TeraFX Review 2024

|

|

TeraFX is #97 in our rankings of CFD brokers. |

| TeraFX Facts & Figures |

|---|

TeraFX is a London-based forex and CFD broker regulated by the FCA. The broker offers NDD market execution on a small range of instruments across currencies, indices and commodities. TeraFX prides itself on its multilingual 24/5 customer service, with client security in mind. Traders can access a range of account types, suitable for novices and pros alike. |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | Forex, CFDs, indices, commodities, cryptocurrencies |

| Demo Account | Yes |

| Min. Deposit | $100 |

| Mobile Apps | Yes |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | FCA |

| MetaTrader 4 | Yes |

| MetaTrader 5 | No |

| cTrader | No |

| DMA Account | No |

| ECN Account | Yes |

| Social Trading | No |

| Copy Trading | No |

| Auto Trading | Yes |

| Islamic Account | Yes |

| Commodities |

|

| CFDs | Access a range of CFDs across commodities and indices, though with a $7 commission, this is not the most competitive rate compared to alternatives. On the positive side, the broker does offer appropriate and regulated leverage up to 1:30. |

| Leverage | 1:30 (Retail), 1:200 (Pro) |

| FTSE Spread | Floating |

| GBPUSD Spread | Floating |

| Oil Spread | Floating |

| Stocks Spread | N/A |

| Forex | Trade 60+ currency pairs on the MT4 platform with low margin requirements. Traders can access the forex market from Sunday through to Friday with 24/5 broker support. |

| GBPUSD Spread | Floating |

| EURUSD Spread | Floating |

| GBPEUR Spread | Floating |

| Assets | 59 |

TeraFX is an online no-dealing desk broker that offers a solid range of forex pairs and a mix of other popular assets. In this 2024 review, we will cover the markets TeraFX offers, the account types available, details on deposits and withdrawals, its fee structure, how to set up a profile, and much more. Our UK team also share their opinion after testing TeraFX.

We liked that TeraFX offers leveraged CFDs and spread betting on popular global markets. We were also reassured to see that the firm is regulated by the FCA. However, TeraFX could improve in several areas, including its trading fees, demo account, and educational materials.

Market Access

TeraFX UK offers a reasonable selection of asset classes: forex, indices, cryptocurrencies, and commodities. CFDs on over 60 currency pairs, nine indices, four crypto pairs and seven commodities are available.

Importantly, many of the most popular forex pairs are available, including GBP/USD, USD/CHF, EUR/JPY and AUD/CAD. More exotic pairs are also available, such as EUR/MXN and GBP/SGD.

We were also pleased to find trading opportunities on several metal and energy commodity products, including UK and US oil, silver, gold, copper and natural gas. Alternatively, investors can take positions on some of the world’s largest index products, including the FTSE 100, DAX 40, Euro Stoxx 50 and Nasdaq 100.

A selection of cryptocurrency pairs is on offer for those interested in DeFi investing and blockchain technologies, which is difficult to find from a UK derivatives broker. The token range includes Bitcoin, Ethereum and Litecoin.

Overall, TeraFX provides a solid selection of assets but nothing out of the ordinary. We found the offering is similar to other minor firms but pales in comparison to the larger product lists available at UK brokers.

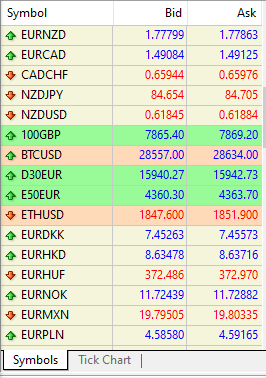

TeraFX Top Symbols

TeraFX Accounts

TeraFX offers competitive trading conditions split between five CFD accounts and two spread betting solutions.

CFD

Our experts found that UK investors can access all of the firm’s CFD account types, with a wider asset range than the spread betting profiles.

All account types have four available base currencies: GBP, USD, EUR and PLN. The GBP currency option is particularly good news for British traders, helping to keep currency conversion fees down.

Importantly, only the Pro and ECN accounts charge commission fees on trades, while all the other account types are zero-commission solutions. All the profiles offer the MetaTrader 4 platform and charge swap fees for overnight positions. We found leverage limits to vary amongst account types and assets, with up to 1:30 leverage for retail accounts and 1:500 for professional accounts.

- Starter – 82 instruments, 50% stop-out level, no commission

- Premium – 147 instruments, 50% stop-out level, no commission

- ECN – 82 instruments, 50% stop-out level, £1.50 – £150 commission per lot

- Professional (Starter or Premium) – All instruments, 20% stop-out level

Spread Betting

Spread betting accounts are only available to UK clients, offering tax-free trading. It is worth keeping in mind that these accounts do not let you buy assets; you simply bet on the direction of price movement.

There are three different spread betting accounts. We were pleased to see that all account types have GBP as their base currency and offer the MetaTrader 5 platform with access to 29 instruments.

These accounts have a minimum bet of £0.50 and a maximum of £50, making the firm a good pick for those on a budget. They also allow for the use of expert advisors in the trading platform.

- Retail – £5.50 commission per lot, up to 1:30 leverage, 50% stop-out level

- Pro – £4.00 commission per lot, up to 1:100 leverage, 20% stop-out level

Setting Up A TeraFX Account

We found it relatively easy to open a TeraFX account:

- Click the Open Live Account button at the top of the broker’s website

- Input your first name, last name, email address and mobile phone number into the Apply Now form. You will also need to accept the terms and privacy policy and confirm that you are over 18 years of age

- Fill out your personal details in the KYC form that appears (nationality, city of birth, passport number, etc.)

- Provide your financial details and disclose any personal trading experience

- Demonstrate proof of identity by uploading a picture of your ID (e.g. passport or driver’s license)

- You will now have an active live account. From here, you can deposit money into your account and begin investing

Payment Methods

TeraFX scores well for its selection of funding options, with fee-free and fast payment methods for UK traders.

Deposits

TeraFX offers the following deposit methods:

- Bank Transfer – GBP, USD, EUR, PLN, minimum deposit of £100, no maximum deposit, 1-5 business days transaction time, no transfer fees

- Debit/Credit Card (Visa/MasterCard/Maestro) – GBP, USD, EUR, PLN, minimum deposit of £100, no maximum deposit, instant transaction time, no transfer fees

- E-Wallet (Skrill, Neteller, Sofort, Union Pay) – GBP, USD, EUR, PLN, minimum deposit of £10, daily maximum deposit of £5,000, instant transaction time, no transfer fees

Withdrawals

TeraFX supports the following withdrawal methods:

- Bank Transfer – GBP, USD, EUR, PLN, min withdrawal of £100, no maximum withdrawal, 1-5 business days transaction time, no transfer fees

- Debit/Credit Card (Visa/MasterCard/Maestro) – GBP, USD, EUR, PLN, min withdrawal of £100, no maximum withdrawal, 2-5 business days transaction time (or more, no transfer fees

- E-Wallet (Skrill, Neteller, Sofort, Union Pay) – GBP, USD, EUR, min withdrawal of £10, daily maximum withdrawal of £10,000, 1-3 business days transaction time, no transfer fees

On the downside, our team was disappointed to see that a £20 withdrawal fee is charged if no positions were made on an account and the full deposit is being withdrawn.

Trading Fees

We think TeraFX’s investing fees are very high, far overshooting most UK retail and professional CFD brokers. Starter Accounts can expect average spreads of 3.3 pips for EUR/GBP and 2.7 pips for GBP/USD, which is at least 2.0 pips more than the industry average. Premium Accounts demonstrate a fairly substantial improvement, bring EUR/GBP spreads to 1.5 pips and GBP/USD spreads to 1.3 pips.

Professional Starter Accounts sit somewhere in between, at 2.5 pips for EUR/GBP and 2.1 pips for GBP/USD, while Professioinal Premium Accounts match the retail Premium Account average spreads.

ECN accounts swap spreads out for commissions, allowing for far more predictable costs to trading and raw market spreads. Commissions on these accounts vary with the asset in question, though most forex products are priced around £5.50 per round turn per lot. TeraFX spread betting accounts also follow a commission model, with retail accounts levying £5.50 per round turn per lot and professional accounts charging £4.

Leverage

Leverage rates at TeraFX are in line with FCA regulations. This means that the firm is comparable to all other FCA and ESMA-regulated brokerages, though offshore firms will often offer at least ten times more margin. Retail CFD and spread betting accounts can access leverage rates of up to 1:30 on major forex products, though this drops for exotic instruments and other markets. Professional CFD accounts have their limits bumped to 1:500, while professional spread betting accounts can only access a maximum of 1:100.

Trading Platforms

TeraFX offers a suite of reliable trading platforms through the MetaTrader software. This is good news for users looking for stable and secure trading platforms.

Importantly, TeraFX offers a different trading platform depending on your account type. For the CFD account types, you will be able to trade on MetaTrader 4. For the spread betting accounts, you can access MetaTrader 5 platform. These are some of the most popular online trading platforms available, offering a wide range of useful tools, customisability and features.

We rate that both MetaTrader 4 and 5 come with lots of in-built features, including 30/38 technical indicators, 31/44 graphical objects, 9/21 timeframes, and 4/6 pending order types. However, MetaTrader 5 comes with additional features like an economic calendar, depth of market data and netting capabilities, making it our favourite.

Traders looking to deploy automated strategies will be pleased to see that both platforms offer Expert Advisors. These are automated trading bots that can be customised and implemented. When we used TeraFX, we found that the firm facilitates this EA functionality, meaning you can make use of any expert advisors you have programmed previously or acquired from the market.

Both MetaTrader 4 and 5 have mobile applications available on iOS and Android devices. These apps allow traders to monitor markets, open and close orders.

You can download the MetaTrader 4 and 5 desktop and mobile platforms directly from the TeraFX website.

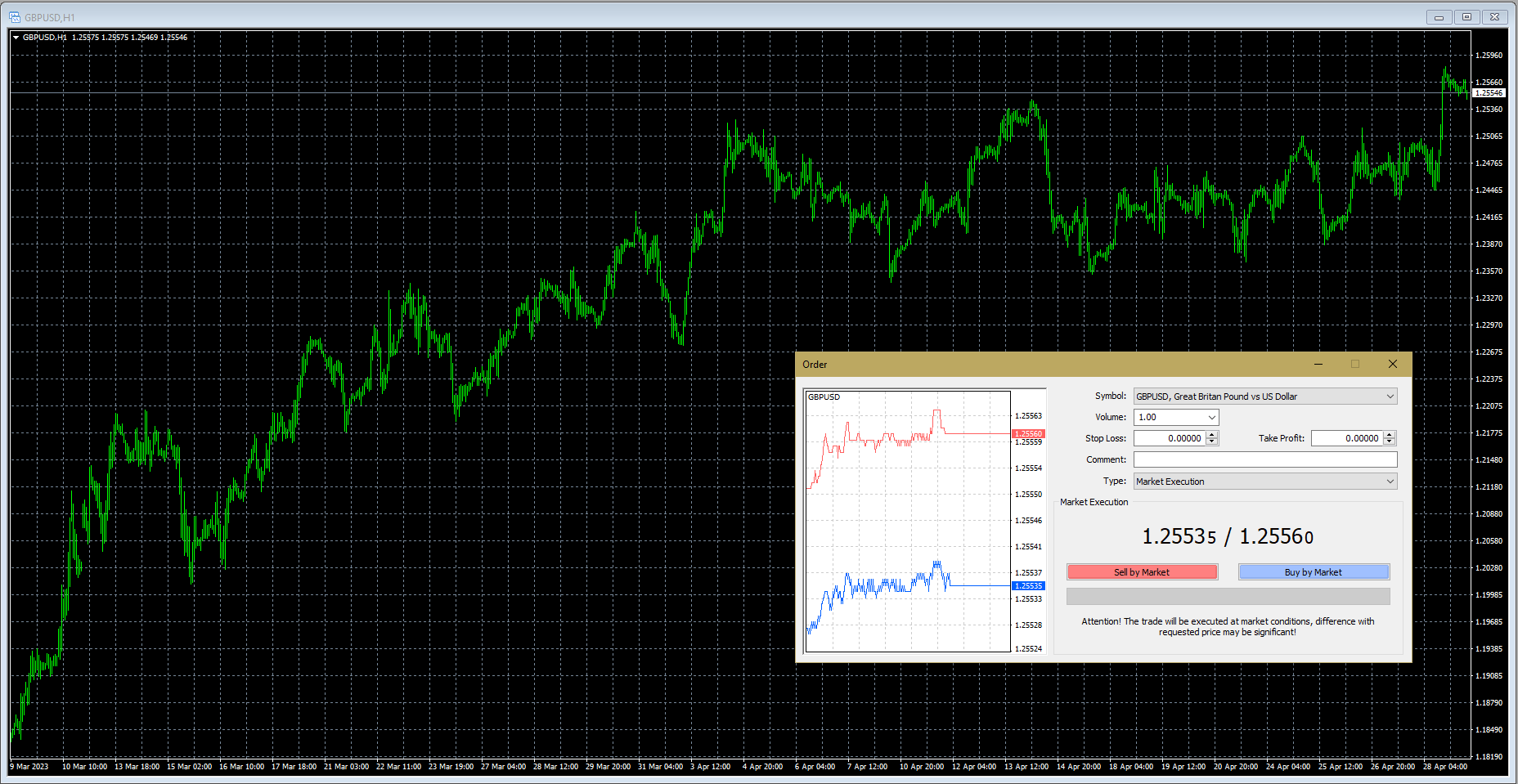

How To Place An Order

- Download the TeraFX MetaTrader 4/5 program

- Install and login to your trading account on the platform

- Click the New Order button on the hot bar at the top

- In the Order menu, choose the asset you want to trade and fill in the order details (volume, stop loss, take profit, execution type, etc.)

- Press the Sell by Market or Buy by Market button to execute a market position

MetaTrader 4 Order Placement Window

Demo Account

We found TeraFX’s demo account offering to be quite disappointing. While there is a free paper trading account that clients can access, it is fairly limited.

There is an account limit of £10,000 and it can only be opened for 30 days, which is disappointing, especially given the importance of continual improvement and strategy development.

UK Regulation

Our team was pleased to see that TeraFX is regulated by the UK’s Financial Conduct Authority, one of the strictest financial regulators.

This means that the broker must follow a range of procedures to ensure the safety of clients and their funds. These include the separation of funds and negative balance protection. Furthermore, clients are entitled to the Financial Services Compensation Scheme for compensation up to £85,000 if the broker fails its financial commitments.

Tera Europe Limited is regulated by the FCA with reference number 564741.

Additional Features

We were somewhat disappointed by TeraFX’s very average level of additional service to clients. The firm provides a free economic calendar on its website but it is not particularly extensive and we did not find it easy to use. Moreover, while the website suggests that there are recorded and upcoming webinars to provide some investing education, these links do not lead anywhere. Other FCA-regulated firms provide a much more substantial and effective range of extra features, services and products.

Customer Support

TeraFX UK offers pretty standard support, with several customer service contact avenues. The website’s support page gives access to a live chatbot, a phone number to call, the firm’s head office address, its DIFC branch office address, an email address and an online callback form. For the fastest response times, we recommend using the live chat service.

- Phone Number: +44 (0) 203 048 4764

- Email Address: customerservices@terafx.co.uk

Company Background

We were reassured to see that TeraFX UK is an online, FCA-regulated CFD broker that is owned and operated by Tera Europe Limited and based in London, UK.

The broker offers a no-dealing desk (NDD) straight-through processing (STP) execution model to enable tight spreads and fast trade execution, as well as an ECN account to further tighten spreads.

TeraFX also provides UK investors with tax-free speculation through its spread betting accounts.

Bonuses & Promotions

Being regulated by the FCA, TeraFX does not offer any financial incentives, bonus deals or promotions to reward new and existing clients for their patronage. As such, we think the firm falls far short of many major brokerage firms that are regulated elsewhere and offer substantial bonuses.

Trading Hours

- Cryptocurrency: Sunday 22:10 GMT to Friday 21:20 GMT. There is a 5-minute break every day from 21:59 – 22:05 GMT

- Forex: Sunday 22:10 GMT to Friday 21:50 GMT. There is a 5-minute break every day from 21:59 – 22:05 GMT

- Metals: Sunday 23:10 GMT to Friday 21:50 GMT. There is a 1-hour break every day from 21:59-23:00 GMT

- Commodities: 24/5

- Indices: 24/5

Should You Trade With TeraFX?

TeraFX is a UK-based, FCA-regulated online broker that offers CFDs and spread betting with low spreads, fast execution and access to powerful platforms. It has an okay selection of tradable assets, more so for those looking towards forex, though there is a notable lack of educational material, financial analysis provision and demo account.

FAQ

Is TeraFX A Scam?

TeraFX is a British brokerage regulated by the FCA. This is one of the most trusted financial regulatory bodies in the world, reassuring us that TeraFX is legitimate.

Is TeraFX A Good Broker To Open A Retail Account With?

While TeraFX has a range of account types suited to both CFD and spread betting investors, the company’s fee structure and lack of additional features holds it back against many of its competitors.

Does TeraFX Offer Competitive Leverage Rates?

The amount of leverage you will have access to depends on the account type you have. The retail trading accounts can have up to 1:30 leverage, while professional accounts can access up to 1:500. This is in line with most UK authorised firms.

What Trading Platforms Does TeraFX Offer?

TeraFX offers the MetaTrader 4 and 5 trading platforms. MT4 is available to those with any of the CFD trading accounts, while MT5 is only available to those with a spread betting account. Fortunately, both platforms are stable, reliable and well-regarded among active traders.

Does TeraFX Offer Any Good Bonus Deals?

TeraFX does not offer any bonuses to traders signing up for an account. There are also no reward schemes or competitions to gain additional capital. Whilst this may be disappointing, it is also fairly common among UK-regulated brokers.

Does TeraFX Have An App?

TeraFX does not have its own bespoke mobile app. However, the MetaTrader 4 and 5 platforms both have mobile applications available for iOS and Android devices. These applications allow you to monitor assets, place and close orders, and so more. They are also available for free download from the respective app store.

Article Sources

Tera Europe Limited FCA Register

Compare TeraFX with Other Brokers

These brokers are the most similar to TeraFX:

- Swissquote - Swissquote is a Switzerland-based bank and broker that offers online trading and investing. The company has a high safety score and is listed on the Swiss stock exchange. The firm offers a huge range of products, from stocks, ETFs, bonds and futures to 400+ forex and CFD assets. Hundreds of thousands of traders have opened an account with the multi-regulated brokerage. Clients can get started in three easy steps while 24/7 customer support is available to assist new users.

- Admiral Markets - Admirals is an FCA- and ASIC-regulated broker with an excellent range of leveraged instruments, including forex, stocks, indices, ETFs, commodities, cryptos and more. The broker supports the MetaTrader 4, MetaTrader 5 and TradingCentral platforms. With both spread betting and CFDs available and thousands of instruments, this broker provides more flexibility than most rivals.

- FP Markets - FP Markets is an ASIC- and CySEC-regulated broker that offers forex and CFD trading on a broad range of assets through the MT4, MT5 and IRESS platforms. With trading available through standard and raw spread accounts on thousands of international stocks, forex, indices, commodities, cryptocurrencies, bonds and ETFs, this broker has some of the most comprehensive market coverage available. FP Markets also offers a full range of additional features, including educational resources and access to powerful software such as Autochartist.

TeraFX Feature Comparison

| TeraFX | Swissquote | Admiral Markets | FP Markets | |

|---|---|---|---|---|

| Rating | 2.6 | 4 | 3.5 | 4 |

| Markets | Forex, Commodities | Forex, Stocks, Commodities | Forex, Stocks, Commodities, Crypto | Forex, Stocks, Commodities, Crypto |

| Minimum Deposit | $100 | $1000 | $100 | $100 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | FCA | FCA, FINMA, DFSA, SFC | FCA, CySEC, ASIC, JSC | ASIC, CySEC, ESMA |

| Bonus | - | - | - | - |

| Education | No | No | Yes | Yes |

| Platforms | MT4 | MT4, MT5 | MT4, MT5 | MT4, MT5, cTrader |

| Leverage | 1:30 (Retail), 1:200 (Pro) | 1:30 | 1:30 (EU), 1:500 (Global) | 1:30 (UK), 1:500 (Global) |

| Visit | ||||

| Review | TeraFX Review |

Swissquote Review |

Admiral Markets Review |

FP Markets Review |

Trading Instruments Comparison

| TeraFX | Swissquote | Admiral Markets | FP Markets | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | No | Yes | Yes | Yes |

| Crypto | No | No | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | Yes | No | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | No | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | No | No | Yes |

| Futures | No | Yes | No | Yes |

| Options | No | Yes | No | No |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | Yes |

| Warrants | No | No | No | No |

| Spreadbetting | No | No | Yes | No |

| Volatility Index | No | No | Yes | Yes |

TeraFX vs Other Brokers

Compare TeraFX with any other broker by selecting the other broker below.

Popular TeraFX comparisons: