Weltrade Review 2024

|

|

Weltrade is #97 in our rankings of CFD brokers. |

| Weltrade Facts & Figures |

|---|

Weltrade is an established online broker providing tight spreads & powerful tools. |

| Awards |

|

|---|---|

| Instruments | Forex, CFDs, commodities, cryptocurrencies |

| Demo Account | Yes |

| Min. Deposit | $25 |

| Mobile Apps | Yes |

| Payments | |

| Min. Trade | 0.01 Lots |

| MetaTrader 4 | Yes |

| MetaTrader 5 | Yes |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | Yes |

| Copy Trading | No |

| Auto Trading | Yes |

| Signals Service | Yes |

| Islamic Account | No |

| Commodities |

|

| CFDs | Diversify your trading portfolio with CFDs. |

| Leverage | 1:1000 |

| FTSE Spread | N/A |

| GBPUSD Spread | 2.1 |

| Oil Spread | 7 |

| Stocks Spread | N/A |

| Forex | Weltrade provides leveraged trading in the highly-liquid FX market. |

| GBPUSD Spread | 2.1 |

| EURUSD Spread | 1.5 |

| GBPEUR Spread | 2.4 |

| Assets | 37 |

| Cryptocurrency | Trade crypto-only pairs and crypto coins against fiat currencies. |

| Coins |

|

| Spreads | Floating from zero |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |

Weltrade is a multi-award-winning forex and CFD broker with over 15 years of experience in the online trading space. Attracting both beginner and advanced investors, ZuluTrade platform integration allows clients to copy the trades of experienced investors, reducing workload. At the same time, frequent bonus offers like giveaways and demo contests keep users returning. This 2024 broker review will cover all you need to know about the Weltrade service, such as account types, minimum deposit requirements, trading apps and regulation. Continue reading to learn more!

About Weltrade

Weltrade was launched in 2006 by a global group of FinTech experts and has grown to serve over 600,000 international customers. Headquartered on the Caribbean island of Saint Vincent and the Grenadines, the broker is a subsidiary of Systemgates Ltd. It operates several office locations throughout Asia and South America.

While it is unclear whether the broker operates a non-dealing desk (NDD) execution model, a range of accounts are available, including micro-lot and copy trade variants. While Systemgates Ltd is licensed by the St Vincent and the Grenadines FSA, the broker is not authorised to offer forex and CFD trading services by the body.

Markets

Weltrade provides over 250 instruments across several markets, including forex, indices, commodities, cryptocurrencies and selected US stocks.

Forex

The broker provides a total of 36 currency pairs, spanning major, minor and exotic forex products. Floating spreads start from 0.5 pips through a Pro account.

Indices

Fourteen global spot indices are available with Weltrade. These include US offerings like the Dow Jones 30, S&P 500 and Nasdaq 100, as well as the UK FTSE 100 and EU STOXX 50.

Note that index CFDs are only available through the MetaTrader 5 (MT5) platform.

Commodities

A relatively small selection of six metals and fuels can be traded through the broker, with no soft commodities supported.

Stocks

Over 200 US equities are available for CFD trading with Weltrade, including some of the largest cap stocks in the world like Tesla, Apple and Amazon.

As with index CFDs, share positions are only supported when using the MT5 platform.

Cryptocurrencies

Just under 40 crypto tokens can be speculated on through the firm, which is a far more extensive selection than many of Weltrade’s competitors. In addition to Bitcoin (BTC) and Ethereum (ETH), many altcoins and Bitcoin-based cross pairs are available.

Clients must open a Weltrade Universe or Digital account to trade crypto CFDs.

Leverage

Access to high leverage rates can be essential to an investor’s trading strategy. However, bear in mind that leverage amplifies risk and potential rewards.

While many brokers have their maximum leverage limited by regulation, Weltrade is free from these restrictions and offers retail clients leverage of up to 1:1,000 on forex and commodities products. Maximum leverage is lower, though still relatively high, at 1:100 on stock and index CFDs.

The margin call level is 20% on all accounts other than the Weltrade Digital variant. Similarly, the broker enforces a stop-out on leveraged positions at 10% on most account types, though this is 20% for the digital variant.

Account Types

Weltrade offers six account types, each fulfilling a specific trading need.

All accounts other than the ZuluTrade copy trade account are commission-free, with no super-low spread ECN account provided by the firm. However, there is no GBP base currency option, with accounts limited to either EUR or USD.

Weltrade can provide a swap-free Islamic variant of any account upon request for traders who cannot pay interest for religious reasons.

Micro Account

The first account offered by Weltrade is the Micro variant, a cent account with micro lot position sizes. Clients need a mere £0.82 to set up a Micro account and take advantage of zero commission trading, with floating spreads from 1.5 pips.

The Micro account gives investors access to the MetaTrader 4 and 5 platforms and the forex and metals markets. The variant is made slightly complicated by the maximum equity level of £820 and the minimum leverage of 1:33 on all positions.

Universe Account

The Universe account allows customers to use the proprietary Weltrade terminal platform to access the forex, metals, energies and crypto markets. A very low £0.82 minimum deposit also applies to this account.

Floating spreads start from 0.0 pips for crypto assets and 0.5 pips for forex pairs, while leverage of between 1:1 and 1:1000 is provided.

Premium Account

A slightly higher £20 minimum deposit allows clients to open a Premium account for use with MT4 and MT5. All markets are supported other than cryptocurrency CFDs and floating spreads start from 1.5 pips. As with the Micro account, minimum leverage of 1:33 is required up to a maximum margin of 1:1,000.

Pro Account

Weltrade’s most competitive trading conditions come with the Pro account. Floating spreads start from 0.5 pips on this MetaTrader-focussed variant, with all instruments other than crypto supported.

This account requires an initial minimum deposit of £82 and is only available with a USD base currency.

Digital Account

The penultimate account type available with the broker is the Digital variant, a crypto-exclusive type with floating spreads from 0.0 pips. Margin call and stop-out levels are twice those of the other accounts at 40% and 20% respectively, while the account requires an initial minimum deposit of £41 to open.

Leverage between 1:3 and 1:100 is facilitated and speculation is supported via the MT4, MT5 and Weltrade terminal platforms.

ZuluTrade Account

The final account type is the ZuluTrade account, which allows users to copy the positions of experienced and proven traders. This is the only variant with a commission fee, charged at 1.5 pips on top of market values.

To open this account, clients must deposit £160 or more, while leverage between 1:33 and 1:500 is available.

Demo Account

Before committing to a live account login, many prospective clients like to try a new broker using a demo account. To this end, Weltrade provides a risk-free trial service for the MT4 and MT5 platforms with up to £80,000 in paper trading funds.

Trading Platforms

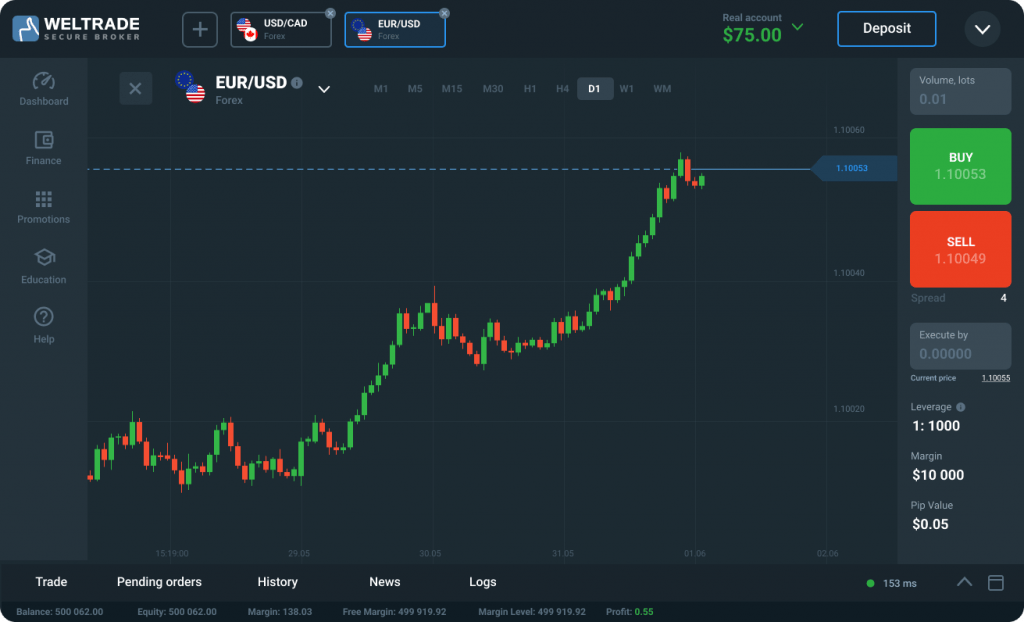

Three trading platforms are available to Weltrade customers: MetaTrader 4, MetaTrader 5 and the broker’s proprietary Weltrade terminal.

MetaTrader 4

Since its launch in 2005, MetaTrader 4 has dominated the forex and CFD trading platform sector. It remains highly popular with brokers and traders today.

As one of the first platforms to offer automation to retail clients, expert advisor robot (EA) integration is one of the system’s strongest elements, with users able to download programs from the MQL4 marketplace.

MT4 is also highly customisable, with investors able to create custom alerts, hotkeys and one-click trading shortcuts. In addition, thirty stock indicators, 31 graphical objects and nine time frames allow for solid technical analysis.

Weltrade customers can download MetaTrader 4 free on Windows, Mac and Linux or as a mobile app for Android and iOS devices. Alternatively, clients can log in to the MetaQuotes browser-based WebTrader.

MetaTrader 5

MetaTrader 5 made several significant improvements over MT4, such as support for more markets, an updated MQL5 coding language and live depth of market data.

38 stock indicators, 44 graphical objects and 21 time frames supplement upgraded backtesting to help users refine their trading strategies. Additionally, 11 order types add precision to advanced strategy executions.

MetaTrader 5 is available to download for Windows, Mac, Linux, Android app and iOS app or can be accessed via the WebTrader platform.

Weltrade Terminal

For clients using a Universe account, the Weltrade terminal provides an easy-to-use browser-based solution for trading forex, indices, commodities and crypto products.

Weltrade Platform

The platform offers over 50 drawing tools and more than 100 indicators, helping users make informed price predictions on the full range of assets. Unlike the MetaTrader platforms, investors can make deposits and withdrawals directly from the Weltrade terminal.

Unfortunately, there is no mobile app for this software package. However, mobile users can access the terminal via their web browser.

Payment Methods

While the broker supports several payment methods, UK traders will be disappointed to learn that there are no GBP deposit or withdrawal options. Instead, clients will be at the mercy of often unfavourable payment provider exchange rates.

Weltrade supports Visa, Mastercard, Skrill, Neteller, Perfect Money, Fasapay and several digital payment methods, including Bitcoin, Ethereum, Litecoin and USDT.

A £0.82 minimum deposit amount applies, though the broker does not state whether a maximum withdrawal requirement is imposed. All fiat deposits process up to instantly, while crypto network times vary. Standard processing times for withdrawals stand at 30 minutes, with payments processed 24/7.

Deposit & Withdrawal Fees

Weltrade does not levy any charges on deposits, with a 0% service fee policy on incoming payments. However, there are fees when making withdrawals, ranging from a 0.5% charge on Perfect Money and FasaPay up to a 2% fee on Neteller.

Trading Fees

Keeping trading costs down is a priority for many investors, with low-fee brokers often favoured over their competitors.

Weltrade primarily operates on a zero-commission model, other than with the ZuluTrade account, where an additional 1.4 pips mark up is added to the market spread. However, this review has discovered that Weltrade levies a £12 per month inactivity fee on accounts that stay dormant for over three months, which may put more sporadic traders off.

As with all brokers, Weltrade charges swap fees for overnight finance on a leveraged position. These rates vary from asset to asset and can be viewed via the MetaTrader or Terminal platforms.

Security & Reguation

Picking a well-regulated broker gives investors the best chance of avoiding scam companies or losing their funds if a firm collapses.

Unfortunately, Weltrade does not operate under any regulation in its EU and UK operations. While parent firm Systemgates Ltd is licensed by the SVG FSA, the regulator makes it clear on its website that it does not offer protections or licences to forex brokers.

Due to this, safety measures such as fund protection schemes are not provided to clients. However, the broker claims to segregate client funds and offers negative balance protection. Happily, Weltrade supports two-factor authentication (2FA) for enhanced login security.

Customer Support

Weltrade supplies plenty of contact options to traders, offering 24/7 support via its offices in Asia and South America. Clients can choose from a live chat feature on the brokers’ website, several email addresses and a UK support number:

- UK Phone Number: +44 020 3411 6458

- General Enquiries Email: info@weltrade.com

- Finance Enquiries Email: finance@weltrade.com

- Technical Support Email: support@weltrade.com

However, Weltrade’s website does not include an FAQ section for quick answers to common queries.

Educational Content

An increasing number of brokers offer educational content in the form of articles, videos, webinars and courses to clients looking to grow their trading skills. For example, Weltrade provides seminars to registered account holders which explain the intricacies of the financial markets, which are available to watch live or on demand.

Advantages Of Weltrade

- No deposit fees

- Lucrative promotions

- ZuluTrade copy trading

- Islamic account support

- Great range of account types

- Range of customer support options

- 2FA and negative balance protection

- Low minimum deposit requirements

Disadvantages Of Weltrade

- No free VPS

- Unregulated

- No ECN account

- No GBP funding

- Limited selection of instruments

Promotions

Brokers often use promotions, such as welcome bonus offers or commission rebates, to tempt new clients to sign up for their services and encourage high-volume trading.

Weltrade operates several bonus offers, such as its deposit insurance program that protects clients from losses for a limited period. In addition, unique schemes such as the Astrocards deposit bonus program and bonus spinner see clients earn bonuses of up to 3,333% of their deposit.

At the same time, traders that turn over more than 300 lots in 2022 will receive an iPhone 13 Pro Max. The broker also runs frequent demo contest promotions with prize pools of over £4,000, such as the Hot 100 and Hot 200 competitions.

Additional Features

Traders relish every edge they can get their hands on, and Weltrade offers clients several helpful additional features to maximise their chances of making correct market predictions.

A trading calculator helps users preview margin size, spreads and swap rates and an economic calendar allows investors to stay on top of upcoming market events.

The broker also offers a “safe box” feature, where clients can earn interest of up to 6% per year on cash balances, depending on their trading lot turnover. However, as the broker has no fund protection scheme, investors should be wary of depositing large sums to take advantage of these lucrative interest rates.

Unlike many of its competitors, Weltrade does not offer a free VPS to traders.

Trading Hours

The Weltrade trading hours mirror those of the forex market, running between 22:00 GMT on Sunday to 22:00 GMT on Friday. Indices and stocks will follow reduced trading hours based on local exchange opening times.

Clients can sign in to the Weltrade client portal or Terminal platform at any time to view their trading activity or make deposits and withdrawals.

Weltrade Verdict

While many aspects of Weltrade may appeal to investors, such as the lucrative promotions, its range of account types or no deposit fees, this review cannot fully recommend a broker with no direct regulation. Despite security measures like negative balance protection and two-factor authentication, the lack of oversight or a fund protection scheme leaves clients vulnerable to fraudulent behaviour.

FAQ

Is Weltrade A Secure Broker?

While Weltrade employs negative balance protection and 2FA to protect clients, the firm is not regulated by a local authority. However, its website is encrypted and the commercial trading platforms it offers are secure.

Does Weltrade Offer A Demo Account?

Weltrade provides a demo account for the MetaTrader 4, MetaTrader 5 and Weltrade Terminal platforms, funded with over £80,000.

Is There A Weltrade Mobile App?

There are Android and iOS apps for the MT4 and MT5 platforms but no proprietary Weltrade app. Traders should always download apps from official app stores rather than as APK files from the internet.

Can I Copy Trade On Weltrade?

Through the ZuluTrade account, investors can automatically emulate the positions of leading traders, for a small commission.

Is There A Weltrade No Deposit Bonus?

While Weltrade offers several promotions and bonus schemes, such as the bonus spinner and Astrocards deposit bonus, a no deposit bonus is not offered.

Compare Weltrade with Other Brokers

These brokers are the most similar to Weltrade:

- Admiral Markets - Admirals is an FCA- and ASIC-regulated broker with an excellent range of leveraged instruments, including forex, stocks, indices, ETFs, commodities, cryptos and more. The broker supports the MetaTrader 4, MetaTrader 5 and TradingCentral platforms. With both spread betting and CFDs available and thousands of instruments, this broker provides more flexibility than most rivals.

- FP Markets - FP Markets is an ASIC- and CySEC-regulated broker that offers forex and CFD trading on a broad range of assets through the MT4, MT5 and IRESS platforms. With trading available through standard and raw spread accounts on thousands of international stocks, forex, indices, commodities, cryptocurrencies, bonds and ETFs, this broker has some of the most comprehensive market coverage available. FP Markets also offers a full range of additional features, including educational resources and access to powerful software such as Autochartist.

- FXOpen - FXOpen is a multi-asset broker with regulation from several trustworthy bodies including the UK's FCA. The broker offers CFD trading on forex, stocks, commodities, indices, cryptocurrencies and ETFs via the MetaTrader 4 & 5 and TradingView platforms.

Weltrade Feature Comparison

| Weltrade | Admiral Markets | FP Markets | FXOpen | |

|---|---|---|---|---|

| Rating | - | 3.5 | 4 | 3.7 |

| Markets | Forex, Commodities, Crypto | Forex, Stocks, Commodities, Crypto | Forex, Stocks, Commodities, Crypto | Forex, Stocks, Commodities, Crypto |

| Minimum Deposit | $25 | $100 | $100 | £300 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | - | FCA, CySEC, ASIC, JSC | ASIC, CySEC, ESMA | FCA, CySEC, ASIC |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | No |

| Platforms | MT4, MT5 | MT4, MT5 | MT4, MT5, cTrader | MT4, MT5 |

| Leverage | 1:1000 | 1:30 (EU), 1:500 (Global) | 1:30 (UK), 1:500 (Global) | 1:30 (EU), 1:500 (Global) |

| Visit | ||||

| Review | Weltrade Review |

Admiral Markets Review |

FP Markets Review |

FXOpen Review |

Trading Instruments Comparison

| Weltrade | Admiral Markets | FP Markets | FXOpen | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | No | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | No | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | Yes | No |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | No | Yes | No |

| Futures | No | No | Yes | No |

| Options | No | No | No | No |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | No |

| Warrants | No | No | No | No |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | No | Yes | Yes | No |

Weltrade vs Other Brokers

Compare Weltrade with any other broker by selecting the other broker below.

Popular Weltrade comparisons: