A Quick Look At The Markets Leading Into December: Equities, USD & Oil

It’s December, a new month, and the final of what has been an eventfully uneventful 2017. Let’s take a look at how the markets stand right now, and see if there’s any opportunities in the final trading month of 2017. Why do we look at the US markets? They lead, the rest follow. Broadly speaking, European equities tend to follow US markets, while the dollar dominates FX trading around the world.

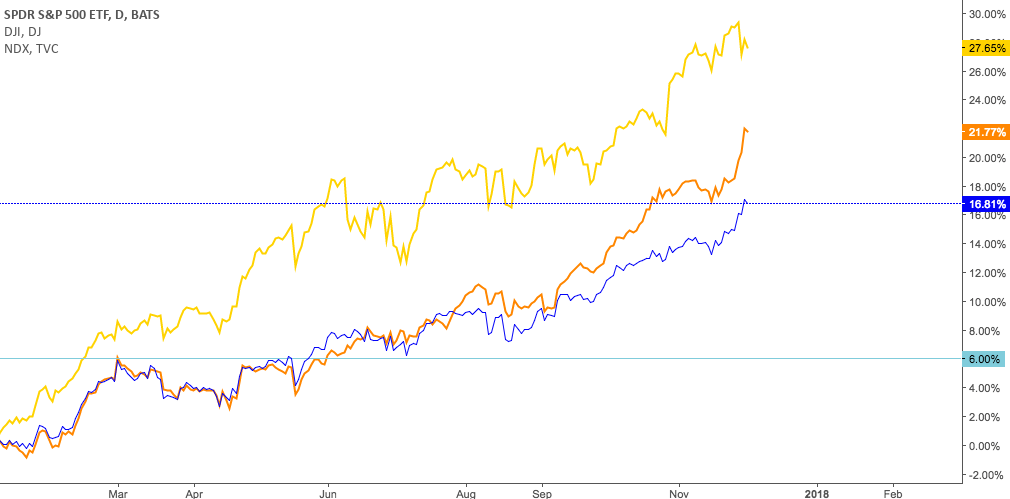

US Equities.

Stocks have been bullish, there’s no question of that. We did start to see some cracks in the armour in the last week of November, however. The quick rotation out of tech and into the banks, driven by the tax reform bill, is the first sign of weakness and divergence in US markets. We’ve also seen the beleaguered retail stocks make a recovery of sorts. The US market is in an interesting position. Risk assets continue to see inflows. Was this weeks Nasdaq drop just a regular correction, or is it a sign of something deeper? The bull looks set to continue, even though liquidity is an issue.

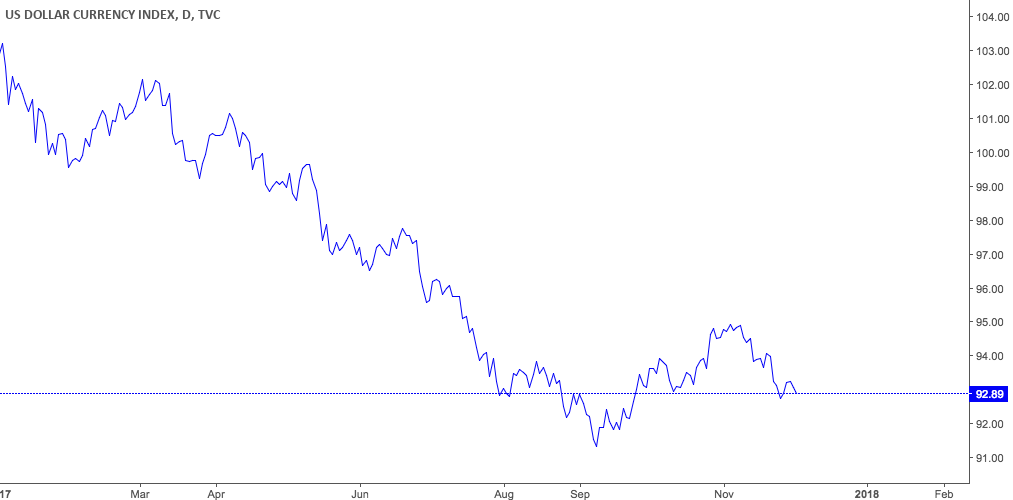

US Dollar.

The fall is the dollar has taken me by surprise. Both the fundamentals and technicals were pointing to a stronger dollar/weaker Euro into the end of the year, however that hasn’t played out…yet. The common narrative is that the dollar is falling on the back of concerns regarding the tax reform bill. I’m not entirely sure that I buy that. We saw yields bounce this week, bank stocks shoot to the moon, and the dollar weaken. As it’s been for the whole year, my view on the dollar is mixed and I can’t really see a trade here. A rate rise in December is priced in, let’s see if stronger data pushes the Fed to a slightly more hawkish stance.

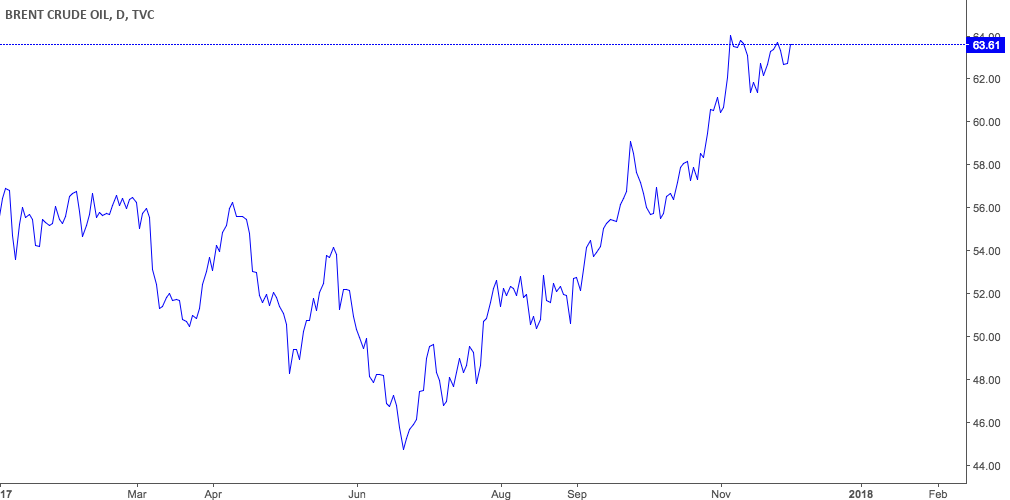

Oil.

In yet another surprise for the skeptics, OPEC and their supply cuts seem to be working. Oil has rallied 17% since May when OPEC struck their deal, with the current price hovering around $63 a barrel for Brent and $58 for WTI. Perhaps the slightly higher oil prices will push costs and inflation through the rest of the economy into the new year. I favour oil lower, generally speaking, however OPEC is doing a very good job at making the short oil trade a very difficult one right now.

We’ve seen volatility return to the US markets, day traders might see some excitement over the next month or two.