Premium Bonds: Are They Really Worth It?

The pursuit of investment opportunities often leads UK citizens to consider Premium Bonds, a unique investment vehicle offered by the National Savings and Investments (NS&I).

Launched in 1956 and with more than 24 million people saving over £122 billion in them, Premium Bonds have evolved into a popular and intriguing investment option for many Britons, combining elements of chance and financial growth.

But, are they really worth it? What are your chances of winning? And crucially, are there better investment opportunities?

Fast Verdict: While the returns may not be the most promising, Premium Bonds offer a safeguard for your cash.

You might want to allocate a modest portion of your funds to them, as long as you recognise that it’s more about enjoyment than expecting substantial returns.

Alternatively, investors in search of higher returns may want to consider the other financial vehicles explained in this guide, such as stocks, index funds and ETFs.

What Are Premium Bonds?

Premium Bonds are a distinctive form of savings and investment offered to UK residents. They stand out from conventional savings accounts and investment instruments due to their unique combination of chance and financial gain.

Instead of accruing interest over time, as with traditional savings accounts, Premium Bonds enter bondholders into a monthly prize draw, where you have the opportunity to win tax-free cash prizes ranging from modest sums to substantial jackpots.

The premise is simple: for each Premium Bond you own you become eligible for a chance to win in the monthly prize draw.

That excitement is why Premium Bonds have become a popular choice for those seeking an alternative and potentially lucrative way to grow their savings.

How Do Premium Bonds Work?

Premium Bonds operate on a unique principle that distinguishes them from traditional savings or investment vehicles.

When you purchase Premium Bonds, you are essentially lending money to the UK government. Instead of earning interest on this loan, you are entered into a monthly prize draw for the chance to win a tax-free cash prize.

While Premium Bonds do not offer a guaranteed return like traditional interest-bearing savings accounts, the appeal lies in the excitement of the prize draw, the potential for significant winnings, and the assurance that the original investment is safe.

Here’s a breakdown of how Premium Bonds work:

- Purchase: You can buy Premium Bonds in increments, with each bond having a specific value. The minimum purchase is £25, and the maximum holding is £50,000 per individual. So, if you save £100, you’ll get 100 bond numbers (each with a chance to win a prize).

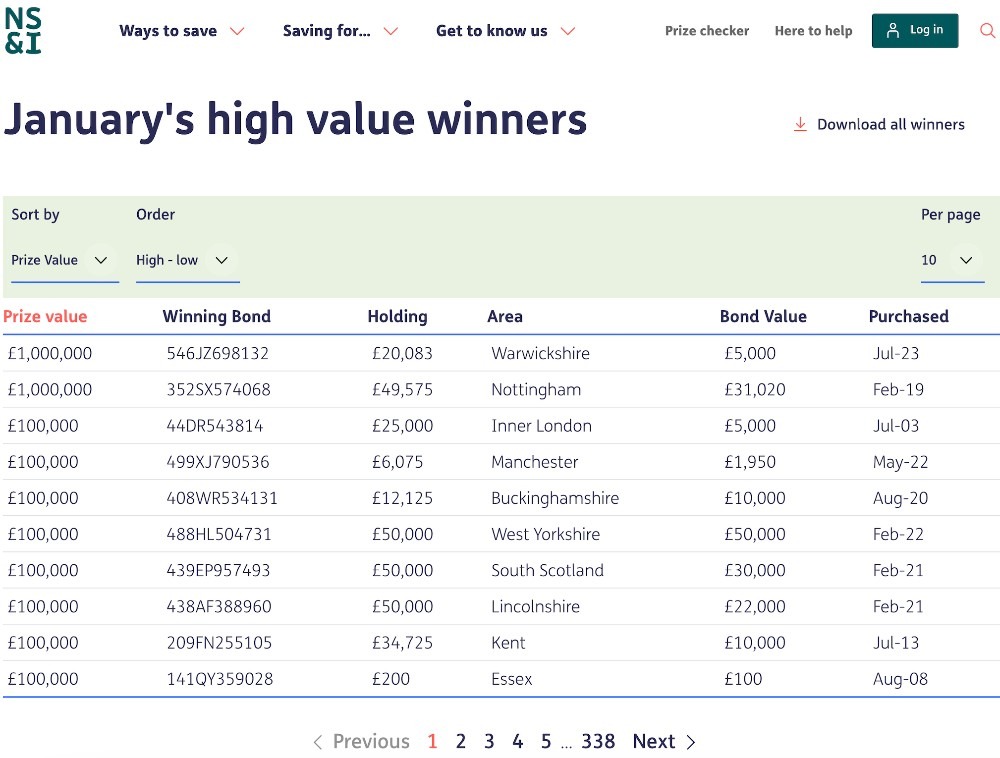

- Prize Draw: Instead of receiving regular interest payments, you are entered into a monthly prize draw. Prizes range from £25 to £1 million. The total prize fund is distributed among the winners, and the winnings are tax-free.

- Random Selection: The prize draw is based on a random, computer-generated process called Ernie (Electronic Random Number Indicator Equipment). Every Premium Bond has a unique identification number that is used in the draw. The more Premium Bonds you hold, the higher the chance of winning, as each bond is treated as a separate entry.

- No Risk of Losing Capital: While there is a high chance of winning no prizes in a given month, the original capital invested in Premium Bonds is secure. You can cash in your Premium Bonds whenever you want, receiving the initial investment amount with no penalties.

- Frequency of Draws: The prize draws occur monthly, and the results are typically announced within the first few days of the month. You can check if you have won on the NS&I website or by using the official app.

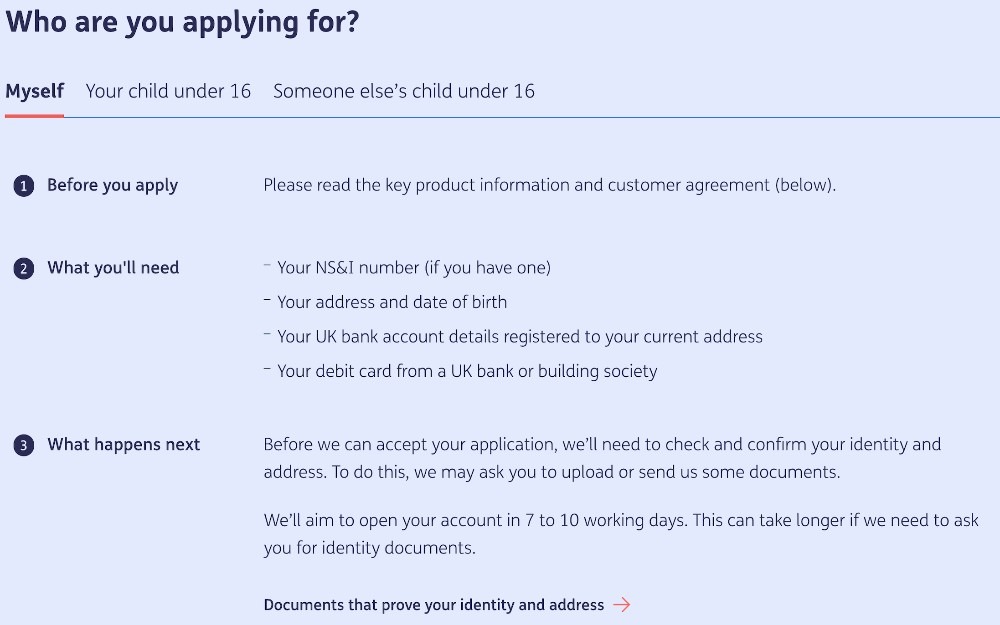

- Accessibility: Premium Bonds can be purchased by UK residents aged 16 and over. Parents and legal guardians can also purchase them for children under 16.

- Government Backing: Premium Bonds are backed by the UK government, providing a level of security for investors.

What Are Your Odds Of Winning?

The likelihood of winning with Premium Bonds hinges on several factors. The number of bonds you possess and the collective value are paramount.

Owning more bonds increases the chances of winning, as each Premium Bond is treated as an individual entry in the monthly prize draw. The total value of your investment affects the odds proportionally – a larger investment correlates with a higher likelihood of winning.

The overall prize fund for a given month also plays a crucial role. A larger prize fund enhances the chances of winning substantial prizes. This fund is determined by the cumulative value of all eligible Premium Bonds in existence.

The prize draw itself is conducted randomly using a computer-generated process. This means that every eligible Premium Bond has an equal chance of being selected, irrespective of its purchase date or specific characteristics.

While these factors influence the odds, Premium Bonds do not guarantee returns. The element of chance is inherent, but the outcomes are unpredictable.

Your chances of winning the top prize are tiny. The majority of users win small amounts or nothing. As per NS&I, the odds of winning at least £25, the minimum prize, stand at one in 21,000.

If you don’t secure one of the larger prizes, it’s improbable that your returns will outpace inflation. Simply put, your funds are unlikely to grow rapidly enough to offset increasing costs, leading to a potential erosion of your buying power over time.

For the latest information on odds and prize distributions, consult the official NS&I website.

How Are Winnings Paid?

Premium Bond winnings are automatically credited to your Premium Bonds account by NS&I. Upon winning a prize, NS&I notifies you through either a letter or email, based on your chosen communication preferences.

You can review your winnings by logging into your online account on the NS&I website or using the official NS&I app. The account summary displays details of the prize won, including the amount.

The option is available to reinvest your winnings into additional Premium Bonds or withdraw the funds. Reinvesting contributes to the total bond holding, potentially increasing your chances of winning in future draws.

Premium Bond winnings are entirely tax-free in the UK, allowing you to retain the full prize amount without any deductions for income tax. For those with a Direct Debit set up for Premium Bond purchases, winnings may be used to acquire additional Premium Bonds in the following month’s draw. Just remember to keep your contact details current with NS&I to ensure you receive timely notifications about any winnings.

While there’s no time limit to claims, Premium Bonds lack the option for direct inheritance. In the event of a Premium Bond holder’s death, the bonds retain eligibility for winning only for a limited 12-month period.

To transfer them, the alternative is to redeem the bonds, which then become part of the deceased’s estate. The executor is required to redeem the bonds to facilitate distribution to the beneficiaries.

And, no surprise, Premium Bonds do not enjoy exemption from inheritance tax. Should the capital tied up in the bonds constitute part of the estate and be passed on, it may be subject to taxation.

Pros & Cons Of Premium Bonds

Premium Bonds may not be the ideal choice if you are seeking guaranteed returns or a steady income stream.

Individual preferences, risk tolerance, and financial goals play a crucial role in determining whether Premium Bonds are a suitable investment option.

Pros

- Chance of Winning Prizes: One of the main attractions is the chance to win tax-free cash prizes in the monthly Premium Bonds draw, adding an element of excitement to the investment.

- No Risk to Capital: The original investment in Premium Bonds is secure and you can cash them in at any time, ensuring the return of the initial amount invested.

- Government Backing: Premium Bonds are backed by the UK government, providing a level of security and reliability.

- Flexibility: Premium Bonds offer flexibility in terms of investment amounts, allowing you to start with a minimum investment and increase it over time.

- Tax-Free Winnings: All winnings from Premium Bonds are tax-free, an attractive feature if you are seeking to maximize returns.

Cons

- No Guaranteed Returns: Unlike traditional savings accounts or fixed-income investments, Premium Bonds do not provide guaranteed monthly or yearly interest.

- Potential for Low or No Prizes: While there is the opportunity to win substantial prizes, there is also a likelihood of winning smaller amounts or no prizes at all.

- Opportunity Cost: Funds invested in Premium Bonds may not generate as much income or growth as alternative investments with more predictable returns.

- Inflation Risk: As Premium Bonds do not provide a fixed interest rate, there is a risk that the returns may not keep pace with inflation, potentially eroding your purchasing power over time.

- Not Suitable for Income Generation: Premium Bonds are not designed to provide regular income, making them less suitable if you are seeking a steady stream of cash flow.

- Market Risk Absent: While this may be considered an advantage by some, Premium Bonds do not expose you to the potential benefits of market growth. If the market performs well, you will not directly benefit from those gains.

How To Buy Premium Bonds

To buy Premium Bonds, start by opening an account with the NS&I. You can do this online through the official NS&I website.

Once your account is set up, decide on the amount you want to invest. The minimum purchase amount is £25. You can choose to invest more, up to the maximum limit of £50,000 per individual.

Proceed to make your purchase through your NS&I account, specifying the desired amount of Premium Bonds you wish to acquire. The purchase process is typically straightforward, and you will receive confirmation once the transaction is complete.

Premium Bonds can also be purchased over the phone or by post, but online transactions are often the most convenient and efficient method.

After acquiring Premium Bonds, you become eligible for the monthly prize draw. You can cash in your Premium Bonds at any time without penalty.

Typically, you must possess the bonds for an entire month before you qualify for winning. Hence, if you purchase bonds at any point in March, you will be eligible for the draw starting from May.

The only deviation from this rule occurs when you reinvest your winnings. In such cases, the bonds resulting from reinvested prizes become eligible for the draw starting from the month following your win.

For instance, if I were to win £25 in September with reinvestment set up, the new £25 worth of bonds would participate in October’s draw.

Alternatives To Premium Bonds

Premium Bonds offer an interesting blend of chance and savings. They have the potential to outperform standard easy-access savings, but realising this potential relies heavily on above-average luck. For the majority, opting for guaranteed interest from traditional savings is the more reliable choice.

There are also attractive alternative investment options that can be considered for financial growth:

Stocks & Equity Investments

Investing in individual stocks or exchange-traded funds (ETFs) provides an opportunity for long-term capital appreciation. However, it comes with market risks and thorough research or consultation with a financial advisor is advisable.

Investing in companies that pay regular dividends can also provide a source of income while allowing for potential capital appreciation over the long term.

If you want to trade stocks and ETFs, IG is a great option for UK investors with FCA oversight, low fees and thousands of instruments.

Visit IG IndexBonds & Fixed-Income Securities

Government or corporate bonds offer a more predictable income stream than Premium Bonds. These fixed-income securities provide regular interest payments and the return of principal upon maturity.

If you want to trade bonds, Interactive Investor is a good pick for UK investors with FCA oversight, a user-friendly app and a large selection of bonds and gilts.

Visit Interactive InvestorIndex Funds & Mutual Funds

Diversified index funds or mutual funds can provide exposure to a broad range of assets, spreading risk and potentially offering stable long-term returns.

If you want to trade indices and funds, Interactive Brokers is a top choice for UK investors with FCA oversight, excellent pricing, and a wide range of indices and funds from major markets.

Visit Interactive BrokersPrecious Metals

Gold and silver are often considered hedges against inflation and can be part of a diversified long-term investment portfolio.

If you want to trade gold and silver, CMC Markets is an excellent choice for UK investors with FCA oversight, top-rate research and analysis tools, plus short-term trading opportunities through derivatives like CFDs and spread betting.

Visit CMC MarketsReal Estate

Real estate, either through direct property ownership or real estate investment trusts (REITs), can be a long-term investment with the potential for both income and capital appreciation.

Retirement Accounts (e.g. pension/401K)

Contributing to retirement accounts offers tax advantages and a long-term approach to building wealth. These accounts often provide a range of investment options, including stocks, bonds, and mutual funds.

Savings Accounts & Certificates of Deposit (CDs)

While not as lucrative as some other investments, savings accounts and CDs provide a low-risk option for preserving capital. They are suitable for the more conservative investor.

Before making any investment decisions, it’s important to assess your financial goals, risk tolerance, and time horizon. Consulting with a financial adviser can help tailor an investment strategy that aligns with your individual circumstances and objectives.

Keep in mind that diversification is a key principle in managing risk, and a balanced portfolio may include a mix of different asset classes.

Bottom Line

If you enjoy taking a bit of a risk, allocating a modest portion of your savings to Premium Bonds isn’t a bad idea, even though the odds are not in your favour.

Comparatively, the likelihood of winning the National Lottery jackpot per ticket in a week is one in 45 million, significantly surpassing the chance of becoming a millionaire through a single Premium Bond in a month, which stands at more than 60 billion to one. Naturally, having more bonds increases your probability of winning.

Alternatively, the other financial vehicles outlined in this guide may serve long-term investors on the hunt for optimal growth.