Advanced Bollinger Strategy

The advanced Bollinger strategy is designed to use the Bollinger bands to trade ranging currencies. There are currencies that typically have a wide intraday range and to traders can use this strategy to catch reversal points along the way.

Top UK Forex Brokers With Bollinger Bands

-

Pepperstone provides forex spreads on the EUR/USD averaging just 0.12 pips with their Razor account. This is highly competitive. Their extensive portfolio includes over 100 currency pairs, which exceeds what most rivals offer. Furthermore, Pepperstone stands out by offering three unique currency indices: USDX, EURX, and JPYX, which are rare on other platforms. They have been recognised with our 'Best Forex Broker' award twice.

When we evaluated Pepperstone's MT4, execution was extremely swift with spreads starting at 0.1 pips, plus a $7 per lot commission on Razor accounts. The Smart Trader Tools plugin provided real benefits, including sentiment, mini-terminal, and trade management tools. EA automation operated seamlessly, and the mobile version replicated desktop performance in live trades.

GBPUSD Spread EURUSD Spread GBPEUR Spread 0.4 0.1 0.4 Total Assets FCA Regulated Platforms 100+ Yes MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade, Quantower -

Vantage provides over 55 currency pairs, exceeding the industry norm, giving traders ample opportunities. With a robust liquidity pool, forex spreads start at 0.0 pips on the ECN account, often beating other options. Additionally, there are no commissions, deposit fees, or hidden charges.

In our tests, Vantage's MT4 showed excellent performance, offering spreads as low as 0.0 pips on Raw/ECN and about 1.1 pips on Standard STP, with ECN commissions starting at around $3 per lot side and none for STP. Micro-lot trading and comprehensive EA automation were effective, complemented by robust mobile MT4 functionality.

GBPUSD Spread EURUSD Spread GBPEUR Spread 0.5 0.0 0.5 Total Assets FCA Regulated Platforms 55+ Yes ProTrader, MT4, MT5, TradingView, DupliTrade -

FOREX.com remains a leading FX broker, providing 80 currency pairs with highly competitive fees. EUR/USD spreads can reach as low as 0.0, with a $7 commission per $100k, making it a standout choice.

In our tests, FOREX.com's MT4 excelled with quick execution and a comprehensive set of custom indicators. The platform supports micro lots, EAs automation, and mobile trading. Integrated Trading Central and real-time news add-ons ensured seamless strategy testing and analysis.

GBPUSD Spread EURUSD Spread GBPEUR Spread 1.3 1.2 1.4 Total Assets FCA Regulated Platforms 84 Yes WebTrader, Mobile, MT4, MT5, TradingView -

Eightcap provides over 50 currency pairs, matching the industry norm but falling short of leaders like CMC Markets, which offers more than 300. Nonetheless, Eightcap distinguishes itself with institutional-quality spreads starting from 0.0 pips on major pairs such as EUR/USD. The broker's competitively low commissions at $3.50 per side further enhance its appeal. Eightcap also equips traders with comprehensive forex data, including essential fundamentals, bullish and bearish signals, and a calendar monitoring significant foreign exchange market events.

During testing, Eightcap’s MT4 offered swift execution and spreads starting at 0.0 pips on the Raw account. The commission was $3.50 per side for each standard lot, with an all-in cost of roughly 0.76 pips. The platform supports micro lots and provides smooth EA automation. The mobile MT4 was fast, and Capitalise.ai integration allowed for algorithmic trading without coding.

GBPUSD Spread EURUSD Spread GBPEUR Spread 0.1 0.0 0.1 Total Assets FCA Regulated Platforms 50+ Yes MT4, MT5, TradingView -

IG provides an extensive selection of over 80 currency pairs through its own web platform, mobile app, or MetaTrader 4. For advanced charting and forex analysis, the ProRealTime software is available. Testing shows forex spreads are competitive, beginning at 0.1 pips on major pairs such as EUR/USD.

When we tested IG’s MT4, execution was stable but a bit slower than their proprietary platform. Spreads averaged 0.6 pips on major pairs without commissions, supporting micro lots and dependable EA automation. Although MT4 did not include IG's exclusive tools, it provided robust mobile functionality and a wide asset range, including CFDs and forex.

GBPUSD Spread EURUSD Spread GBPEUR Spread 0.9 0.8 0.9 Total Assets FCA Regulated Platforms 80+ Yes Web, L2 Dealer, MT4, TradingView, AutoChartist, TradingCentral, ProRealTime -

FxPro provides over 70 currency pairs, though minors are excluded, and is renowned for its rapid execution and tight spreads, averaging 0.45 pips on EUR/USD. Traders can design, evaluate, and implement short-term strategies using the top-tier MT4 platform with expert advisors for algorithmic trading.

In our tests, FxPro’s MT4 provided robust execution with options for market or instant execution accounts. The platform accommodates micro lots, dependable EA automation, and mobile trading. FxPro’s tailored MT4 plugin enhanced analytics and risk management tools beyond the standard suite.

GBPUSD Spread EURUSD Spread GBPEUR Spread 0.6 0.45 0.73 Total Assets FCA Regulated Platforms 70+ Yes FxPro Edge, MT4, MT5, cTrader, AutoChartist, TradingCentral, DupliTrade, Quantower -

Axi excels with over 70 currency pairs, outpacing competitors such as AvaTrade, which provides just over 50. Coupled with the enhanced MT4 platform via the NextGen add-on, Axi stands out as a top choice for forex traders.

GBPUSD Spread EURUSD Spread GBPEUR Spread 0.5 0.2 0.5 Total Assets FCA Regulated Platforms 70+ Yes Axi Copy Trading, MT4, AutoChartist

Safety Comparison

Compare how safe the Advanced Bollinger Strategy are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✘ | ✔ | |

| Vantage FX | ✔ | ✔ | ✘ | ✔ | |

| Forex.com | ✔ | ✔ | ✘ | ✔ | |

| Eightcap | ✔ | ✔ | ✘ | ✔ | |

| IG | ✔ | ✔ | ✔ | ✔ | |

| FXPro | ✔ | ✔ | ✘ | ✔ | |

| Axi | ✔ | ✔ | ✘ | ✔ |

Payments Comparison

Compare which popular payment methods the Advanced Bollinger Strategy support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| Vantage FX | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| Forex.com | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| Eightcap | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| IG | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ |

| FXPro | ✔ | ✘ | ✔ | ✔ | ✔ | ✘ |

| Axi | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

Mobile Trading Comparison

How good are the Advanced Bollinger Strategy at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| Pepperstone | iOS & Android | ✘ | ||

| Vantage FX | iOS & Android | ✘ | ||

| Forex.com | iOS & Android | ✘ | ||

| Eightcap | iOS & Android | ✘ | ||

| IG | iOS & Android | ✔ | ||

| FXPro | iOS & Android | ✘ | ||

| Axi | iOS & Android | ✘ |

Beginners Comparison

Are the Advanced Bollinger Strategy good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|---|---|---|---|---|

| Pepperstone | ✔ | $0 | 0.01 Lots | ||

| Vantage FX | ✔ | $50 | 0.01 Lots | ||

| Forex.com | ✔ | $100 | 0.01 Lots | ||

| Eightcap | ✔ | £100 | 0.01 Lots | ||

| IG | ✔ | $0 | 0.01 Lots | ||

| FXPro | ✔ | $100 | 0.01 Lots | ||

| Axi | ✔ | $0 | 0.01 Lots |

Advanced Trading Comparison

Do the Advanced Bollinger Strategy offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Pepperstone | Expert Advisors (EAs) on MetaTrader | ✔ | 1:30 (Retail), 1:500 (Pro) | ✔ | ✘ | ✔ | ✘ |

| Vantage FX | Myfxbook AutoTrade, Expert Advisors (EAs) on MetaTrader | ✘ | 1:30 | ✔ | ✘ | ✘ | ✘ |

| Forex.com | Expert Advisors (EAs) on MetaTrader | ✘ | 1:30 | ✔ | ✔ | ✔ | ✘ |

| Eightcap | TradingView Bots | ✘ | 1:30 | ✔ | ✘ | ✔ | ✘ |

| IG | Expert Advisors (EAs) on MetaTrader, build your own on ProRealTime | ✔ | 1:30 (Retail), 1:222 (Pro) | ✔ | ✔ | ✔ | ✔ |

| FXPro | Expert Advisors (EAs) on MetaTrader, cBots on cTrader | ✔ | 1:30 (Retail), 1:500 (Pro) | ✔ | ✔ | ✔ | ✘ |

| Axi | Expert Advisors (EAs) on MetaTrader, Myfxbook | ✔ | 1:30 | ✔ | ✔ | ✔ | ✘ |

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the Advanced Bollinger Strategy.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|---|---|---|---|---|---|---|---|---|

| Pepperstone | |||||||||

| Vantage FX | |||||||||

| Forex.com | |||||||||

| Eightcap | |||||||||

| IG | |||||||||

| FXPro | |||||||||

| Axi |

Our Take On Pepperstone

"Pepperstone is a premier trading platform, providing tight spreads, swift execution, and sophisticated charting tools for seasoned traders. Beginners benefit from no minimum deposit, comprehensive learning materials, and outstanding 24/7 support."

Pros

- The award-winning customer support can be accessed through phone, email, or live chat. During tests, response times have consistently been under 5 minutes.

- Pepperstone offers rapid execution speeds of approximately 30ms, enabling swift order processing and execution, making it ideal for traders.

- In recent years, Pepperstone has significantly enhanced the deposit and withdrawal process. By 2025, clients can use Apple Pay and Google Pay, while 2024 saw the introduction of PIX and SPEI for customers in Brazil and Mexico.

Cons

- Pepperstone's demo accounts expire after 30 days, which may not provide sufficient time to explore various platforms and evaluate trading strategies.

- Pepperstone doesn't offer cTrader Copy, a favoured feature for copying trades found in the cTrader platform, which is available on other platforms such as IC Markets. However, Pepperstone has launched its own user-friendly copy trading app.

- Although its market range has improved, its crypto offerings remain limited compared to brokers specialising in this sector, lacking real coin investment options.

Our Take On Vantage FX

"Vantage is an ideal choice for CFD traders looking for a well-regulated broker with access to the dependable MetaTrader platforms. With a swift sign-up process and a minimum deposit of $50, starting trading is simple and fast."

Pros

- With a minimal deposit requirement of just $50 and no funding fees, this broker stands out as an excellent option for novice traders.

- The trading software suite is outstanding, featuring the acclaimed MT4 and MT5 platforms.

- Vantage upholds a high trust score through its solid reputation, backed by premier regulation from the FCA and ASIC.

Cons

- Regrettably, cryptocurrencies are accessible solely to clients in Australia.

- Based on tests, average execution speeds of 100ms to 250ms are slower compared to other options.

- To access optimal trading conditions, a substantial deposit of $10,000 is required. This includes a commission of $1.50 per transaction per side.

Our Take On Forex.com

"FOREX.com excels in serving traders of all levels, offering more than 80 currency pairs, spreads starting at 0.0 pips, and competitive commissions. Its robust charting platforms provide over 100 technical indicators and comprehensive research tools."

Pros

- FOREX.com provides top-tier forex rates beginning at 0.0 pips, along with attractive cashback rebates up to 15% for dedicated traders.

- The in-house Web Trader continues to stand out as one of the best-designed platforms for aspiring traders with a slick design and over 80 technical indicators for market analysis.

- An abundance of educational resources is available, such as tutorials, webinars, and an extensive YouTube channel, designed to enhance your understanding of financial markets.

Cons

- Demo accounts are typically limited to 90 days, hindering effective strategy testing.

- FOREX.com's MT4 platform provides around 600 instruments, a notable reduction compared to the more than 5,500 options on its other platforms.

- US clients are not protected against negative balances, which means you could end up owing more than your initial deposit.

Our Take On Eightcap

"Eightcap excels for traders, offering diverse charting platforms, educational Labs, and AI tools. With over 120 crypto CFDs, it stands out in crypto trading and has won our 'Best Crypto Broker' award twice consecutively."

Pros

- In 2026, Eightcap integrated TradeLocker, distinguishing itself as the premier regulated broker for TradeLocker. It continues to offer ultra-fast execution and competitive fees for active traders on the charting platform.

- With spreads starting at 0 pips, minimal commission charges, and leverage up to 1:500 for select clients, Eightcap delivers affordable and flexible trading opportunities. These conditions suit various strategies, such as trading and scalping.

- Eightcap has excelled in all essential trading areas, surpassing all rivals to clinch our 'Best Overall Broker' award for 2024. It also earned the titles of 'Best Crypto Broker' and 'Best TradingView Broker' for 2025.

Cons

- The demo account is available for 30 days, after which it requires a request for extension. This is less convenient than XM's offering, which provides an unlimited demo mode.

- Despite a helpful array of educational guides and e-books in Labs, Eightcap lags behind IG's extensive resources for aspiring traders. IG boasts a dedicated Academy app and features 18 diverse course categories.

- Despite the growing range of tools available, Eightcap lacks popular industry resources such as Autochartist and Trading Central. These provide advanced charting analytics, live news, and essential market insights for traders focused on short-term strategies.

Our Take On IG

"IG offers a complete package: an easy-to-use web platform, top-tier beginner education, enhanced charting via TradingView, up-to-date data, and strong trade execution for seasoned traders."

Pros

- The web-based platform supports traders at every level, offering advanced charting tools and real-time market data vital for trading. Additionally, IG now includes TradingView integration.

- IG secured a crypto asset license from the FCA, enabling its return to the UK market. It now offers buying, selling, and storage services for over 55 digital tokens with fees starting at 1.49%, all under FCA regulation.

- IG excels with its diverse instruments, offering stocks, forex, indices, commodities, and cryptocurrencies. Additionally, it provides US-listed futures, options, and an AI Index, ensuring varied diversification opportunities.

Cons

- IG imposes a monthly inactivity fee of $12 after two years, discouraging occasional traders.

- Beginners may find IG's fees complicated, as they vary depending on the trades or services. This could cause confusion and unexpected costs.

- Based on tests, stock and CFD spreads remain less competitive than the lowest-cost brokers, such as CMC Markets.

Our Take On FXPro

"FxPro is an excellent choice for traders, offering swift execution speeds under 12ms, reduced fees since 2022, and outstanding charting platforms like MT4, MT5, cTrader, and FxPro Edge."

Pros

- FxPro provides four dependable charting platforms, including the user-friendly FxPro Edge. It features more than 50 indicators, 7 types of charts, and 15 different timeframes.

- FxPro uses a 'No Dealing Desk' (NDD) model for swift and transparent order execution, usually within 12 milliseconds, making it well-suited for short-term trading strategies.

- FxPro's Wallet is a notable feature enabling traders to securely manage their funds. It ensures additional protection and ease by separating unused funds from active trading accounts.

Cons

- There are no passive investment options such as copy trading or interest on cash. While traders might not find these essential, competitors like eToro, which accommodate both active and passive investors, offer more extensive services.

- FxPro offers customer support five days a week around the clock, accessible via various platforms, and the service quality is reliable based on tests. However, the absence of weekend support can be a drawback for traders requiring help beyond standard market times.

- FxPro, with its $10M funded demo account and expanding Knowledge Hub, mainly caters to experienced traders. Beginners might find its account and fee structure challenging to understand.

Our Take On Axi

"Axi excels for forex trading on MetaTrader 4 with over 70 currency pairs, MT4 NextGen features, and tight spreads starting at 0.2 pips on the Pro account."

Pros

- Axi provides an excellent MT4 experience, enhanced by the NextGen plug-in for sophisticated order management and analytics, with low execution latency around 30ms.

- Experienced traders are invited to join the Axi Select funded trader programme via the broker's international branch. This scheme offers up to $1 million in capital with the benefit of a 90% profit share.

- Axi Academy offers a wealth of educational resources, from free eBooks and video tutorials to interactive quizzes. These are particularly beneficial for novice traders.

Cons

- Even with the expansion of stock CFDs in the US, UK, and EU markets, its range still falls short compared to companies like BlackBull, which provide thousands of equities for varied trading opportunities.

- Although Axi delivers excellent performance, its support is not available 24/7. This unavailability can be inconvenient for traders operating in different time zones or requiring help beyond regular trading hours.

- Axi retains our confidence. However, recent issues with ASIC and FMA require it to maintain a secure environment and comply with licensing standards.

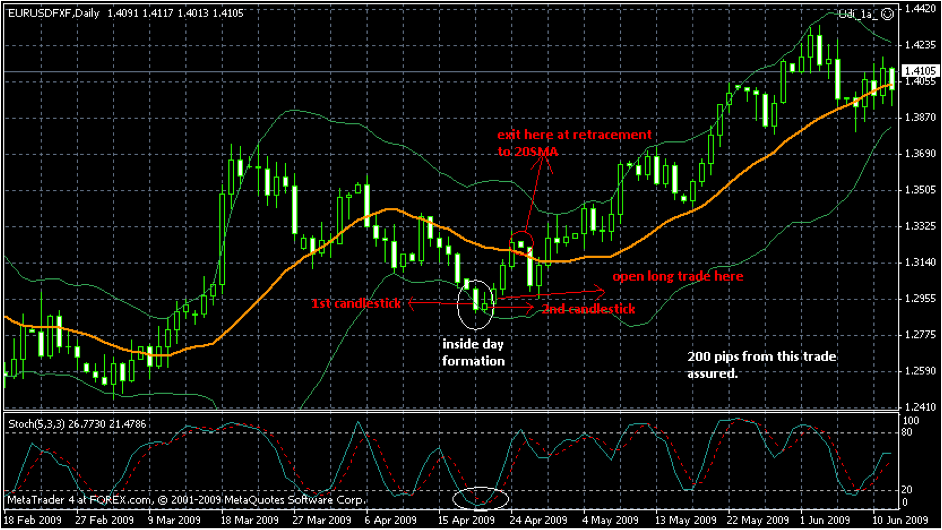

The success of this trading system is hinged around the appearance of the inside day candlestick formation, which will form the basis of entry confirmations. This is what it looks like:

inside day candle formation

An inside day candle is formed as follows:

The Day 1 candle (the first candle) has a higher high and a lower low than the Day 2 candle (the second candle). Sometimes, the lows of both candles may be at the same level while the high of Day 1 > Day 2 high. In other words, the Day 1 candle envelops the Day 2 candle, or the Day 2 candle is “inside” the Day 1 candle. The picture says it all.

This formation has to occur at either extremes of the Bollinger band indicator for a trade signal to be initiated.

Strategy Setup

This strategy is best used on the 1hr, 4hr and long term time charts such as the Daily chart. This trading strategy does well with 3 indicators, but the addition of the pivot point calculator helps to provide a confirmation on whether the price of the currency asset has topped or bottomed out.

Setup the three (or four) indicators as indicated below.

a) Bollinger band (at default settings of 20 Period, 2.0 Multiple and SMA).

b) Stochastics oscillator set to 5,3,3 (default settings).

c) 20-day simple moving average (20SMA). This SMA corresponds to the middle Bollinger, but it should be demarcated for clarity.

d) Autopivot calculator.

Long Entry

The trader should execute a long trade if the following criteria are met:

a) The Inside day candle forms and touches, or cuts the lower Bollinger band.

b) If the Stochastics oscillator crosses at <25, indicating an oversold market condition.

Once this happens, the EA should automatically go long at the open of the next candle. If this situation occurs at a support line as shown by the Autopivot calculator, the signal is reinforced. If the entry point is higher than the high of the 2nd candle in the inside day formation (Day 2 candle), the signal is more reliable.

Example 1

Chart showing long entry setup and strength of the signal when the third candle’s open is very close to, or higher than the 2nd candle’s high

Short Entry

The trader should execute a long trade if the following criteria are met:

a) The inside day candle forms and touches or cuts above the upper Bollinger band.

b) The Stochastics crosses at >75, indicating an overbought market condition.

Once this happens, the trader should open a short position at the open of the next candle. If the entry point is lower than the low of the 2nd candle in the inside day formation (Day 2 candle), the signal is more reliable. If this situation occurs at a support line as shown by the Autopivot calculator, the signal is reinforced.

Setting the Stop Loss and Profit Targets for this Strategy

The stop loss for the Advanced Bollinger band system should be placed 20 pips above (for short entry) or below (for long entry) the Day 1 candlestick in the inside day candle formation.

Since the strategy is used to catch a top or bottom of a trend and follow it until the condition changes, the trailing stop profit strategy is used. This is where the 20SMA comes in. Once the market breaks the 20SMA in the trade direction, the EA should open a 20 pip trailing stop to start trailing the price action. For a SHORT entry, the trailing stop should be set when the price action breaks below the 20SMA, and for a LONG entry, the trailing stop is set when the price action breaks above the 20SMA.

Another way of taking profits is to wait until the currency price starts to retrace and touches the 20SMA. So for a long trade, the trader could wait until the currency price starts to retrace downwards and touches the SMA before closing the trade manually. For a short trade, the trader could wait until the currency price takes a bounce off the bottom and close the trade manually when the price action hits the 20SMA.