What Is The VIX And Why Does It Matter?

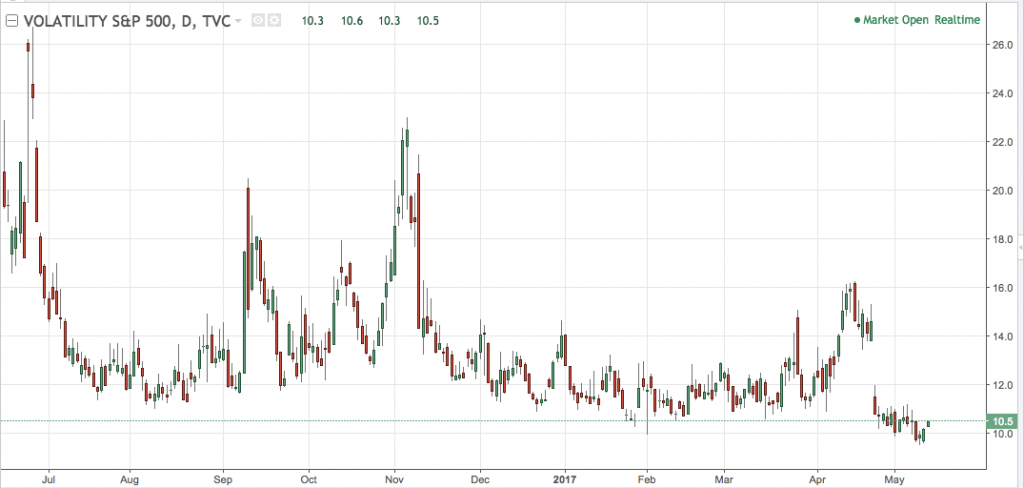

The VIX (CBOE:VIX) is getting a lot of attention right now. The index is currently hovering around the 10-11 level, and has been here since the first round of the French election. To give you some perspective, the VIX averages around 16-17 and reached just above 80 during the financial crisis. Moves to the downside are not uncommon at all, especially during summer when volume dwindles. This sustained move down is raising a lot of questions, mostly around why the market is so complacent in the face of geo-political risk and uncertainty.

VIX – Why It Matters

The VIX is an index that tracks the implied volatility of options on S&P500 companies. Implied volatility is higher when traders are unsure about the future, and prepared to pay more for protection against downside risk. Think of it as an insurance premium, when risk is high premiums are high, and vice-verse. Fund managers who are looking to hedge their long stock positions may buy puts as downside protection. The more demand for protection, the higher the implied volatility, the higher the index…or so the theory goes.

The math might be complex, but understanding what it means for traders is relatively simple. Traditionally, it’s has been used to measure “fear” in the market. The higher the number, the more fear traders have of a downwards move in equity prices.

Why is the VIX so low right now?

Two of the many possible reasons for this sustain depression are:

- There’s a number of funds that sell options or short futures on the VIX. This strategy has been working extremely well, and has become a little crowded. Some commentators believe the prolonged depression is a side-effect of this strategy.

- It illustrates that investors have reached an extreme level of complacency towards risk. It’s been a long time since a correction. Everyone knows the market can go down, but managers aren’t paying to protect against it happening. Maybe they’re right. Buying the dip has worked for years now and shorts have been crushed time and time again.

Will volatility return? Yes. Is there a trading strategy here? Perhaps, some traders are trying to get long in front of a move. It’s a game of attrition, and for those that are long volatility it’s been an expensive game to play.