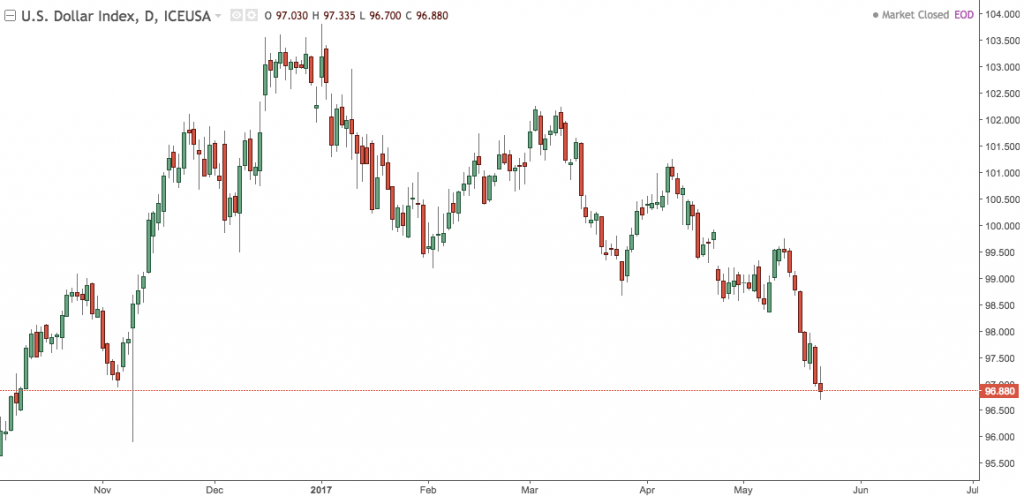

The US Dollar Moves Lower And Lower In 2017

Last week saw a significant spike in volatility across most markets. While traders welcomed the opportunity, those with US Dollar exposure have been eagerly watching one of the years largest moves unfold.

The US Dollar Index has taken a beating in 2017. The charging bull of November and December is a distant memory, and the dollar looks very soft. Peaking on the first trading day of the year, the USD has ground lower and lower as the “Trump Trade” has slowly unravelled. Both the macro fundamentals and the political expectations have shifted, and the USD has fallen back to it’s pre-election level.

What is the US Dollar Index?

The US Dollar Index tracks the USD against a basket of other currencies. Like any index, it’s comprised of a number of components, let’s take a look:

- Euro (EUR), 57.6% weight

- Japanese yen (JPY) 13.6% weight

- Pound sterling (GBP), 11.9% weight

- Canadian dollar (CAD), 9.1% weight

- Swedish krona (SEK), 4.2% weight

- Swiss franc (CHF) 3.6% weight

What do you notice about the index components? Most strikingly, the Euro makes up well over 50% of the index. There’s no mention of the AUD, NZD, any South American currencies or the Chinese Renminbi. Obviously, one could poke holes at the index for these reasons, however it’s currently the most widely used gauge of USD strength or weakness, and for this reason it’s very important.

Is the dollar weak, or are the components strong?

I’d suggest that it is a mixture of both right now. The recent strength of the Euro has definitely contributed towards the weakness in the dollar index, especially since it broke the $1.10 level as predicted last week. The other major components have contributed for their own reasons:

- The Yen is stronger on safe-haven demand, following last weeks risk-off move

- The Pound is stronger on a continual improvement of economic conditions in the UK, and the Brexit narrative

- The Canadian dollar is holding ground on a rebound of oil prices.

Where to from here?

We see the FMOC minutes and the preliminary GDP numbers this week. Traders will be watching the minutes for any signs of dovishness, which would be very weak for the dollar. If both the Fed and the GDP numbers are positive, however, we may see a short term change in the outlook as the shorts cover.

It’s also the end of the month, which usually sees institutions manage their positions aggressively.