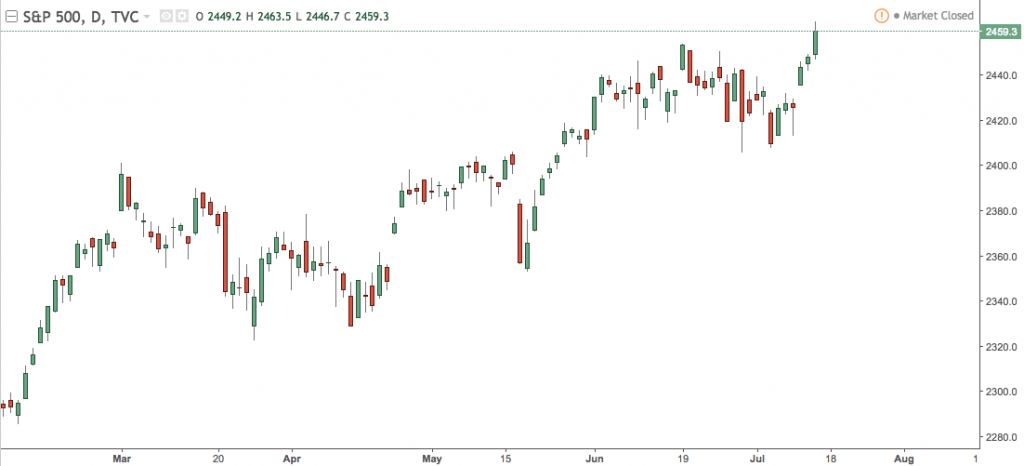

S&P500 Makes All Time Highs As Central Bankers Mix Their Messages

The “New World” of Central Bank tightening took some interesting twists and turns this week, as the BOC raised rates to get ahead of the data, and the Federal Reserve backed off their hawkish statements. In the midst of it all, the S&P500 made record highs on Friday, despite disappointing earnings and laggards in the Financials.

Record highs.

The S&P500 made a new record high on Friday, pushing past its 19 June top and running hard into the afternoon. Buying was sparked by Yellen’s somewhat dovish testimony this week and poor US macro data, as the likelihood of further interest rate increases and a longer tightening cycle have quickly diminished.

The continually changing Central Bank posturing is making the task of creating a narrative a little tricky. For example, the Canadian Central bank came out this week with a rate hike, it’s first since 2010, which saw the Loonie go to the moon. To be fair, Poloz did telegraph their intentions, however the move in the CAD suggests that no one really thought it would happen. The statement is the interesting part, essentially they are raising now to get ahead of the data, while acknowledging that growth will slow over the next couple of years. Perhaps there’s some domestic issues they’re looking to tackle, such as housing costs, and now is the best opportunity they’re likely to get. This begs the question, will the RBA raise is they’re given an opportunity, now that the green light has been given internationally?

What about Oil?

In case you weren’t confused enough by all this, throw in Oil. We saw a massive drawdown in inventories on Wednesday, however an increase in production took all the wind out of the sails, and buyers dried up. Oil is clearly in a bear market right now, with any up move seen as an opportunity for the longs to get out while they can. Despite OPEC’s best attempts, supply worries continue to weigh on oil. The $45 mark on Brent does seem to be holding a bid, but a break below $42 could see some significant downside.

The moral of the story is: stay nimble in your trades. Central Banks are at a crossroads right now and the markets are hanging on their every word, while oil is in a similar predicament.