FP Markets Review 2024

|

|

FP Markets is #65 in our rankings of CFD brokers. |

| FP Markets Facts & Figures |

|---|

FP Markets is an ASIC- and CySEC-regulated broker that offers forex and CFD trading on a broad range of assets through the MT4, MT5 and IRESS platforms. With trading available through standard and raw spread accounts on thousands of international stocks, forex, indices, commodities, cryptocurrencies, bonds and ETFs, this broker has some of the most comprehensive market coverage available. FP Markets also offers a full range of additional features, including educational resources and access to powerful software such as Autochartist. |

| Pros |

|

|---|---|

| Cons |

|

| Awards |

|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Bonds, ETFs, Crypto |

| Demo Account | Yes |

| Min. Deposit | $100 |

| Mobile Apps | iOS & Android |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | ASIC, CySEC, ESMA |

| MetaTrader 4 | Yes |

| MetaTrader 5 | Yes |

| cTrader | Yes |

| DMA Account | Yes |

| ECN Account | Yes |

| Social Trading | Yes |

| Copy Trading | Yes |

| Auto Trading | Expert Advisors (EAs) on MetaTrader |

| Islamic Account | Yes |

| Commodities |

|

| CFDs | FP Markets' CFD trading covers a range of markets, including 10,000+ equities, indices, commodities, cryptocurrencies and ETFs. Spreads are tight and traders get fast execution speeds. |

| Leverage | 1:30 (UK), 1:500 (Global) |

| FTSE Spread | 1.64 |

| GBPUSD Spread | 1.9 average |

| Oil Spread | 0.04 |

| Stocks Spread | Variable |

| Forex | FP Markets is a good option for forex traders, with 70+ pairs covering an excellent range of currencies. Spreads are already tight on standard accounts and start from zero on raw spread accounts, and the broker offers high leverage up to 1:500 and top-tier liquidity. |

| GBPUSD Spread | 1.9 |

| EURUSD Spread | 1.1 |

| GBPEUR Spread | 1.7 |

| Assets | 60+ |

| Currency Indices |

|

| Stocks | Speculate on price movements of 10,000+ international stocks using CFDs. An excellent range of global markets is covered, including exchanges from London, Hong Kong, Paris, Frankfurt, Madrid, Amsterdam and New York. However, the broker does not support physical stock trading. |

| Cryptocurrency | Take positions on popular cryptocurrencies, including Bitcoin, Ethereum, Ripple, Bitcoin Cash, and Litecoin with leveraged CFDs. However, you cannot directly buy and own crypto tokens. |

| Coins |

|

| Spreads | Floating |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |

FP Markets is a forex and CFD broker offering direct market pricing with spreads from 0 pips. UK investors can invest in 10,000+ instruments on powerful platforms; MT4, MT5, and Iress. This FP Markets review will cover available leverage, minimum deposit requirements, spreads and fees, withdrawal times, plus login security. We also explain how the registration process works and unpack client portal features.

FP Markets is an award-winning broker with a wide range of trading instruments and an excellent selection of tools, including MT4, MT5, Autochartist, Trading Central, and Myfxbook Autotrade

Company History & Overview

FP Markets is a global brokerage, established in 2005 in Sydney, Australia. The brand has been recognised with 40+ industry awards.

Although it is not regulated by the FCA, UK traders can be reassured of licensing from the European Securities and Markets Authority (ESMA) and the Cyprus Securities and Exchange Commission (CySEC). The broker also operates a ‘zero restrictions’ rule, meaning it gives investors the flexibility to trade exactly how they want to.

FP Markets offers 24/5 trading on a range of asset classes including forex, indices, commodities, cryptocurrencies, and bonds. UK traders also benefit from low latency execution with fast trade speeds and deep liquidity from a pool of tier-one institutions.

Markets

FP Markets offers 10,000+ instruments across seven asset classes. This is significantly more than most alternatives.

- 16 global indices such as the FTSE 100, GER 40 and CAC 40

- 2 corporate and government bonds including UK Long Gilt

- 60+ currency pairs including GBP/USD, EUR/GBP, and GBP/AUD

- 12 cryptocurrency CFDs including Bitcoin, Ethereum, Litecoin, and Ripple

- 20+ soft and hard commodities including Natural Gas, Corn, and livestock

- 10,000+ international stock CFDs including Aviva, Barclays, BT Group, Lloyds, and Rightmove

- 290 ETF products including SPDR Gold Shares ETF, iShares Global Clean Energy ETF, and Vanguard FTSE Developed Mkts ETF

Note, access to instruments varies between trading platforms.

Fees & Commissions

Trading fees vary between FP Markets account types. The Raw Account offers direct market pricing with spreads from 0 pips, plus a £2.25 commission fee per side. The Standard Account follows a commission-free pricing model with floating spreads from 1 pip. For example, our traders were offered the GBP/USD at 1.9 pips on the Standard Account vs 0.8 pips on the Raw Account. Gold was offered at 0.18 pips vs 0.08 pips on the Raw Account.

FP Markets will disable dormant accounts after three months. However, unlike other brokers such as IG (£12 per month), there is no inactivity fee and profiles can be reactivated at any time.

The broker does not charge any fees to make a deposit. Swap rates apply for positions held overnight.

Trading Platforms

FP Markets offers UK investors the choice of three trading platform options; MetaTrader 4, MetaTrader 5, and Iress. The terminals offer various advanced functions and customisation capabilities.

All platforms can be downloaded to desktop devices or used as web traders.

Iress Viewpoint

Iress ViewPoint is FP Markets’ active investor platform. It offers sophisticated functionalities including analytics, module linking, and multiple portfolio management. The transparent DMA pricing feature shows queued orders pending execution.

- Live news stream

- Market depth feature

- Real-time price quotes

- Fully customisable interface

- Historical market data analysis

- Multi-asset price action comparison

- 50+ drawing tools and charting capabilities

- 59 in-built technical indicators such as RSI and Ichimoku clouds

How To Place An Order

- Log in to the client portal and open the Iress ViewPoint platform

- Select ‘Buy’ or ‘Sell’ from the top right of the platform interface to open the order window

- Choose the account from the dropdown menu (only applicable for users with multiple profiles)

- Toggle between ‘Volume’ or ‘Value’ in the order window and add the amount

- Select the order type from the next dropdown menu

- Choose the order lifetime – GTC or EOD

- Select ‘Place Order’

- Press ‘Ok’ in the order confirmation pop-out once reviewed

The adjacent window to the right is an order summary. It auto-populates as information is entered into the order window.

MetaTrader 4

MetaTrader 4 is the most popular trading software among retail investors. It is a top choice for traders of all experience levels given the range of features and user-friendly interface.

- Custom alerts

- MarketWatch

- One-click trading

- Nine timeframes

- 24 analytical objects

- Access to Expert Advisors (EAs) with MQL4 programming

- 60+ pre-installed technical indicators such as MA and Bollinger Bands

FP Markets also hosts an MT4 Traders Toolbox with 12 custom tools to enhance users’ experience on the platform. The tools can be downloaded from the client dashboard and integrated directly into the platform. All features are simple to use and provide additional trade ideation and execution support. Functionality includes a market sentiment tool, tick charts, and a correlation matrix.

MetaTrader 5

MetaTrader 5 allows for more advanced trading of non-forex assets. It provides all the necessary tools for technical analysis, therefore it doesn’t need to be used as an additional platform to MT4.

- Strategy tester

- Scalping allowed

- One-click trading

- 21 timeframes

- Advanced Market Depth

- View up to 100 charts at a time

- 80+ in-built technical indicators and 44 analytical objects

- Live news streams and an integrated economic calendar

- MQL5 programming language allows users to create custom robots

MetaTrader 5

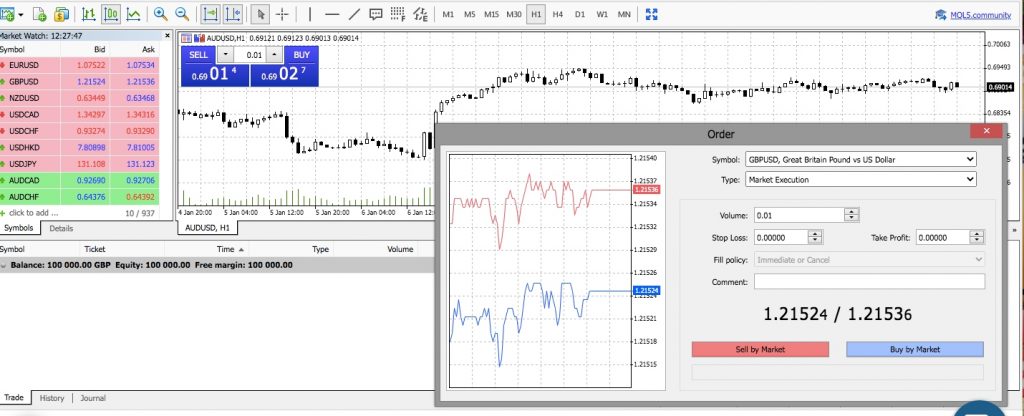

How To Place A Trade

To process of placing a trade is relatively similar between MT4 and MT5.

The easiest way to open a new order is to double-click on the instrument from the Market Match window. From here, the New Order page will pop out. Complete the relevant trade details including volume, risk management, and ‘buy’ or ‘sell’.

Mobile App

FP Markets offers a proprietary mobile app available to download on iOS and Android (APK) devices.

The FP Markets Trading App is simple to use, with full account management tools, a custom favourites menu, and in-app support. Traders can monitor, review and open investments with a range of technical indicators and analysis charts.

Both MT4 and MT5 are also available as mobile applications. Similar to the FP Markets Trading App, investors can make use of all functions and features, though it has more of a dated interface vs the broker’s proprietary app. Nonetheless, clients can use interactive charts, view full trading history and manage portfolios. Additionally, price alerts and notifications can be enabled.

Payment Methods

Deposits

Depositing to a live FP Markets trading account is relatively quick and easy.

The broker has a minimum deposit requirement of £100 for both account types. This is lower vs Pepperstone (£500 recommended) and IC Markets (£200).

FP Markets accepts several payment methods for GBP deposits which we outline below. There are no commission fees, but banking charges may apply. Any third-party bank charges on deposits over £10,000 will be compensated by the broker.

- Skrill – Instant funding

- SticPay – Instant funding

- Neteller – Instant funding

- Rapid Transfer – Instant funding

- Apple Pay And Google Pay – Instant funding

- Visa & MasterCard Credit/Debit Card – Instant funding

- Bank Wire Transfer – Up to one working day processing time

- LetKnowPay (cryptocurrency solution) – Average one-hour processing time, blockchain dependant

- Finrax Payments (cryptocurrency solution) – Average one-hour processing time, blockchain dependant

Unfortunately, FP Markets does not accept PayPal.

Withdrawals

FP Markets offers the same payment methods for withdrawals except for Apple Pay and Google Pay.

Initial withdrawals must be made via the same method used to deposit. Once the total deposit value has been withdrawn, you can use alternative methods to withdraw the remaining funds.

Although FP Markets does not charge any withdrawal fees, third-party costs apply. Allow up to one working day to receive profits.

- Skrill- 1% fee

- Neteller – 1% fee

- Rapid Transfer- 1% fee

- Bank Wire Transfer – No fees

- Visa & MasterCard Credit/Debit Card – No fees

- LetKnowPay (cryptocurrency solution) – Blockchain fees apply

- Finrax Payments (cryptocurrency solution) – Blockchain fees apply

- SticPay – 5% fee for bank wire transfers or 2.5% for wallet withdrawals

How To Make A Withdrawal

- Log in to the client dashboard

- Click ‘Funding’ from the menu on the left and then select ‘Withdraw’

- Choose the relevant withdrawal method from the dropdown menu

- Enter the payment details in the pop-out window (UK investors will need to click the ‘Overseas’ option from the country dropdown)

- Click ‘Submit’

The broker reviews all withdrawal requests within 24 hours. An email confirmation will be sent once the funds have been reviewed and verified.

Demo Account

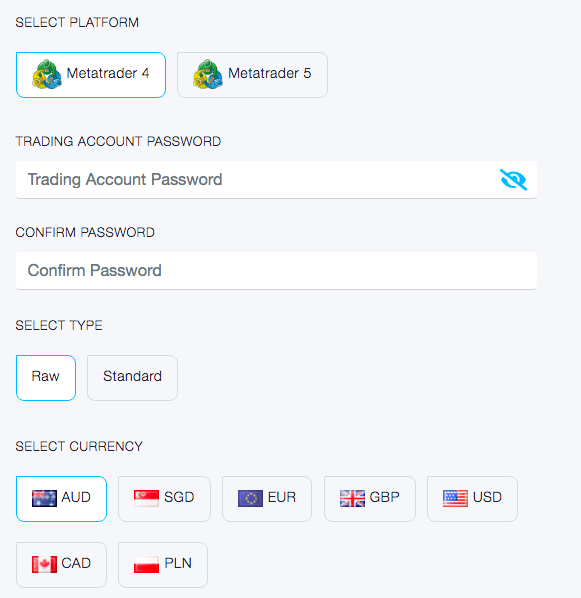

FP Markets offers a risk-free demo account on the MT4 and MT5 terminals, similar vs IG, XTB, XM, and Plus500.

When registering, you can choose a pricing model based on the different account types (Raw or Standard) and select a trading currency (including GBP).

Functionality between the practice profile and live account is the same, however, orders placed in demo mode are not executed in the live market and therefore may be executed much quicker.

Our experts were pleased that there are no time constraints on the practice account, however, if the FP Markets account is not accessed for more than 30 days it will expire.

How To Open A Demo Account

- Hover over the ‘Platforms’ icon in the top menu on the broker’s webpage

- Click on ‘MetaTrader 4’ or ‘MetaTrader 5’

- On the platform page scroll down to ‘Request A Demo’

- Complete the registration form including base currency and account type

- Select ‘Save and Next’

- Download MT4 or MT5 or open the WebTrader

- Log in to the platform

- Start trading in demo mode

Bonuses

Due to ESMA regulations, FP Markets does not offer bonus rewards to UK customers. As a result, British traders will not be able to use a deposit bonus, no deposit bonus, or any other welcome incentive.

While this is a shame, this is common practice among brokers regulated by a financial body in the UK and Europe. Instead, check out the broker’s analysis tools to give yourself a competitive edge.

UK Regulation

For investors based in Europe, the broker’s services are overseen and regulated by the Cyprus Securities and Exchange Commission (CySEC), license number 371/18. This is a well-respected financial authorization with strict requirements for firms to adhere to, similar to the UK’s Financial Conduct Authority (FCA). This includes the segregation of client funds, negative balance protection, and internal procedures for risk management.

External financial audits are completed regularly and all retail investors can access personal account statements. This is helpful to assist with local tax regulations. The broker accesses the best pricing from top-tier financial institutions to ensure the highest levels of interbank liquidity.

Account Types

FP Markets offers two live accounts; Standard and Raw.

Both offer ECN pricing from tier-one liquidity providers, a minimum trade size of 0.01 lots, lightning-fast order processing, and VPS availability. The main difference between the Standard account and the Raw account is the spreads and commission fees.

A swap-free Islamic account is also available upon request.

Standard Account

- Commission-free

- Spreads from 1 pip

- £100 minimum deposit

Raw Account

- Spreads from 0 pips

- £100 minimum deposit

- £2.25 commission per side

How To Open A Live Account

- Click on the ‘Visit’ link at the top or bottom of this FP Markets review

- Complete the online registration form

- Upload identity verification documents

- Log in to the client area

- Deposit funds and start trading

Note, UK investors must comply with know-your-customer and anti-money laundering requirements. This includes providing account verification documentation, such as a passport and proof of residency.

Leverage

UK traders can access leverage up to 1:30. This is designed to protect retail investors against significant losses.

Leverage limits:

- Major Forex Pairs – 1:30

- Minor And Exotic Forex Pairs – 1:20

- Indices – 1:20

- Commodities – 1:10

- Shares – 1:5

- Cryptocurrency – 1:2

A useful margin calculator is available on the FP Markets website.

Additional Tools

While using FP Markets, our experts were pleased with the range of useful trading tools available:

VPS

FP Markets has a partnership with Liquidity Connect, providing Virtual Private Server hosting to retail traders. The VPS plan offers an ultra-low-latency solution helping to minimise slippage.

The service can be integrated with the MetaTrader 4 and MetaTrader 5 platforms to run algorithmic strategies, including EAs, with no downtime.

A minimum deposit of £1000 is required to get started.

Autochartist

Autochartist is a third-party charting program that can be used to identify trading opportunities. It monitors the financial markets 24 hours a day, providing opportunity and risk alerts in real-time. The program can highlight 1000+ trade opportunities per month.

The plug-in can be installed on the MT4/MT5 platforms with alerts available via email, SMS, or within the client area.

Trading Central

FP Markets customers can also access Trading Central, a one-stop solution for investment research.

The program hosts a suite of analytical tools, including an in-depth Economic Calendar, Market Buzz, and Crowd Insight. Trading Central filters through thousands of data sources allowing investors to view information based on personal preferences and trading goals. This information can be used to identify profitable entry and exit points, create trade scenarios, and confirm a strategy using indicators.

Once you have created a live trading account with FP Markets, you can access the Trading Central software directly through the client portal.

Copy Trading

The FP Markets Copy Trading tool allows investors to follow and copy successful traders via the MT4 and MT5 terminals. It is ideal for beginners, stripping away the complexities involved in finding a suitable opportunity or delving into a new instrument with limited market knowledge.

Another major benefit is that you can stay in control with the click of a button. You can stop trading at any time and mirror the investments of an unlimited number of traders. You can also still use risk management parameters such as take profits and stop losses.

Alternatively, UK traders can use the Myfxbook AutoTrade function within the MetaTrader 4 platform. The third-party program is available for an undisclosed charge. It allows users to monitor, analyse and evaluate trading strategies while copying established investors.

How To Get Started With FP Markets Copy Trading Tool

- Sign up for an FP Markets live account

- Click on the ‘Social Trading’ icon in the client area

- Find the best traders. Filter through trading history and past performance

- Select ‘Follow’ once you have chosen a trader to copy

- Complete the subscription verification form and click ‘Submit’

- Use the ‘Auto Copy’ icon to replicate the positions of traders

Opening Hours

The FP Markets MT4 and MT5 server times are GMT+2 or GMT+3 (New York Daylight Saving) with the trading week commencing at 00:02 on Monday and closing at 23:57 on Friday.

Trading hours vary between instruments. All forex trading, including GBP pairs, are available 24 hours a day with a daily market closure between 23:59 and 00:01. The FTSE 100 index is available to trade Monday to Friday from 01:00 to 24:00 and UK stocks can be traded between 11:00 and 19:30.

Customer Service

FP Markets customer support is available 24/5, though it is good to see that there is weekend support available between 08:00 and 16:00 (GMT). Contact methods include a phone contact number, email, and live chat service.

When we used the FP Markets live chat, we were pleased with the fast response time of under one minute. In fact, FP Markets quotes a 24-second average reply time.

For general enquiries, the FAQ section has a wealth of information including how to close an account, margin requirements such as stop-out levels and margin call, withdrawal policy details, and tutorials on how to create a demo login.

Contact details:

- Telephone – +44 28 2544 7780

- Email – supportteam@fpmarkets.com

- Live Chat – Icon available at the bottom right of each webpage

Trader Safety

Following our broker review, our experts are confident that FP Markets provides a secure trading environment. All personal and transactional data is encrypted during transmission with external networks, including 128-bit secure trading on the MT4 and MT5 platforms.

Customers can also employ two-factor authentication (2FA) at login for additional security.

Should You Trade With FP Markets?

FP Markets is an excellent broker with a vast range of instruments, platforms, and copy trading technology. The user-friendly client portal and fast sign-up process also make it ideal for traders of all experience levels. Open an account with FP Markets today to get started.

FAQ

Does FP Markets Offer A Good Range Of Trading Instruments?

FP Markets offers over 10,000 instruments, notably more than many competitors. Trading opportunities span equities/shares, indices, commodities, cryptocurrencies, and bonds. Assets can be traded via CFDs and futures CFDs.

Is FP Markets A Safe Broker?

FP Markets is a secure brokerage that has been providing broker-dealer services for over 15 years. It is regulated across the globe, with oversight from the Cyprus Securities and Exchange Commission (CySEC). The trading firm also offers various safeguarding measures, including segregated accounts and negative balance protection.

Is FP Markets A Good Broker?

FP Markets is a good trading broker. The company offers several platforms, two account types, direct market pricing, third-party analysis tools, and copy trading. This is in addition to strong regulatory oversight and a reliable customer support team.

Is The FP Markets Registration Process Quick?

The FP Markets online registration form can be completed within five minutes. However, all new users must comply with AML and KYC conditions. This means identity verification documents must be submitted before your live account is activated.

Can I Practise Trading On An FP Markets Demo Account?

Yes. FP Markets offers a raw or standard pricing demo account. UK traders can practice trading on the MT4 and MT5 servers with virtual funds.

Compare FP Markets with Other Brokers

These brokers are the most similar to FP Markets:

- IC Markets - IC Markets is a globally recognized forex and CFD broker known for its excellent pricing, comprehensive range of trading instruments, and premium trading technology. Founded in 2007 and headquartered in Australia, the brokerage is regulated by the ASIC, CySEC and FSA, and has attracted more than 180,000 clients from over 200 countries.

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for traders at all levels.

- AvaTrade - AvaTrade is a leading forex and CFD broker, established in 2006 and regulated across 9 jurisdictions. Over 400,000 users have signed up with the broker which processes over 2 million trades each month. The firm offers multiple trading platforms, including MT4, MT5, and a proprietary WebTrader. 1250+ financial instruments are available for trading, alongside a comprehensive education center and multilingual customer support.

FP Markets Feature Comparison

| FP Markets | IC Markets | Pepperstone | AvaTrade | |

|---|---|---|---|---|

| Rating | 4 | 4.8 | 4.8 | 4.9 |

| Markets | Forex, Stocks, Commodities, Crypto | Forex, Stocks, Commodities, Crypto | Forex, Stocks, Commodities, Crypto | Forex, Stocks, Commodities |

| Minimum Deposit | $100 | $200 | $0 | $100 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | ASIC, CySEC, ESMA | ASIC, CySEC, FSA | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB | ASIC, CySEC, FSCA, ISA, CBol, FSA, FSRA, BVI, ADGM |

| Bonus | - | - | - | - |

| Education | Yes | Yes | Yes | Yes |

| Platforms | MT4, MT5, cTrader | MT4, MT5, cTrader | MT4, MT5, cTrader | MT4, MT5 |

| Leverage | 1:30 (UK), 1:500 (Global) | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) | 1:30 (Retail), 1:500 (Pro) | 1:30 (Retail) 1:400 (Pro) |

| Visit | ||||

| Review | FP Markets Review |

IC Markets Review |

Pepperstone Review |

AvaTrade Review |

Trading Instruments Comparison

| FP Markets | IC Markets | Pepperstone | AvaTrade | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes | No |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | Yes | No | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | Yes | Yes | Yes | Yes |

| Futures | Yes | Yes | No | No |

| Options | No | No | No | Yes |

| ETFs | Yes | Yes | Yes | Yes |

| Bonds | Yes | Yes | No | Yes |

| Warrants | No | No | No | No |

| Spreadbetting | No | No | Yes | Yes |

| Volatility Index | Yes | Yes | Yes | Yes |

FP Markets vs Other Brokers

Compare FP Markets with any other broker by selecting the other broker below.

Popular FP Markets comparisons: