLocker. It continues to offer ultra-fast execution and competitive fees for active traders on the charting platform.

- With spreads starting at 0 pips, minimal commission charges, and leverage up to 1:500 for select clients, Eightcap delivers affordable and flexible trading opportunities. These conditions suit various strategies, such as trading and scalping.

Cons

- The demo account is available for 30 days, after which it requires a request for extension. This is less convenient than XM's offering, which provides an unlimited demo mode.

- Eightcap must enhance its range of over 800 instruments to rival top competitors like Blackbull Markets, which offers 26,000+ assets, especially improving its limited commodities selection.

- Despite a helpful array of educational guides and e-books in Labs, Eightcap lags behind IG's extensive resources for aspiring traders. IG boasts a dedicated Academy app and features 18 diverse course categories.

Our Take On PU Prime

"PU Prime suits seasoned, high-volume traders with its ECN account, offering tight spreads starting at 0.0 pips and low commissions from $1 per side. The user-friendly copy trading app and comprehensive Trading Academy, featuring progression levels, also make PU Prime ideal for aspiring traders."

Pros

- For short-term traders, there's an excellent set of tools, including margin and position sizing calculators, economic calendars, and robust technical insights from Autochartist.

- Over the years, PU Prime has enhanced its offerings by launching the PU Social app in 2022, obtaining ASIC approval for its Australian branch in 2025, and increasing its trading instruments by over 200, surpassing 1,000 in total.

- The platform range is robust. The PU Prime Web Trader and app offer user-friendly interfaces, intuitive order setup, and dynamic charts for swift trade execution.

Cons

- The ECN account demands a $10,000 minimum deposit, preventing some active retail traders from accessing optimal pricing. These traders might incur higher costs on spreads and commissions with Prime, Standard, or Cent accounts.

- Contacting customer support can be cumbersome and time-consuming. Recent tests revealed the need to navigate various chatbot menus, answer questions, and input contact details before speaking to an agent.

- The internal market updates provide a brief overview but lack the depth required for in-depth strategy development or advanced analysis.

Our Take On 4xCube

"4xCube is ideal for traders who use MetaTrader and are keen on copy trading."

Pros

- A broad range of payment options, including bank cards

- The top-tier trading platforms, MetaTrader 4 and MetaTrader 5, are accessible.

- Hokocloud copy trading tool

Cons

- US clients are not eligible.

- Elevated charges for certain payment options.

- The broker lacks regulation from a reputable authority.

Our Take On AdroFX

"AdroFx attracts traders seeking an efficient and cost-effective method for high-leverage currency speculation through two reliable platforms, such as MetaTrader 4. Nonetheless, testing indicates it lags behind top trading brokers in areas like regulation and investment offerings."

Pros

- AdroFx caters to traders by offering flexibility, allowing the use of scalping and other swift strategies without restrictions.

- With over 60 currency pairs available, this extensive range surpasses many competitors, offering ample opportunities for forex traders.

- Efficient and knowledgeable customer support delivers tailored responses swiftly during testing.

Cons

- Most payment methods incur hefty withdrawal fees, such as a 1.9% charge on card transactions. However, this cost is typically avoidable with leading trading brokers.

- With just over 100 instruments, the selection is limited, especially in stocks and cryptocurrencies. This narrow range restricts diversification, making the platform less appealing to seasoned traders.

- The research tools provided are quite basic and offer limited insights into future events that could assist new traders in spotting opportunities. This is particularly evident when compared to more robust platforms such as eToro.

Our Take On InstaForex

"InstaForex remains a leading forex broker, offering more currency options than most competitors. Tight spreads and low minimum deposits ensure accessibility for traders of all levels, particularly those accustomed to the MT4 and MT5 platforms."

Pros

- The broker is an excellent choice for dedicated forex traders, offering over 100 currency pairs and competitive spreads starting at 0.0 pips. Additionally, it provides a top-tier collection of forex market resources.

- The broker is beginner-friendly, offering low minimum deposits and commission-free trading.

- InstaForex provides an excellent trading environment, utilising the robust MT4 and MT5 platforms. These platforms come equipped with numerous technical analysis tools, automation features, and various order types.

Cons

- The broker's website and client portal seem outdated, making navigation challenging for beginners.

- The broker exclusively offers trading instruments as CFDs.

- Customer support is offered exclusively in English, Czech, Polish, and Slovak.

How Investing.co.uk Chose The Top Brokers For Sign-Up Deals

Our team reviewed each broker’s promotional offers in detail, verifying eligibility, terms and conditions, and how easy it is for clients to actually redeem the bonus.

Brokers were then ranked using our overall ratings system, which covers more than 200 factors, including platform reliability, fees, customer support, and payment methods, so that welcome bonuses are considered in the wider context of a broker’s quality.

What To Look For When Choosing A Sign-Up Bonus For Trading

What The Welcome Bonus Means

A welcome bonus is an offer you get when you open a new trading account, but these can take a few forms. Make sure you choose the deal that best suits your needs and trading style.

- Deposit match: The broker adds a percentage to your first deposit.

- No-deposit bonus: You get a small sum for free, often just to test the platform.

- Trading credit: Funds you can use to open trades, but may not be withdrawn right away.

- Reward points or perks: Sometimes less direct, like discounted fees or loyalty points.

At first, it can look like free money. However, we’ve spent countless hours over the years combing through terms and conditions, and bonuses almost always come with strings attached.

InstaForex offers a range of welcome bonuses to new users

The Terms & Conditions

Every bonus has rules. You need to read them. Some common conditions include:

- Minimum deposit: You may need to deposit a specified amount to qualify.

- Time limits: Some bonuses expire if you don’t use them fast enough.

- Withdrawal rules: You often can’t withdraw the bonus right away. You might have to trade a set volume first.

- Restricted products: Some bonuses are only applicable to specific markets, such as forex or CFDs.

If you skip the small print, you could end up disappointed.

Wagering Or Trading Requirements

This is the big one. Brokers usually want you to place trades worth many times the bonus before you can withdraw it.

For example:

- You get a £50 bonus.

- The broker states that you need to trade 30 times that amount.

- That means £1,500 worth of trades before you can touch the bonus.

For casual traders, this can be unrealistic. Always check the multiplier.

Limits On Withdrawals

Some brokers let you withdraw profits from a bonus. Others don’t. Sometimes, the bonus is only ‘virtual credit.’ It allows you to trade, but you’ll never see the funds in your bank account.

Questions to ask:

- Can I withdraw the bonus itself?

- Can I withdraw profits made with the bonus?

- Do I lose the bonus if I withdraw my own funds early?

The answers change from broker to broker.

Bonus Size vs Practical Value

Bigger is not always better. A £200 bonus might look good. But if you need to trade £20,000 before you can use it, it may not be worth much.

A smaller bonus with fairer conditions can actually be more useful. Always weigh the size of the bonus against the rules tied to it.

No-Deposit Bonuses

These sound attractive. You don’t risk your own cash. However, they are usually very small—typically £10 or £20.

The catch:

- You may not be able to withdraw any funds until you meet the heavy trade requirements.

- They often serve as a test drive, rather than a genuine profit opportunity.

They can still help you learn a platform, but don’t expect them to replace your own deposit.

Loyalty vs One-Time Offers

Some brokers we’ve tested pair a welcome bonus with ongoing perks. Others simply offer you a one-time deal, and that’s it.

If you’re only interested in the welcome boost, this won’t be a concern. But if you’re in it for the long term, a smaller welcome bonus with fairer, ongoing rewards might be a better deal.

Expiry Dates

Most bonuses don’t last forever. Some expire in 30 days. Others in 90. If you don’t use the funds within the specified time, you will lose them.

That also means if the trading requirements are too steep for the timeframe, the bonus may be pointless. Always check the clock before you sign up.

Bonus Restrictions In The UK

UK-regulated brokers are not allowed to offer monetary or non-monetary incentives to trade CFDs or spreads for retail investors. This includes classic deposit bonuses or trading credit, with a narrow exemption for some research or information tools.

This means the flashiest promotions targeting UK traders typically come from offshore or unregulated firms. These brokerages often sit outside the FCA’s rules and the FSCS compensation scheme, so you will have far less protection if the firm fails, say for financial reasons, or if they refuse withdrawals.

If a broker is offering a very tempting deal, check whether they are FCA-regulated. If not, be cautious.

The Risk Of Chasing Bonuses

It’s easy to get caught up in chasing offers across multiple brokers. But switching often just for a bonus can be a distraction.

Consider:

- Each bonus locks you into rules that may not suit your trading style.

- Constant switching can spread your funds too thin.

- You may end up trading more than you planned, simply to meet the requirements.

Sometimes, it’s better to view the bonus as a small extra, rather than the main reason to choose a broker.

Practical Steps Before You Accept A Trading Bonus

Here’s a simple checklist:

- Read the fine print. Don’t skim.

- Work out the math. Can you realistically meet the trading requirements?

- Check withdrawal rules. Make sure you can take out profits.

- Look at the expiry date. Will you have enough time?

- Confirm regulation. Stick to FCA-regulated brokers for safety.

Bottom Line

A welcome bonus can give you a head start. But it’s not free money. It’s an incentive designed to encourage you to trade.

The best welcome bonus is one you can actually use. Small, fair, and transparent beats big, restrictive, and confusing.

If you treat it as a nice extra, not the main reason to sign up, you’ll avoid most of the common pitfalls.