SmartFX Review 2024

|

|

SmartFX is #97 in our rankings of CFD brokers. |

| SmartFX Facts & Figures |

|---|

SmartFX is an offshore regulated CFD and forex broker with MT5 integration and 5000+ instruments. The brand offers 24/5 customer support and one account type for simplicity. SmartFX is regulated by the Vanuatu Financial Services Commission (VFSC). |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | Forex, CFD-indices, CFD-equities, futures |

| Demo Account | Yes |

| Min. Deposit | $500 |

| Mobile Apps | Yes |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | VFSC |

| MetaTrader 4 | No |

| MetaTrader 5 | Yes |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | No |

| Copy Trading | No |

| Auto Trading | Yes |

| Signals Service | Yes |

| Islamic Account | No |

| Commodities |

|

| CFDs | I think the 5000+ CFD instruments including forex, commodities, indices and stocks should serve active traders well. The MT5 platform also offers plenty of advanced tools and features to facilitate complex CFD trading strategies. |

| Leverage | 1:400 |

| FTSE Spread | Floating |

| GBPUSD Spread | Floating |

| Oil Spread | Floating |

| Stocks Spread | Variable |

| Forex | I found an average range of 45+ major, minor and exotic currency pairs at SmartFX, tradable on the MT5 platform. I did appreciate the flexible leverage up to 1:400 and minimum order sizes from 0.01 lots. |

| GBPUSD Spread | Floating |

| EURUSD Spread | Floating |

| GBPEUR Spread | Floating |

| Assets | 43 |

| Stocks | I was impressed with the 1,600+ EU and US share CFDs from leading companies including Adidas, Amazon, Facebook and Google. You can benefit from real-time pricing on the terminal, as well as MQL5 programming for algo traders. |

SmartFX is a Vanuatu-based forex brokerage option that provides CFDs in markets that include FX, indices, stocks and precious metals. This 2024 trading review covers important aspects of the broker, such as trading platforms, account options, mobile apps and available leverage. Continue reading the result of many reviews to find out if SmartFX is a good choice for retail forex trading.

About SmartFX

Founded in 2018, SmartFX.com offers trading solutions to clients around the globe from twin head offices in Dubai and Vanuatu. The broker welcomes both retail and pro traders and provides over 2,000 international finance instruments through the MetaTrader 5 trading platform.

As a subsidiary of Smart Securities and Commodities Limited, the firm is regulated by the Vanuatu Financial Services Commission (VFSC). However, the company does not own any of the many similarly named forex brokers, nor does it operate the SmartFX ultimate scalper expert advisor (EA) software.

Markets

With over 2,000 instruments available for CFD speculation, SmartFX clients can choose between forex, indices, commodities and stocks markets. In addition to these markets, investors can request a bespoke product on an asset not currently offered by the broker through customer support (more on how to contact the help team later).

Forex

More than 40 currency pairs are supported by SmartFX, including major, minor and exotic forex products. While the broker does not disclose specific typical spreads, these are slated to be competitive compared to other zero commission forex offerings.

Indices

Twelve spot and ten futures indices are provided for CFD speculation. Staple exchanges such as the UK FTSE 100 and US S&P 500 are supplemented by less common offerings like the Singapore Nifty and US Dollar Index.

Commodities

Thirteen commodity markets are available through SmartFX, split into two spot and eleven futures instruments. The spot products are silver and gold pairs, while the futures options span the metals and energies sub-markets. Unfortunately, no soft commodity CFDs are provided by the broker.

Stocks

Investors can gain exposure to sectors such as technology, finance and medicine through individual stock trading. SmartFX supports over 1,600 share CFDs, encompassing several US exchanges and selected EU, UK and Indian assets.

No additional spreads are added to stock products, with the broker levying a trading commission of £5.25 per side per lot on equities instead.

Leverage

SmartFX allows retail clients to trade with leverage rates of up to 1:400 on forex and CFD instruments. This level is significantly higher than FCA-regulated brokers but slightly lower than some other VFSC-licensed companies.

The broker does not disclose its margin call and stop-out levels, which this review found troubling.

Account Types

Whether you’re a retail or pro trader, SmartFX offers a singular account type to suit all users – the Smart account.

This account offers competitive spreads and zero-commission trading on most of its products, though a commission is levied on stock trading. Clients can trade with leverage of up to 1:400 and the MetaTrader 5 (MT5) platform. Opening this account requires an initial minimum deposit of £410.

The Smart account is available as an Islamic variant, giving those who cannot pay interest due to their religious beliefs the option of a swap-free account.

Demo Account

The ability to test new trading strategies using real-time market data risk-free or trial a particular broker’s trading conditions is invaluable to investors. SmartFX provides the option of a demo account for its MetaTrader 5 platform, complete with up to £100,000 in practice funds.

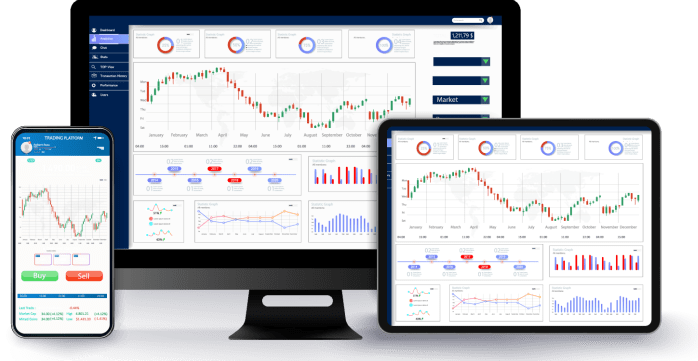

Trading Platforms

There is only one trading platform available to SmartFX clients – the latest offering from MetaQuotes, MetaTrader 5.

MetaTrader 5, often abbreviated to MT5, was released in 2010 with support for more asset classes and several new features compared to its predecessor.

Strategy backtesting is enhanced by software that can take advantage of newer computer technology. At the same time, an upgraded MQL5 coding language allows traders to create their own EAs and indicators more easily.

The platform features 38 indicators and 44 graphical objects as standard, with the option to add more through the MQL5 marketplace. In addition, 21 time frames are available to aid in technical analysis and ultimate control over trading is assisted by two new order types compared to MT4.

MetaTrader 5

MetaTrader 5 is available to download for Windows, Mac and Linux desktops. In addition, the platform is accessible as a browser-based WebTrader and mobile apps for Android and iOS devices.

Mobile Apps

SmartFX clients can download the MetaTrader 5 app variant for iPhone and Android mobile devices directly from the Google Play and App Store without needing an APK download.

The broker offers no proprietary app and all similarly named apps are for unrelated services.

Payment Methods

Various payment methods are supported by SmartFX, with traders able to make GBP currency deposits and withdrawals using credit cards, debit cards and e-wallet solutions Skrill and Neteller.

Deposits using all three methods are processed instantly within standard business hours. In addition, clients will be pleased to learn that there are no minimum deposit requirements for transactions on existing accounts.

Processing times for withdrawals are slightly longer, with the broker taking 1-3 hours to approve and distribute transfers for all three supported GBP methods. Due to the need for withdrawals to be approved, this process may take longer on weekends. A minimum withdrawal of £80 is required, though clients can withdraw total account balances smaller than this.

Deposit & Withdrawal Fees

All SmartFX deposits and withdrawals are fee-free on the broker’s side, which will appeal to cost-savvy currency traders. However, the company reserves the right to levy banking charges if no trading activity is made on an account.

Trading Fees

Fees and commissions are never far from the mind of an experienced trader, with charges that potentially eat into hard-earned profits rarely tolerated.

To this end, SmartFX levies no commission on most of its markets, with the broker’s fees recovered from the trading spread. However, a £5.25 per side per lot charge applies to stock CFDs, which is reasonably high compared to competitors.

The firm does not disclose whether a fee is applied to inactive accounts, so infrequent traders should err on the side of caution. Overnight costs vary from asset to asset and can be found via the MetaTrader 5 section for each product.

Security & Regulation

To avoid scams in the forex and CFD space, we recommend using a well-regulated broker licensed by a body such as the UK FCA.

While SmartFX holds a regulatory licence from the Vanuatu Financial Services Commission (VFSC), this regulator does not provide the same level of protection as a more established firm. For example, the broker does not offer negative balance protection to clients, a critical safety method that prevents traders from losing more than their deposited capital when on margin.

Additionally, SmartFX is not part of a fund protection scheme, nor does it hold client funds in segregated bank accounts. These findings may make prospective clients think twice before signing up with a broker with such a lack of protective measures.

Two-factor authentication (2FA) utilises one-time password technology to provide maximum security to a broker’s login. Unfortunately, the SmartFX login portal does not support 2FA, though the MetaTrader 5 platform does.

Customer Support

SmartFX recognises the importance of customer support for traders, with swift assistance for login and trading issues often making the difference between profit and loss. This review found the customer service department responsive, friendly and knowledgeable when contacting the team via live chat.

Clients can contact the broker through the website’s live chat feature, call either the Vanuatu or Dubai office or send the support team an email. Its dedicated team is available between 06:00 and 15:00 GMT from Monday to Saturday. However, the broker’s live chat often operates outside of these hours. Investors can contact support via:

- Email Address: support@smartfx.com

- Dubai Phone Number: +9714 431 9003

- Vanuatu Phone Number: +678 777 3222

In addition, SmartFX provides an FAQ section with solutions to queries on EAs, demo trading, regulation and its financial instruments.

Educational Content

To help newer traders learn more about the forex and finance markets, many brokers provide clients with educational content in the form of articles, webinars and videos.

SmartFX offers fortnightly webinars hosted by one of its industry experts to help clients identify emerging trends in finance, provide technical analysis ideas and build an overall investing strategy. Additionally, a daily market analysis output gives traders up-to-date market insights concerning the trading day ahead.

This is complemented by an educational blog with various pieces on specific markets and overall trading ideas. The blog also includes some fairly eclectic posts drawing links between the natural world, Buddhist teachings and successful trading.

Advantages Of SmartFX

- MT5 access

- Free daily market analysis

- Great choice of stock CFD products

- Fee-free GBP deposits and withdrawals

- Zero commission trading on most markets

- Responsive and knowledgeable support team

Disadvantages Of SmartFX

- Weak VFSC regulation

- No welcome bonus programs

- No ECN, low-spread account option

- No crypto or soft commodity products

- Lack of transparency around trading fees

- No negative balance protection or fund protection schemes

Promotions

While many brokers offer bonus offers to entice new clients to their service, SmartFX does not provide any such schemes. Therefore, traders seeking a no deposit bonus, commission rebate program or other welcome deal should look elsewhere.

Additional Features

Although SmartFX provides a free economic calendar and daily forex market analysis, the broker is missing some key features that competitors offer. Omitted additional features such as VPS server access and trading calculators can enhance the trading experience of investors.

Trading Hours

SmartFX clients can access the broker’s full range of instruments via the MetaTrader 5 platform, WebTrader and app 24 hours a day, five days a week. However, the trading of some assets, such as indices and individual stocks, will be limited to their local exchange hours.

Users can make deposits and withdrawals at any time via the broker’s website.

SmartFX Verdict

SmartFX is an appealing choice to stock CFD specialists, with over 1,600 stock instruments from UK, EU and US exchanges. In addition, the broker does not levy any deposit or withdrawal fees and offers commission-free trading on most markets. However, weak regulation and a lack of industry-standard security measures stand against the firm. The omission of a raw-spread ECN account and crypto and soft commodity products may also dissuade some prospective clients from signing up.

FAQ

Is SmartFX A Scam?

While SmartFX appears to be a legitimate broker, weak regulation and no fund protection scheme make the firm a risky choice for traders compared to FCA-regulated options. However, VFSC regulation is still much better than nothing.

Is There A SmartFX App?

There is no proprietary SmartFX app for either Andriod APK download or iOS. However, the broker’s supported trading platform, MetaTrader 5, has an app available for iPhone and Android devices.

Is SmartFX Open To UK Traders?

Yes, SmartFX accepts traders from the UK and most global jurisdictions.

Does SmartFX Provide Signals?

SmartFX offers a daily market analysis of the major financial markets on its website. However, it is worth mentioning that the broker is not associated with the SmartFX ultimate scalper expert advisor (EA) software.

Can I Trade Options On SmartFX?

SmartFX does not support options trading. Instead, clients can speculate using CFDs on various markets, including forex, commodities and stocks.

Compare SmartFX with Other Brokers

These brokers are the most similar to SmartFX:

- Swissquote - Swissquote is a Switzerland-based bank and broker that offers online trading and investing. The company has a high safety score and is listed on the Swiss stock exchange. The firm offers a huge range of products, from stocks, ETFs, bonds and futures to 400+ forex and CFD assets. Hundreds of thousands of traders have opened an account with the multi-regulated brokerage. Clients can get started in three easy steps while 24/7 customer support is available to assist new users.

- IG Index - Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Interactive Brokers - Interactive Brokers (IBKR) is a premier brokerage for experienced traders, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

SmartFX Feature Comparison

| SmartFX | Swissquote | IG Index | Interactive Brokers | |

|---|---|---|---|---|

| Rating | 1.3 | 4 | 4.4 | 4.3 |

| Markets | Forex, Stocks, Commodities | Forex, Stocks, Commodities | Forex, Stocks, Commodities | Forex, Stocks, Commodities, Crypto |

| Minimum Deposit | $500 | $1000 | $0 | $0 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | $100 |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | VFSC | FCA, FINMA, DFSA, SFC | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA | FCA, SEC, FINRA, CBI, CIRO, SFC, MAS, MNB |

| Bonus | - | - | - | - |

| Education | No | No | Yes | Yes |

| Platforms | MT5 | MT4, MT5 | MT4 | - |

| Leverage | 1:400 | 1:30 | 1:30 (Retail), 1:222 (Pro) | 1:50 |

| Visit | ||||

| Review | SmartFX Review |

Swissquote Review |

IG Index Review |

Interactive Brokers Review |

Trading Instruments Comparison

| SmartFX | Swissquote | IG Index | Interactive Brokers | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | No | No | No | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | Yes | Yes | No |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | No | Yes | No |

| Silver | Yes | Yes | Yes | No |

| Corn | No | No | No | No |

| Futures | Yes | Yes | Yes | Yes |

| Options | Yes | Yes | Yes | Yes |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | Yes |

| Warrants | No | No | Yes | Yes |

| Spreadbetting | No | No | Yes | No |

| Volatility Index | No | No | Yes | No |

SmartFX vs Other Brokers

Compare SmartFX with any other broker by selecting the other broker below.

Popular SmartFX comparisons: