Volatility Returns! Equities See Some Red On Tax & Saudi Concerns

Volatility is back!

It’s probably a little early to make that claim, after all, we’ve only seen one down day. However, today was different.

Why?

Firstly, the Nikkei dropped…hard. While the index finished -0.28% on the day, it fell sharply from the highs and continued in the futures after hours. The total fall from the peak -3.8%. The drop came on the back of a move in the Yen, which strengthened on some risk off flows. This will be a key indicator to watch overnight when reviewing pre-market action tomorrow. If we see further Yen and Gold flows, look for softer equities.

Secondly, European equities were sold. Europe followed the Asian lead, the DAX was off almost -1.5% and the Euro Stoxx50 was down almost 1%. Again, these numbers are not huge, but they are the biggest we’ve seen for a while.

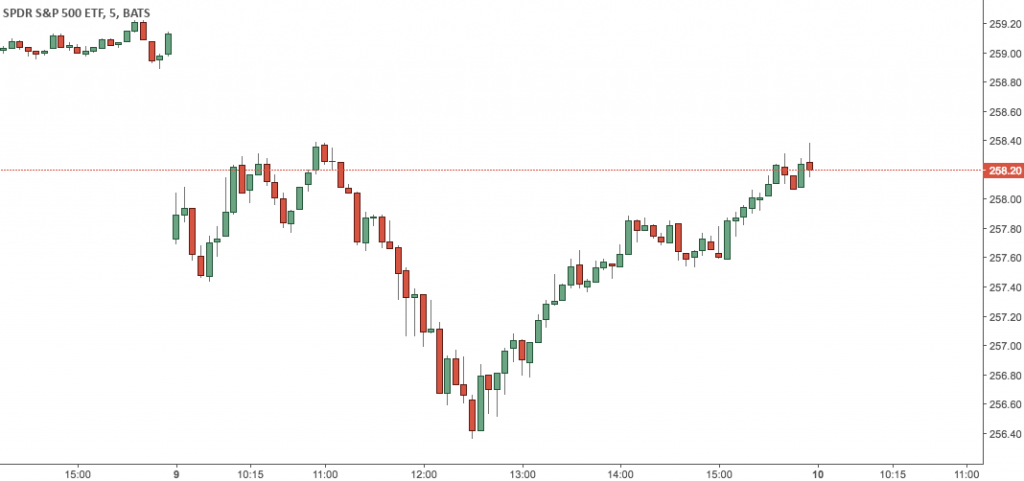

Finally, US stocks gapped down, which is as rare as hens teeth over recent months. The “failed” US tax bill saw stocks sell off, before the buyers stepped back up to push prices back towards the opening price. Still, the Dow finished -0.43%, S&P500 -0.41% and the Nasdaq -0.58%.

This is what volatility looks like.

What we saw today was a willingness for traders to sell, and for buyers to buy. There was price movement, up and down. Individual stocks moved, as the mechanism for price discovery did it’s job. The combination of earnings season, Saudi Arabia and the US tax situation all contributed to uncertainty about the future.

Tomorrow is Friday, a day that is usually pretty calm and quiet in the markets. But with this increase in volatility, it’s possible that we could see some action. Traders may be less likely to hold risk over the weekend, or perhaps we could see some profit taking after what has been an unprecedented bull market.

The encouraging part of today’s action was the buyers did step back in. If we start to see that disappear, lower prices for stocks will only be a matter of time.