Gemini Review 2025

With a large global presence, the Gemini exchange is one of the leading and largest cryptocurrency brokers around. It provides sleek, intuitive platforms for traders and investors of all experience levels, as well as being known for its high level of security and advanced safety features. In this 2025 broker review, we will cover what Gemini is, what it offers, what coins and tokens are available, major trading fees and more.

Gemini Headlines

Gemini is a New York-based cryptocurrency broker that provides easy-to-use services to beginner and veteran crypto traders, started by founders and brothers, Cameron and Tyler Winklevoss, in 2014. The firm strongly emphasises its security features, holding assets in its state-of-the-art storage system and being both SOC 1 Type 2 and SOC 2 Type-2 compliant.

Originally, this broker was only available to U.S.-based traders but it has since opened to both European and UK investors. UK traders can be assured that the broker is regulated by the Financial Conduct Authority’s Electronic Money Regulations 2011.

Gemini Services

Trading Platforms

Gemini offers two trading platforms, a bespoke exchange designed to be intuitive and streamlined and the more advanced ActiveTrader platform.

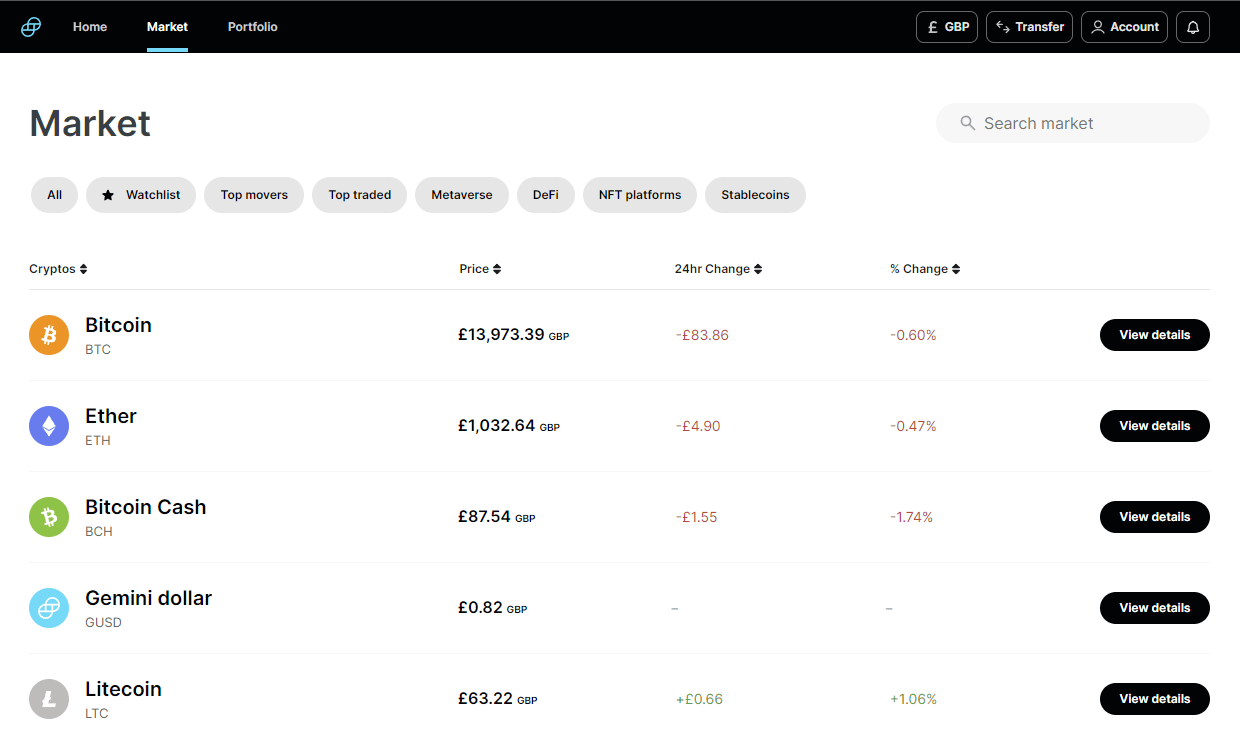

Gemini Exchange

Gemini Exchange is an intuitive investing platform, perfect for beginners on their first foray into crypto trading. The platform lets you quickly see the price of assets and their 24-hour and percentage change, as well as view their price charts. You can keep a watchlist of assets and quickly see the top-moving cryptocurrencies.

The exchange platform allows you to place recurring buy orders and set dynamic price alerts, among many other useful features. It also comes with great security features, such as 2-factor authentication (2FA) and only enabling withdrawals to approved addresses.

Gemini Exchange

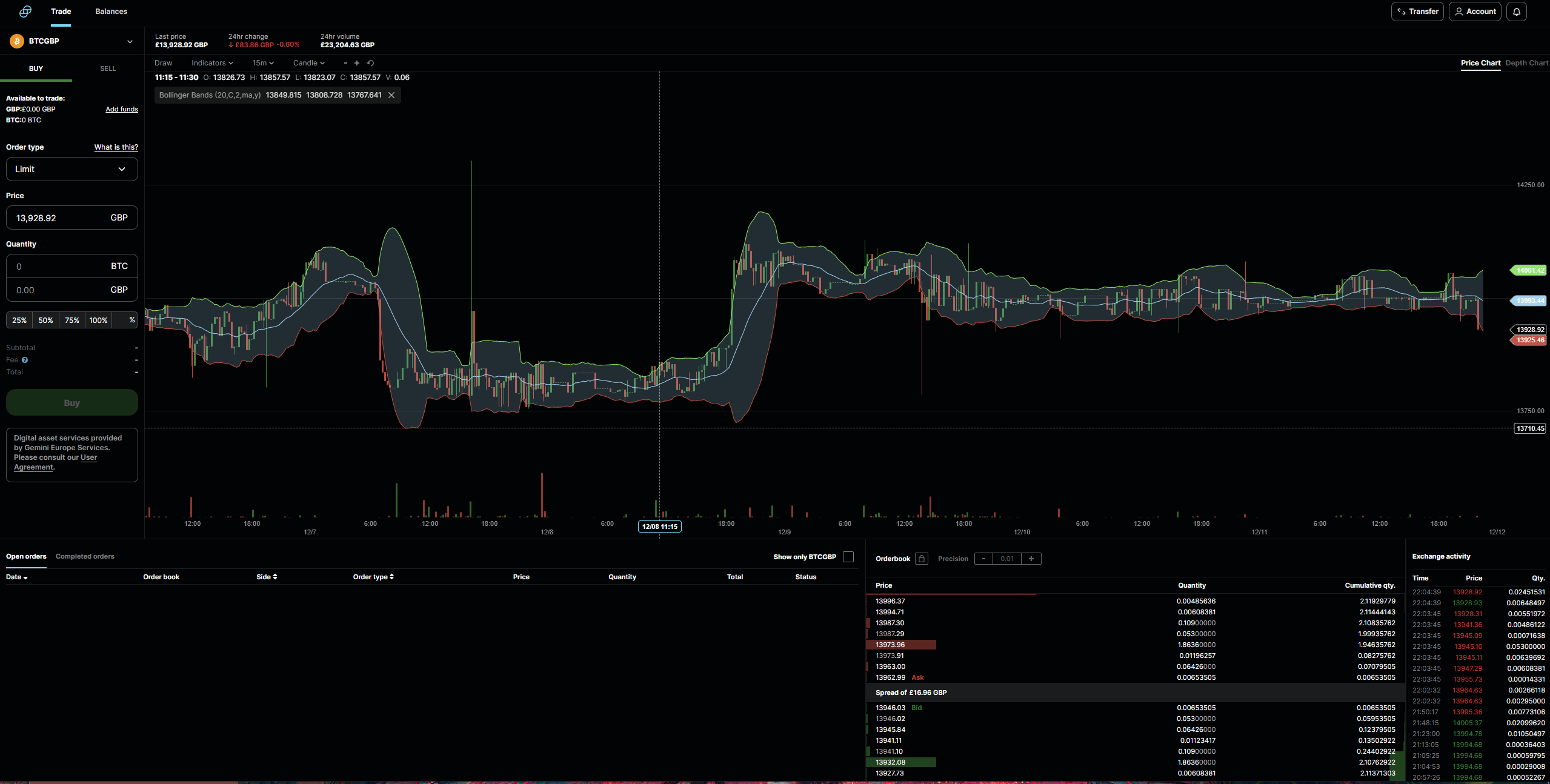

ActiveTrader

The ActiveTrader platform is a more sophisticated, high-performance platform aimed at experienced traders. This program offers advanced charting and high-speed trade executions, allowing you to implement investing strategies with precision.

ActiveTrader performs trades following a price-time priority model on central limit order books. This means that the highest bid order and the lowest offer order “touch” and form a trade on any asset. As such, this creates a real-time, anonymous and low-cost execution system, allowing for customer-to-customer (p2p) trading. This is coupled with the platform’s many available order types and execution options.

ActiveTrader is also available on most mobile browsers, allowing clients to use the Gemini platform’s charting features on the go.

ActiveTrader Platform

Gemini Wallet

The Gemini exchange has a safe and secure wallet infrastructure to store your assets. You can deposit your crypto into an insured hot wallet or a state-of-the-art cold storage system. The broker continually improves and upgrades its wallet infrastructure to ensure it can support new currencies and improve customers’ experience.

The high-security storage offered comes with a multitude of features. These include insurance against certain types of losses from the hot wallet. This is backed by world-class underwriters, helping you protect your capital. The firm also has large capital reserves as it is a licensed fiduciary and New York trust company. Moreover, it claims to have lots of internal controls in its storage and production environments.

The company also provides 24/7 customer support to ensure problems are solved quickly, including deposit and withdrawal issues.

Clearing

Gemini offers external clearing services, which allow two parties to settle trades off the order book. Gemini will act as the confirming third party in these pre-arranged transactions to make sure the settlement is timely and reduce counterparty risk. There is no minimum trade size for Gemini Clearing and a market-competitive price is offered.

The firm ensures validity on both sides of the transaction by requiring both parties to follow Gemini’s KYC onboarding and AML requirements. Cryptocurrency trades are facilitated immediately (or within an approved settlement window) if both parties are fully funded.

There are several additional services and control options available to clients with Gemini’s white glove solutions. Privacy is also something the exchange accounts for, ensuring that transactions are anonymous, with information only known by the counterparties. Furthermore, trade details are not published on the company’s market data feed.

Gemini Dollar

Gemini has its own stablecoin available for investments. The Gemini Dollar (GUSD) is a stablecoin backed by the USD. This allows clients to transact on decentralised exchanges and provide liquidity (such as with DeFi automated market makers). Each GUSD is equivalent to $1 and can be exchanged for USD online.

Transparency of GUSD is ensured by the public provision of monthly audit details from an independent accountancy firm, BPM LLP. GUSD can be bought and sold fee-free only in US dollars. Buying or selling directly with GBP incurs a foreign exchange fee.

Using GUSD is incredibly quick as the transfer occurs in seconds and the settlement is done on the Ethereum blockchain. It is also supported on dozens of DeFi applications, exchanges and protocols, including Harvest, Curve, Trust Wallet, 1inch, Ethereum and more.

Gemini Staking

Users can participate in the local blockchain ecosystem by staking their cryptocurrencies to a network to act as a block validator. Gemini node operators will then use the tokens to correctly add valid blocks to the blockchain, generating rewards. These staking rewards are then partially passed onto the staker, allowing them to gain additional credit for staking their tokens. In the case that the node operators perform invalid functions and a portion of the pledged tokens are lost, the exchange guarantees to reimburse any losses.

Institutional Products

The broker also offers several products to institutional clients, including asset managers, hedge funds, market makers, corporations, proprietary trading firms, wealth managers and family offices. These are rolled into the Gemini Prime package, which includes existing custody, clearing and OTC trading capabilities, as well as tailored financing solutions.

Which Cryptocurrency Assets Are Available?

The Gemini exchange gives UK traders access to 105 different cryptocurrencies. These include some widely popular assets, such as Bitcoin (BTC), Ethereum (ETH), Dogecoin (DOGE) and 1inch (1INCH). The firm also offers its own stablecoin, Gemini Dollar (GUSD).

However, the exchange is missing some major coins, including Cardano (ADA) and Ripple (XRP). These are two of the largest cryptocurrencies by market capitalisation, so their absence may be something to consider.

Fees & Costs

There are several types of fees that Gemini charges, depending on the service used. These include:

- Transfer Fees: The exchange will charge different fees depending on the type of deposits or withdrawals you opt for. For example, debit card deposits incur a 3.49% fee, while bank wire transfers are free. Withdrawal fees depend on the coin withdrawn.

- Withdrawal Fees: Withdrawing Ethereum-based cryptos is free (including GUSD). However, other coins will incur a charge. For example, withdrawing Bitcoin incurs a 0.0001 BTC fee and Dogecoin withdrawals incur a 4 DOGE fee. The fee varies depending on the coin.

- Convenience Fees: Gemini incurs a 0.5% “convenience fee” for those that use the web or mobile app to perform trades and investments.

- Transaction Fees: You will face a different fee structure depending on the trading platform you use. In general, the Gemini Exchange platform incurs larger fees than the Gemini ActiveTrader platform. These are detailed below.

In general, Gemini’s fee structure can be complicated and relatively costly compared to some competitors. The exchange fees are particularly pricey compared to other cryptocurrency brokers, such as Coinbase, although the ActiveTrader fees are much more comparable.

Gemini Exchange & Web Order Fees

The Gemini Exchange platform and web orders follow a tiered fee structure that has costs increase as the order amount increases.

- Orders below £7.50 – £0.75 fee

- Orders between £7.50 & £20. – £1.25 fee

- Orders between £20 & £50 – £2.00 fee

- Orders between £50 & £150 – £2.25 fee

- Orders above £150 – 1.49% fee

ActiveTrader Fees

Charges on the ActiveTrader platform follow a maker-and-taker-fee structure. The amount paid for a transaction depends on whether your cryptocurrency request is met with another’s existing request or you are making a request that will then be matched with someone else.

The prior is a taker position, while the latter is a maker trade. Maker fees are lower than taker fees as they provide more liquidity. These fees are more heavily tiered (according to notional USD), ranging from under $1,000 to over $500,000,000 trading volume in the last 30 days.

The ActiveTrader fees are given below, tiered by 30-day investing volume:

- Below £10,000 – 0.40% maker, 0.20% taker fee

- Between £10,000 and £50,000 – 0.30% maker, 0.10% taker fee

- Between £50,000 and £100,000 – 0.25% maker, 0.10% taker fee

- Between £100,000 and £1,000,000 – 0.20% maker, 0.08% taker fee

- Between £1,000,000 and £5,000,000 – 0.15% maker, 0.05% taker fee

- Between £5,000,000 and £10,000,000 – 0.10% maker, 0.03% taker fee

- Between £10,000,000 and £50,000,000 – 0.08% maker, 0.02% taker fee

- Between £50,000,000 and £100,000,000 – 0.05% maker, 0.00% taker fee

- Between £100,000,000 and £500,000,000 – 0.04% maker, 0.00% taker fee

- More than £500,000,000 – 0.03% maker, 0.00% taker fee

Leverage & Margin Trading

It is important to note that, because of regulation, Gemini cannot provide margin or leveraged trading.

Mobile Apps

Gemini Mobile is the broker’s app that allows you to invest, watch the market movement and be alert to any major movements. The app takes design cues from the Gemini Exchange platform, providing an intuitive, streamlined experience to users. It also takes advantage of advanced security features, such as 2-factor authentication and Face ID. The app is available on the Apple App Store for iOS and Google Play Store for Android devices.

Payment Methods

UK traders are more limited in terms of available deposit and withdrawal methods, compared to US clients. Those available are:

- SWIFT Wire Transfers – Unlimited deposits and withdrawals, with a minimum of £50. Fees are determined by your bank.

- Debit Card – Instantly enact a crypto trade with a debit card. Payment cards cannot be used to directly deposit capital into a Gemini account. Instead, they are used to automatically purchase cryptos. This comes with a 3.49% additional fee. Debit cards are not a supported withdrawal method.

- Bank Transfer – Bank wire transfers are supported for deposits to and withdrawals from a Gemini account. There are unlimited withdrawals supported and no minimum amount. Fees are determined by your bank.

While there are not many payment methods, payment cards and bank transfers are still supported. Setting up a bank transfer simply requires you to go to the Payment Methods page on your account hub. Here, you can choose the payment methods you would like to use and input the required details.

Demo Account

The Gemini Exchange does not offer a demo account option. However, a wealth of educational services is available to those that want to learn how to use the broker’s trading platforms. Furthermore, the minimum trade order on the live account is very small, at 0.00001 BTC (roughly £0.14 at the time of writing). This means you can practise investing with very little capital at risk.

Deals & Promotions

Gemini has frequent sign-up bonuses available, typically giving new users a set quantity of cryptocurrency when they buy or sell some within 30 days of signing up. At the time of writing, there is a deal to get £10 worth of Bitcoin if you sign-up, input the promo code lpnvmesn and spend £100 in cryptocurrency within 30 days.

Regulation & Licensing

Gemini is regulated within the UK and US. Gemini Europe is authorised by the Financial Conduct Authority in the United Kingdom under the Electronic Money Regulations 2011. It is important to note that crypto assets are not regulated in the UK. However, the exchange must have effective anti-money laundering (AML) and terrorist financing procedures in place.

Education & News

The broker provides users with lots of educational materials to help them understand what cryptocurrencies are, how to trade them, how to use Gemini’s platforms and more. There are 468 articles covering 239 topics on the company’s sister site, Cryptopedia. The firm also has a Newsroom on its website, in which it posts links to relevant recent press about the exchange and cryptocurrencies.

Customer Service

The Gemini exchange offers 24/7 customer service through its online ticket system. It also has a large, detailed support page on its website that covers many general questions that users may have. There is no email or telephone number with which to call customer support. All queries must go through the online ticket system or via its social media channels on Twitter, Facebook, Instagram and LinkedIn.

Pros Of Gemini

- Advanced security and safety features

- Access to over 100 cryptocurrencies, including many popular coins

- Trading platforms designed for both beginner traders and experienced traders

- A wealth of educational resources

- Streamlined mobile app

Cons Of Gemini

- Complicated fee structure

- High fees on the Gemini Exchange platform

- Absence of some high-profile cryptocurrencies

- Customer service limited to an online ticket system

- No demo account

How To Begin Investing With Gemini

1) Open An Account

Opening an account with Gemini is simple. On its website, click to join and enter your name and email address and create a password. You will then be required to provide a mobile phone number to set up two-factor authentication. To proceed further, you will need to provide identification, which can be a picture of your Passport, Driver’s License or National ID. Your ID will normally be verified within a couple of working days.

2) Deposit Funds

Once verification is complete, you must do is add a payment method. This can be done from the account section of the website or trading platform. Once you have transferred funds into your account via bank wire or SWIFT wire transfer, you can start purchasing cryptocurrencies. From here, you can trade against other Gemini clients or sell your tokens for a profit or loss. Alternatively, you can buy cryptos directly using a debit payment card.

Trading Hours

Crypto markets are open 24/7, 365 days a year, granting great flexibility to crypto traders. This is because it is not on one regulated exchange but rather across a decentralised network of computers. As such, crypto traders can trade cryptocurrencies at any time.

Gemini Safety & Security

Gemini places security and trust at its centre. Doing so has led them to develop a leading security program, complete the SOC 1 Type-2 and SOC 2 Type-2 exams and earn an ISO 27001 certification. The firm is also regulated by multiple financial authorities, including the Financial Conduct Authority (FCA) in the UK. Moreover, it hires third parties to perform annual penetration tests to ensure the security of its systems.

Every account requires 2FA as a default and the firm supports hardware security keys like Yubikey. Furthermore, clients can create an address allowlist to ensure capital can only be withdrawn to certain wallet addresses.

The exchange has implemented several internal controls to mitigate the risks of insider threats. This includes requiring multiple signatories to transfer crypto out of the cold storage system, storing private keys offsite at high-security data centres and rigorous background checks on employees throughout their employment.

Rightfully, Gemini is known for its high level of attention towards the security and safety of client assets.

Gemini Verdict

Gemini provides a secure, easy-to-use platform for both beginner and experienced cryptocurrency investors. The Gemini Exchange platform is great for novice traders to find their feet and get started, thanks to its intuitive design and useful tools. The more advanced ActiveTrader platform allows adept crypto enthusiasts to implement advanced investing strategies with reliability. While fees may be fairly high, the lack of withdrawal limits and robust safety and security measures that have meant the firm has never been hacked may make it more attractive to some. Furthermore, the company offers several other DeFi FinTech services that benefit both retail traders and institutional investors.

FAQ

Is The Gemini Exchange Regulated & Legit?

Gemini is regulated by several regulatory bodies and, in the UK, it is regulated by the Financial Conduct Authority (FCA) under the Electronic Money Regulations Act 2011.

Does The Gemini Exchange Offer A Demo Account?

Gemini does not offer a demo account on either of its investing platforms. However, the minimum trade amount is very low at 0.00001 BTC. Therefore, you can trade with very small quantities to practise on a live account.

Is Gemini A Trustworthy Broker?

Gemini is not only regulated by many financial watchdogs but also by a New York trust company, a fiduciary and a qualified custodian. The company’s security has been tested through the SOC 1 Type-2 and SOC 2 Type-2 exams and earned an ISO 27001 certification. Furthermore, it has many reputable partners, including Samsung and TradingView.

What Order Types Does Gemini Offer?

Gemini offers simple buy and sell orders with the option for one-time or recurring orders. The ActiveTrader platform gives clients the ability to place market orders, limit orders, stop-limits, maker-or-cancel orders, immediate-or-cancel orders and fill-or-kill orders.

Does Gemini Have A Mobile App?

Gemini boasts a bespoke mobile trading platform available on iOS and Android. It has a simple, customisable interface, with features to keep up with the latest price action of all available tokens.

Top 3 Gemini Alternatives

These brokers are the most similar to Gemini:

- Swissquote - Founded in 1996, Swissquote is a prominent Swiss bank and broker, providing online trading opportunities for an impressive portfolio of three million products, including forex, CFDs, futures, options, and bonds. Renowned for its reliability, Swissquote has earned a solid reputation through pioneering trading solutions. It was the first bank to introduce cryptocurrency trading in 2017, and has since expanded its offerings to include fractional shares and the Invest Easy service.

- IG Index - Founded in 1974, IG is a part of IG Group Holdings Plc, a publicly listed brokerage (LSE: IGG). The company provides spread betting, CFD, and forex trading, offering access to over 17,000 markets. Its platforms and investing apps are notably user-friendly. Over the past 50 years, IG has consistently been an industry leader, excelling in all essential areas for traders.

- Pepperstone - Founded in Australia in 2010, Pepperstone is a highly regarded broker specialising in forex and CFDs. Serving more than 400,000 clients globally, it provides access to over 1,300 financial instruments through popular platforms like MT4, MT5, cTrader, and TradingView. Its fee structure is both low and transparent. With regulation by reputable bodies such as the FCA, ASIC, and CySEC, Pepperstone guarantees a safe trading environment for traders at every level.

Gemini Feature Comparison

| Gemini | Swissquote | IG Index | Pepperstone | |

|---|---|---|---|---|

| Rating | 3.8 | 4 | 4.7 | 4.8 |

| Markets | Cryptos | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting |

| Minimum Deposit | $0 | $1,000 | $0 | $0 |

| Minimum Trade | 0.00001 BTC | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | No | Yes | Yes | Yes |

| Regulators | NYDFS, MAS, FCA | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB |

| Bonus | - | - | - | - |

| Education | Yes | Yes | Yes | Yes |

| Platforms | - | MT4, MT5 | MT4 | MT4, MT5, cTrader |

| Leverage | - | 1:30 | 1:30 (Retail), 1:222 (Pro) | 1:30 (Retail), 1:500 (Pro) |

| Visit | 70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. |

75.1% of retail investor accounts lose money when trading CFDs |

||

| Review | Gemini Review |

Swissquote Review |

IG Index Review |

Pepperstone Review |

Trading Instruments Comparison

| Gemini | Swissquote | IG Index | Pepperstone | |

|---|---|---|---|---|

| CFD | No | Yes | Yes | Yes |

| Forex | No | Yes | Yes | Yes |

| Stocks | No | Yes | Yes | Yes |

| Crypto | Yes | No | No | Yes |

| Commodities | No | Yes | Yes | Yes |

| Oil | No | Yes | Yes | Yes |

| Gold | No | Yes | Yes | Yes |

| Copper | No | Yes | Yes | Yes |

| Silver | No | Yes | Yes | Yes |

| Corn | No | No | No | Yes |

| Futures | No | Yes | Yes | No |

| Options | No | Yes | Yes | No |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | No | Yes | Yes |

| Volatility Index | No | Yes | Yes | Yes |

Gemini vs Other Brokers

Compare Gemini with any other broker by selecting the other broker below.

Popular Gemini comparisons:

|

|

Gemini is #34 in our rankings of crypto brokers. |

| Top 3 alternatives to Gemini |

| Pros |

|

|---|---|

| Cons |

|

| Awards |

|

| Instruments | Cryptos |

| Demo Account | No |

| Minimum Deposit | $0 |

| Minimum Trade | 0.00001 BTC |

| Regulated By | NYDFS, MAS, FCA |

| Mobile Apps | iOS & Android |

| iOS App Rating | |

| Android App Rating | |

| Payment Methods | ACH Transfer, Credit Cards, Etana, Mastercard, PayPal, Visa, Wire Transfer |

| Copy Trading | No |

| Islamic Account | No |

| Crypto Coins | , 1INCH, AAV, ADA, AMP, ATOM, BAL, BAT, BCH, BNT, BRD, BTC, COMP, CRV, CSP, DAI, DOGE, DOT, ENJ, EOS, ETH, FIL, FXC, GNT, GRT, KEEP, KNC, LINK, LOOM, LRC, LTC, LUNA, MANA, MKR, NMR, OMG, OXT, PAXG, REN, SAND, SKL, SNX, SOL, STORJ, TBTC, UMA, UNI, WBTC, WNXM, WTON, XLM, XRP, XTZ, YFI, ZEC, ZRX |

| Crypto Spreads | Transaction fee from $0.99 |

| Crypto Lending | Yes |

| Crypto Mining | No |

| Crypto Staking | Yes |

| Auto Market Maker | No |