Best Binary Options Brokers In The UK 2026

Finding a trusted binary options broker is challenging, especially with scams and strict regulatory requirements from the FCA. We’ve cut through the noise – revealing the best binary options brokers in the UK, ranked by our team of experienced binary traders, after considering maximum payouts, market access, and security.

Top UK Binary Options Brokers

Safety Comparison

Compare how safe the Best Binary Options Brokers In The UK 2026 are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|

Payments Comparison

Compare which popular payment methods the Best Binary Options Brokers In The UK 2026 support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|

Mobile Trading Comparison

How good are the Best Binary Options Brokers In The UK 2026 at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|

Beginners Comparison

Are the Best Binary Options Brokers In The UK 2026 good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|

Advanced Trading Comparison

Do the Best Binary Options Brokers In The UK 2026 offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the Best Binary Options Brokers In The UK 2026.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|

How Did Investing.co.uk Choose The Best Binary Options Brokers?

Our review process started by verifying that each broker in our evolving database offers binary options trading and welcomes UK clients.

We then applied our proprietary rating system, analysing over 200 data points across eight core categories including FCA regulation, available binaries, maximum payouts, contract options, and platform reliability.

Overall ratings were assigned by our UK experts, which includes binary traders with 20+ years of experience. This approach ensures our recommendations reflect the actual needs of UK-based binary options investors.

What Is A Binary Options Broker?

A binary options broker allows you to speculate on financial market price movements through web-based and mobile binary apps.

These brokers define the terms of each contract, including the payout structure, and supply tools to help you analyse market trends and make strategic decisions.

With binary options, the premise is simple: will a specific asset go up or down by a particular time? If your forecast is correct, you receive a fixed return. If not, your initial investment is lost.

Rather than charging traditional fees like a forex broker, binary firms primarily earn revenue from the imbalance between profitable and losing trades. Because you are betting directly against the broker, the firm acts as the counterparty to each position, making broker transparency and trustworthiness especially critical.

While the UK’s Financial Conduct Authority (FCA) prohibits local firms from marketing or selling binary options, British investors can still access offshore brokers. However, this raises the risk to your capital due to scams and unfair trading practices.

Unlike conventional brokers who connect traders to the broader markets, binary options providers often structure trades in-house. This makes careful broker selection essential for UK-based options traders looking for fair terms and reliable service.

What To Look For In A UK Binary Options Broker

A binary broker that aligns with your goals, risk tolerance, and trading style will give you the best chance of long-term success. Here’s what to look for:

Binary Assets

The variety of assets and markets a binary options broker offers plays a crucial role in shaping trading opportunities.

A well-rounded broker should offer access to a broad range of instruments – forex pairs, stocks, indices, cryptocurrencies, and commodities – giving you the flexibility to build strategies around different sectors and global events.

For example, British traders may want to speculate on GBP/USD in the forex market or stock indices such as the FTSE 100. You may even prefer to trade commodities like gold, oil, or natural gas or even invest in the fast-moving crypto market with contracts on Bitcoin, Ethereum, or Ripple.

A wider asset selection allows you to trade in line with your market knowledge. Whether you follow UK economic data, global tech stocks, or the price of crude oil, having access to those markets via binary options can help you turn insight into opportunity.

Additionally, trading across multiple asset classes can help manage risk and avoid overexposure to a single market or event. In short, the more asset variety your broker offers, the more control and opportunity you have as a binary options trader.

Trading binary options at an online broker showed me how each asset demands a different approach. GBP-based forex binaries moved fast around economic data, which is ideal for short expiries.FTSE 100 options are steadier and suited to longer trades with lower payouts, while commodities like gold worked well with range strategies.

Binary Tools

Unlike traditional forex and CFD brokers, leading binary options brokers don’t tend to offer trading through the popular MetaTrader (MT4 and MT5) or TradingView platforms. Though there are a few MT4 binary brokers.

Instead, most offer proprietary web-based platforms, ideal for beginners who prefer a more straightforward, user-friendly interface without the steep learning curve.

The catch is that the charting package is usually fairly basic in our experience – think fewer indicators, charting styles, drawing tools, and customisation options.

Test the broker’s platforms with a free binary options demo account before committing real money – this lets you assess trade execution speed, usability, and available features without taking on any risk.

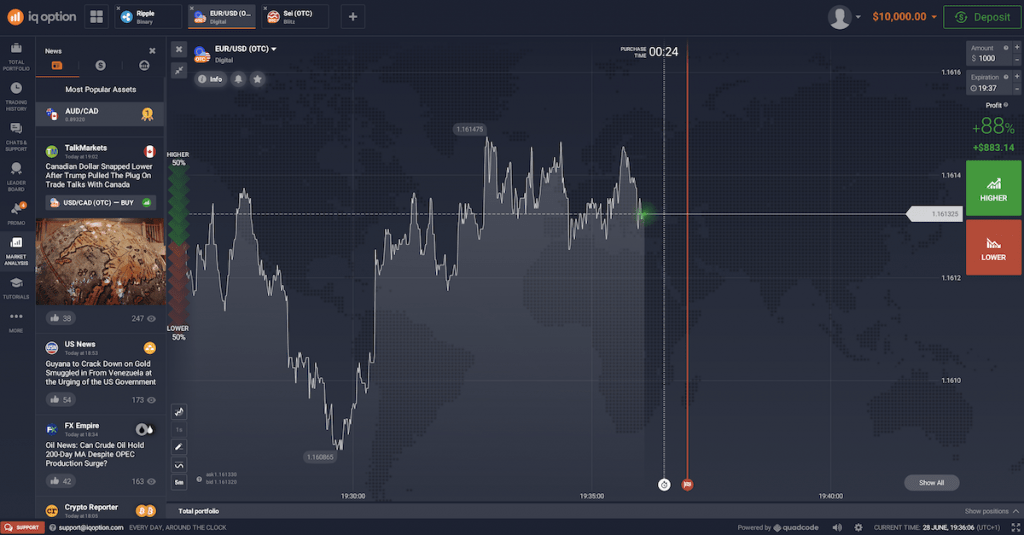

IQ Option, like most binary options brokers, only offers a proprietary trading platform

Contract Payouts

One of the most critical factors when selecting a binary options broker is the potential return per trade. This directly impacts your earnings and also reflects how the broker generates profit.

In most cases, binary options are offered over-the-counter (OTC), meaning you’re trading directly with the broker – not through an exchange. Here, the broker acts as the counterparty to your trade.

You’ll receive a fixed payout based on the advertised return if your prediction is correct. If you’re wrong, the broker keeps your initial stake.

For example, if you place a £100 trade with an advertised return of 85%, a successful outcome would earn you £185 in total (£100 stake + £85 profit). But if the trade goes against you, you will lose the complete £100.

Check the broker’s payout rates on your preferred assets. Some platforms offer significantly higher returns on forex pairs or crypto, which can significantly affect your long-term profitability.

Always review the broker’s pricing structure, payout rates, and return calculation before opening a live account.

Binary Option Types

When choosing a binary options broker, consider the type of contracts available. The contract type you select will shape your strategy and risk profile, especially if you’re trading in high volume.

The most popular is the high/low option, also known as up/down, where you simply decide whether the price of an asset, such as UK stock, will rise or fall over a set period.

Another contract type is the One Touch option, which pays out if the asset reaches a specific price level – just once – before the expiry time. It doesn’t matter if the price moves back after touching the target; a single touch is enough to trigger the return.

Other choices include Boundary (or Range) options, where you predict whether the price of an asset will remain within a defined upper and lower limit.

Ladder options are also popular. They offer tiered payouts based on whether the asset hits certain price levels, which can reward more accurate forecasting with higher returns.

Contract duration is a critical factor. Some brokers offer expiry times as short as 5 seconds or 1 minute, catering to fast-paced, intraday strategies. Others provide longer-term contracts lasting days, weeks, or even months – better suited for traders with a broader market outlook.

Some platforms like Pocket Option also include features like rollover, which allows you to extend a trade’s expiry by increasing your stake. This can be especially useful if you anticipate a trend continuing but need more time for the price action to align with your prediction.

Choosing the right combination of contract type, expiry time, and asset class is key to building a strategy that matches your risk tolerance and trading goals.

After a Bank of England announcement, I traded GBP/USD using One Touch and Boundary options with a £250 stake. One Touch offered a high payout if the price hit a specific level, but the target was far and risky.On the other hand, Boundary options paid out if the price stayed within a set range – ideal for calmer UK market periods. Choosing the right type based on market conditions proved crucial for success.

Bonuses

One area where binary options brokers often stand out from well-regulated forex and CFD providers is in the range of bonuses and promotions they offer.

Most firms we’ve evaluated offer welcome deposit bonuses, where brokers match a percentage of your initial funding, or trading contests with real cash prizes, and other incentives designed to boost engagement.

These offers can appeal to newer traders looking for extra value or seasoned traders seeking additional upside from their regular activity.

However, caution is essential. From our analysis, binary options promotions often come with turnover requirements – you may need to trade your bonus amount many times before you can withdraw any profits linked to it.

This can lead traders to take excessive risks or overtrade, especially if they’re focused on unlocking bonus-related rewards rather than following a structured strategy.

If you’re considering a binary platform that offers bonuses, always read the terms carefully. Some offers can increase your starting capital, but only if used wisely within a disciplined risk framework.

Bonuses can offer extra value, but only when paired with sound money management. Don’t let a 50% deposit match tempt you into abandoning your trading plan.

Bottom Line

Binary options have become popular for new and experienced traders thanks to their simplicity and fixed-risk structure.

They offer a straightforward way to speculate on price movements across various markets, including forex, stocks, commodities, and cryptocurrencies.

However, with so many brokers competing for your attention – some regulated, others not – finding a trustworthy platform can be overwhelming.

To get started, turn to our selection of the best binary options brokers in the UK.