Markets Tread Carefully On Labour Day, While North Korean Situation Worsens

The market reaction to the latest North Korean escalation has been muted due to the US holiday, but expect some volatility on Tuesday morning.

US traders will come back to work tomorrow morning facing an escalation of the North Korean crisis. The small selloff into Friday’s close on the SPY appears warranted, as geopolitical issues continue to concern political and market commentators. The North Korean situation seems to be getting worse, without a clear solution in the foreseeable future.

Safe Havens See Flows.

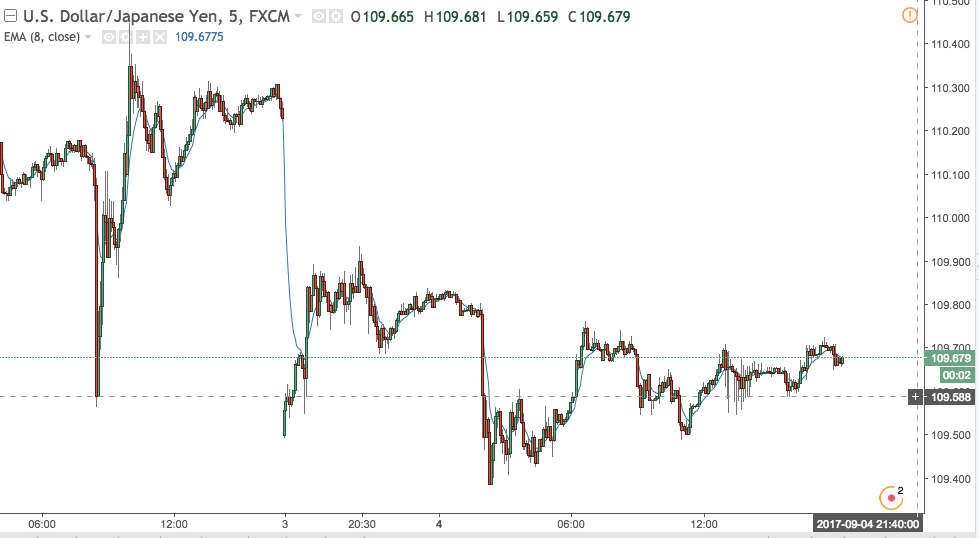

The USD/JPY gapped down and traded in a reasonably tight range on Sunday & Monday. The risk-off sentiment is clear, however European and Asian traders are waiting to see how the US markets interpret the latest round of escalation. Volume is low, but expect that to increase significantly over the coming weeks as people return from holiday and position themselves for the rest of the year.

Will the North Korean situation be resolved?

Let’s take a quick look at three scenario’s;

Scenario 1, base case: Nothing happens. North Korea and the USA continue to escalate and descalate the situation. There is no scenario where North Korea wins in an all out war, or any type of war. They are massively out gunned. What they have now is a deterrent and some leverage. When the situation finally resolves itself into a “business as usual” scenario, equities will likely rally and risk on sentiment resumes.

Scenario 2, the unlikely event of North Korea attacking Japan or Guam: This would be met with retaliation by the US, massive casualties, and the end of the North Korean regime.

Scenario 3, pre-emptive strike by the US or South Korea. It’s possible, but the North has nuclear weapons, and the risk is far too great to take.

Playing out those 3 scenario’s, and the many variants in between, the likely case is that the situation will resolve itself diplomatically and it will be business as usual. Any bumps in the road are just that. You’ll likely see traders positioned as such.